Today, the price of Bitcoin faced a heavy decline as its price crashed toward a significant low of around $91K. Over the past 24 hours, Bitcoin’s trading volume has increased by more than 147%, totalling $106 billion.

In a broader perspective, Bitcoin fell below $100,000 on January 7 and showed a downward trend. It reached a low of approximately $89,397 on January 13 but has started to recover. However, the BTC price is still threatening to drop in the coming days. Over the last 24 hours, its total market capitalization decreased by 3.5%, settling at $1.89 trillion.

Bitcoin’s Liquidation Nears $467 Million

Cryptocurrencies like Bitcoin and Ether fell on Monday, partly due to new U.S. tariffs on allies which sparked fears of global trade wars and led investors to pull out of risky assets. Bitcoin hit a three-week low, following the announcement of a 25% tariff on Canada and Mexico, and 10% on China by President Donald Trump, signaling the start of protectionist trade policies and a new trade war with America’s major trading partners.

Bitcoin price witnessed a free fall as it dropped toward the low of $91K, primarily due to increased selling pressure from long-term holders.

Over the course of the last week, Bitcoin has seen a decline of 3.6% in its price, and over the past 30 days, it has achieved a minor gain of 0.38%. Currently, there’s a strong selling pressure around the $105K mark, which might continue to be a significant barrier for buyers to overcome.

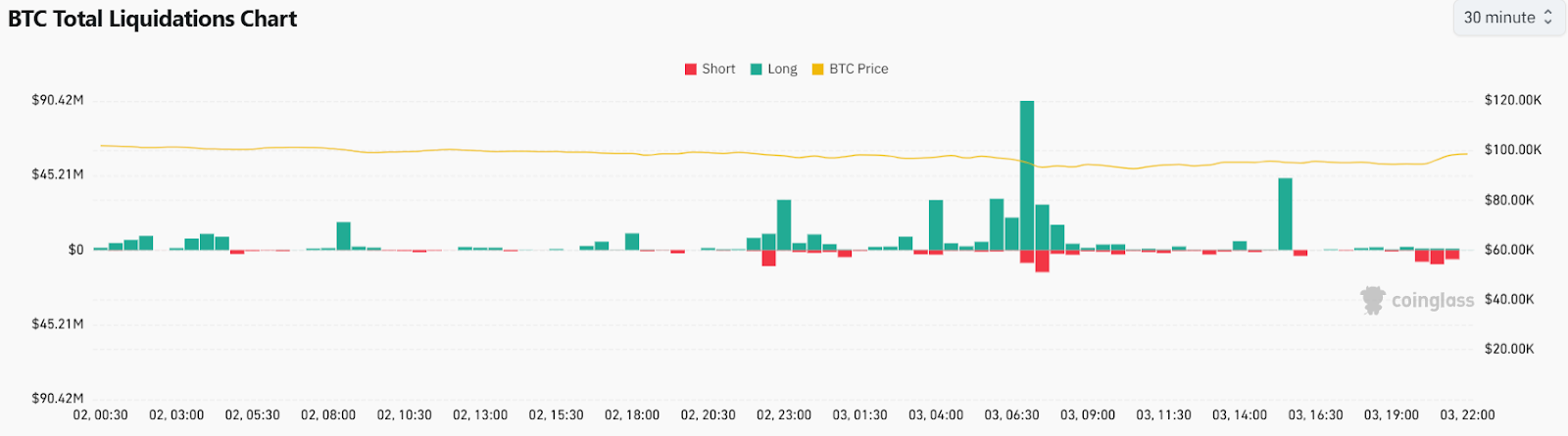

The trading sentiment during this period is illustrated by data from Coinglass, which indicates that there was a total liquidation of over $467 million in the Bitcoin market. This consisted of $377 million worth of positions liquidated by buyers and about $90 million by sellers, reflecting the volatility and the nearly balanced domination of buying and selling pressure.

However, despite the bearish undertones suggested by these liquidations, the funding rate for Bitcoin remains at a positive 0.0017%. This suggests that buyers are still somewhat bullish and maintain a slight advantage, potentially positioning them to drive a recovery from the current price levels.

Bitcoin Price Prediction: Technical Analysis

The price of Bitcoin struggled to hold on to its momentum around $105,000, resulting in a steep decline below multiple support channels. The BTC price dropped toward the low of $91K; however, it then faced a minor correction toward $100K. Right now, Bitcoin is priced at $98,936, having dropped by 0.32% in the last 24 hours.

The Bitcoin to USDT trading pair is struggling below $100K, which might pose a slight challenge. If it can stay above this level, it would be advantageous for buyers. The price could then attempt to move above $105,000, and potentially even to $108,000.

On the other hand, if the price continues to trade below the EMA20 trend line on the 1-hour chart, sellers might push it back down to $93,500. However, the RSI around level 54 suggests there might be a potential rise.

Bitcoin Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, BTC price might continue to struggle around $100K-$105K. On the other hand, $95K is the lower range.

Long-term: According to Coincodex’s Bitcoin price prediction, Bitcoin’s value is expected to increase by 33.56% and hit $127,904 by March 5, 2025. Coincodex’s technical indicators suggest a Neutral sentiment, while the Fear & Greed Index indicates a level of 44, which corresponds to Fear. Over the past 30 days, Bitcoin has seen 15 green days, accounting for 50% of the time, with a price volatility of 3.96%. Based on these forecasts, Coincodex suggests that it is a good time to buy Bitcoin.

How much is Bitcoin price today?

Bitcoin price is trading at $98,936 at the time of writing. The BTC price has dropped by over 0.32% in the last 24 hours.

What is the BTC price prediction for February 3?

Throughout the day, BTC price might continue to struggle around $100K-$105K. On the other hand, $95K is the lower range.

Is Bitcoin a Good Buy Now?

According to long-term forecasts, Bitcoin price might reach $127,904 by March 5. This makes BTC price a good investment considering its monthly yield.

Investment Risks for Bitcoin

Investing in Bitcoin can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.