August was arguably the most boring month for crypto in 2023 so far. Trading volumes declined to multi-year lows, and volatility was unbelievably low. Even a $1 billion liquidation couldn’t awaken the interest of the community. Nevertheless, the market is getting closer to an important period where multiple bullish events may occur.

In this report, we will delve into the state of the crypto market in August, examining the most important data, events, and trends that impacted the industry last month.

Executive Summary

- Grayscale has won a lawsuit against the SEC regarding their Bitcoin ETF application.

- Base has been the best performing blockchain of the month.

- August was a difficult month and more turbulence should be expected.

- Decentralized finance is still struggling.

- Token sales and fundraising activities are at a low point.

What happened in August?

While the month lacked motivation for people to actively engage in crypto, a few important events happened in August.

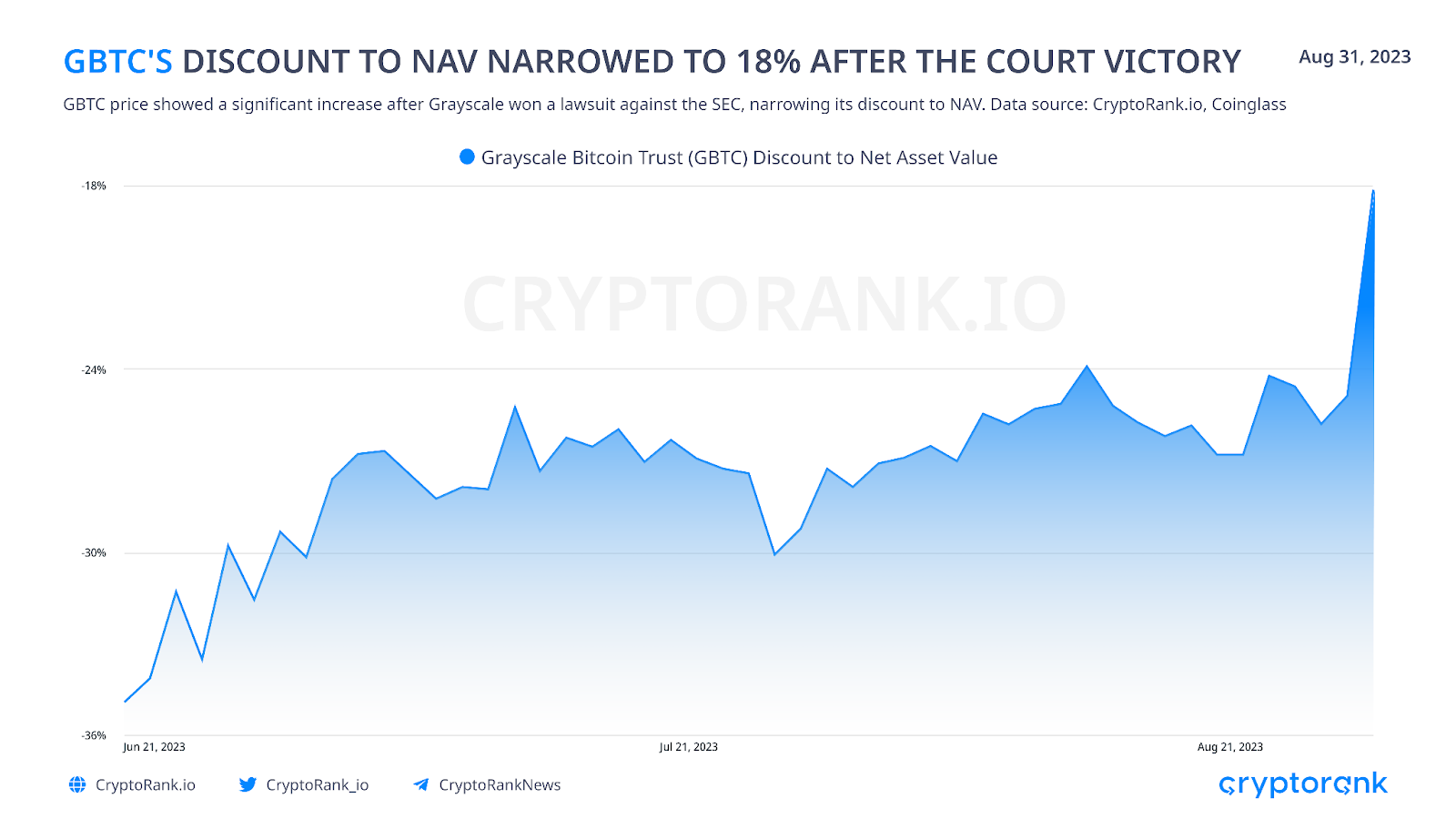

Grayscale Won Lawsuit Against SEC

Arguably the best growth driver for Bitcoin currently is the anticipated launch of several spot Bitcoin ETFs. Grayscale was one of the first companies to launch a Bitcoin ETP (Grayscale Bitcoin Trust), but due to disagreements with SEC, it had no right to convert it into an ETF yet. Recently, the federal court ruled that the U.S. SEC must review its rejection of Grayscale Investments’ attempt to convert the Grayscale Bitcoin Trust (GBTC) into an ETF. Now there’s more optimism about the future of GBTC.

However, while the majority expects spot Bitcoin ETFs to be eventually approved, SEC postponed the decision on 7 applications, including the most anticipated – BlackRock’s one.

