Although Bitcoin’s price recently surged toward $106,000, it struggled to maintain its momentum. However, buyers strongly defended the support level at $102K. The trading volume for Bitcoin has dropped by 6.1% over the past 24 hours, reaching $75.7 billion.

Looking at a broader time frame, Bitcoin dropped below $100,000 on January 7 and has generally been on a downward trend since then. It hit a low of about $89,397 on January 13 but has begun to recover from this decline. Over the last 24 hours, its total market capitalization has risen by 0.27% to $2.1 trillion.

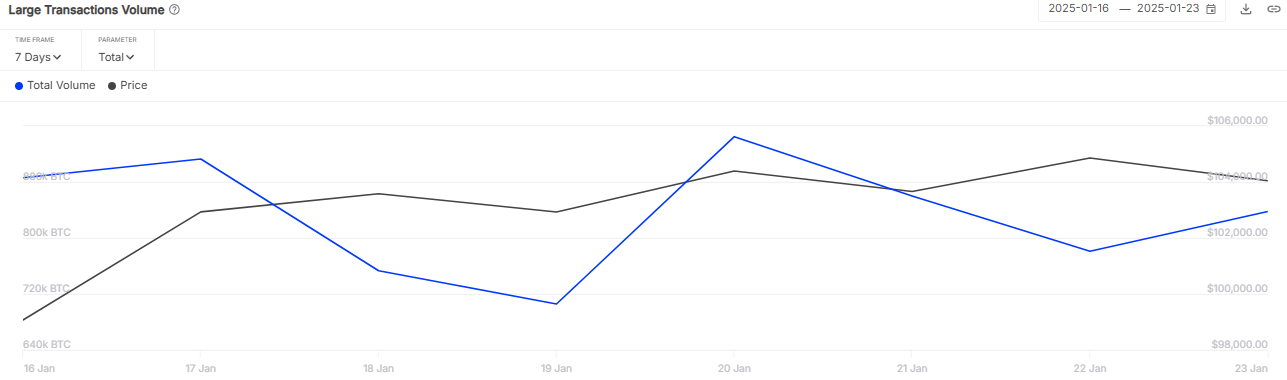

Bitcoin’s Large Transaction Rises

The Bitcoin price has surged significantly after President Trump signed multiple executive orders supporting the cryptocurrency market, which has reignited buying interest and triggered strong upward momentum in its price.

Over the past week, Bitcoin’s price rose by 1.3% and achieved a 7.8% increase over the last 30 days. Today, it reached a peak of $106,428, but failed to attract sufficient buyers, resulting in a period of consolidation.

In the last 48 hours, Bitcoin’s large transaction volume has spiked as the price began to recover. According to IntoTheBlock, the volume increased from a low of 781K BTC to 837K BTC, indicating an increased trading interest among large-scale investors or “whales”.

This activity from whales could help support Bitcoin’s price as it attempts an upward correction. However, the rising U.S. debt poses a potential bearish threat to Bitcoin’s price, potentially triggering selling among holders if Bitcoin struggles to overcome key resistance levels.

Despite the bearish consolidation, Bitcoin’s funding rate remains positive at 0.0032%, suggesting that buyers are still in a favorable position to rebound from current levels and potentially break through the $111,000 mark.

Bitcoin Price Prediction: Technical Analysis

Bitcoin price has been on a strong surge as it broke above previous resistance levels and is now attempting to surge above immediate Fib channel. However, it is experiencing some selling pressure around the $106K level, creating a significant challenge for buyers. Right now, Bitcoin is priced at $105,940, having risen by 1.01% in the last 24 hours.

The Bitcoin to USDT trading pair is still just under $108,000, which might pose a slight challenge. If it can stay above this level, it would be advantageous for buyers. The price could then rise to $111,000, and potentially even to $115,000.

On the other hand, if the price drops below the EMA20 trend line on the 1-hour chart, sellers might push it back down to $102.5K. However, RSI suggests there might be a potential rise, as it’s currently at a level (56) that indicates buying interest.

Bitcoin Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, BTC price might continue to struggle around $106K. However, the pressure might soon weaken, resulting in a surge toward $108K. On the other hand, 102.5K is the lower range.

Long-term: According to the Bitcoin price prediction on Coincodex, the price of Bitcoin is expected to increase by 25.01%, reaching $131,576 by February 23, 2025. Coincodex’s technical indicators suggest that the current market sentiment is bullish, and the Fear & Greed Index indicates a level of 75, signaling Greed. Over the past 30 days, Bitcoin has experienced 17 out of 30 green days, with a price volatility of 3.96%. Based on this forecast, it is suggested that now is a good time to buy Bitcoin.

How much is Bitcoin price today?

Bitcoin price is trading at $105,940 at the time of writing. The BTC price has increased by over 1.01% in the last 24 hours.

What is the BTC price prediction for January 24?

Throughout the day, BTC price might continue to struggle around $106K. However, the pressure might soon weaken, resulting in a surge toward $108K. On the other hand, $102.5K is the lower range.

Is Bitcoin a Good Buy Now?

According to long-term forecasts, Bitcoin price might reach $131,576 by February 23. This makes BTC price a good investment considering its monthly yield.

Investment Risks for Bitcoin

Investing in Bitcoin can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.