Over the past 24 hours, the price of Chainlink (LINK) made a solid decline as it dropped below the crucial level of $15.5. Currently, bears are aiming for further declines below the Fib levels. The fear/greed index has dropped, now showing a fear sentiment at level 29. Meanwhile, Chainlink’s trading volume has surged by 140% in the last 24 hours, reaching $783 million.

Looking at the longer trend, LINK’s price has been declining since mid-December, dropping from a high of $31 to about $15 on 3 February. In recent weeks, LINK price consolidated below $20 and it again fell below the $15 mark. In the last 24 hours, its market capitalization has dropped by 11.3%, hitting $9.55 billion.

LINK’s Price Faces Nearly $7 Million in Liquidation

The cryptocurrency market has made a solid crash in recent hours, resulting in a significant liquidation in the overall market. As a result, the price dropped below the crucial level of $15.5, triggering significant long liquidation.

In the last 24 hours, Chainlink has seen a significant amount of long position liquidations. According to Coinglass, about $6.88 million in LINK trades occurred, with long liquidations accounting for $6.77 million of this volume.

Amidst this bearish pressure, interest in Chainlink trading has dropped. Open interest, which tracks the total number of outstanding trading contracts, has dropped to $493 million, reflecting a 4.93% decrease in just 24 hours.

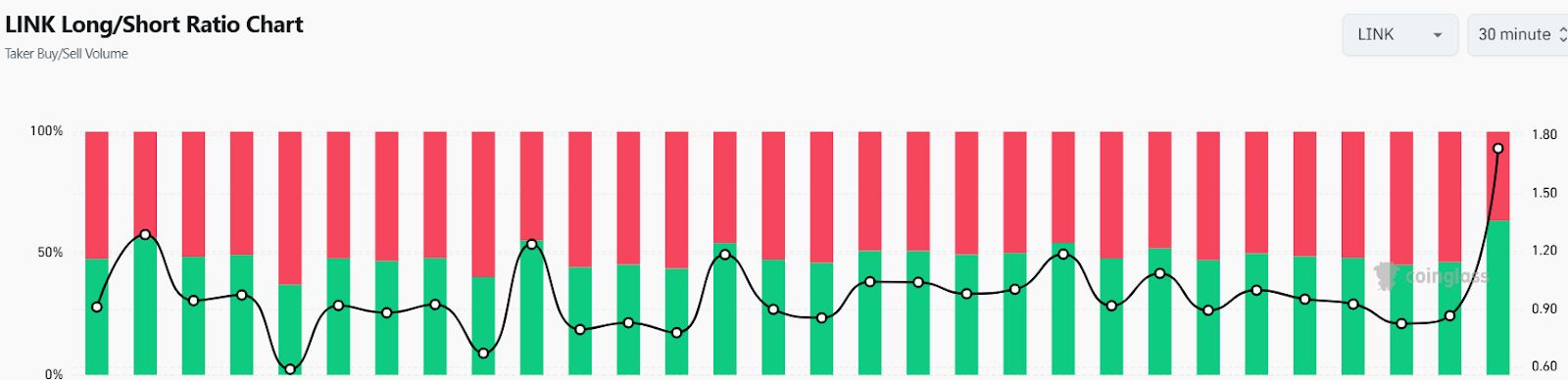

Looking ahead, the upcoming trends for LINK’s price appear to be tilting towards an upward correction. The long/short ratio trades at 1.7337, suggesting that 63.42% positions are expecting LINK price to surge.

Chainlink Price Prediction: Technical Analysis

Chainlink’s price continues to be under intense bearish pressure as it recently dropped below the $15.5 support level. As buyers failed to defend the decline, LINK price is now dropping below immediate Fib channels. As of writing, Chainlink’s price stands at $14.78, having dropped by 12.5% in the last 24 hours.

The LINK/USDT trading pair is facing multiple rejections as sellers defend an immediate surge ahead. With the Relative Strength Index (RSI) hovering around the oversold region at level 18, there is a possibility that Chainlink’s price could trigger a rebound from the current level. If it sustains above the EMA 20 trend line, it could benefit buyers and potentially push the price for $18.4.

On the other hand, if the LINK price fails to rebound from its current level, we might see a strong correction toward the low of $12.87.

LINK Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, LINK price might continue to decline. If the price maintains its current momentum, we might see a drop toward $12.87. On the upside, $18.4 is the range.

Long-term: According to the current Chainlink price prediction on Coincodex, the price of Chainlink is expected to decrease by -2.63% and reach $14.75 by March 27, 2025. Technical indicators suggest a bearish sentiment, while the Fear & Greed Index indicates a score of 49, classifying it as Neutral. Over the past 30 days, Chainlink has experienced 13 out of 30 green days, with a price volatility of 12.68%. Based on this forecast, it is currently not advisable to purchase Chainlink.

How much is the LINK price today?

LINK price is trading at $14.78 at the time of writing. The LINK price has dropped by over 12.5% in the last 24 hours.

What is the Chainlink price prediction for February 25?

Throughout the day, the LINK price might continue to decline. If the price maintains its current momentum, we might see a drop toward $12.87. On the upside, $18.4 is the range.

Is LINK a Good Buy Now?

According to long-term forecasts, the Chainlink price might reach $14.75 by March 27. This makes LINK price a bad investment considering its monthly yield.

Investment Risks for Chainlink

Investing in LINK price can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.