The TON-Telegram partnership is redefining how decentralized finance (DeFi) reaches the masses. By leveraging Telegram’s massive 950-million-user base and TON’s scalable blockchain infrastructure, this integration simplifies DeFi for non-crypto-savvy users while opening new doors for developers and projects. With seamless mini-apps, tap-to-earn games, and native wallets, TON and Telegram are creating a user-friendly gateway to Web3 innovation. Explore how this synergy is driving DeFi growth, enhancing liquidity, and setting the stage for blockchain’s next big leap.

Q1. How do you see TON’s integration into Telegram as a contributor to DeFi adoption, particularly among non-crypto-savvy consumers?

According to Roman Rossov, head of product at WeFi, Telegram already has over 950 million active users monthly, and embedding TON’s blockchain removes many of the traditional barriers to entry—especially for people who aren’t familiar with crypto. Users don’t need to understand private keys, gas fees, or staking concepts upfront. They can interact with DeFi services seamlessly through a familiar platform.

So, participation in DeFi has become really easy and accessible. If you look at the TON-based mini-games on Telegram, they offer very simple experiences. Users are interacting with these games on the go without even realizing that they’re actually engaging in DeFi and blockchain activities.

For non-crypto-savvy consumers, this approach removes the intimidating learning curve. It allows them to explore decentralized financial services in a practical, user-friendly way. So, Telegram works like a bridge, and TON is the engine driving this shift.

Q2. What strategies can WeFi implement to leverage the TON network’s user base and increase DeFi’s accessibility to everyday Telegram users?

We’re already integrating experiences like Wenix, our upcoming PvP game as part of our strategy. In Wenix, players compete globally by battling beasts, wagering on outcomes, and earning rewards in real-time. It’s designed to be fast, interactive, and fun, eliminating the complexity typically associated with DeFi.

The game is currently being tested with early players, and the feedback has been encouraging. We’re leveraging Telegram’s native features, such as embedded wallets and seamless transactions, which simplify onboarding. As we prepare for Wenix’s official release, our focus remains on blending entertainment and accessibility to bridge the gap between mainstream users and decentralized finance.

Q3. While TON Foundation eyes an ambitious goal of onboarding 500M users onto the blockchain by 2028, what is WeFi’s role in achieving this target?

