In the ever-evolving landscape of cryptocurrency exchanges, FixedFloat emerges as a beacon of innovation and user-centric design. Offering a simplified approach to crypto trading, FixedFloat stands out with its non-custodial nature, lightning-fast transactions through integration with the Lightning Network, and a commitment to user privacy by eliminating registration and KYC checks.

This comprehensive FixedFloat review delves into the core services and benefits that define FixedFloat’s position in the market. From its inception in 2018 as a Lightning Crypto Exchange to its recent expansion in supported languages and cryptocurrencies, FixedFloat has consistently evolved to meet the dynamic needs of the crypto community.

What is FixedFloat?

Founded in 2018, FixedFloat established itself as a leading Lightning Crypto Exchange, leveraging the benefits of automation and seamless integration with the Lightning Network. This innovative network empowers users to conduct transactions off the main blockchain, resulting in accelerated speeds and reduced fees.

As it marked its fourth anniversary in 2022, FixedFloat showcased remarkable achievements, including surpassing a million completed orders, maintaining a steady daily influx of over 1,000 loyal customers, and gaining the trust of more than 5,000 new visitors each day. The commitment to the Lightning Network remained unwavering, with active participation in the cryptocurrency community, including the sponsorship of a Monero fan gathering.

The FixedFloat exchange is a completely automated cryptocurrency exchange, providing users with a streamlined method for trading digital assets. Its distinguishing feature lies in its non-custodial design, eliminating the requirement for users to undergo registration or KYC checks. Additionally, its seamless integration with the Lightning Network amplifies the speed of Bitcoin transactions.

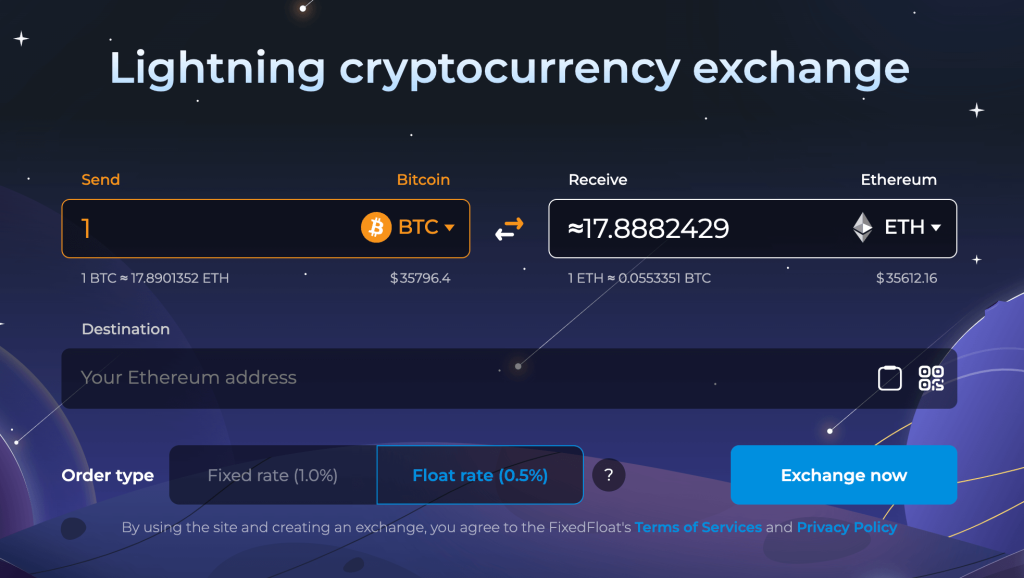

The trading platform prides itself on offering the most competitive rates in the market. Noteworthy is FixedFloat’s capability to facilitate cryptocurrency exchanges with either fixed or floating rates. Fixed rates guarantee that the displayed cryptocurrency amount remains constant, whereas floating rates adjust dynamically based on market fluctuations.

FixedFloat’s User Experience

The FixedFloat platform offers a remarkably user-friendly navigation experience, catering to individuals at all levels of expertise in the cryptocurrency space. A notable advantage is its emphasis on convenience. Creating orders on the website is straightforward, with users simply selecting the currencies they wish to exchange, choosing a rate type, and entering the desired amount.

This user-friendly process is further enhanced by the option for users to either scan a QR code or provide a wallet address, facilitating swift exchanges on the platform. In a recent development, the crypto trading platform has successfully undergone a substantial website redesign, featuring a modern user interface that ensures seamless navigation across all devices.

Moreover, FixedFloat has broadened its language support to enhance client accessibility. Presently, the platform accommodates users in 12 languages, encompassing Turkish, Ukrainian, Polish, Dutch, Simplified Chinese, and Italian. Plans are underway to include Japanese, Korean, Arabic (UAE), and Hebrew in the near future.

