October truly proved its nickname “Uptober” once again. Bitcoin reached a new year-to-date high, and several other large-cap coins experienced a significant surge. However, the rest of the market remained relatively stable, albeit with a more positive sentiment compared to the previous quarter.

Key Takeaways:

- Markets exhibited significant growth, with the expectation of Bitcoin ETF approval being the main driving force.

- Trading volumes experienced a spike of over 50%, with Binance maintaining 50% dominance.

- DeFi continues to face challenges in terms of growth.

- Public and private fundraising activity remains relatively low.

Market Overview

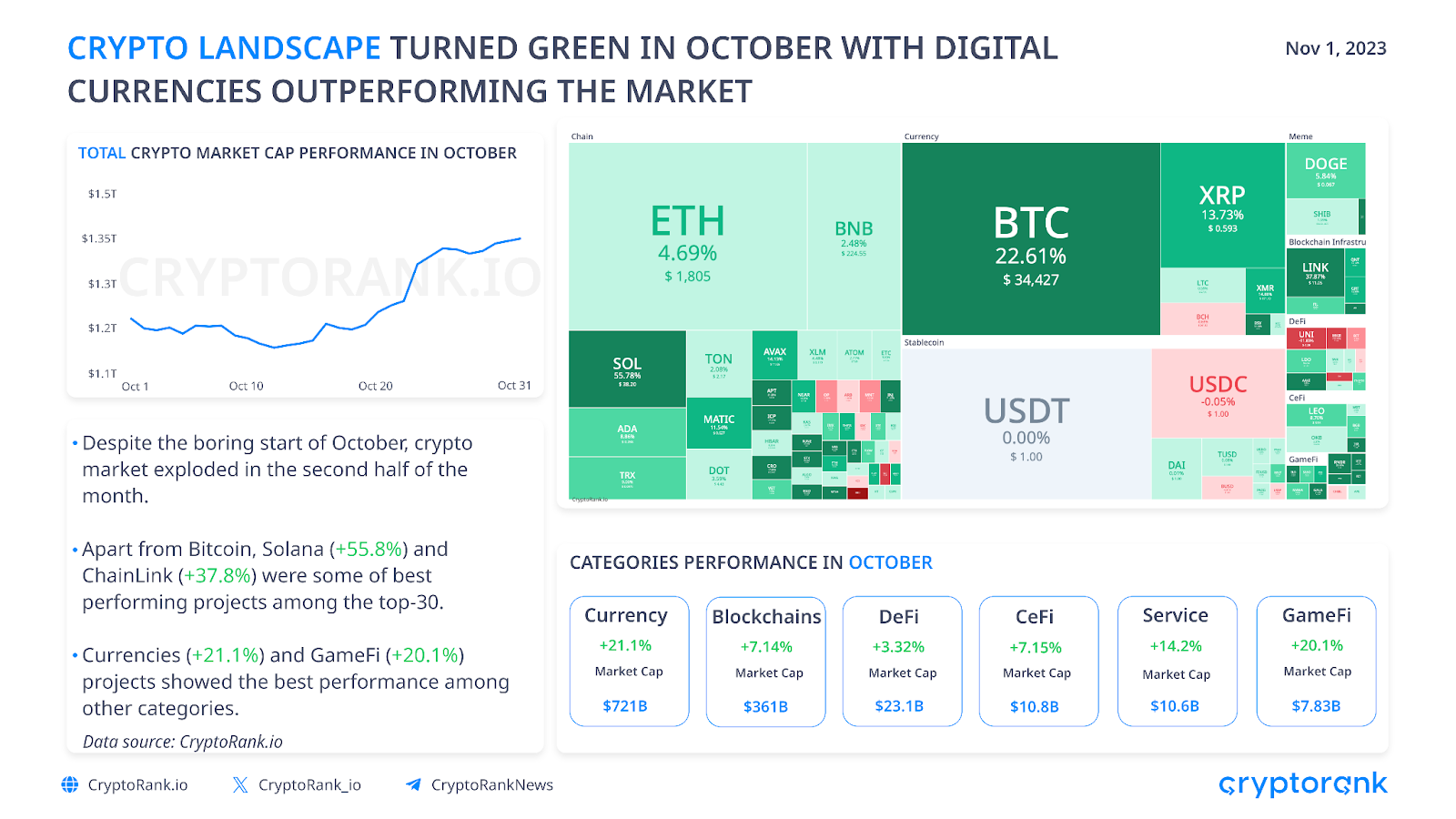

Despite starting the month on a negative note, the situation quickly improved after the first two weeks. Bulls injected a renewed sense of optimism into the market, driven by the growing anticipation for the approval of a Bitcoin ETF.

October was the first positive month for crypto in nearly six months, but it is unlikely that the market has entered a growth stage. The liquidity in crypto is still relatively low, and the volatility of major coins remains near the bottom. Currently, there is almost no new money entering the crypto market, but this could change rapidly if the SEC approves the first Bitcoin ETF.

Bitcoin Performance

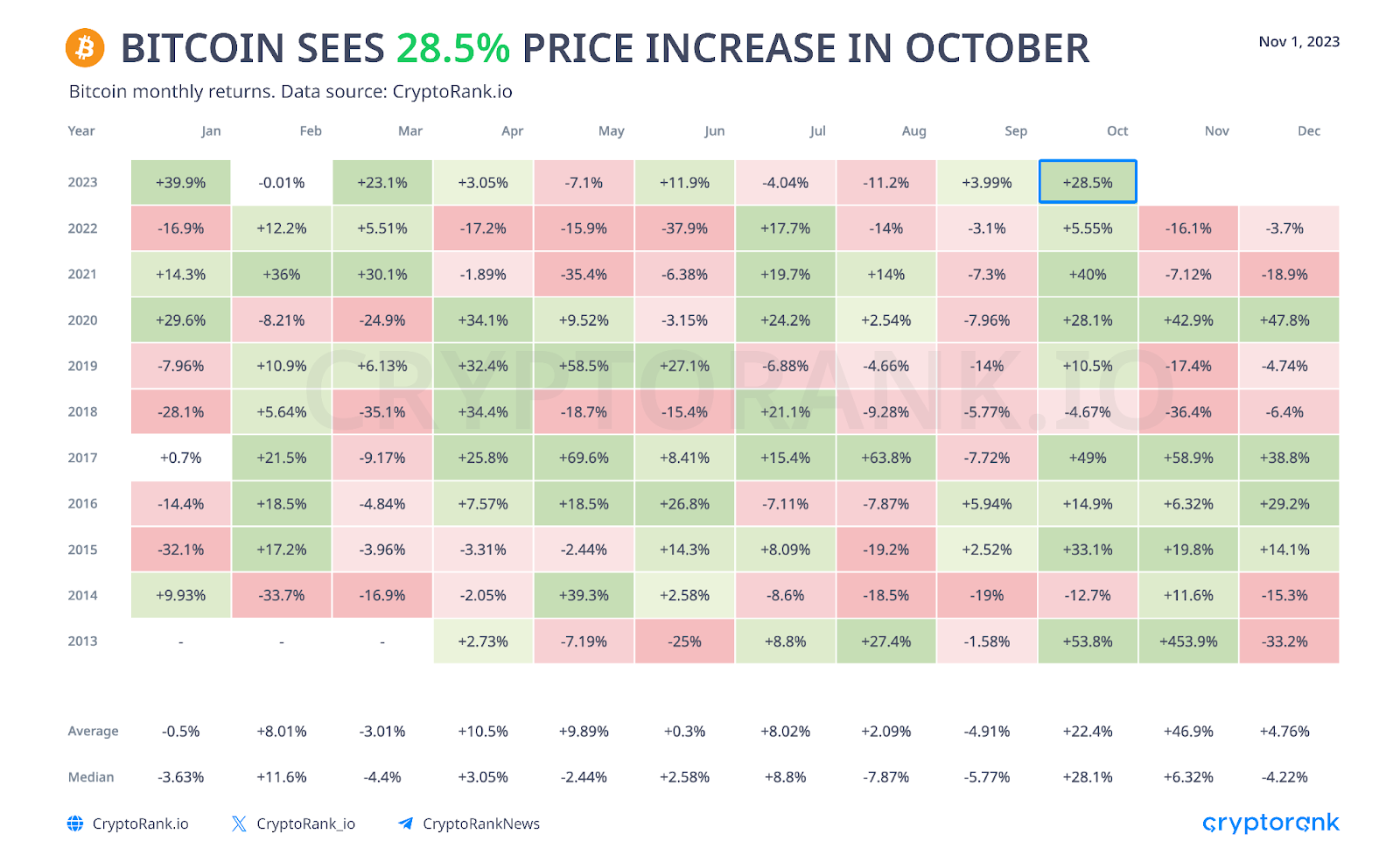

Autumn is usually a great time for Bitcoin, except for September. October 2023 proved this once again, as Bitcoin experienced a 28.5% price increase, surpassing both the 10-year average and median indicators.

Data source: https://cryptorank.io/price/bitcoin

It is worth noting that November has the potential to perform even better, based on the average return over the past 10 years. However, its performance in November is particularly strong during bull markets, and it is not certain that we are currently in a bull market.

Altcoins Performance

In October, we witnessed several gainers, including Solana, which experienced a growth of nearly 80%. It surpassed many other projects and secured a stable 7th place. Solana’s market capitalization increased by almost $6 billion, making it the most profitable month since January 2021. This growth continues the recovery from the significant drop related to FTX. For a comprehensive list of the top gainers, refer to the infographic below.

Data source: https://cryptorank.io/performance

Bitcoin ETF Approval Is Getting Closer?

Without a doubt, the main driver of October’s growth was the expectations surrounding the upcoming launch of the first Bitcoin spot ETF. This highly anticipated event had a significant impact on the market twice during the second half of the month.