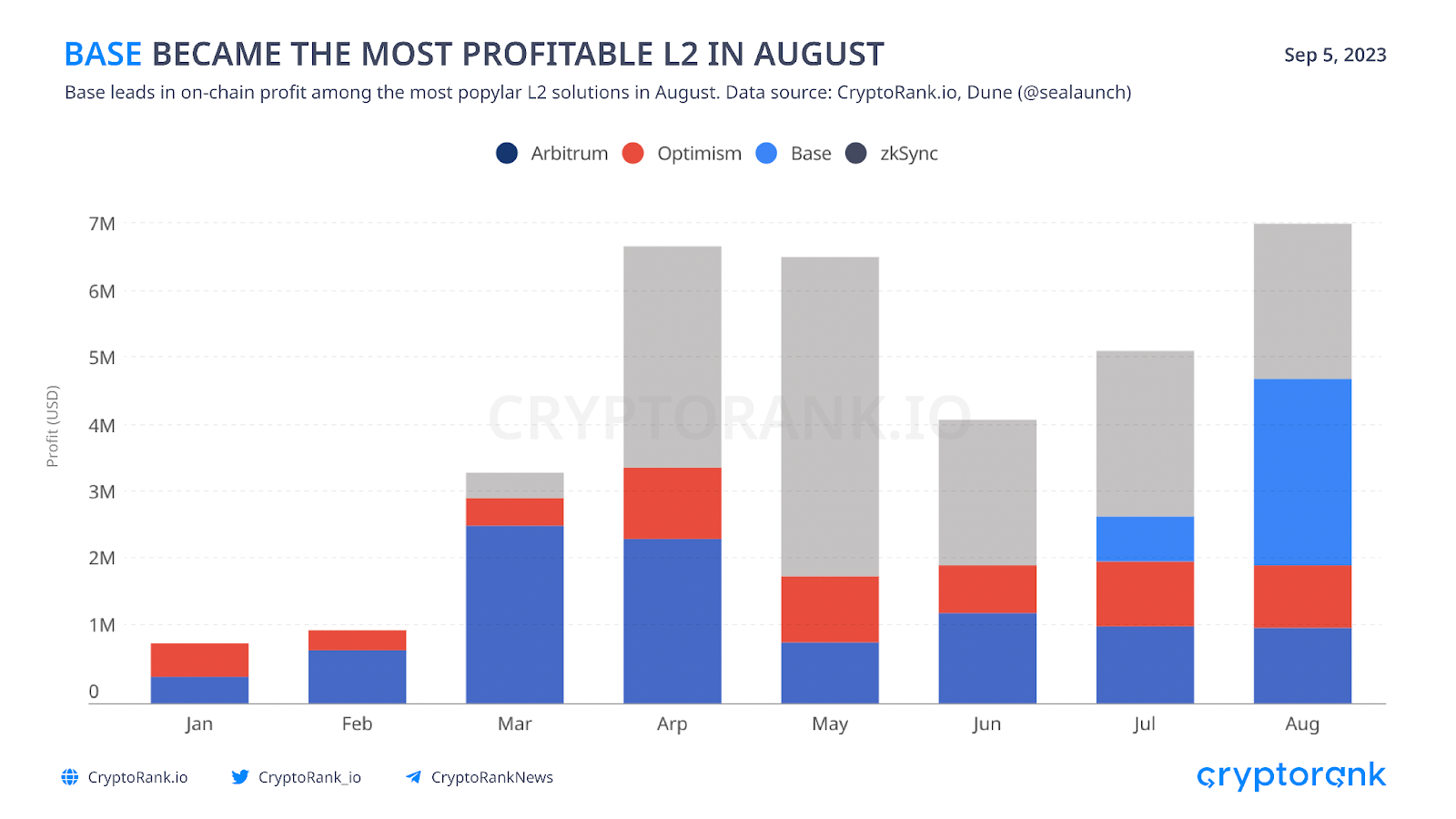

Onchain Summer by Base

In the beginning of August, Coinbase launched open mainnet for its own Layer2 blockchain – Base. It was a spectacular launch, instantly gaining a huge boost in TVL and community attention. Given the current state of the market, Base has become quite a profitable business unit for Coinbase.

Base was the quickest network to break through 1M users. Thankfully for quick adoption from tier-1 dApps and emergence of new ones, such as friend.tech. It has quickly surpassed the $400M TVL mark, taking the 3rd place among Layer 2 blockchains.

PayPal Has Launched Stablecoin PYUSD

In early August, PayPal launched a controversial stablecoin issued by Paxos. The controversy stems from the fact that it is a heavily centralized stablecoin (like most stablecoins) and that’s why it is not very appealing to the crypto community.

The new stablecoin will only be available for US residents (as for now). It is not intended to replace USDT or USDC, but rather to introduce blockchain to new users. The stablecoin is built on Ethereum and offers high-speed transfers at a relatively low cost. This makes it a good option for people who frequently use PayPal.

