Over the last 24 hours, the price of Hedera has dropped steeply as it faced selling pressure around $0.35. HBAR price recorded a drop of nearly 2.78%, touching the low near $0.32. Additionally, Hedera’s trading volume has dropped by 36.7% in the last 24 hours, reaching $627 million.

Looking at a longer timeline, Hedera’s price dropped below $0.39 on December 3 and has been decreasing since then. However, after maintaining a stable range between $0.23 and $0.25 for some time, Hedera has begun to recover, preventing further price drops. Its market capitalization has dropped by 3.5% to $12.5 billion in the last 24 hours.

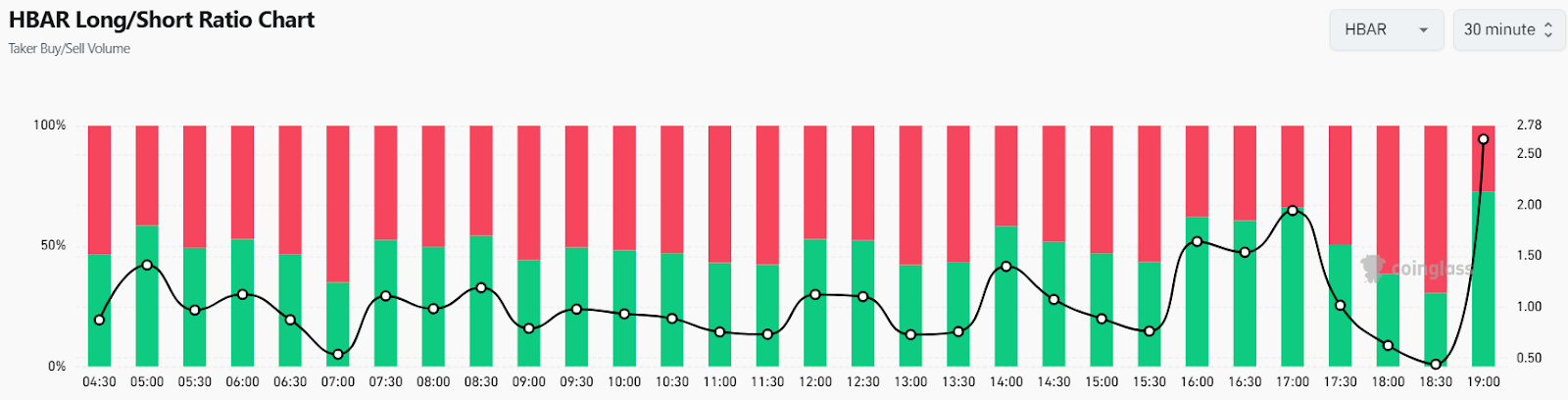

HBAR Faces Surge in Long/Short Ratio

As Trump takes over, there’s a noticeable increase in buying demand for Hedera (HBAR). Currently, buyers are struggling to keep the price stable around $0.35, but they haven’t given up.

In the last 24 hours, there’s been a lot of trading activity, with a significant push from buyers. According to Coinglass, around $593K worth of Hedera trades were liquidated, with $503K of that from buyers closing their long positions, where they bet on price increases.

Despite the recent price struggle, trading interest in Hedera has grown. The open interest, which shows the total number of unsettled derivative contracts, has climbed to $433 million, indicating increased market engagement.

Additionally, the market may shift upward as the ratio of long to short positions is rising. Currently, the long/short ratio is at 2.647, suggesting an increase in long positions, where traders bet on price surges. Right now, 72.5% of traders think Hedera’s price will go up, while 27.5% are betting it will fall.

Hedera Price Prediction: Technical Analysis

As Donald Trump returns to the White House, the crypto market is seeing a rise. However, the price of Hedera Hashgraph (HBAR) is still encountering resistance around $0.35. Currently, the HBAR price is at $0.324, having dropped over 3.7% in the last 24 hours.

The HBAR/USDT trading pair remains under $0.35, showing strong selling pressure from bearish traders. This price point may continue to be a significant barrier, as short-term holders (STHs) might opt to sell off their positions at this level. If the price stays below the EMA20 trend line on the 1-hour chart, sellers could attempt to push it down towards $0.32 along the downtrend line.

With the Relative Strength Index (RSI) remaining below the midline at 43, there could be a retest of the support level. Should the price stabilize above $0.35, it could shift the advantage to the buyers, potentially driving the price up to $0.37.

Hedera Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, Hbar price might continue to struggle below $0.35. If the price moves above that level, we might see a trade around $0.37. On the down side, $0.32 is the range.

Long-term: According to Coincodex’s Hedera Hashgraph price prediction, the price of Hedera Hashgraph is expected to increase by 26.57% and reach $0.42058 by February 21, 2025. Coincodex’s technical indicators suggest that the current market sentiment is bullish, and the Fear & Greed Index indicates a level of 84, signifying Extreme Greed. Over the past 30 days, Hedera Hashgraph has experienced 13 green days out of 30, with a price volatility of 9.55%. Based on this forecast, it is considered a good time to invest in Hedera Hashgraph.

How much is Hedera price today?

HBAR price is trading at $0.32 at the time of writing. The HBAR price has dropped by over 3.7% in the last 24 hours.

What is the Hedera price prediction for January 22?

Throughout the day, the Hbar price might continue to struggle below $0.35. If the price moves above that level, we might see a trade around $0.37. On the down side, $0.32 is the range.

Is Hedera a Good Buy Now?

According to long-term forecasts, the HBAR price might reach $0.42 by February 21. This makes HBAR price a good investment considering its monthly yield.

Investment Risks for HBAR

Investing in Hedera can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.