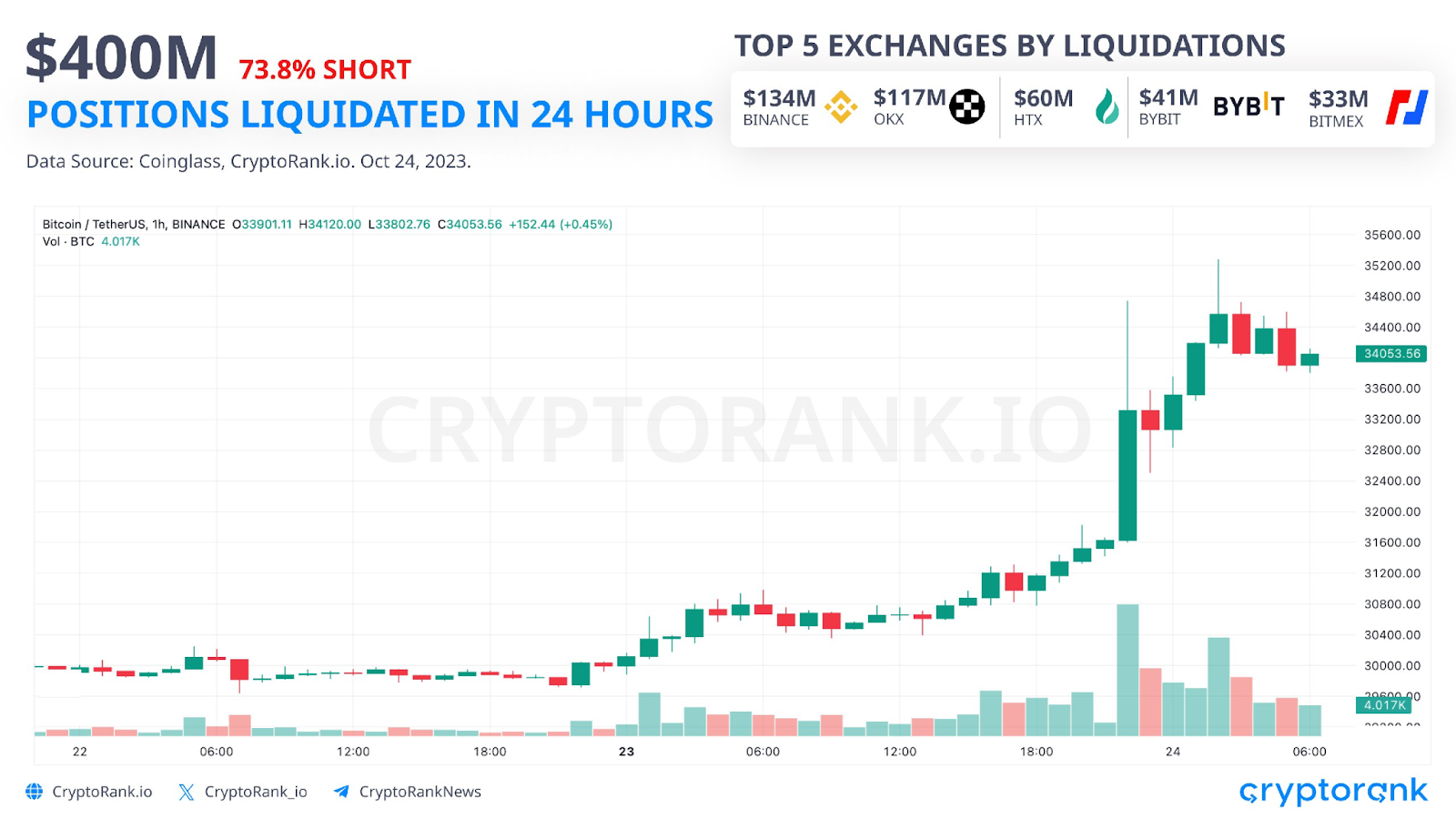

It all started with a fake screenshot from Bloomberg Terminal claiming that the iShares Bitcoin spot ETF had been approved by the SEC. This fake news quickly spread on social media, causing a massive increase in the price of Bitcoin, surpassing $30,000. However, within approximately 30 minutes, BlackRock confirmed that their application had not been approved. As a result, the market quickly declined, and more than $100M worth of futures positions were liquidated during that hour. You can read more about these liquidations here.

Despite this setback, there were other positive developments regarding the Bitcoin ETF just a few days later. It was discovered that iShares Bitcoin Trust by BlackRock had been listed on the DTCC website with the ticker IBTC since August. This news generated speculative interest, suggesting that insiders expect the ETF to be approved soon. Additionally, a US Court confirmed the ruling on Grayscale, stating that the SEC must re-review the GBTC bid. These news items contributed to Bitcoin spiking past $35K, setting a new year-to-date high and resulting in over $400M in liquidations.

Undoubtedly, the launch of a Bitcoin ETF will be a significant event for the crypto market. It will bring more money into the ecosystem and increase the adoption of cryptocurrency as an investment instrument. Although the chances for ultimate approval are high, it may not happen in 2023.

Trading Volumes Spiked in October

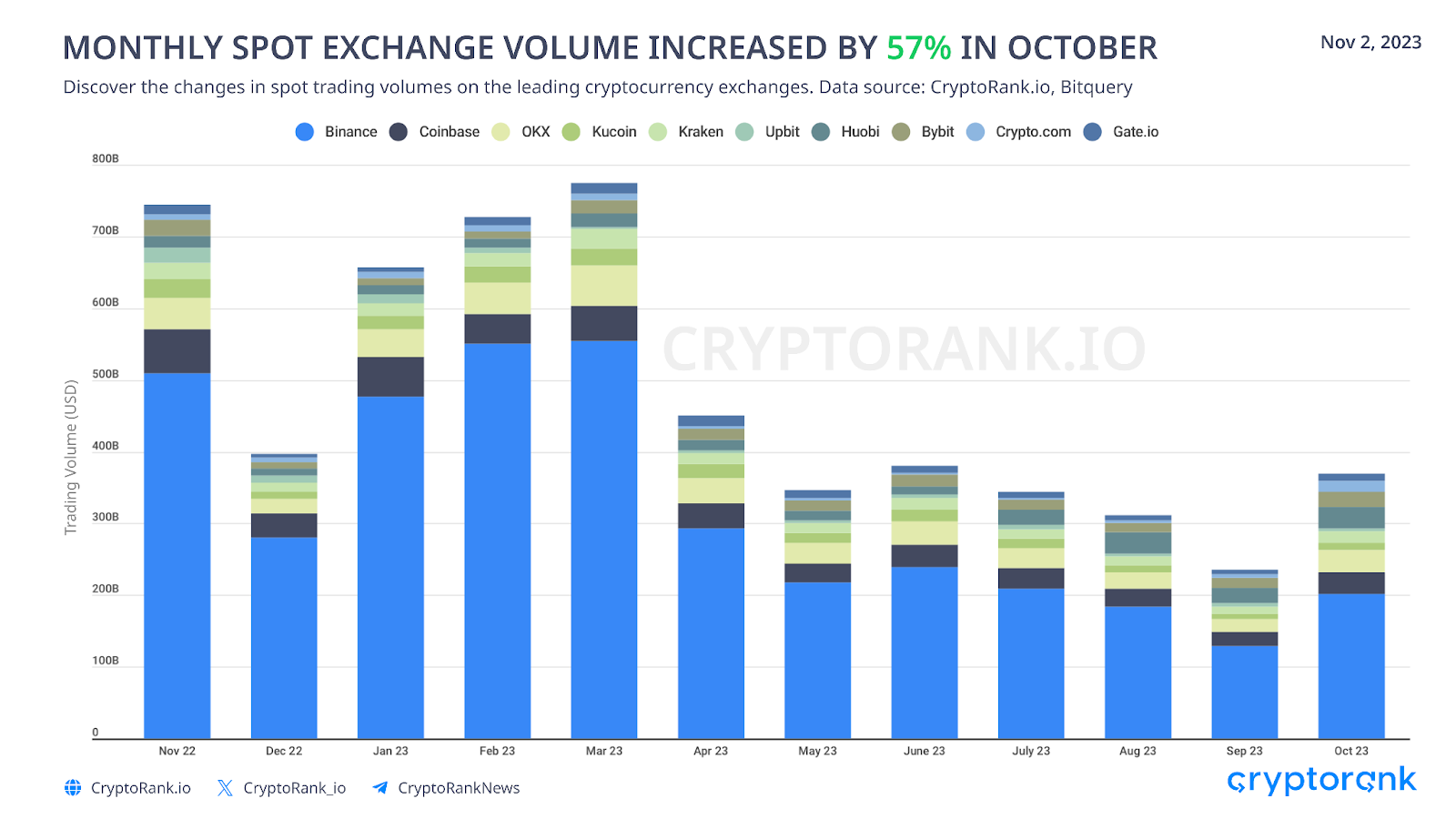

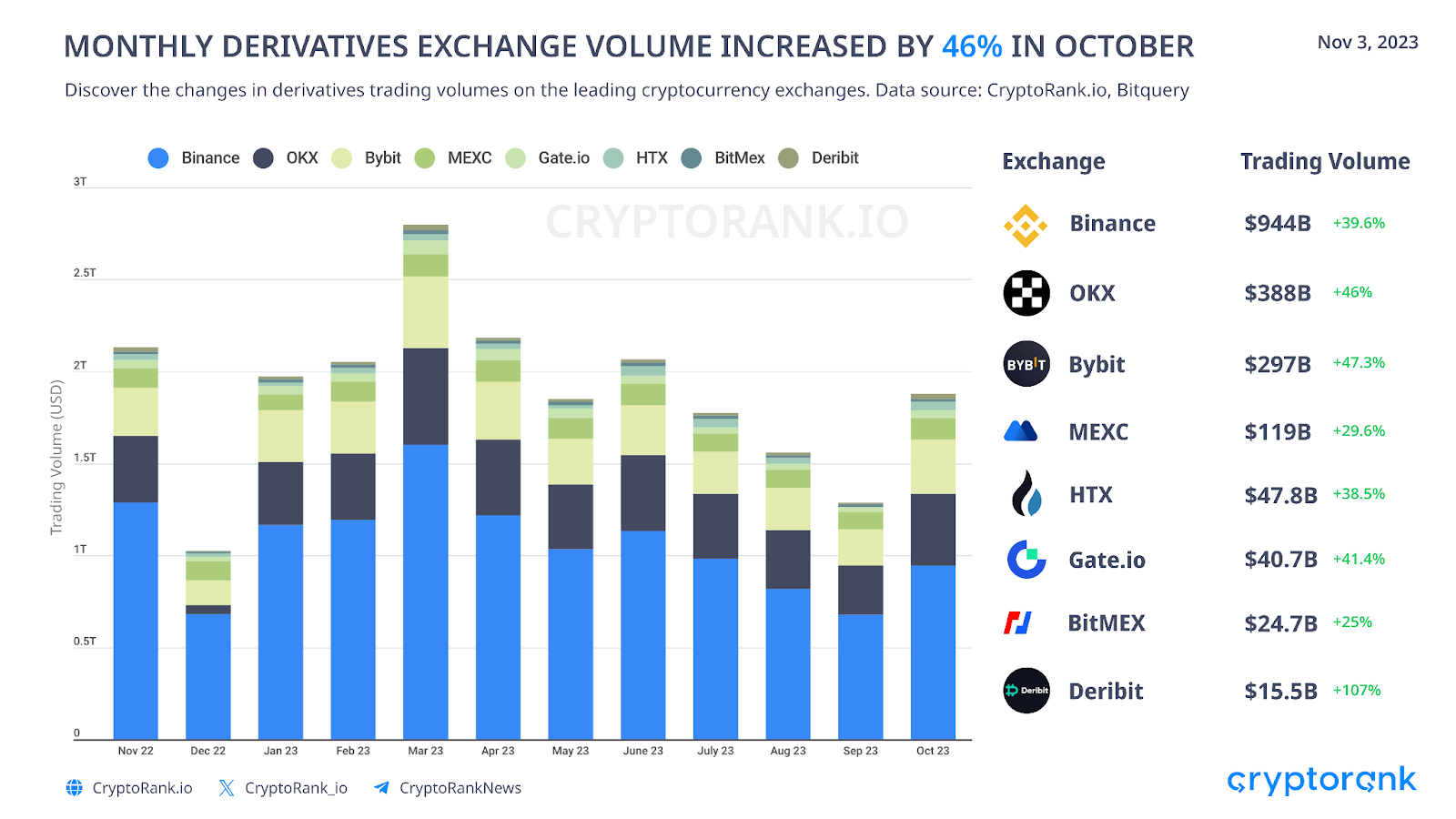

Like often, shock events lead to a significant rise in trading volumes. In October, the same occurred, resulting in a 57% increase in trading volumes.