Market Overview

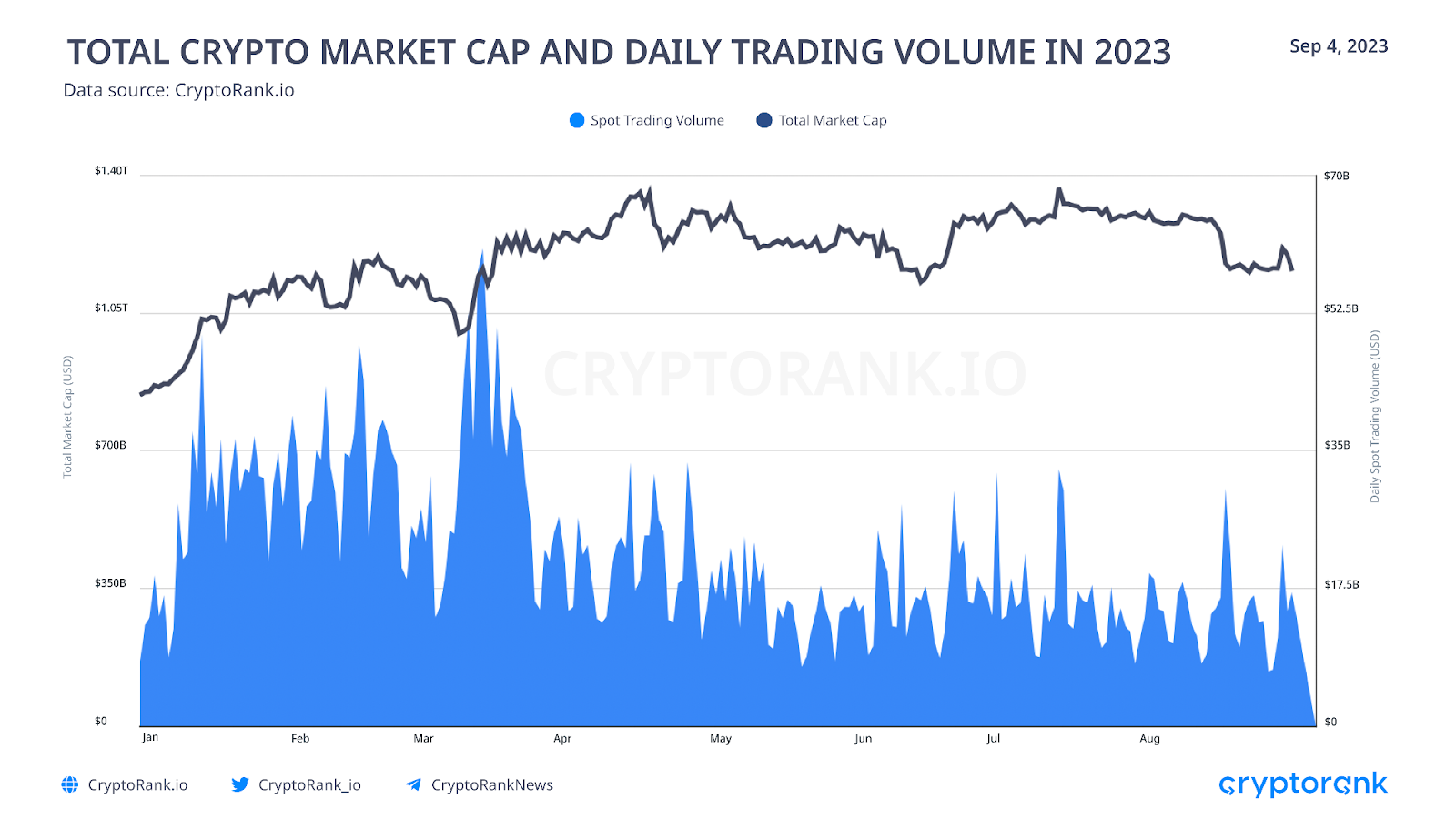

Summer is typically considered a low-volatility time for financial markets, but this August was particularly uneventful for the crypto market.

The low volatility that had been building up for many weeks finally led to a significant move at the beginning of the month, with liquidations of over $1 billion. This was the largest liquidation since the FTX collapse, but it occurred on relatively low volume. Basically, it was a long squeeze.

The market quickly stabilized, and the price of BTC continued to trade around the same level for over a week. Later, the news of Grayscale’s court victory sparked some positivity, resulting in a sharp rise in price that quickly dissipated after the ETF application deadline was postponed.

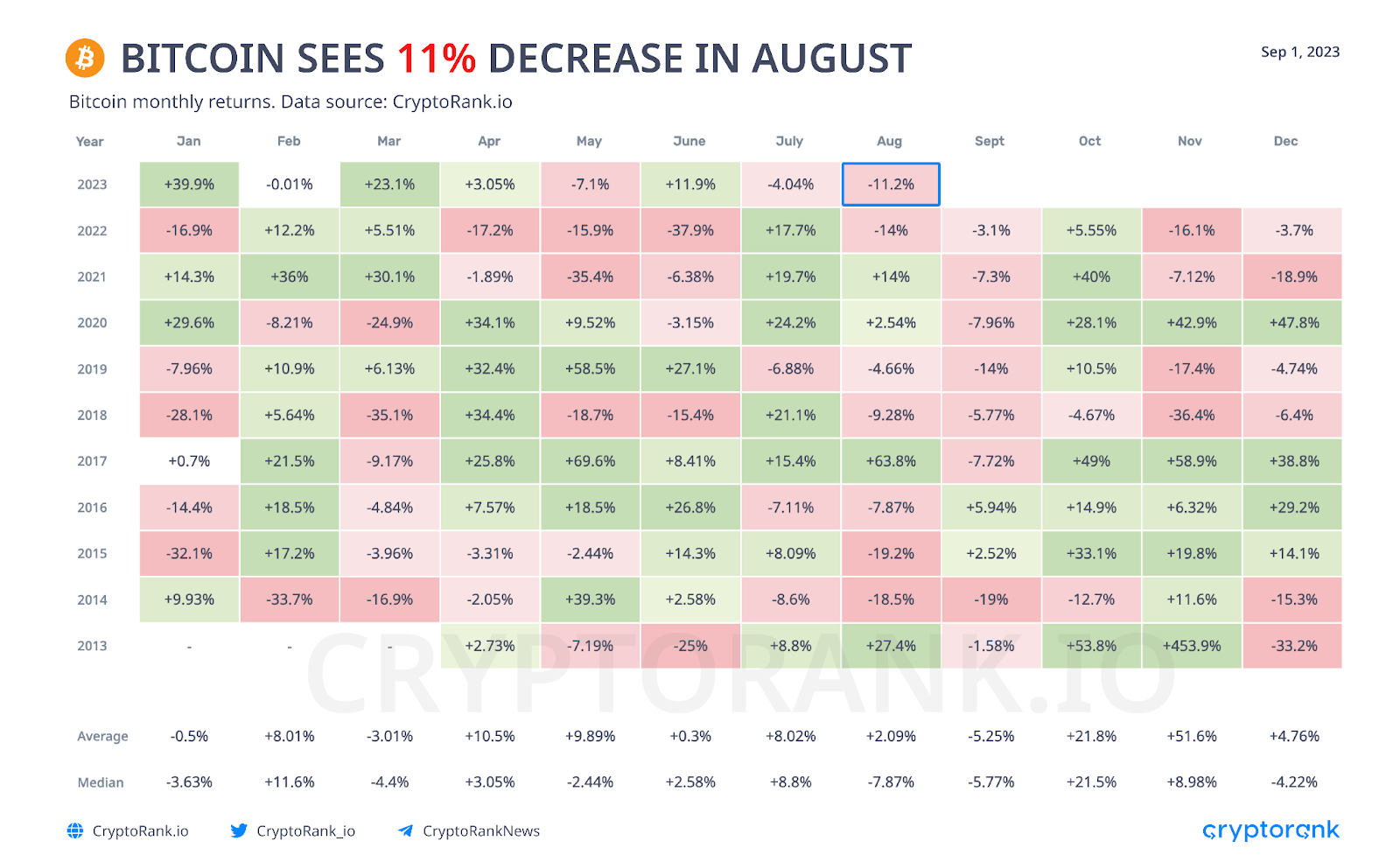

Bitcoin Performance

August 2023 was a bad month for Bitcoin, with its price losing more than 11%. It is noteworthy that the last month of summer often leads to high losses. September is statistically an even more prone month for crypto to decline, although the last time there was a significant decline in September was back in 2014.

The strong factor is the anticipation of two important events in 2024 for Bitcoin: the launch of the first spot ETFs and 4th halving. The fact that both of these events are expected in the same timeframe is bullish and gives a lot of hope. Currently, the markets are uncertain about the future of cryptocurrency and the macroeconomic outlook. As a result, most investors have taken a wait-and-see approach and are not ready to push their strategies to the end.

Altcoins Performance

The majority of the market followed Bitcoin’s direction, but some altcoins managed to grow despite the conditions. It’s worth noting that there were many Pump and Dump events this month, including noticeable ones like CYBER and YGG, as well as many smaller ones. Low trading volumes make it easy for stakeholders to manipulate the price in a short-term perspective.

