The crypto market has come a long way since its inception, with blockchain networks evolving rapidly to accommodate a growing number of assets and use cases. The most recent development in this space is the launch of decentralized asset management platforms on several blockchain networks, marking a significant departure from traditional financial services. In a recent blog post, DeFi asset management platform DeFund announced its launch on the Arbitrum network and support for GMX, providing an enhanced trading experience for on-chain traders.

DeFund Integrates With Arbitrum Network And GMX Protocol

The DeFi market continues to flourish, with innovative platforms pushing the boundaries of what is possible within the ecosystem. One such platform is DeFund, a decentralized asset management platform that has recently announced its launch on the Arbitrum network and its support for the GMX protocol.

The DeFund platform has made a strategic decision to launch on the Arbitrum network, a layer-2 scaling solution that significantly improves the efficiency and speed of Ethereum-based transactions. This move is not only beneficial for DeFund users but also represents a vote of confidence in the Arbitrum ecosystem.

As a Layer 2 solution for Ethereum, Arbitrum aims to enhance Ethereum’s throughput and scalability while preserving its security and decentralization features. By implementing DeFund’s smart contracts on the Arbitrum network, users of DeFund can experience a swifter and more seamless trading experience without the concerns of excessive gas fees and network congestion.

In recent times, Arbitrum has emerged as a leading Ethereum scaling solution, owing to its technology and a robust, community-driven ecosystem. As of the end of April 2023, the total value locked in the Arbitrum network has reached over $6.1 billion, with a user base exceeding 5.8 million.

DeFund To Embrace More On-Chain Users

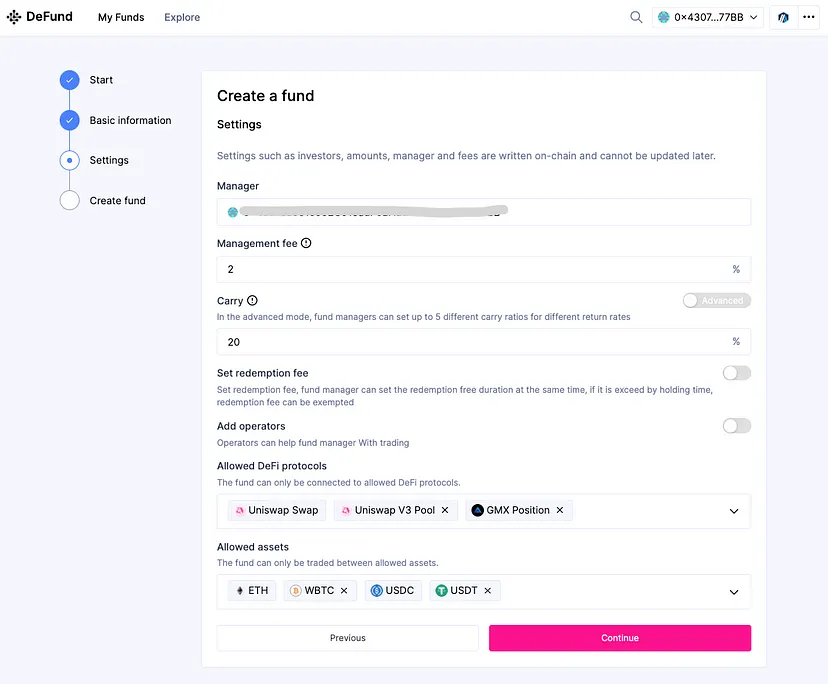

With the introduction of the DeFund protocol on Arbitrum, users are presented with an additional choice for exploring DeFund’s offerings. Ethereum is better suited for users and fund managers with substantial capital, while Polygon caters to a smaller overall fund volume but provides a more cost-effective experience for retail investors.

Arbitrum facilitates the inclusion of more on-chain funds, effectively addressing the high gas fee issues that previously plagued Ethereum users and enabling DeFund to attract a larger on-chain user base. DeFund currently supports Ethereum Mainnet, Polygon, and Arbitrum, allowing users to connect their wallets and choose their preferred network for managing funds based on individual preferences.

GMX is a decentralized platform for perpetual and spot trading, enabling users to trade cryptocurrencies such as BTC, ETH, AVAX, UNI, and LINK directly from their wallets with efficiency and affordability. With 0% slippage, a 10 basis point fee, up to 50x leverage, and no KYC or geographical restrictions, GMX delivers a seamless trading experience. Previous versions of DeFund only supported the Uniswap V3 protocol, which allowed instant spot swaps, limited orders, and liquidity pool additions for popular tokens.

However, this limited trading possibilities due to minor price variations and the lack of short-selling options. By incorporating GMX, users now have access to both spot and contract trading, enhancing their profit potential through increased leverage. This integration transforms DeFund into a more centralized exchange-like platform for fund managers, enabling them to better execute their investment and trading strategies.

Recently, DeFund unveiled its platform SDK to investors with development skills, allowing them to implement private strategies on local servers. This not only maintains the confidentiality of trading tactics but also facilitates automated direct engagement with the protocol, boosting the effectiveness of fund managers in managing assets.

Besides the trading SDK, the transparency and security of on-chain funds are vital for asset management. The fund protocol’s constraints enable fund managers to handle assets without the power to transfer them.

As the total market value of encrypted assets stands at approximately $2 trillion, and the DeFi market value reaches $140 billion, the expansion of encrypted assets will serve as the primary catalyst for the growth of decentralized asset management. DeFund, being well-positioned in this space, is poised to capitalize on this rapidly growing crypto market and drive innovation in the future of digital asset management.