Binance remains the top leader in trading volumes, accounting for 54.3% of the total trading volume among the top 10 crypto exchanges. Trading volume in Binance has bounced back, in both spot and derivatives markets. Crypto.com (+204%), OKX (+76.7%), and Bybit (+67.3%) exhibited the highest monthly growth in spot trading volume.

It is worth noting that Spot volumes grew significantly stronger than derivative volumes. Open Interest in crypto markets remains low, but showed some increase on the most active days. Binance also dominates the trading volume of derivatives, accounting for 50%.

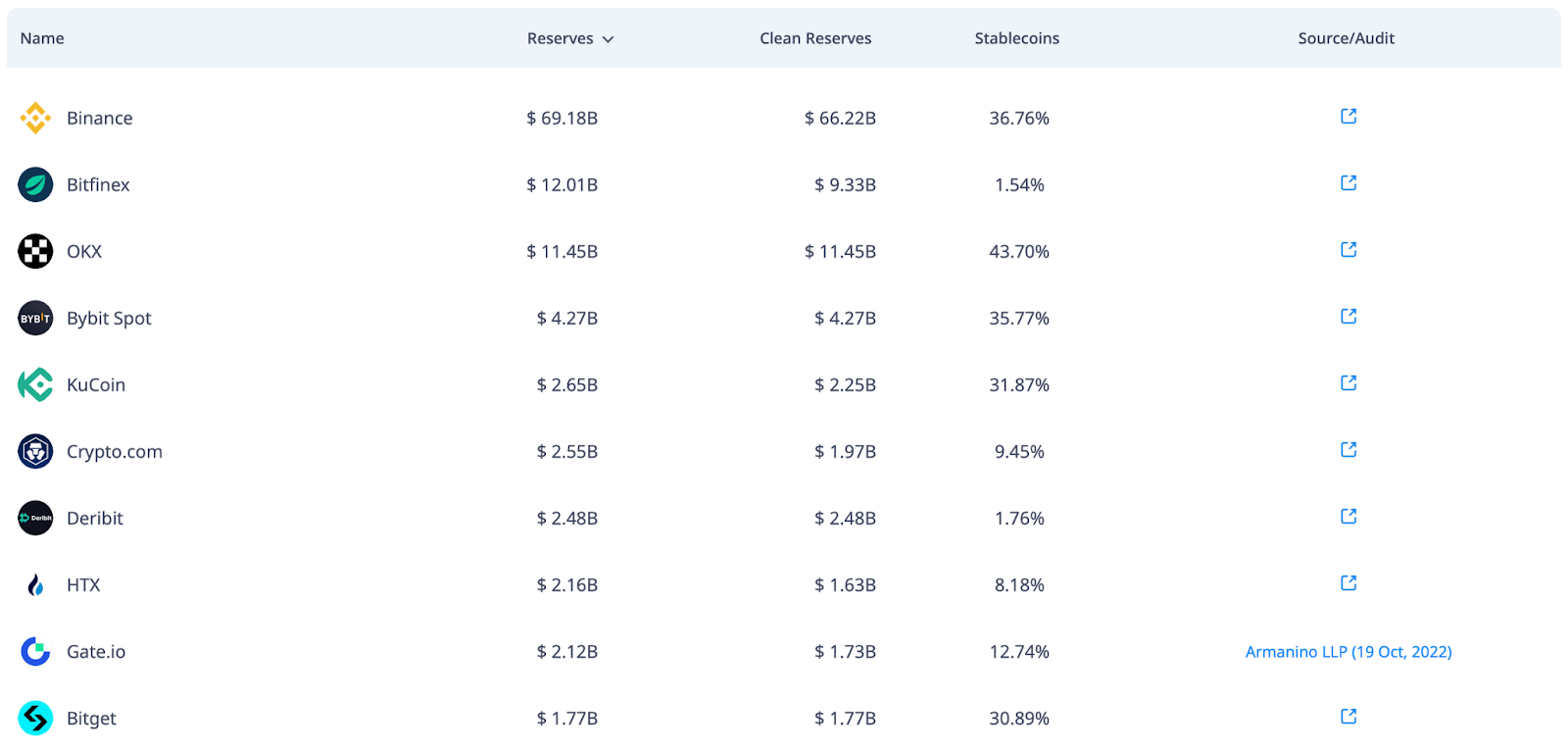

Along with the recovery of the market and trading volumes, the reserves of centralized exchanges also showed good growth. Binance remains the undisputed leader with reserves of over $69 billion, of which almost 37% are stablecoins. The market recovery has an extremely positive effect on the business of centralized exchanges, pushing them towards new initiatives.

Data source: https://cryptorank.io/exchanges/cex-transparency

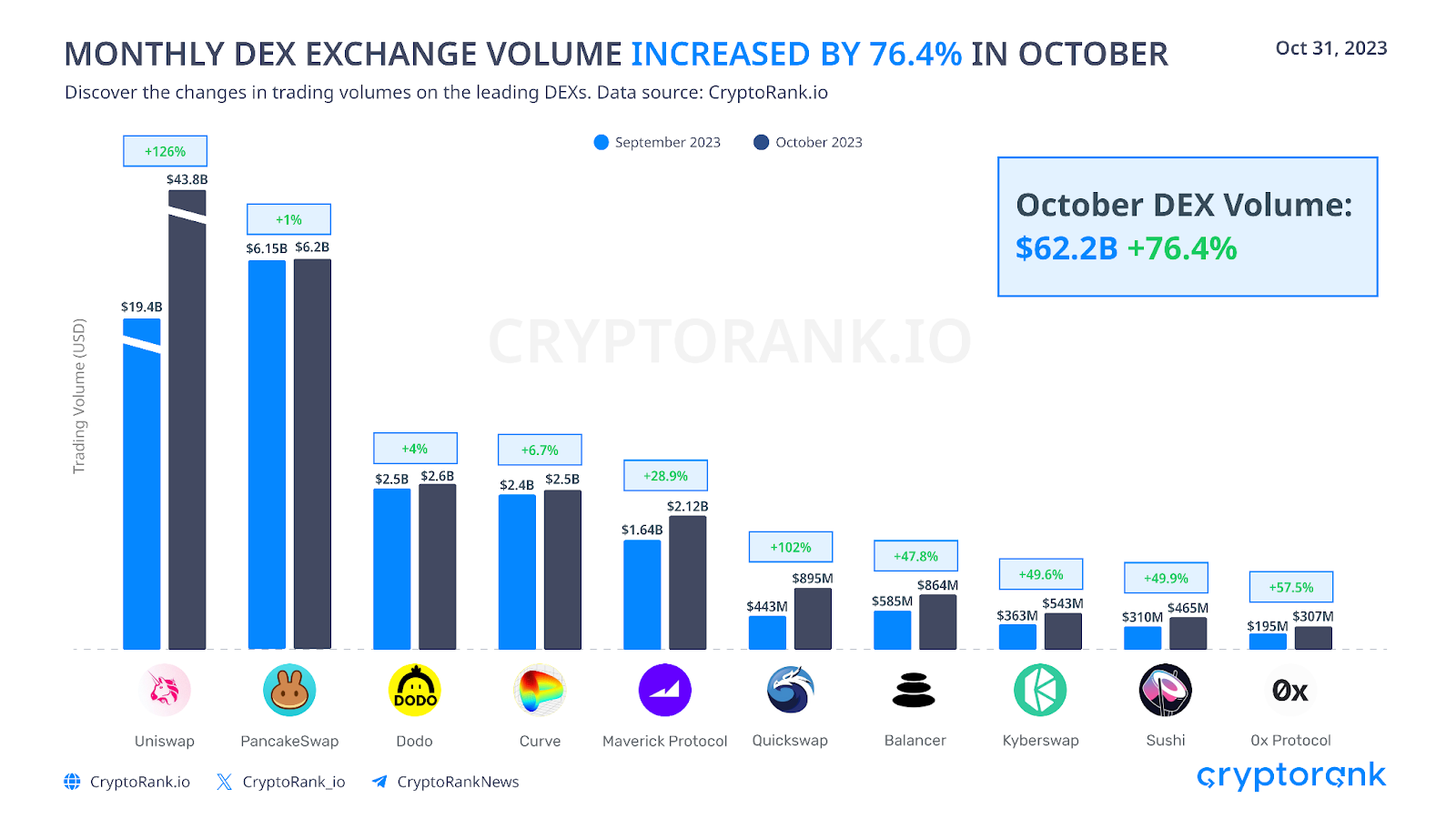

Decentralized exchanges (DEXs) demonstrated the highest monthly growth in trading volume compared to centralized exchanges. The overall DEX trading volume increased by 76%, with Uniswap and QuickSwap leading the way with increases of 126% and 102% respectively. However, the total monthly volume of DEXs still remains relatively low, at approximately 17%.