Against this backdrop, many assets are performing outstandingly even as other assets decline, counteracting the market trend. However, without an overall trend, these positive movements quickly come to an end. Similar to a Ponzi scheme, the first traders to act take everything.

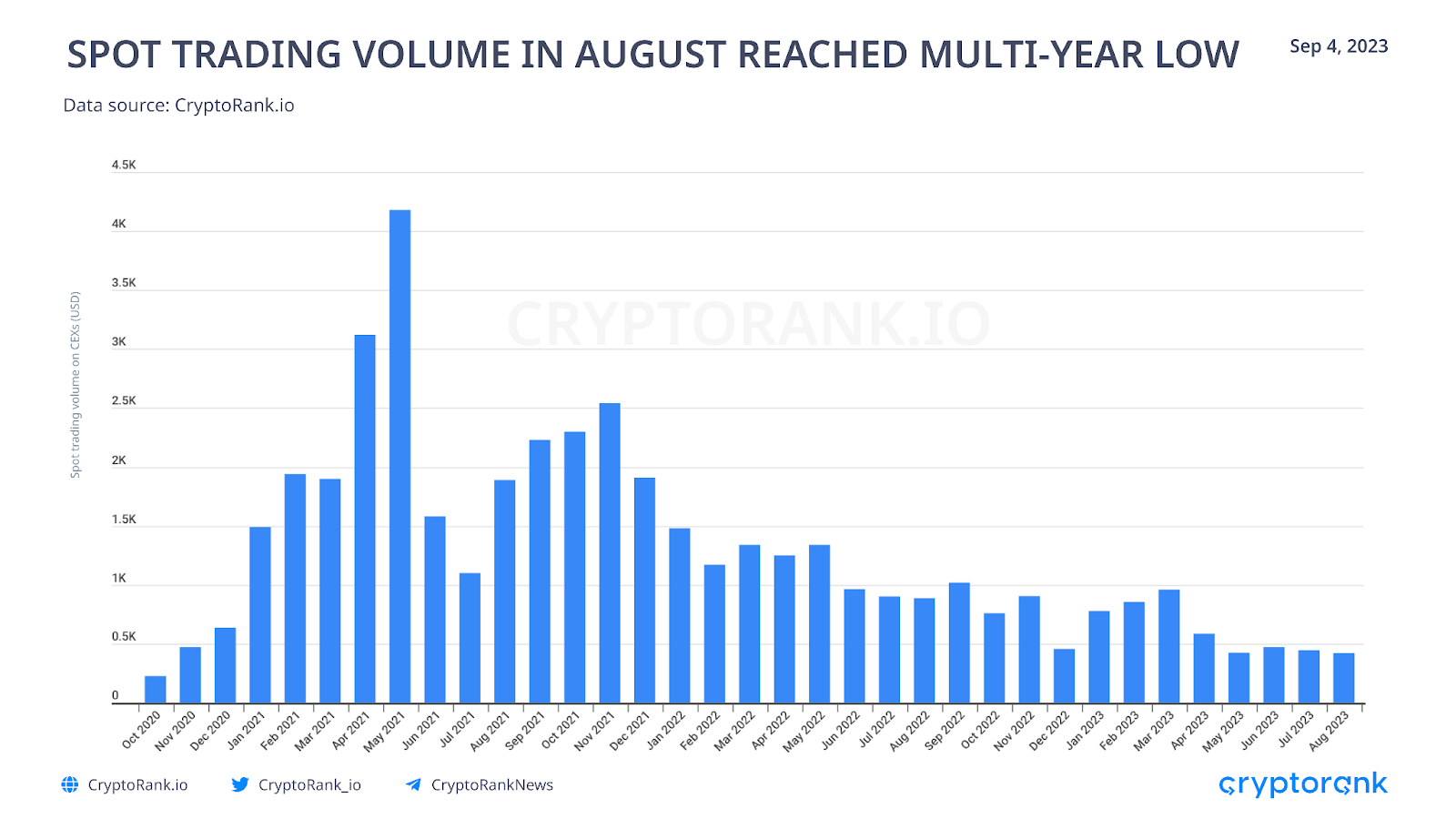

CEX Trading Volumes Are in Continuous Decline

Undoubtedly, centralized exchanges are facing a difficult period. Earnings from trading fees have decreased, while expenditures continue to rise. Even the most prominent exchanges have had to reduce their staff during this bear market.

Total spot trading volume on centralized exchanges reached its lowest level since October 2020, at $422 million. However, the decline compared to the previous months wasn’t significant.

