Although Bitcoin’s price recently surged toward $106,000, it couldn’t maintain its momentum and quickly fell to a low of $102,277. The trading volume for Bitcoin has increased by 10.4% over the past 24 hours, reaching $68.2 billion.

Looking at a broader time frame, Bitcoin dropped below $100,000 on January 7 and has generally been on a downward trend since then. It hit a low of about $89,397 on January 13 but has begun to recover from this decline. Over the last 24 hours, its total market capitalization has risen by 0.64% to $2.05 trillion.

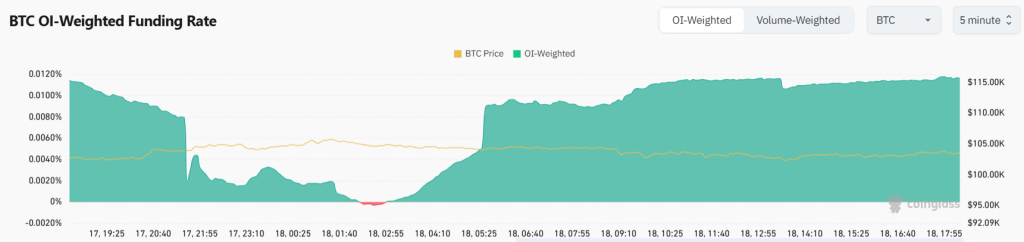

Bitcoin’s Funding Rate Remains Positive

Several analysts have observed that when Bitcoin’s price rises, the likelihood of establishing a Bitcoin reserve also increases. It appears that a price increase in Bitcoin makes the setup of a reserve more probable.

This week, Bitcoin’s price increased by 9.3% and saw a gain of 1.1% over the past 30 days. Yesterday, Bitcoin’s price nearly reached $106,000 but didn’t attract enough buyers, leading to a decrease to $102,277.

Santiment’s data indicates that the 7-day MVRV indicator is at a level where short-term investors typically start taking profits, suggesting a potential risk. By using a 7-day Moving Average (MA) on this indicator, we can filter out random fluctuations and better pinpoint when the Bitcoin price might change direction.

In situations where the market isn’t moving much, whenever this 7-day MA hits 3%, it usually signals a price reversal. Right now, after Bitcoin’s recent 18% increase, this indicator has reached a similar peak, suggesting that a price drop may be on the way.

However, the funding rate of Bitcoin remains positive despite the bearish threat. It is currently at 0.0116%, suggesting that buyers still have the advantage in bouncing back from the current level.

Bitcoin Price Prediction: Technical Analysis

The price of Bitcoin recently rose smoothly from $100,000 and approached $106,000. But then, as sellers began taking profits, its momentum slowed and the price fell towards $102,000. Currently, it is experiencing some selling pressure around a key technical level but may soon break through it. Right now, Bitcoin is priced at $103,819, having risen by 1.15% in the last 24 hours.

The Bitcoin to USDT trading pair is still just under $104,000, which might pose a slight challenge. If it can stay above this level, it would be advantageous for buyers. The price could then rise to $108,256, and potentially even to $111,000.

On the other hand, if the price drops below a specific trend line (EMA20) on the 1-hour chart, sellers might push it back down to $100,000. However, a technical indicator called the RSI suggests there might be a potential rise, as it’s currently at a level that indicates buying interest.

Bitcoin Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, BTC price might continue to struggle around $104K. However, the pressure might soon weaken, resulting in a consolidation below $108K.

Long-term: According to Coincodex’s Bitcoin price prediction, the price of Bitcoin is expected to increase by 23.95% and reach $128,175 by February 17, 2025. Their technical indicators suggest a bullish current sentiment, while the Fear & Greed Index indicates a level of 77, which represents extreme greed. Over the past 30 days, Bitcoin has experienced 15 green days, accounting for 50% of the time, with a price volatility of 2.48%. Based on this forecast, Coincodex suggests that now is a good time to buy Bitcoin.

How much is Bitcoin price today?

Bitcoin price is trading at $103,819 at the time of writing. The BTC price has increased by over 1.15% in the last 24 hours.

What is the BTC price prediction for January 18?

Throughout the day, BTC price might continue to struggle around $104K. However, the pressure might soon weaken, resulting in a consolidation below $108K.

Is Bitcoin a Good Buy Now?

According to long-term forecasts, Bitcoin price might reach $128,175 by February 17. This makes BTC price a good investment considering its monthly yield.

Investment Risks for Bitcoin

Investing in Bitcoin can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.