In the last 24 hours, the price of Bitcoin has recovered well, breaking out from its previous range of $96,000 to $97,000. It is currently trading at $99,719, achieving a daily increase of over 2.5%. Although the price briefly reached a high of $100,781, it has struggled to consistently stay above $100,000. Bitcoin’s 24-hour trading volume has increased by 3.7% to $57.2 billion.

Looking at the bigger picture, Bitcoin dropped below the $100,000 mark on January 7 and has been in a downward trend since. However, after hitting a low of around $89,397 on January 13, Bitcoin has managed to prevent further losses and has been recovering since. Consequently, its market capitalization has risen by 2.6% to $1.97 trillion in a day.

On-chain Data Might Defend Bitcoin Above $100K

On Wednesday, Bitcoin and the cryptocurrency market quickly increased in value, gaining nearly $100 billion in market capitalization after the December US Consumer Price Index (CPI) was reported to have risen to 2.9%.

Bitcoin’s price went up by 7.1% this week, but that’s less than the average for the broader market, making people wonder if its price rise can last. Adding to these doubts, recent data on Bitcoin transactions shows potential problems that could slow its growth.

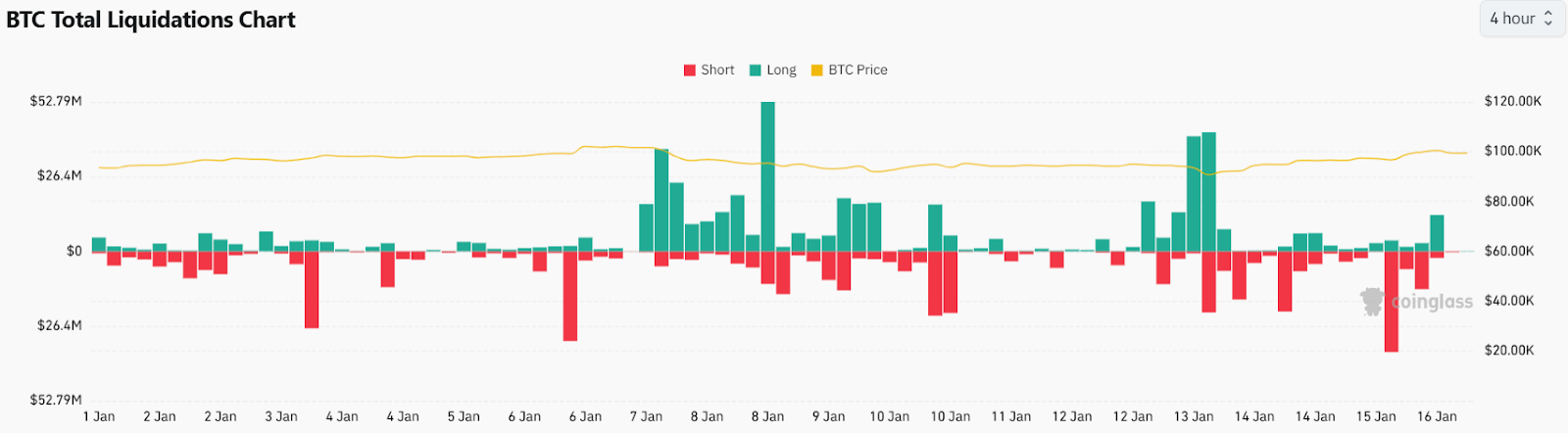

While prices in the overall cryptocurrency market are going up, the number of transactions on Bitcoin’s main network is going down. For example, on January 9, there were 507,730 Bitcoin transactions, but this number dropped by 37% to just 318,000 transactions by yesterday.

The significant drop in transactions, even as prices rise, suggests two issues: regular buyers are not heavily involved, leading to fewer transactions, and only a small group of traders are driving the price changes. This raises concerns about Bitcoin’s ability to continue its upward trend.

Bitcoin Price Prediction: Technical Analysis

Following the release of CPI data, Bitcoin price sharply rose from the low of $97K to over $100K in just a few hours. The price consolidated below $100K multiple times before marking a high near $100.7K. As BTC price faced selling from STHs, it dropped below immediate Fib level of 23.6%.

The BTC/USDT trading pair continues to hover around $100K, which could be a major obstacle. If the price falls below the EMA20 trend line on the 1-hour chart, the sellers will likely try to push it back down to $90,000.

However, if the price manages to hold above $100K, it would favor the buyers. The trading pair could then increase to $102,914, and possibly reach $108K afterward. If it surpasses this level, the next target could be above $125,000. We expect a minor upward correction as the RSI level is at 57, maintaining the buying demand.

Bitcoin Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, BTC price might continue to struggle around $100K. However, the pressure might soon weaken, resulting in a retest of $103K. We expect Bitcoin price to attain the $103K mark in the next 24 hours. On the bearish side, $96K is the range.

Long-term: According to Coincodex’s Bitcoin price prediction, the price of Bitcoin is expected to increase by 25.12% and reach $125,102 by February 15, 2025. Coincodex’s technical indicators currently show a Bullish sentiment, and the Fear & Greed Index is at 70, indicating Greed. Over the last 30 days, Bitcoin has experienced 15 green days, representing 50% of the time, with a price volatility of 3.17%. Based on this forecast, Coincodex suggests that it is a good time to buy Bitcoin.

How much is Bitcoin price today?

Bitcoin price is trading at $99,483 at the time of writing. The BTC price has increased by over 2.5% in the last 24 hours.

What is the BTC price prediction for January 16?

Throughout the day, Bitcoin price might consolidate around $100K. If it breaks above, we might see $103K today. On the downside, $96-$97K is the lower range.

Is Bitcoin a Good Buy Now?

According to long-term forecasts, Bitcoin price might reach $125,102 by February 15. This makes BTC price a good investment considering its monthly yield.

Investment Risks for Bitcoin

Investing in Bitcoin can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.