DeFi Revived, But Not Significantly

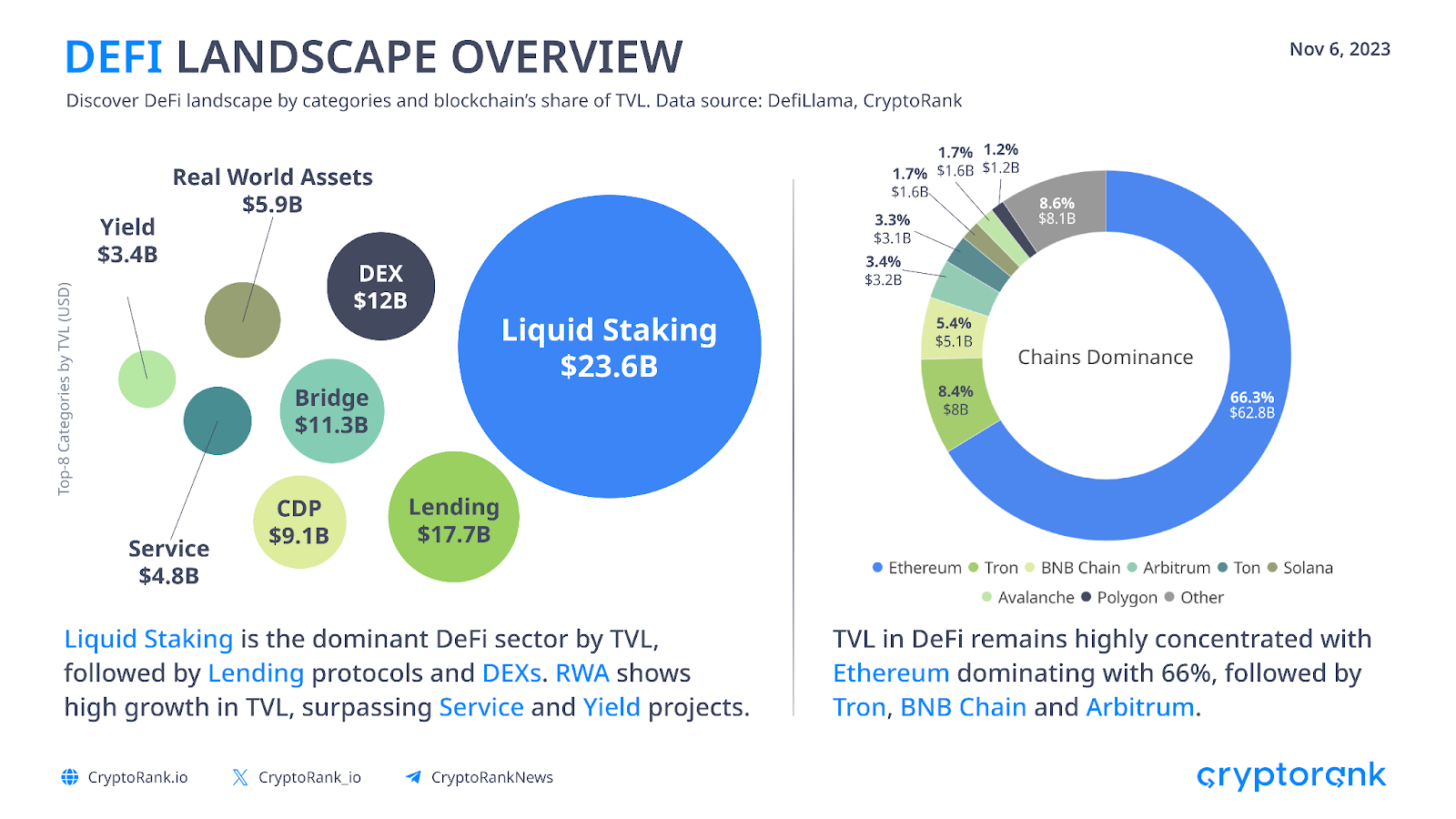

The market saw an upturn in October, which had a notable impact on Bitcoin and a few top altcoins. However, the DeFi sector has largely remained unaffected.

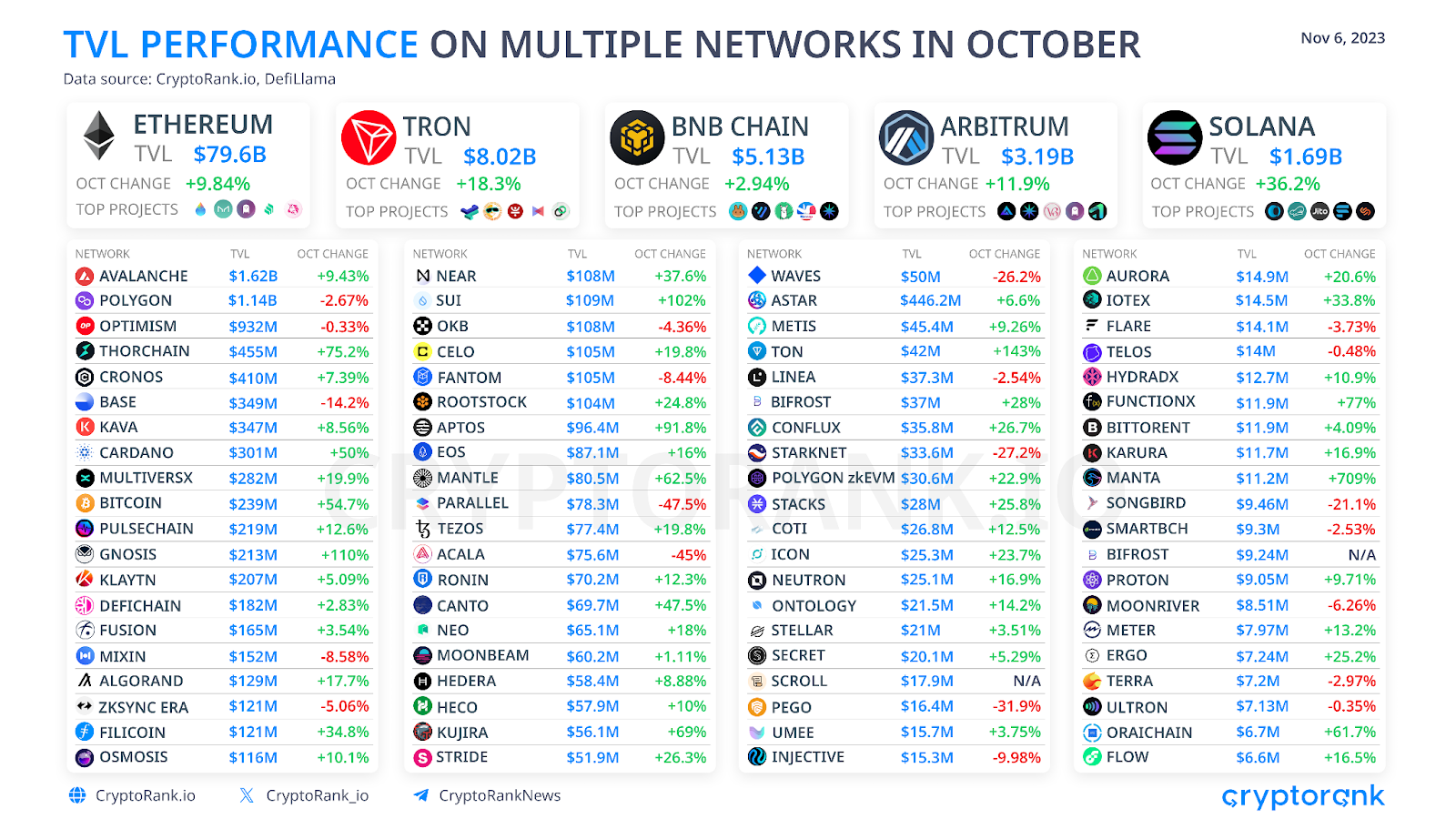

Indeed, Ethereum remains the dominant blockchain in terms of Total Value Locked (TVL), and its price increase of +8.61% in October had an effect on DeFi TVL. However, it hasn’t been enough to create sufficient traction for other tokens or give users a reason to invest in DeFi. It is worth noting that Real World Assets (RWA) showed significant TVL growth in October and is now the 6th largest DeFi category. To learn more about RWA, you can read our comprehensive research.

TVL has remained close to its lowest point since Terra’s collapse, indicating significant problems in the landscape. The main problem is likely the lack of new developments and sustainable yields. The majority of TVL is locked in secure Liquid Staking, DEXs, and Lending/Borrowing pools that generate yield in major coins. However, since most crypto users have a low risk tolerance and are not ready to invest more, DeFi will likely stagnate.

Due to the growth in token prices, most blockchains have shown an increase in Total Value Locked. Notably, some popular Layer 2 networks like Base, zkSync Era, and StarkNet have experienced a significant decrease in TVL. This could be due to deposits flowing out to other, more interesting blockchains, such as the recently launched Scroll.

