Equilibria Finance, the platform devoted to offering an easy-to-use forum for maximizing profits, has made an exclusive development. It has recently mentioned in its blog post on Medium that the company is releasing an improved token structure for its local token EQB. As noted in the post, the success of the GNG Protocol and Camelot Exchange has inspired the platform to take this move. The xGND and xGRAIL tokens have remained effective and made considerable progress.

Equilibria Finance Introduces the Exclusive Token Structure for EQB

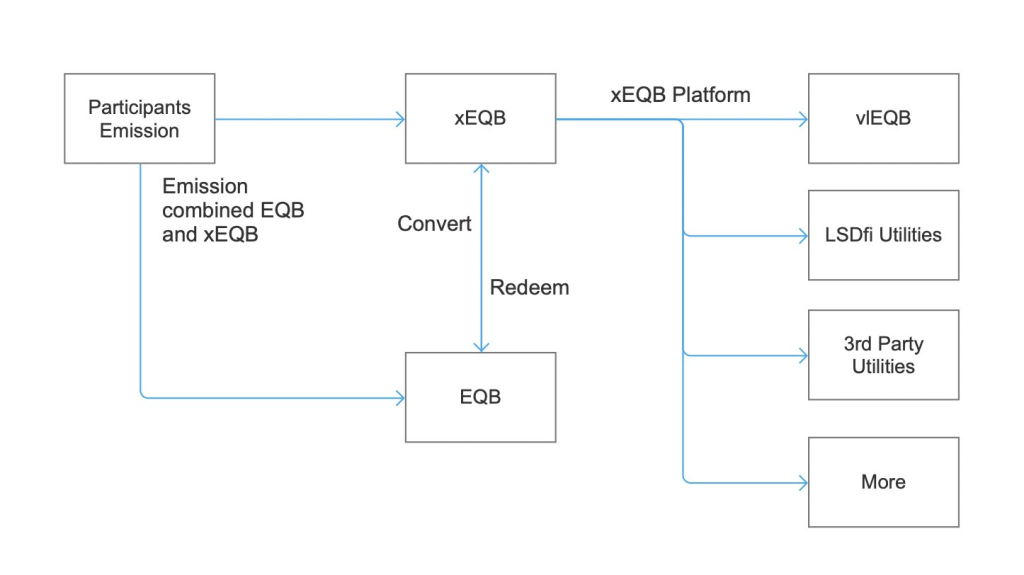

Keeping that in view, the Equilibria-based token’s escrowed version provides an exclusive mechanism to align the liquidity providers, token holders, and the protocol. This circumvents the pitfalls related to mercenary capital normally witnessed in decentralized exchanges. The provision of a redemption procedure for the conversion of xToken to the original coin via vesting is offered with the latest development.

In this way, the people holding xToken can have the incentive of involving in a commitment for the longer term on the platform. The respective mechanism develops a resilient bond between the protocol and stakeholders. This discourages the speculative response for the short term. In addition to this, xEQB provides a resilient mechanism to facilitate the advancement of diverse use cases along with the transformation of the protocol into an exposed platform.

This is done by allowing flexible allocations as well as permitting an expanded and diverse series of features. In general, the redemption procedure and design of the xEQB promote a community-driven approach to prioritize the success and longevity of the protocol over short-term gains. The open allocation agenda thereof not just increases the protocol’s versatility and functionality but also promotes active participation, innovation, and collaboration.

The Platform Assures to Maintain a 1:1 Ratio While Converting xEQB to EQB

While providing more details about this, the platform brought to the front that a 1:1 ratio will be maintained while converting the xEQB tokens to the original EQB tokens. Following that, the additional EQB tokens are to be transacted to an admin address to be burned afterward. This minimizes the EQB token’s overall supply. This contributes to the token’s deflation over time.

The platform also discussed the expectations for the xEQB tokens. The xEQB token will provide additional LSDFi integration in line with the xEQB platform. Moreover, several fee-sharing sources, taking into account fees collected from Limit Orders concerning YT/PT trading, Pendle Pools-based leverage yield farming, and YT/PT-based leverage trading. Additionally, flexibility will also be provided in adopting additional benefits and use cases.