Degis, an Avalanche-based next-generation protection protocol, has started a partnership with GMX. With this, it aims to provide exhaustive insurance to the consumers of GMX via the incorporation of GMX in the unique Protocol Protection product thereof. The company stated that it is confident about the protection services provided by it. It assured that sufficient compensation would be given to them if any undesirable or unforeseen situation is countered by the users on-chain.

GMX Partners up with Degis to Let Its Consumers Avail Insurance through Protocol Protection

Protocol Protection, considered to be a next-generation-based protection product, provides an exhaustive shield against all forms of hazards to be countered on-chain. The platform noted that they are endeavouring to adopt the latest pricing model along with aggregate liquidity in the case of Protocol Protection. Degis added that the venue’s Protocol Protection is determined on the behalf of base premium as well as the dynamic model of pricing.

In GMX’s case, the first base premium is specified by the entirety of the veDEG holders, while the annualized premium witnessed during the initial seven days is to be set as the base premium. Following seven days, the market will determine the premium price. The price can additionally be affected by the Protection Pool LP tokens’ amount in every Priority Pool on the protocol. Meanwhile, the community as well as the 3rd-party auditing firms are permitted to propose repricing for the base premium.

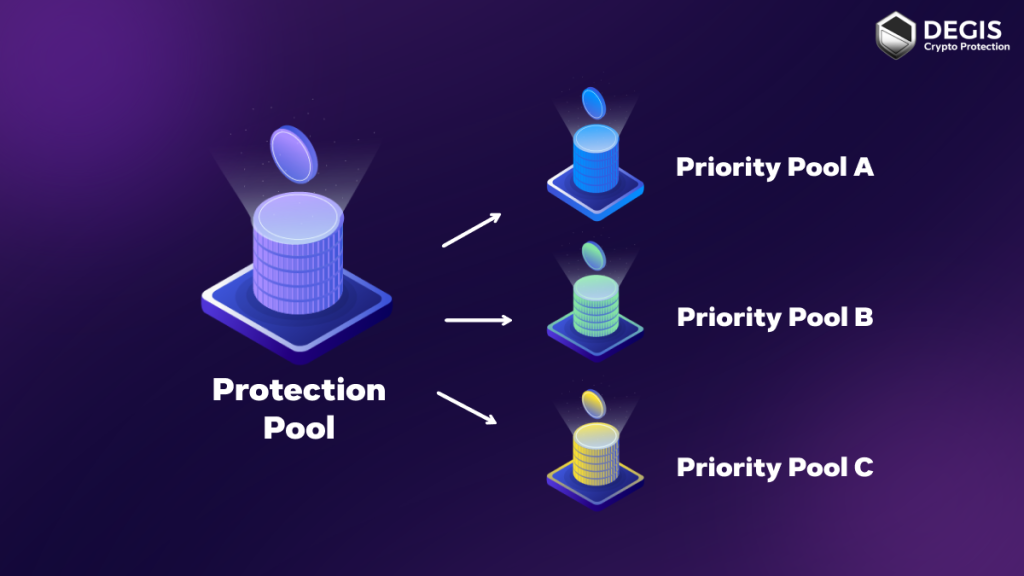

The repricing proposal’s approval will be determined on the behalf of the people holding veDEG tokens. Via the application of the pricing model of Degis, the consumers can get additionally precise as well as privileged premiums, in line with the risk associated with the insured object as well as insured object along with the modifications related to the demand and the market supply. As opposed to the present protocols based on the insurance market, the Protocol Protection of Degis has organized a Protection Pool on Priority Pool’s top.

More Liquidity and Insurance to Be Offered to the Users

The customers are allowed to offer protection over the entirety of the insured projects operating on the venue via providing the Protection Pool with liquidity. This guarantees that there are sufficient reserves in the venue. The funds’ utilization rate has witnessed considerable progress. Simultaneously, the providers of liquidity are additionally enabled to have premium income taken from the entirety of the insured projects.

The position of GMX is that of a top decentralized exchange platform specified for swaps and perpetual futures on Avalanche and Arbitrum blockchains. With the assistance of this project, the traders get the ability to short or long the leverage on AVAX, ETH, BTC, as well as the rest of the prominent crypto tokens by nearly 30x straight from the wallet in their possession.

Degis count as the next-generation-based as well as an all-inclusive protection protocol that is the initial on Avalanche. The company gives exhaustive protection to traders and customers along with offering risk management and scalability to the crypto market.