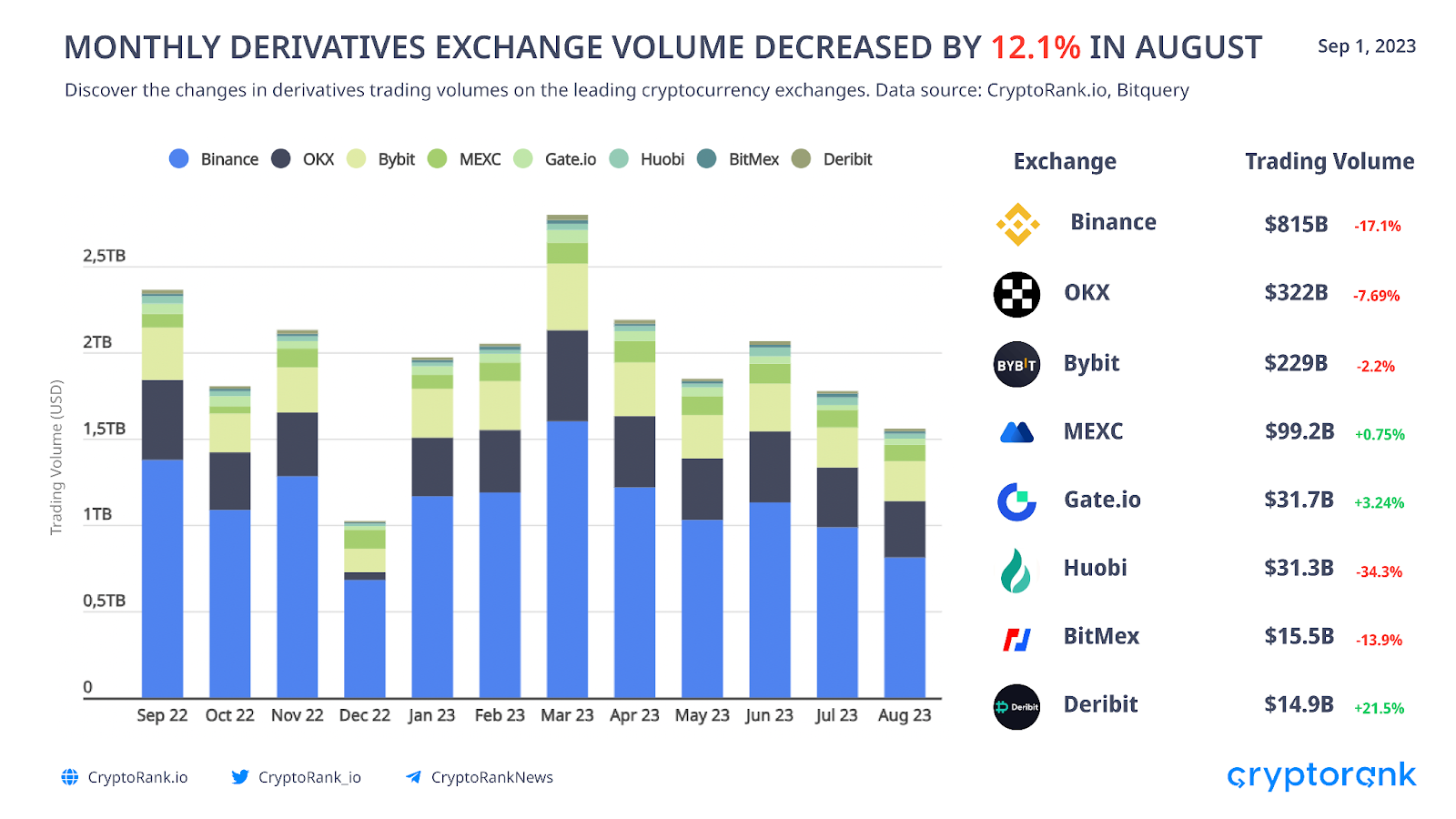

Derivatives markets are experiencing a similar trend, with most exchanges showing a significant decline. The lowest multi-year volume was recorded in December 2022.

DeFi is Struggling to Grow

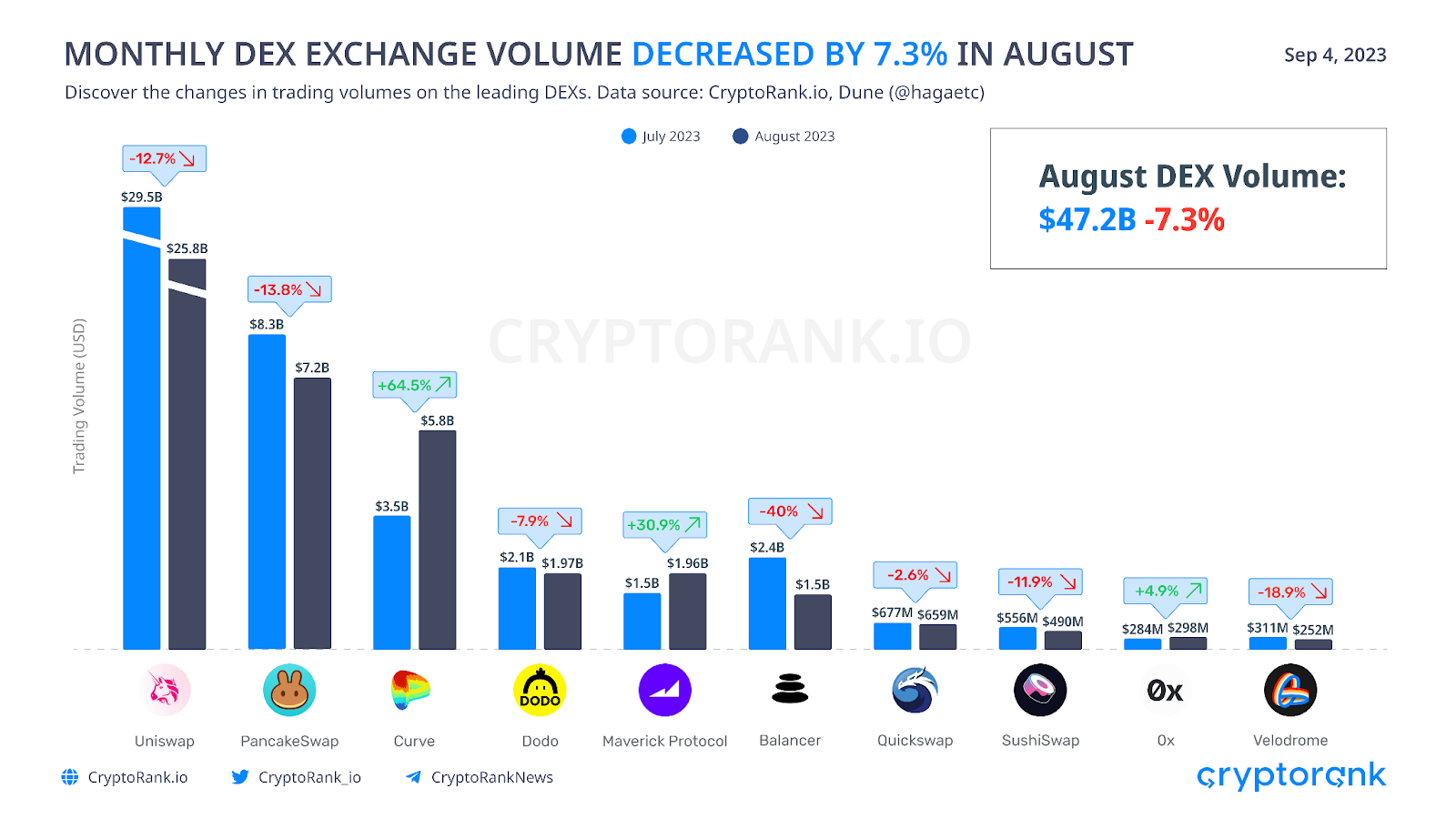

The decline of interest in cryptocurrency has had a negative impact on decentralized finance (DeFi). As one of the core elements of DeFi, exchanges have also experienced a significant drop in trading volume and revenue.

Remarkably, Maverick Protocol has entered the top 5 DEXs in terms of trading volume growth in August. It is possible that it will maintain a stable 4th place among other DEXs in the coming months.