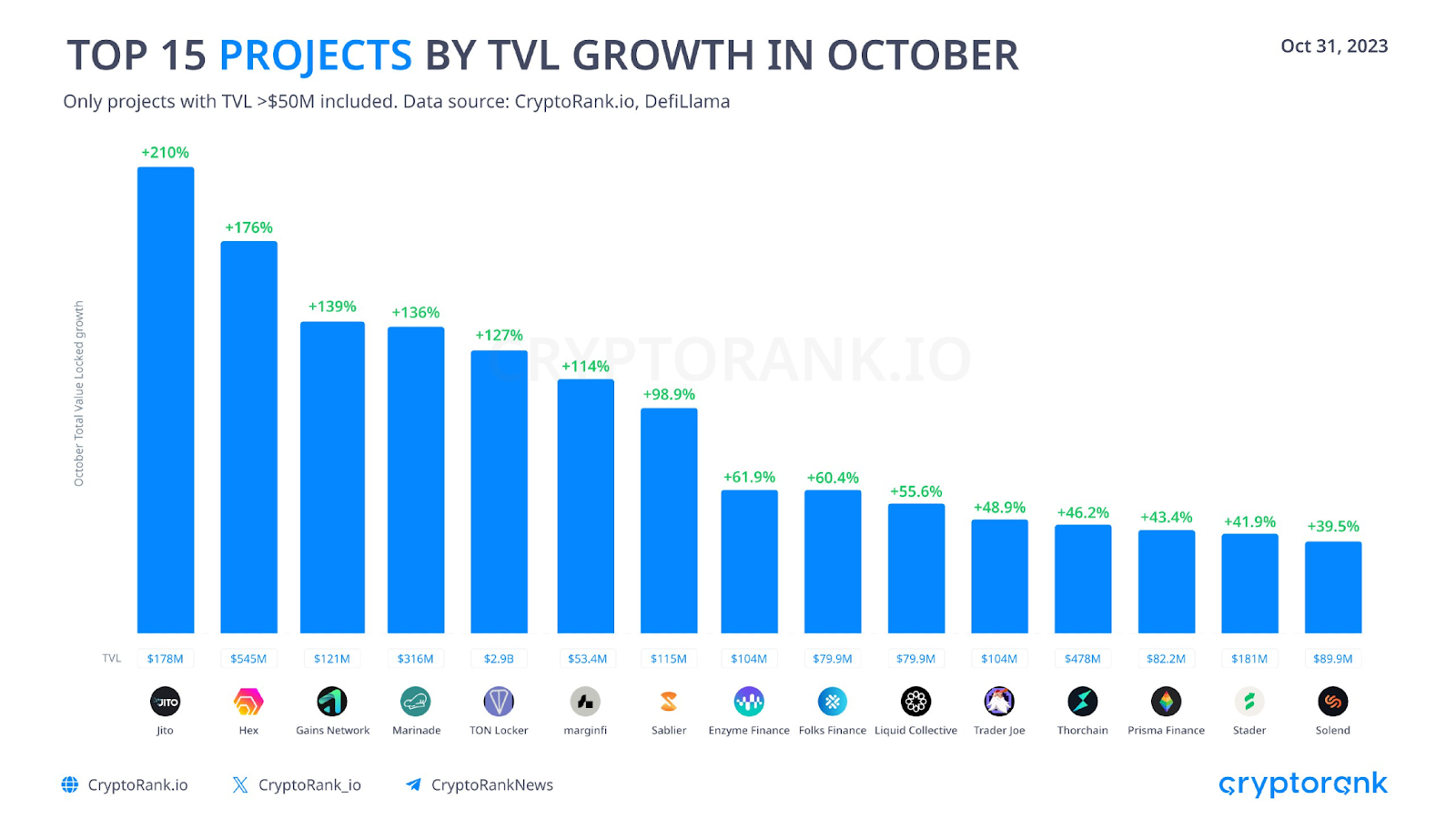

In October, Solana-based protocols offering Liquid Staking pools for SOL, Jito, and Marinade emerged as leaders in TVL growth. Additionally, LSD protocols for other networks, including TON Locker and Liquid Collective, demonstrated significant growth.

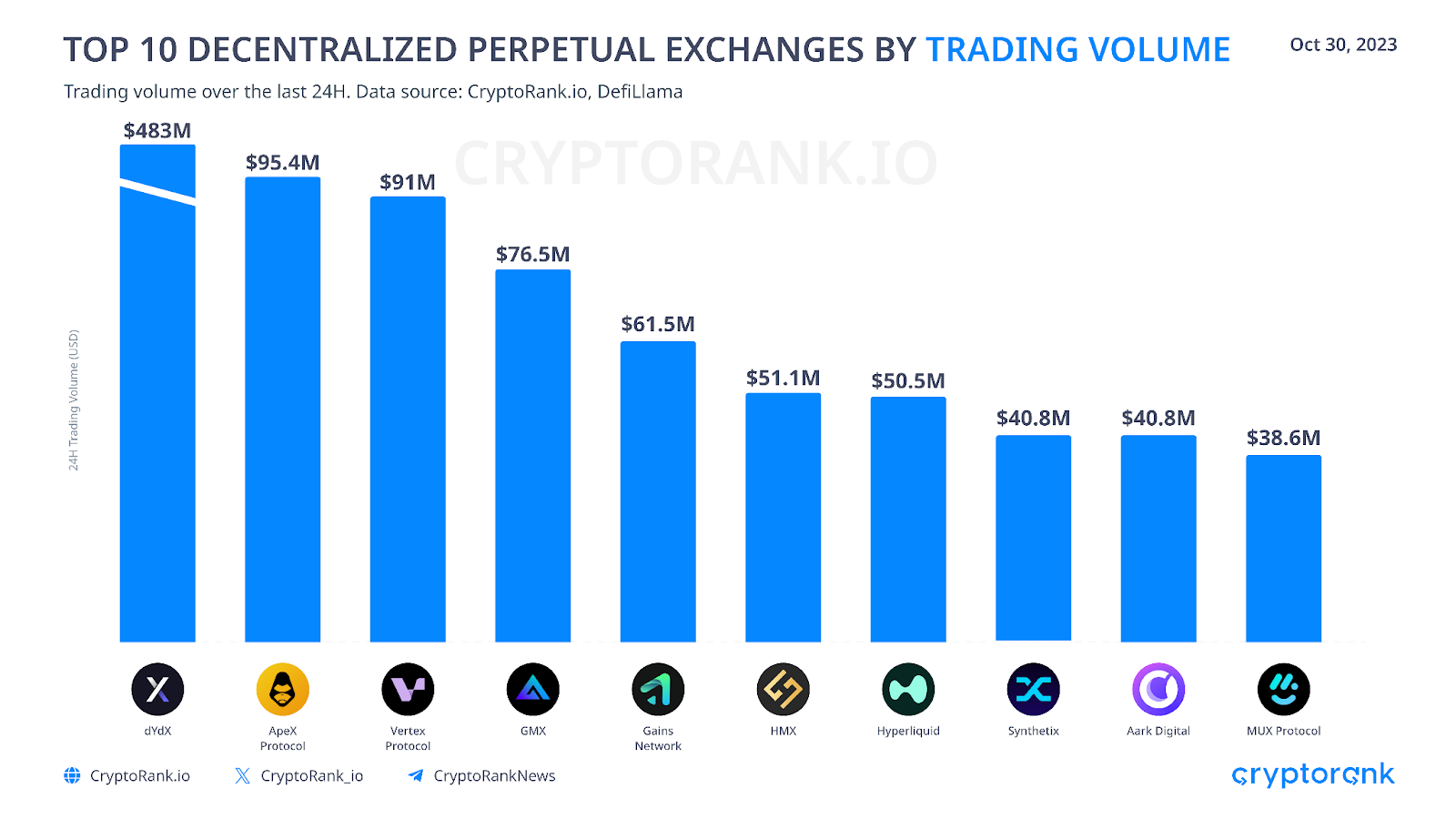

dYdX remains a leader among perpetual decentralized exchanges. GMX, which was in the lead at the start of the year, has now relinquished its position to Vertex Protocol, another DEX on Arbitrum. The perpetual DEXs segment has grown significantly compared to a year ago, but still represents a small portion of the overall crypto derivatives market.

However, new advancements have the potential to revive DeFi, and one such development is Real World Assets, which has recently gained significant popularity.

Public and Private Fundraising Decline Continues

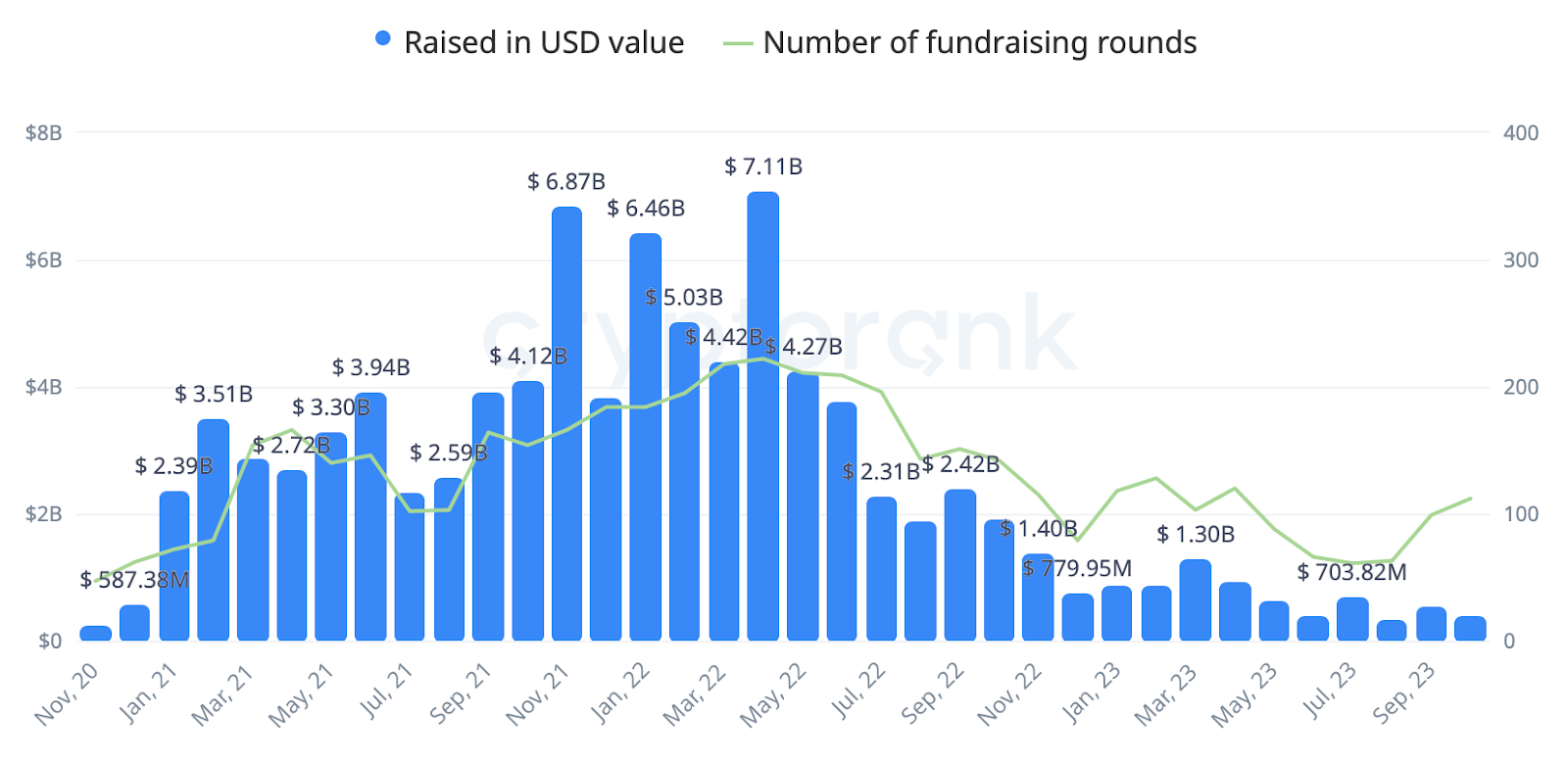

Despite the significant growth of the crypto market in October, the situation in crypto fundraising remains unchanged. Although there has been an increase in the number of fundraising rounds, primarily due to the distribution of grants by the Arbitrum Foundation, the total amount raised continues to decline.

