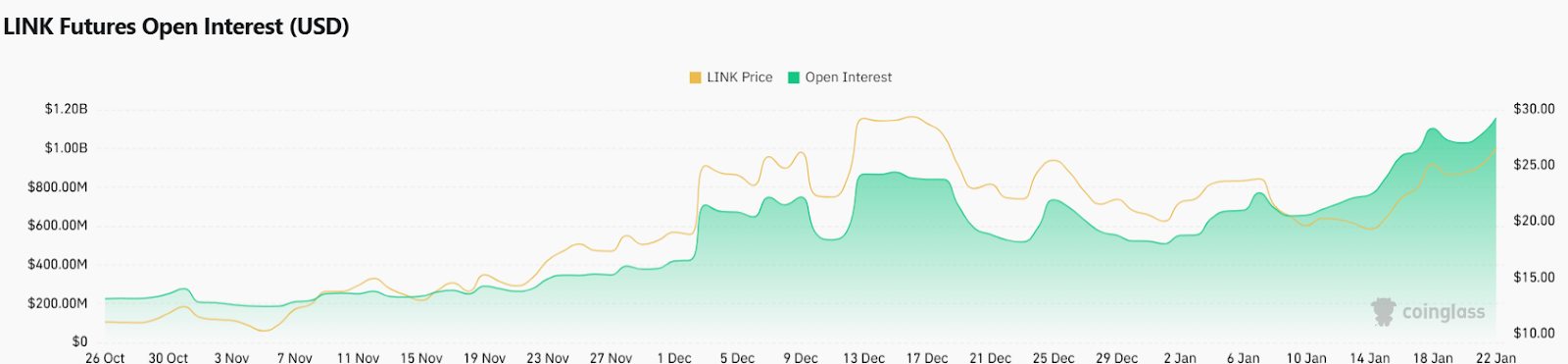

Over the past day, Chainlink (LINK) has struggled to maintain a price above $26. Despite these challenges, buyer optimism remains, as the price of LINK appears poised for further gains. Currently, it hovers around the same price levels seen in early January. The fear/greed index has also risen, now indicating a greed sentiment at level 66. However, Chainlink’s trading volume has seen a significant decline, dropping by 42.6% in the last 24 hours to $1.24 billion.

In a broader view, LINK’s price has been on a downward trend since mid-December, decreasing from a high of $31 to approximately $18 last week. Despite this decrease, there remains substantial buying interest and market activity, suggesting that its current price is within a potential buying range. Additionally, over the last 24 hours, its market capitalization has increased by 0.9%, reaching $16.47 billion.

LINK Faces Liquidation Over $1.3 Million

The cryptocurrency market is seeing a bearish rally after Trump ended his inauguration speech without mentioning crypto. This has triggered a significant selloff in the market, resulting in a surge in total liquidations.

In the last 24 hours, Chainlink (LINK) has seen a high level of trading activity. According to Coinglass, about $1.37 million worth of LINK trades were liquidated, with $784.7K resulting from buyers closing their long positions. On the other hand, sellers liquidated around $582K worth of positions.

Despite the recent bearish pullback, there’s been a rise in interest in trading Chainlink. The open interest, which represents the total number of unsettled derivative contracts, has climbed to $1.13 billion, signaling a boost in demand.

Furthermore, the long/short ratio, indicating the balance between buyers and sellers, has risen toward 2.114. This shows that most traders are now betting on the price of LINK to increase. Currently, 67.86% of traders expect the price to rise soon.

Chainlink Price Prediction: Technical Analysis

The LINK price has been facing multiple rejections around the $27. Right now, Chainlink’s price is at $25.9, having climbed over 0.11% in the last 24 hours.

The LINK/USDT trading pair is close to $26 and could potentially rise above the immediate Fibonacci channels. With the Relative Strength Index (RSI) still in the buying zone at level 56, there’s a chance Chainlink’s price could rise above $30.

On the other hand, if the price falls below the 20-period Exponential Moving Average (EMA20) on the 1-hour chart, sellers might push it down towards the $24 range.

LINK Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, LINK price might continue to hover below $27. If the price moves above that level, we might see a trade around $30. On the downside, $24 is the range.

Long-term: According to the Chainlink price prediction from Coincodex, the price of Chainlink is expected to increase by 52.67% and reach $39.73 by February 21, 2025. Coincodex’s technical indicators suggest that the current market sentiment is bullish, and the Fear & Greed Index indicates a level of 84, signifying Extreme Greed. Over the past 30 days, Chainlink has experienced 17 out of 30 green days and a price volatility of 8.10%. Based on this forecast, it is considered a good time to purchase Chainlink.

How much is the LINK price today?

LINK price is trading at $25.89 at the time of writing. The LINK price has increased by over 0.11% in the last 24 hours.

What is the Chainlink price prediction for January 22?

Throughout the day, the LINK price might continue to hover below $27. If the price moves above that level, we might see a trade around $30. On the downside, $24 is the range.

Is LINK a Good Buy Now?

According to long-term forecasts, the Chainlink price might reach $39.73 by February 21. This makes LINK price a good investment considering its monthly yield.

Investment Risks for Chainlink

Investing in LINK price can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.