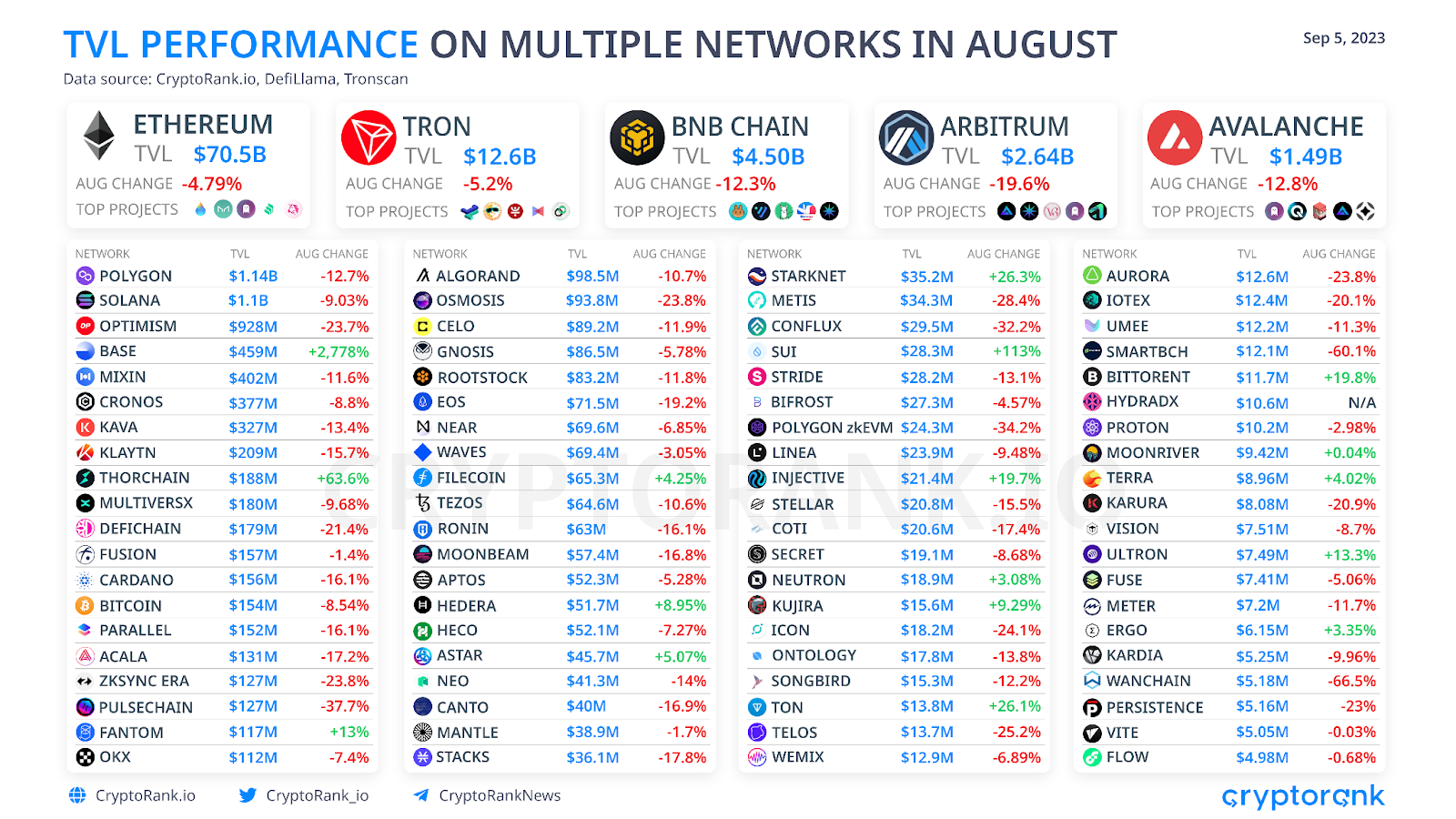

Most networks experienced a decrease in total value locked (TVL), mainly due to a decline in crypto asset prices. However, with the launch of Base, funds are flowing out from most networks to the Base blockchain. Several Layer 2 (L2) blockchains saw a significant decline in TVL instead of the expected increase.

Base was the clear winner of the month, with a total value locked (TVL) increase of +2,778%. It has surpassed zkSync and now holds the 9th place among other blockchains by TVL.