Data source: https://cryptorank.io/funding-analytics

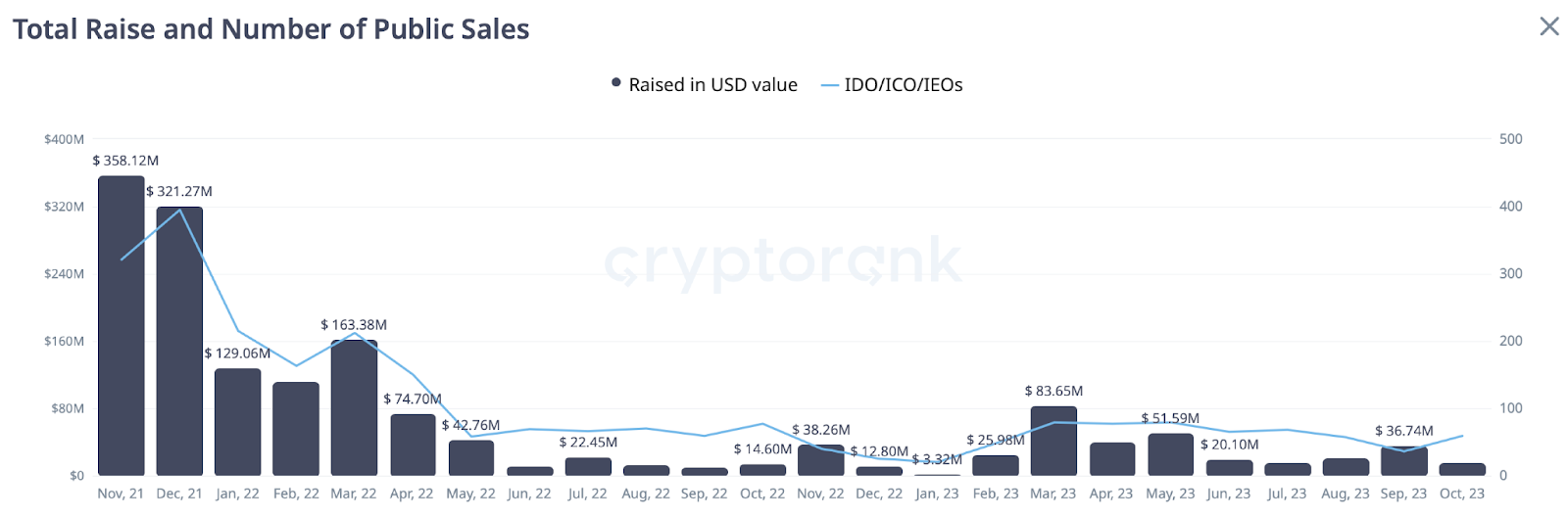

The situation in the public token sales sphere is similar. The number of rounds and amounts of token sales in IDOs, IEOs, and ICOs are currently very low. There is no trend yet that could reverse this situation.

Data source: https://cryptorank.io/ico-analytics

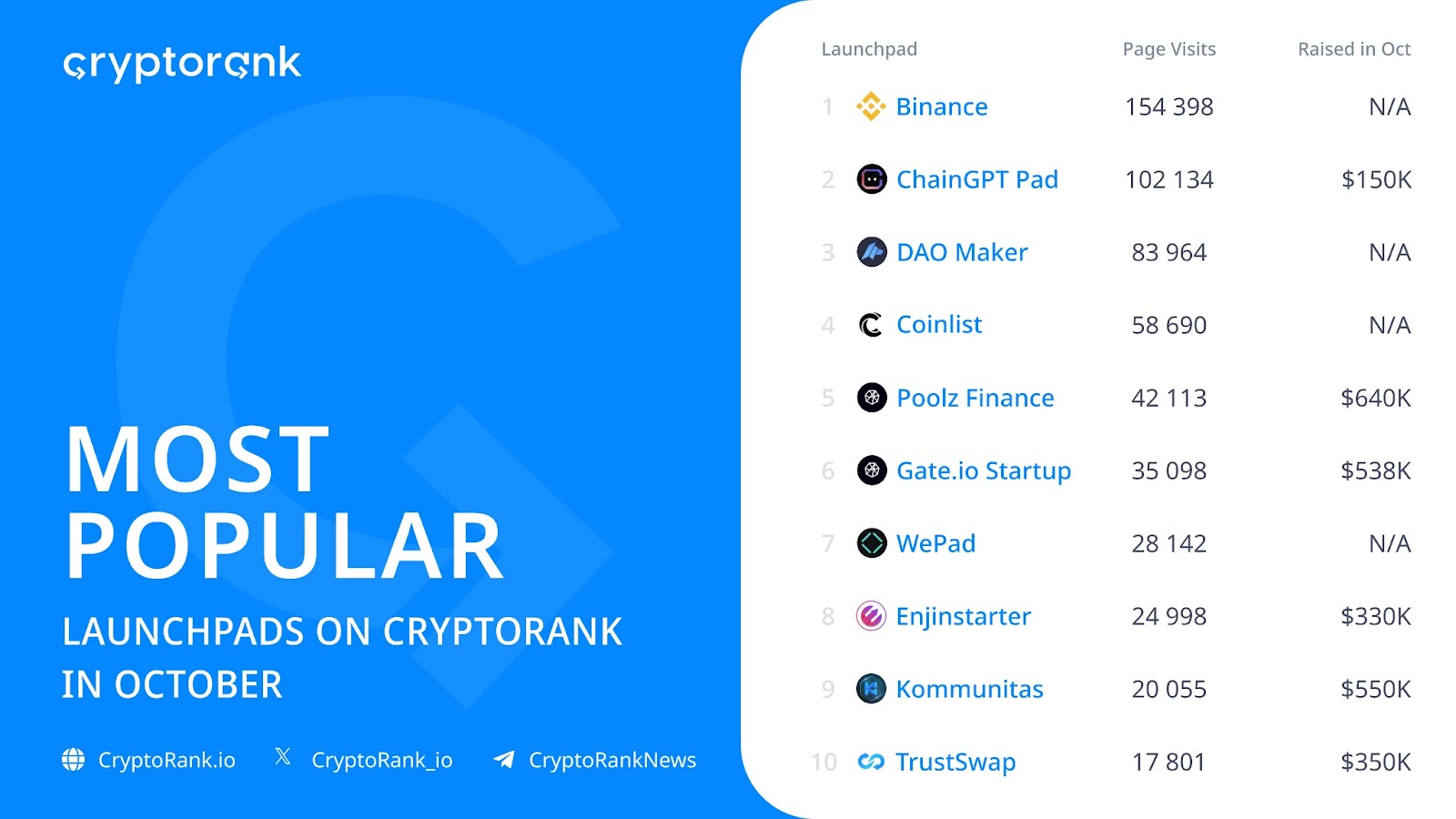

However, launchpads remain very popular among CryptoRank.io users. Binance Launchpad is the undisputed leader, even though there were no token sales in October.

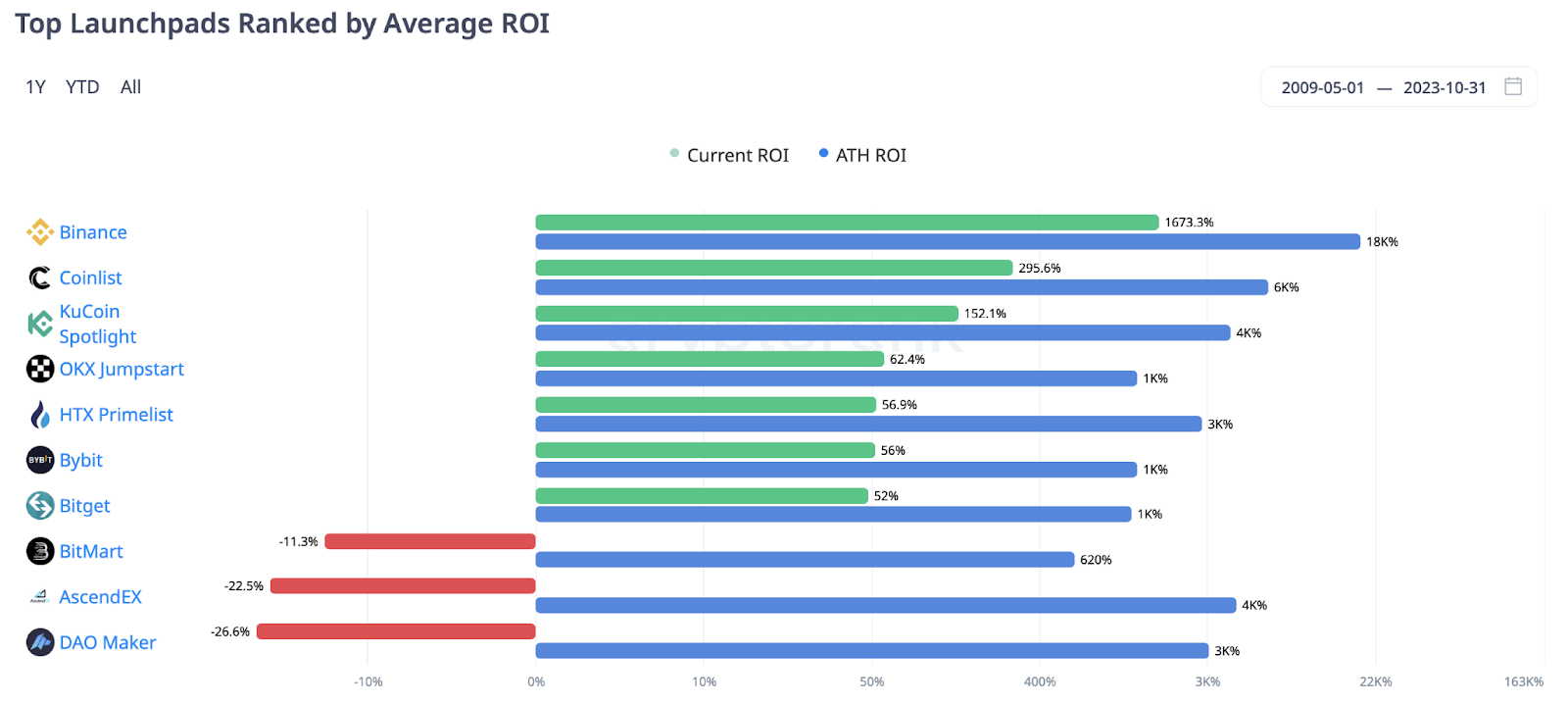

The popularity of Binance Launchpad can be attributed to its consistently high yield, even during bear markets. Currently, only 7 launchpads are exhibiting positive average returns. It is worth noting that none of these launchpads are IDO launchpads.

