Bitcoin price faced a crash toward the low of $87K, first time in recent months. Though buyers are attempting for a recovery rally, sellers continue to dominate below $90K. Over the past 24 hours, Bitcoin’s trading volume has increased by more than 200%, totaling $79.4 billion.

In a broader perspective, Bitcoin fell below $100,000 on January 7 and showed a downward trend. It reached a low of approximately $89,397 on January 13. On Feb 3, Bitcoin again crashed and reached a low near $91K. Today, the price again declined, reaching a new low since November 2024. Over the last 24 hours, its total market capitalization dropped by 7.5%, settling at $1.74 trillion.

Bitcoin’s Long Liquidation Surpasses $700 Million

On Tuesday, Bitcoin dropped to its lowest level in over three months, driven by market anxiety over U.S. tariffs which compounded the recent downturn in crypto investor confidence following last week’s $1.5 billion ether theft from the Bybit exchange.

Global investors are increasingly nervous as signs emerge that the so-called exceptionalism of the U.S. economy may be waning, amid preparations by President Donald Trump to implement tariffs.

On Monday, Trump confirmed his intention to impose a 25% tariff on imports from Canada and Mexico starting in early March. This announcement has heightened market unease, leading to a sharp rally in safe-haven U.S. Treasury prices and pushing yields to their lowest in two months.

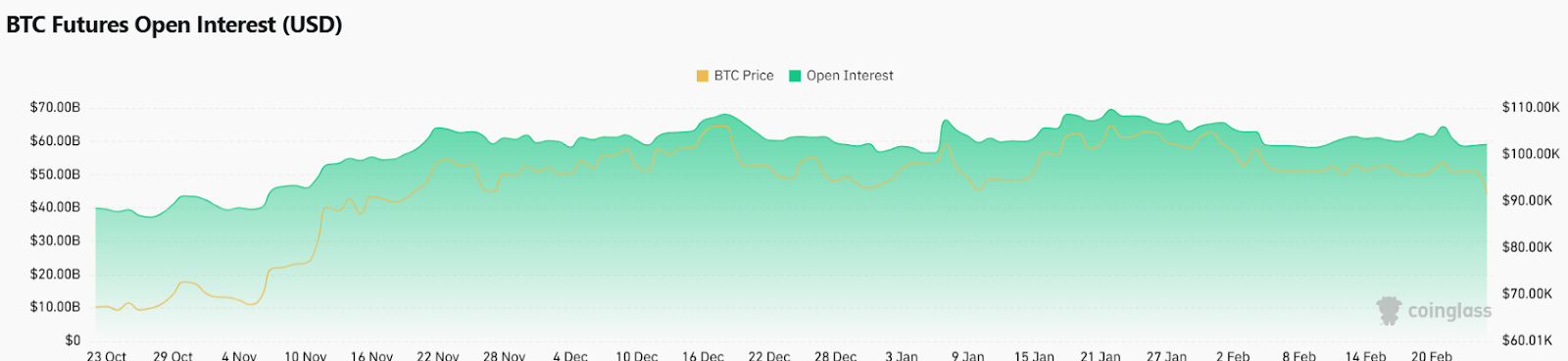

Recent data from Coinglass reveals that Bitcoin saw nearly $742.6 million in total liquidations over the last 24 hours, with buyers liquidating $700.5 million and sellers around $42.07 million, indicating a significant increase in long liquidations. Additionally, the open interest for Bitcoin has dropped by 5.6%, touching over $56.6 billion in the last 24 hours.

However, Bitcoin’s funding rate trades at +0.0072%, indicating that buyers remain somewhat bullish. This could help buyers to continue pushing the BTC price upwards.

Bitcoin Price Prediction: Technical Analysis

Bitcoin’s price is experiencing an extreme bearish pressure as it dropped toward three-month low at $87K. As a result, sellers are now holding the price below immediate Fib levels. Currently, Bitcoin trades at $87,003, reflecting a 7.8% drop in the past 24 hours.

The BTC/USDT trading pair will now aim for a retest of the $85K level. As selling pressure intensifies, buyers will continue to defend further decline. However, if Bitcoin rebounds above $85K, we might see a recovery toward $95,000.

On the other hand, if Bitcoin fails to meet buyers’ demand around $85K, we might see further decline toward the low of $77K.

Bitcoin Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, BTC price might aim for $85K. If it rebounds above that level, we might see $90K-$95K. On the other hand, $77K is the lower range.

Long-term: According to Coincodex’s latest Bitcoin price prediction, the price of Bitcoin is expected to increase by 41.47% and reach $126,478 by March 27, 2025. Coincodex’s technical indicators suggest that the current market sentiment is bearish, while the Fear & Greed Index indicates a level of 25, representing ‘Extreme Fear.’ Over the past 30 days, Bitcoin has seen 12 out of 30 green days, with a price volatility of 2.86%. Based on this forecast, it is currently not an advisable time to purchase Bitcoin.

How much is Bitcoin price today?

Bitcoin price is trading at $87,003, at the time of writing. The BTC price has dropped by over 7.8% in the last 24 hours.

What is the BTC price prediction for February 25?

Throughout the day, BTC price might aim for $85K. If it rebounds above that level, we might see $90K-$95K. On the other hand, $77K is the lower range.

Is Bitcoin a Good Buy Now?

According to long-term forecasts, Bitcoin price might reach $126,478 by March 27. This makes BTC price a good investment considering its monthly yield.

Investment Risks for Bitcoin

Investing in Bitcoin can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.