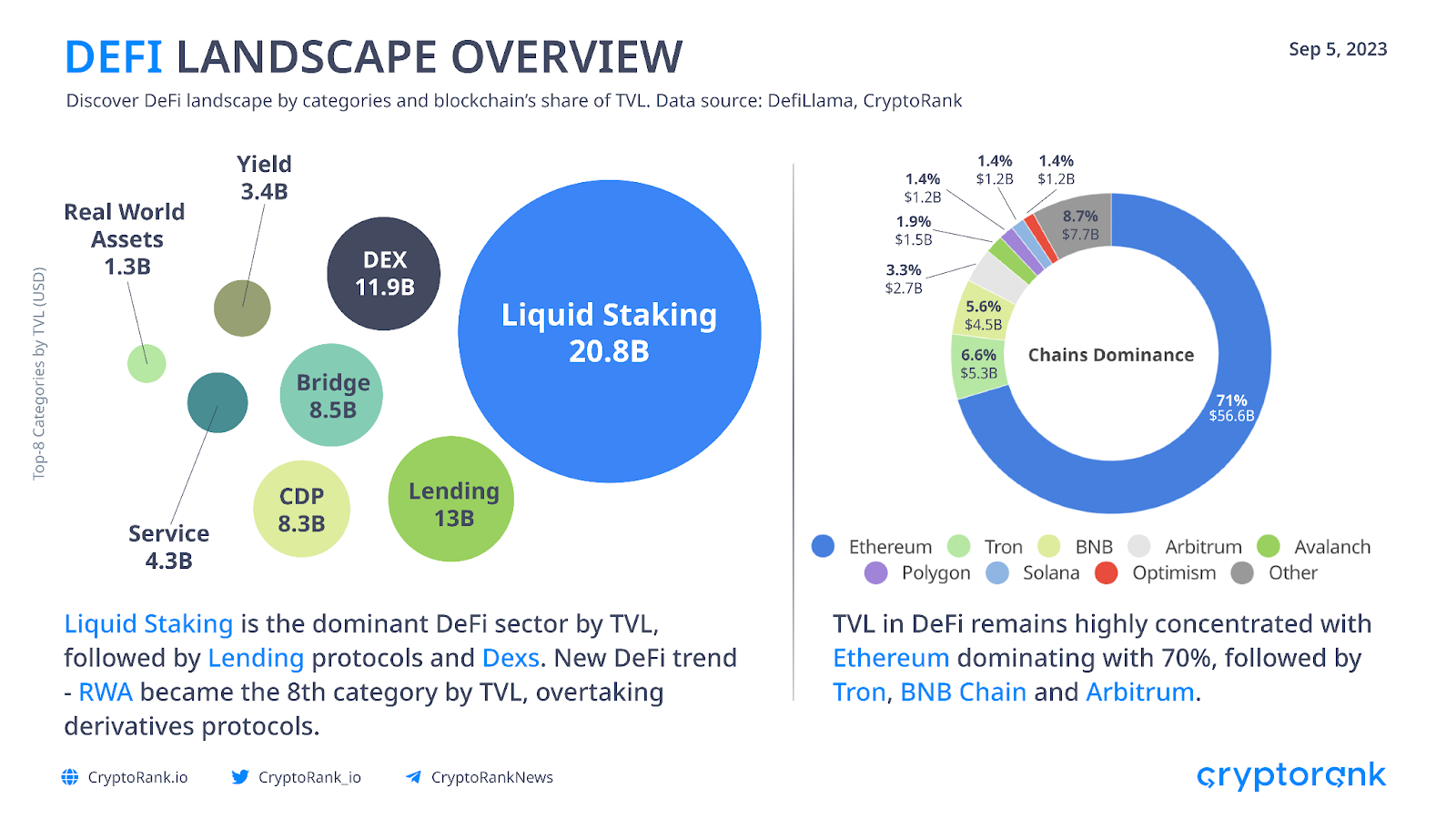

Liquid staking has continued to dominate this month, offering stable rewards with a decent APR for a bear market. This is one of the main reasons why users continue to stake ETH and other coins. Ethereum remains the leading blockchain, with a 71% share among other blockchains.

Arguably, one of the most significant issues in DeFi is the lack of safety measures that still terrify many users. Since the beginning of the bear market, there hasn’t been much improvement in this regard. Hacks and exploits continue to surface, resulting in the theft of hundreds of millions of dollars every month. Another concern is scams, which are equally efficient at removing cryptocurrencies from circulation.

The issue of exploits and scams goes beyond just people losing money and exiting the market. Stolen assets are often removed from circulation, which has a negative impact on the entire market. Reduced liquidity leads to fewer opportunities and potential for growth.

