Decentralized finance (DeFi) has been making waves in the cryptocurrency world over the past few years, providing users with greater financial freedom and opportunities for higher returns on their digital assets. However, as the popularity of DeFi has grown, so too have the risks and vulnerabilities associated with it. Hacks in DeFi have become increasingly common, raising concerns about the safety and security of users’ funds. Recently, a prominent DeFi protocol, Tender.fi, has become a victim of significant theft as it witnessed abnormal borrowings in the network.

Tender.fi Halts Borrowing Activity After Being Exploited

The latest victim of a DeFi exploit is Tender.fi, a popular protocol for borrowing and lending digital assets. Recently, Tender.fi experienced an unusual amount of borrowing activity, with millions of dollars in loans taken out in a short period of time. The lending pool for the protocol quickly became depleted, causing panic among users and the community.

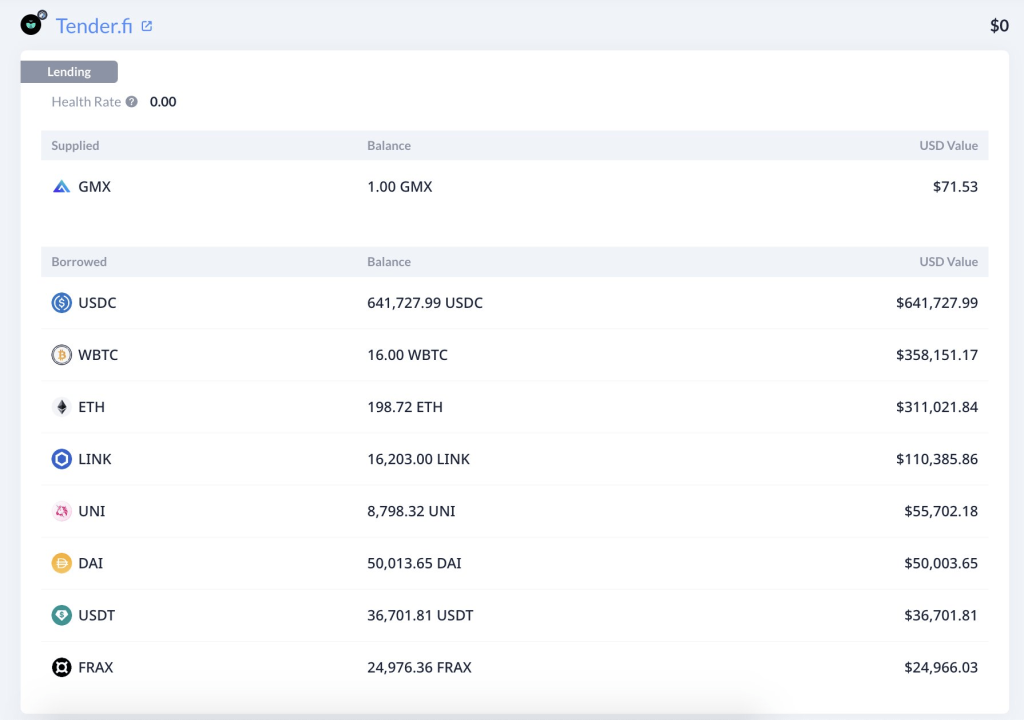

Upon further investigation, it was discovered that a hacker had exploited a vulnerability in the Tender.fi smart contract of the arbitrum lending agreement, allowing the scammer to borrow an enormous amount of digital assets without providing sufficient collateral. As a result, the hacker had managed to drain the lending pool and escape with their ill-gotten gains.

According to Lookonchain, a blockchain analytics firm, the white hat attacker was able to borrow $1.59 million in assets by depositing only one GMX token worth $71 due to a misconfigured pricing oracle.

The Tender.fi team quickly sprang into action, freezing the protocol to prevent further losses and launching an investigation into the exploit. The team also reached out to other DeFi projects to alert them to the vulnerability in their code and urged them to sort out this exploit quickly.

The Tender.fi team said, “We are investigating an unusual amount of borrows that came through the protocol, in the meantime, we have paused all borrowing. Thank you for your patience. The team is attempting to contact the owner of the address. We reached over debank and on chain.”

Tender.fi Token Makes A Severe Plunge

With the rise of DeFi, the risks associated with it have also increased. Recently, the exploit in the Tender.fi platform resulted in a significant drop in the value of its native token TND. In the aftermath of the hack, the platform’s team immediately took necessary actions to address the issue and also reached out to the community to provide updates on the situation and reassure users that their funds were safe.

Despite these efforts, the damage had already been done. The native token TND continued to drop in value in the last few hours as investors and traders panicked and rushed to sell their holdings. Some users also withdrew their funds from the platform, further exacerbating the sell-off.

Following a statement from the DeFi protocol Tender.fi that borrowing has been paused, the native token TND has seen a significant drop in value. TND, which is primarily traded on the decentralized exchange Uniswap, has fallen by 34%, now trading at $1.99 compared to yesterday’s high of $3.56.