Data source: https://cryptorank.io/ico-analytics

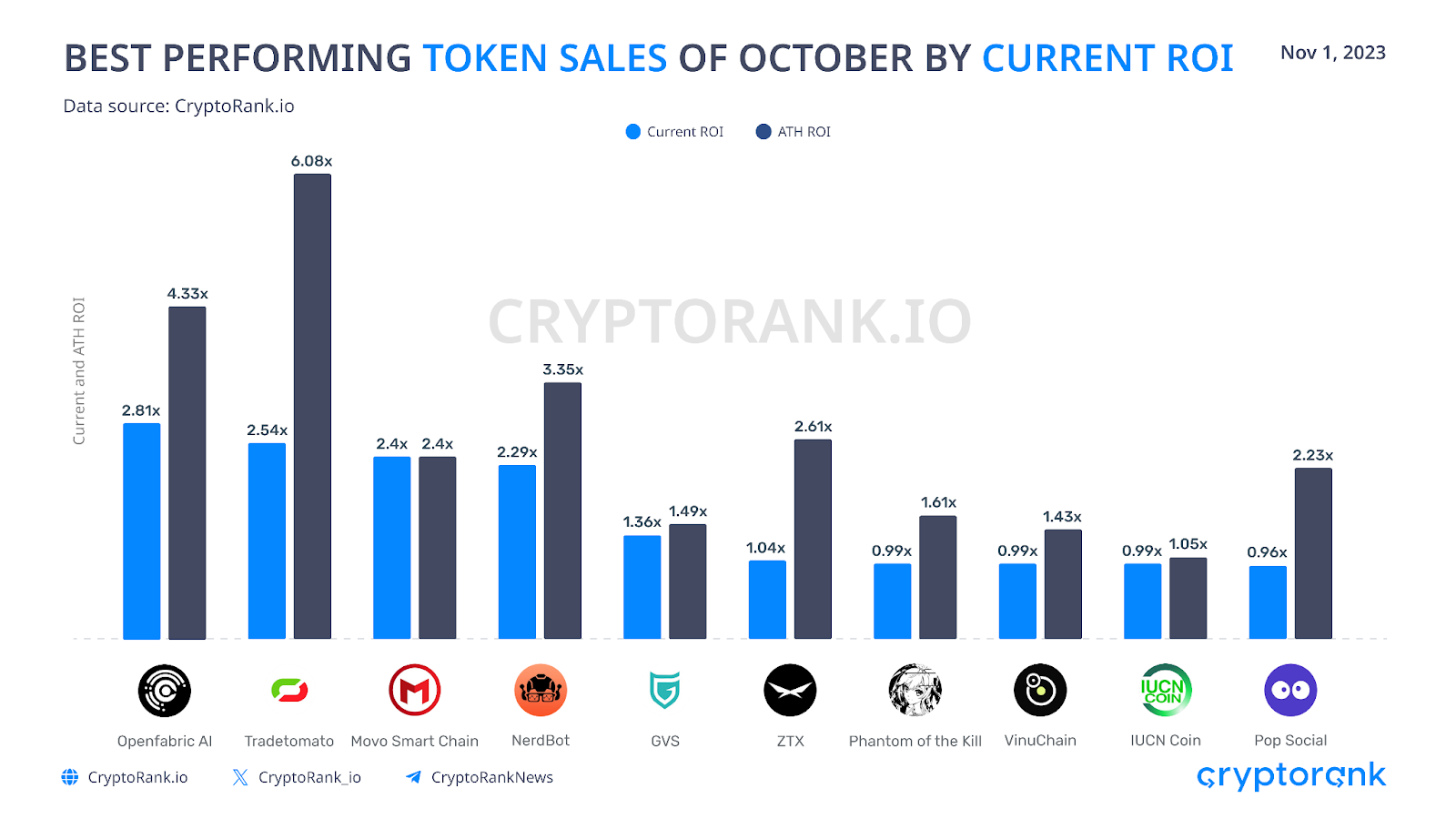

The performance of token sales in October was disappointing. Only a few projects that conducted token sales during this month were able to demonstrate a satisfactory return on investment. Unfortunately, as long as there is minimal interest in new projects, it will be challenging for launchpads to achieve significant returns.

On-Chain Overview

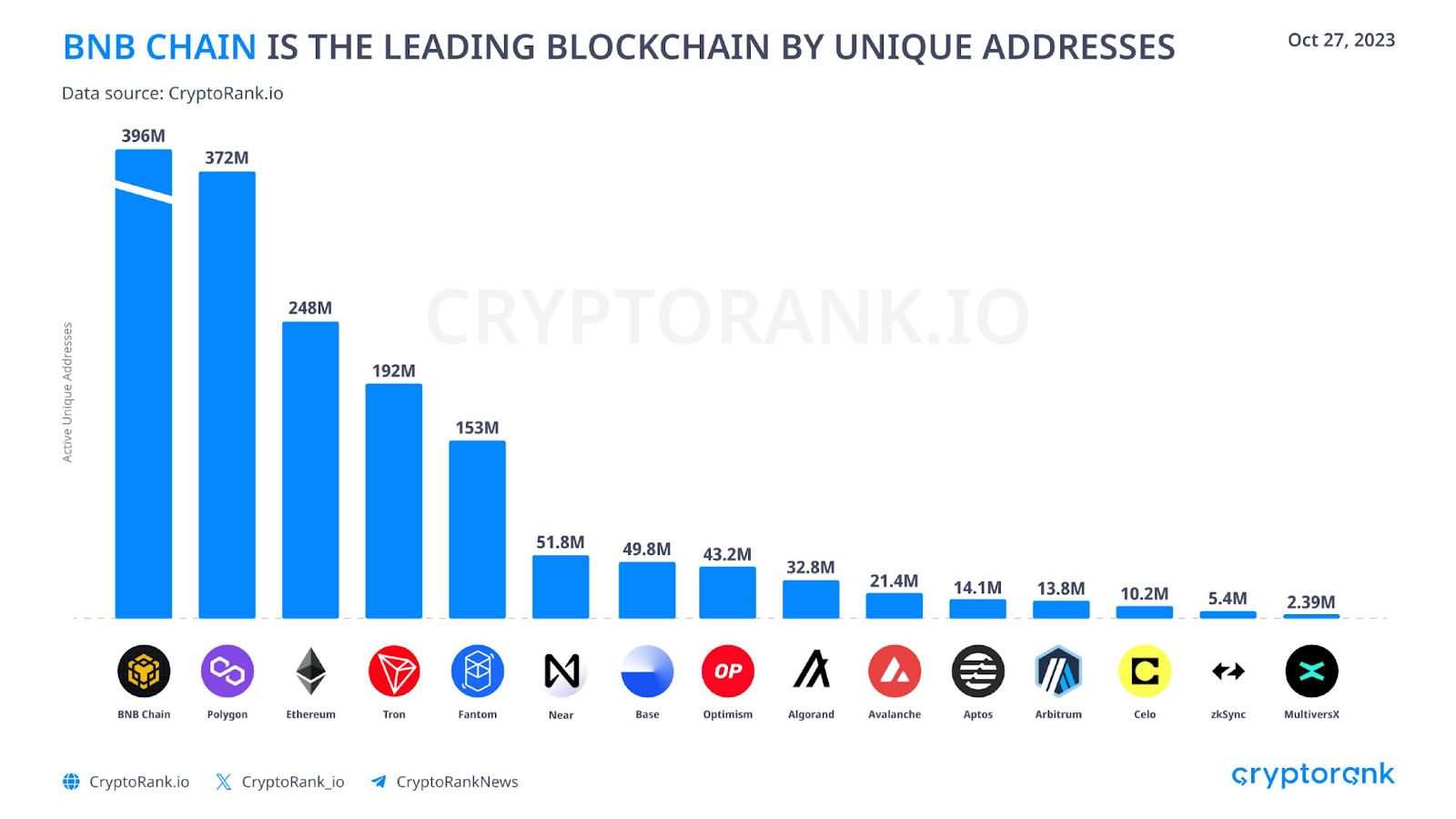

The on-chain picture consistently shows positive changes. The total number of addresses on the leading smart-contract platforms has already surpassed 1.5 million. BNB Chain holds the top position, followed by Polygon and Ethereum. In recent months, Base has demonstrated the most remarkable growth in address numbers and is now approaching 50 million.