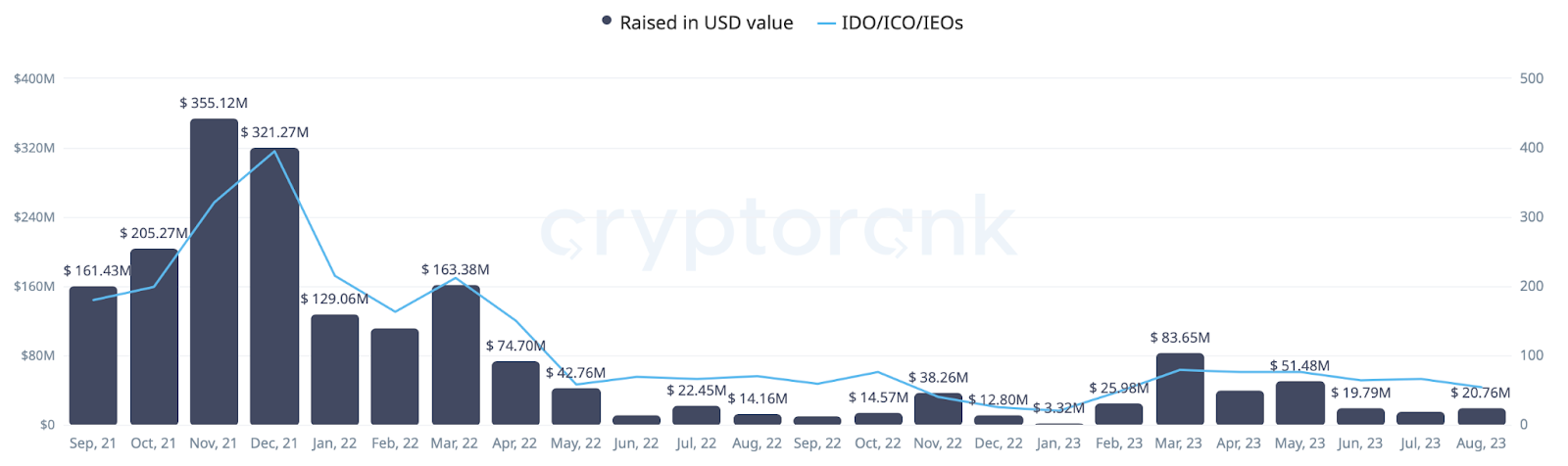

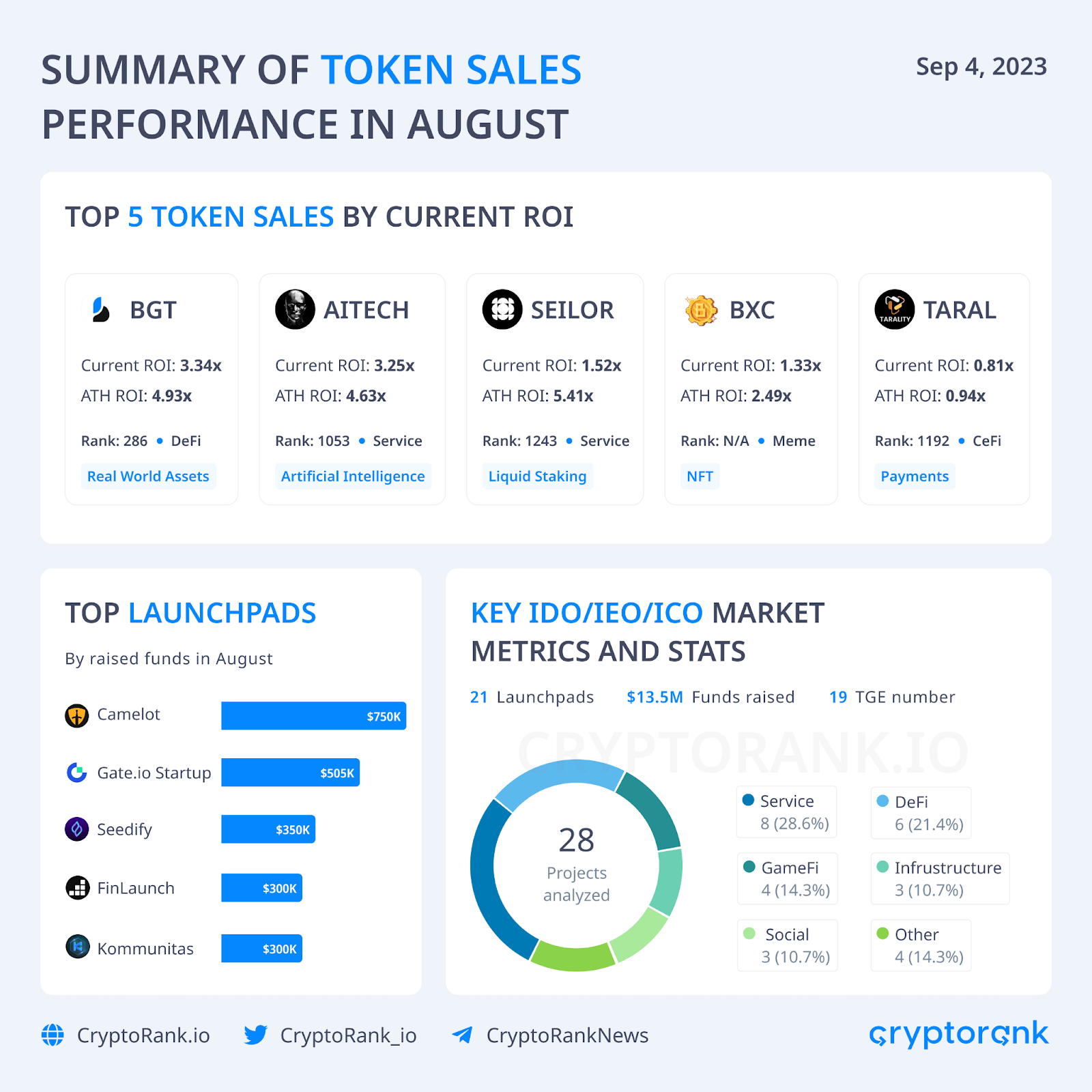

Interest in Token Sales Remain Low

Launchpads typically experience a productivity slump during the summer months. While this summer showed improvement over the previous one, activity levels remained relatively low. In August, there were 54 token sales, a decrease of 16 compared to August of the previous year. However, the total amount raised this month was more impressive, with $20.8M raised.

Investors did not have the opportunity to enjoy high yields from token sales this month. As usual, due to bearish market conditions, many projects quickly lost traction and significantly declined from their all-time highs (ATH).

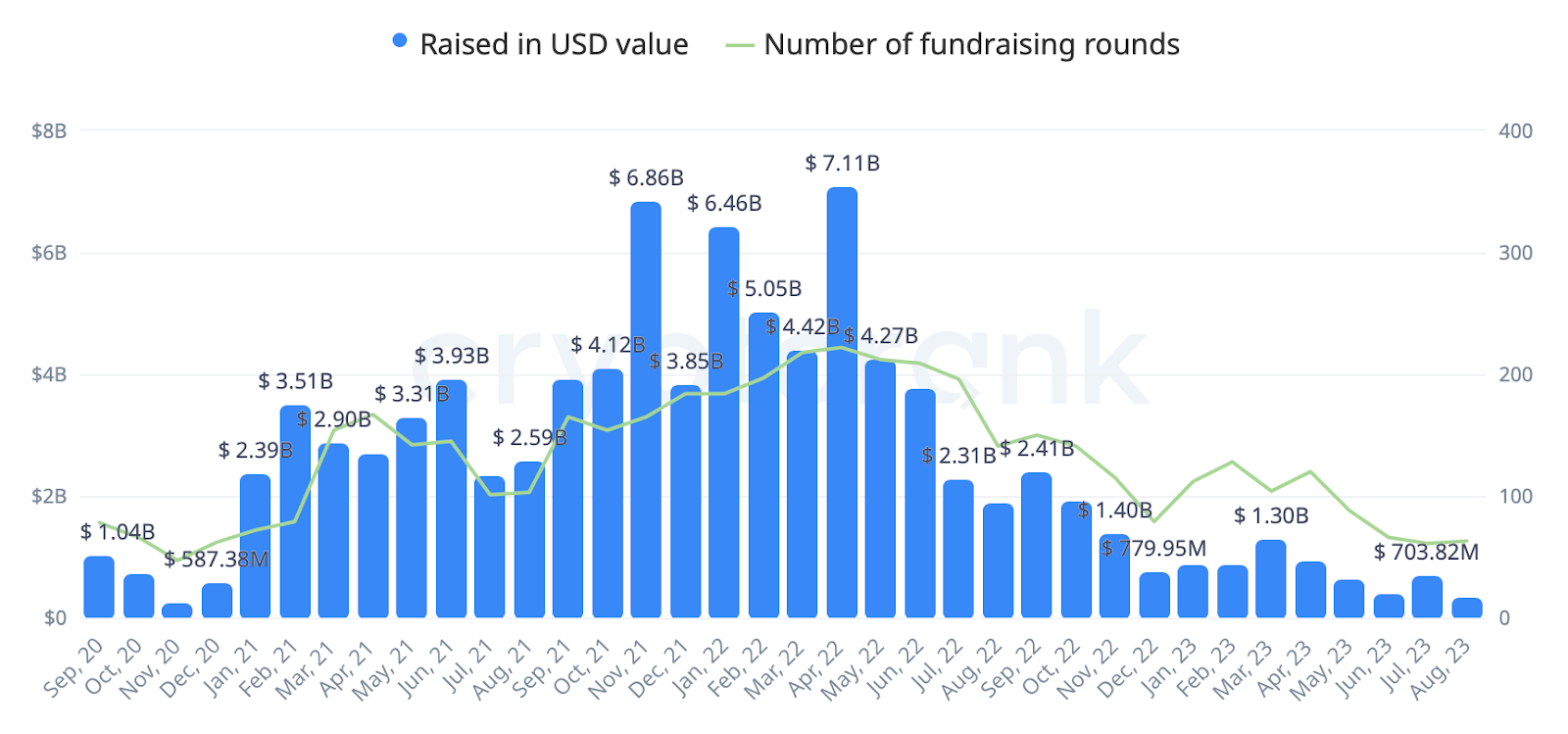

In reality, the situation is no different from private fundraising. As of August 2023, the monthly amount raised has hit its lowest value in almost three years, since November 2020. While this can be partially attributed to low business activity during the summer, it also reflects the current state of the market, which is characterized by significant frustration.

The Bottom Line

As is often the case, a significant price movement occurs after a period of uneventful price action. At this time, it is unclear whether the movement will be upward or downward.

Historically, September has been a bad month for cryptocurrency, based on average monthly returns. While the markets remain hopeful, they also prepare for the worst-case scenario. However, the upcoming launch of spot Bitcoin ETFs and halving events provide hope for a bullish future.