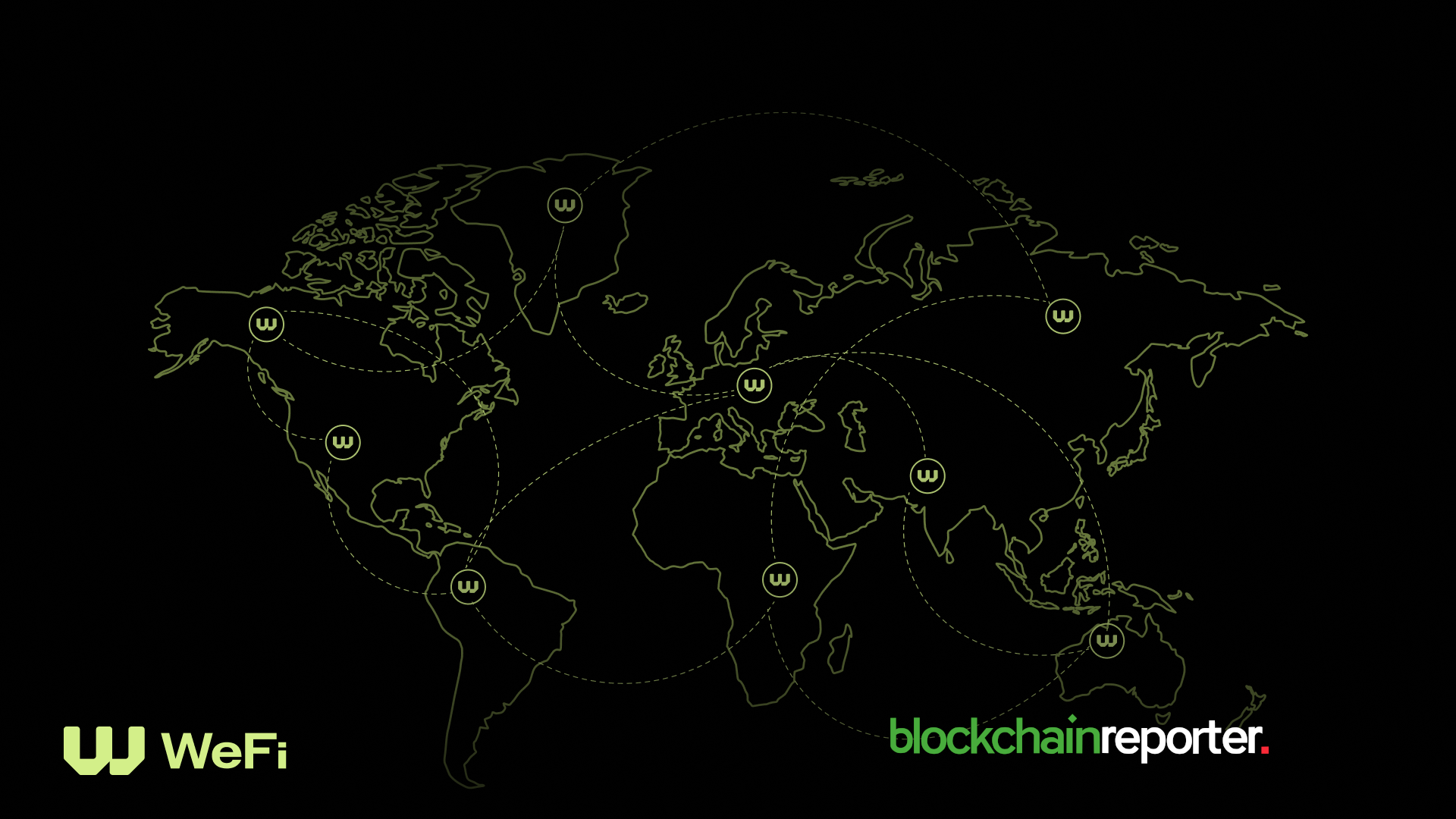

We’re focusing on making products that leverage TON’s scalability and Telegram’s vast user base to create a frictionless entry point into Web3. With initiatives like Wenix and upcoming integrations, we want to make sure that new users find genuine value and utility in the blockchain, driving long-term engagement and adoption.

Q4. How significant is it to create blockchain applications that engage users without requiring direct blockchain interaction?

Most people are drawn to a product’s utility and experience, not its underlying technology. This is why the ‘invisible blockchain’ approach is important. It has proven successful with tap-to-earn games like Hamster Kombat, where millions of users engage without focusing on the TON blockchain itself. The seamless experience ensures that users enjoy the benefits of decentralization—security, transparency, and ownership—without facing a steep learning curve. This design philosophy is key to bridging the gap between traditional users and Web3 so that blockchain can integrate naturally into everyday life.

Q5. In your opinion, how could the TON-Telegram partnership boost liquidity in the DeFi ecosystem?

The synergy between Telegram’s user-friendly interface and TON’s technical capabilities creates a feedback loop. More users interacting with DeFi applications generate higher volumes and liquidity, making the ecosystem more stable and appealing to individual users and institutional players. For instance, features like Telegram’s mini-apps and TON’s integration with stablecoins can drive increased activity, bringing more users into liquidity pools and DeFi protocols.

Q6. What are the key challenges in scaling DeFi entities to accommodate a vast user base like Telegram’s, and how does TON’s infrastructure address them?

I think the challenges in scaling DeFi are largely driven by high transaction volumes, network congestion, and user accessibility. Many blockchains struggle to handle millions of users due to limited throughput and inefficiencies in transaction processing.

However, TON’s infrastructure is in an optimal position to address these issues. Its unique architecture includes “workchains” that distribute transaction loads across multiple chains. This design significantly increases scalability and ensures smooth performance, even during spikes in activity. For example, during the Lost Dogs airdrop, TON identified and resolved validator bottlenecks, reinforcing its ability to support high-volume use cases.

Q7. Beyond liquidity, how does the TON-Telegram integration drive the scalability and growth of the DeFi sector?

The biggest advantage of TON-Telegram integration is how easy it is for users to access DeFi services. Telegram provides a massive entry point with its 950 million monthly users, while TON offers the blockchain infrastructure to support seamless, high-volume activity. Together, they create an environment where users can interact with DeFi services intuitively.

Mini-apps and tap-to-earn games on Telegram demonstrate how DeFi can blend into everyday digital experiences. These applications attract millions of users by offering real-world utility and entertainment, building a bridge from traditional to decentralized finance. We’re also leveraging this appeal by developing Wenix, our upcoming PvP game on Telegram. With Wenix, players will be able to compete globally by participating in battles, betting on outcomes, and earning real-time rewards—all through the Telegram ecosystem.

Also, the industry has already seen the effectiveness of this TON-Telegram integration throughout 2024. At the height of the tap-to-earn craze, TON had over 280,000 daily active users through Telegram. This is also a reason why we’ve chosen to develop Wenix as a Telegram-integrated game. It provides the most accessible gateway to onboarding users into DeFi without them needing prior technical knowledge.

Q8. How can DeFi projects leverage this TON-Telegram merger to enhance their further advancement?

I think developers haven’t yet scratched the surface of the enormous potential that TON and Telegram’s integration brings. DeFi projects can use Telegram’s native wallets and TON’s infrastructure to simplify onboarding and reduce friction for new users. Embedding features like instant token swaps or micro-loans directly into Telegram chats makes DeFi accessible during regular conversations.

Projects can also leverage Telegram’s mini-app ecosystem to offer interactive financial tools, increasing user engagement without overwhelming them with technical details. The tap-to-earn craze from 2024 was just the start of what this merger can do. There’s still a long way to go.

Q9. Looking ahead, what developments or innovations within the TON ecosystem do you believe will significantly impact the DeFi landscape in the upcoming five years?

The next five years in the TON ecosystem will likely focus on refining scalability, improving interoperability, and expanding real-world DeFi applications. TON’s focus on interoperability could integrate more blockchains, allowing DeFi projects to connect with other ecosystems. This would expand liquidity options and diversify use cases, benefiting both developers and users. Real-world applications, such as decentralized lending, remittance solutions, and tokenized assets, will likely mature, driving mass adoption.