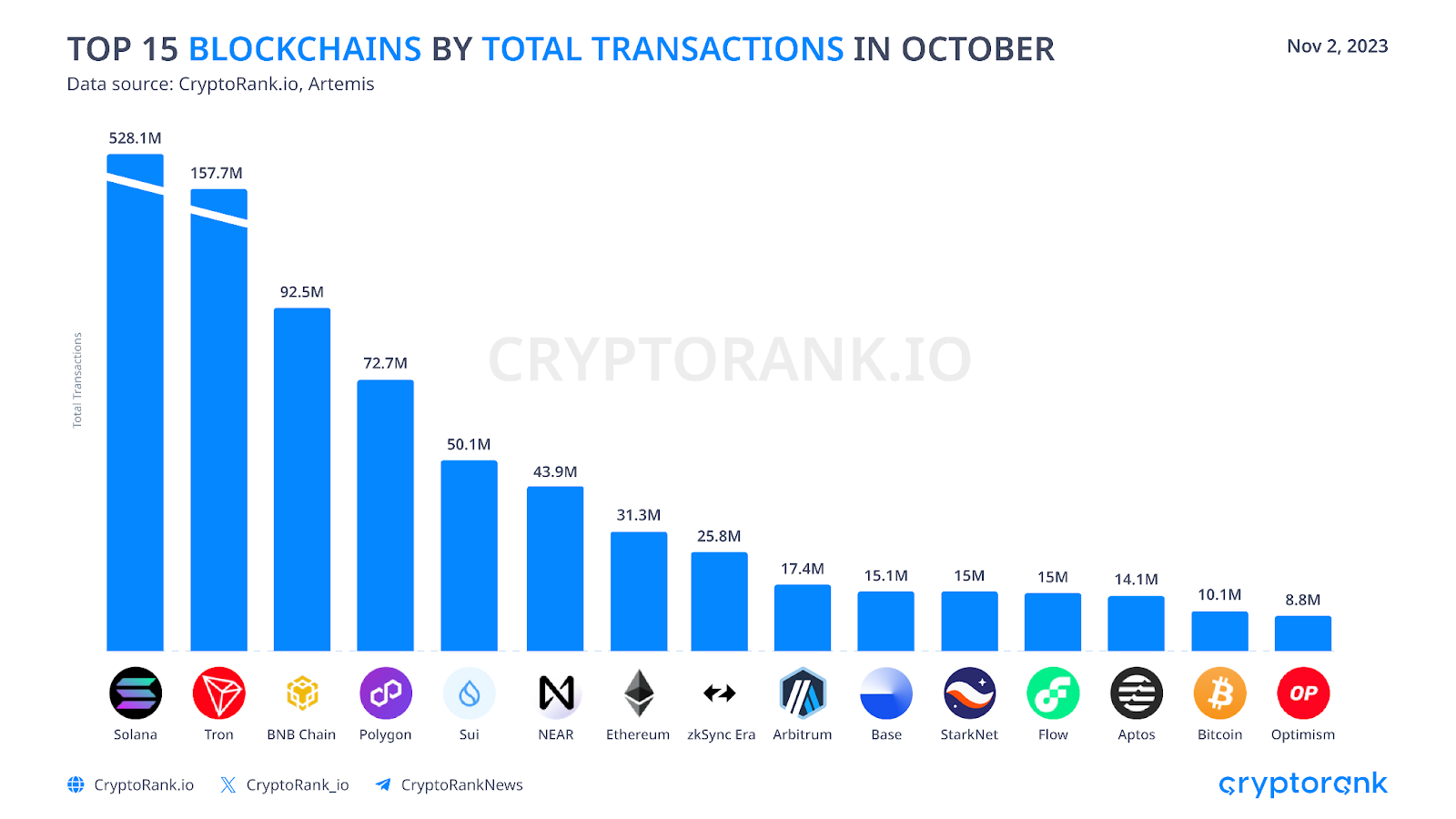

In October, Solana continued to be the top blockchain in terms of the number of transactions, thanks to its high TPS (Transactions Per Second) and low fees. Among EVM-networks, BNB Chain holds the leading position. As for Ethereum Layer 2 blockchains, zkSync maintains its leadership, with a significant advantage over Arbitrum and other competitors.

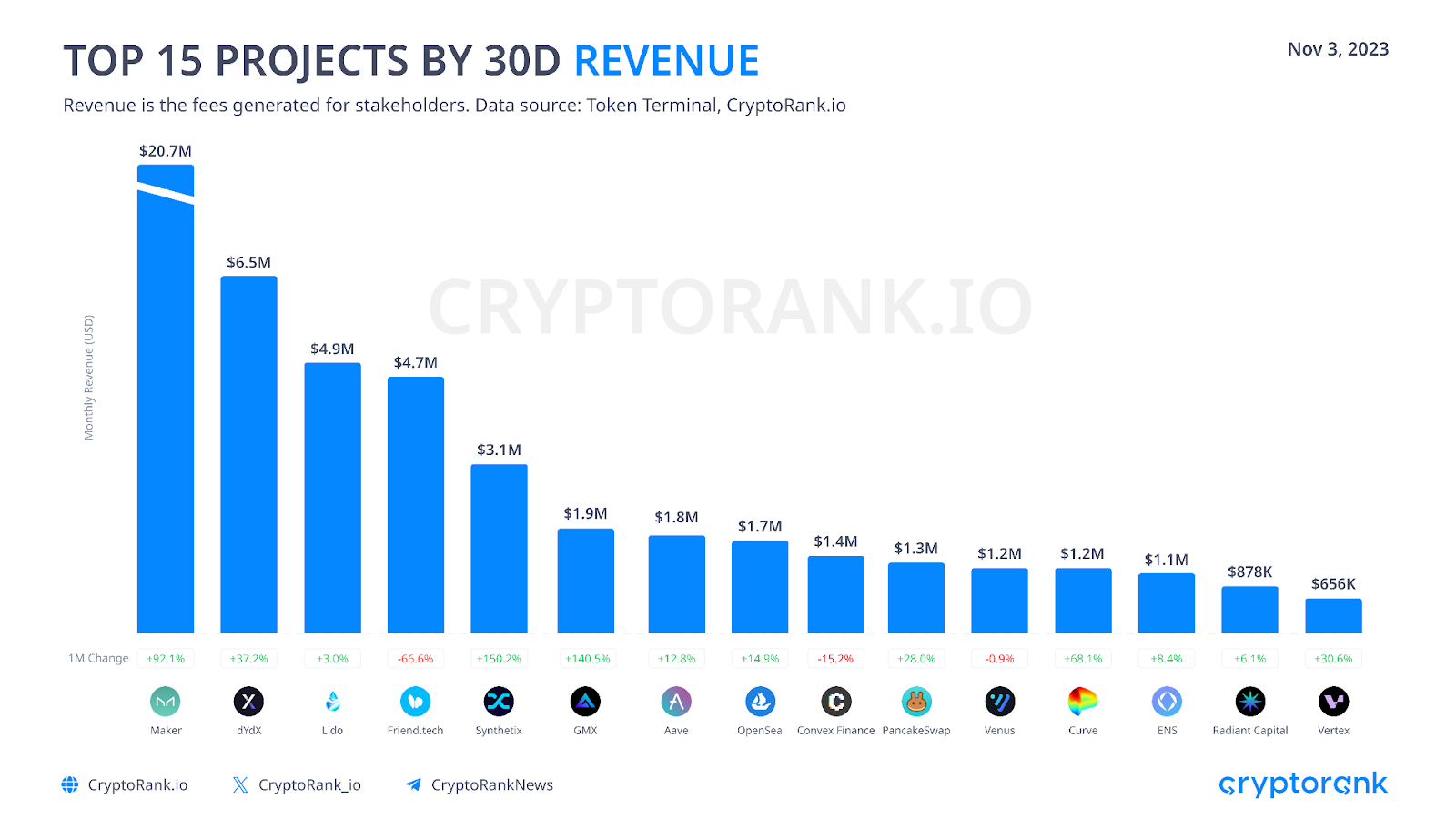

In October, Maker DAO achieved a significant increase in revenue, establishing itself as a leader among decentralized applications. The role of RWA is crucial in the development of the CDP project, enabling Maker to grow both its Total Value Locked (TVL) and revenue.

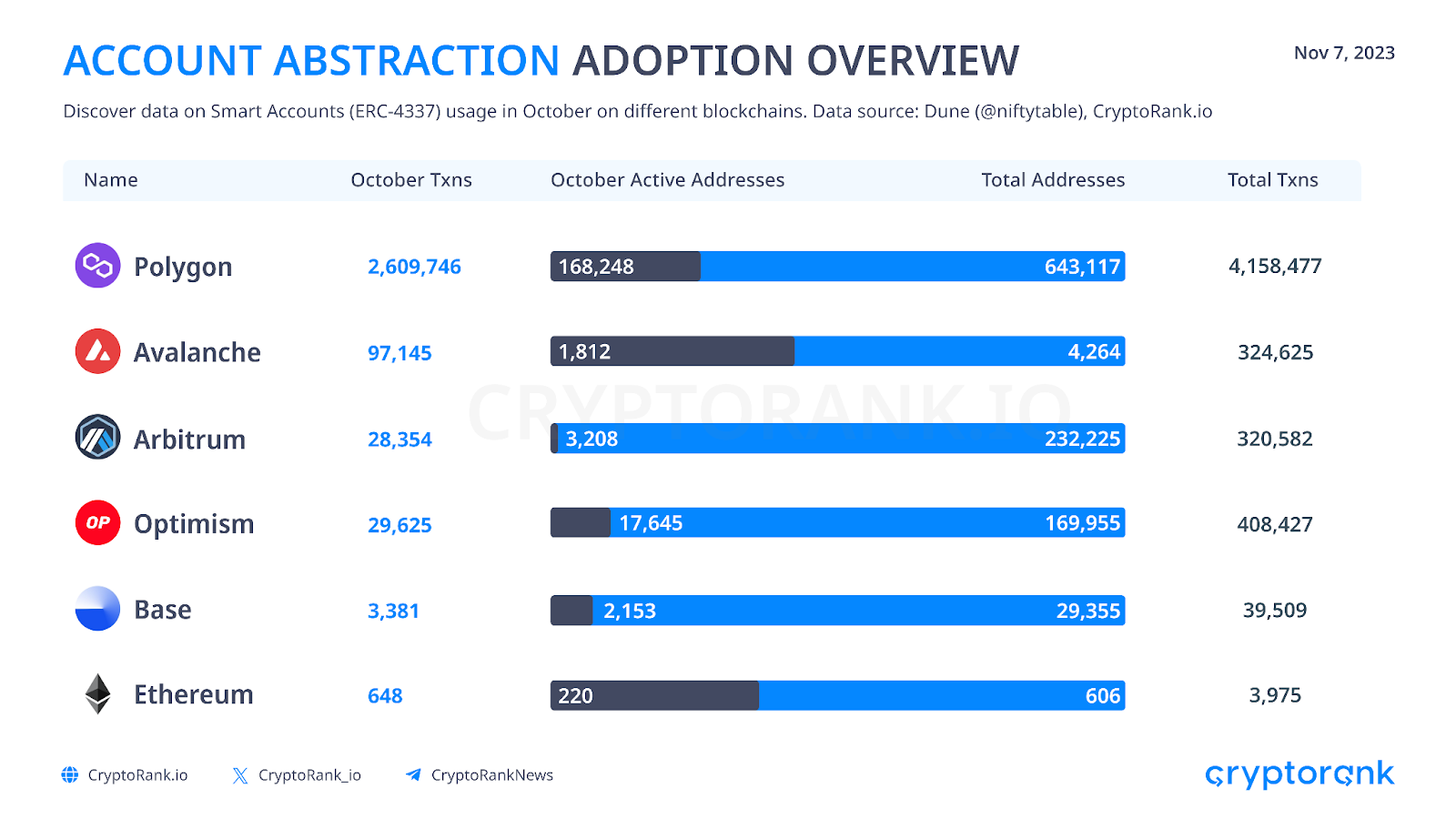

Active growth is evident in the usage of decentralized applications with Account Abstraction. The current frontrunner in this field is Polygon, with over 2.6 million transactions sent by ERC-4337 smart accounts.

The Bottom Line

October 2023 has been a highly successful month for the crypto market, but the bear market still persists. Two crucial events on the horizon will significantly impact the future of the crypto market: the approval of the Bitcoin spot ETF and the Bitcoin halving. If both events turn out positive, we can expect another bull run.

Currently, the market eagerly anticipates a bullish moment for altcoins and the emergence of new technologies that can stimulate cryptocurrency growth. While the on-chain picture continues to attract many developers, the number of new users from outside the web3 space remains limited.