Supported Cryptocurrencies

FixedFloat not only prioritizes a user-friendly interface but also offers a diverse and inclusive range of supported cryptocurrencies, providing users with a broad spectrum of options for their crypto exchanges. With an impressive array of 68 cryptocurrencies, the FixedFloat exchange ensures that users can engage with major players in the market.

The platform’s commitment to diversity is evident in its support for cryptocurrencies like Cardano (ADA), Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and Solana (SOL). This extensive selection caters to the varied preferences and investment strategies of the crypto community. What sets FixedFloat apart is its continuous effort to stay ahead in the ever-evolving digital landscape.

Recent additions to its portfolio, such as Solana (SOL) and Avalanche (AVAX), underscore the trading platform’s responsiveness to emerging trends and technologies. This dedication to expansion not only enhances the crypto exchange’s versatility but also demonstrates a proactive approach to meeting the evolving needs of its users.

FixedFloat Fees And Payment Types

FixedFloat provides users with two distinct methods for cryptocurrency exchange, each with its own fee structure: fixed rate and float rate. Opting for the fixed rate incurs a 1% fee based on the transaction amount, in addition to any applicable network fees. This ensures that you receive the exchange rate visible at the initiation of the transaction.

Nevertheless, should the market rate shift by more than 1.2% prior to confirmation on the blockchain, users may be required to decide between accepting the new rate or opting for a refund. Opting for the float rate incurs a reduced fee of 0.5%, alongside network fees. The exchange rate is established upon the confirmation of your transaction on the blockchain.

In this scenario, if the market experiences an uptrend, you receive a higher amount of cryptocurrency, and conversely, in a downtrend, the amount is reduced. This method offers a fair and dynamic approach to exchange, aligning with market changes. Both options feature transparent fees, devoid of any concealed commissions. Your choice between the two can be tailored to your preferences and comfort level with market fluctuations.

Security and Transparency

ixedFloat places a strong emphasis on security and transparency, ensuring users have a secure and trustworthy environment for their crypto transactions. The exchange’s commitment to security is rooted in its decentralized nature. Transactions occur directly between users, eliminating the need for intermediaries or third-party agents. This peer-to-peer approach enhances the overall security of transactions, reducing the vulnerability to external threats.

Remarkably, FixedFloat operates on a non-custodial model, meaning it does not store user deposits. This unique feature significantly minimizes the risk of potential losses from cyber attacks or security breaches. By removing the need for a central authority to hold funds, FixedFloat empowers users to have greater control over their assets.

To further enhance user control, FixedFloat facilitates order tracking through various channels, including email, website notifications, and order links. This multi-channel approach ensures that users can stay informed about the status of their transactions and have visibility into the process, adding an extra layer of transparency and control.

In addition, FixedFloat takes transparency seriously, as evidenced by its clear and straightforward fee structure. The platform does not hide commissions, providing users with a transparent view of transaction costs. This commitment to openness ensures that users can make informed decisions, knowing the exact costs associated with their exchanges.

FixedFloat KYC Process

A standout feature of the FixedFloat exchange is its deliberate choice to abstain from enforcing KYC compliance requirements. This departure from the industry norm is a testament to the platform’s commitment to user privacy and data protection. For individuals who prioritize safeguarding their personal information, this distinctive approach provides a breath of fresh air. The absence of mandatory KYC checks contributes to an expedited onboarding process for users.

By eliminating the need for exhaustive identity verification procedures, FixedFloat streamlines the initial user experience, allowing individuals to quickly and seamlessly access the platform without cumbersome administrative hurdles. Moreover, FixedFloat’s KYC-free model inherently reduces security risks associated with the storage and handling of sensitive personal data.

Users can engage in crypto trading with the assurance that their information is not stored on the platform, mitigating the potential impact of data breaches or unauthorized access. The KYC-free approach of FixedFloat aligns with the philosophical stance of prioritizing user autonomy and privacy. This resonates strongly with individuals who seek a cryptocurrency exchange that respects their principles and values in an era where data protection is paramount.

Affiliate Program

The FixedFloat exchange presents a compelling affiliate program, providing an opportunity for you to earn profits from every exchange conducted by customers you refer. Upon registration in the program and acquisition of an affiliate link, you can promptly commence earning. Just integrate the link into your platforms or resources, and whenever individuals click on it to initiate an exchange, you’ll receive 40% of the profits generated from each exchange carried out by your referred clients.

The program ensures complete transparency by showcasing all exchanges conducted by your referred customers in your affiliate account on FixedFloat’s website. With a substantial profit percentage and a minimal withdrawal threshold set at just 0.001 BTC, FixedFloat’s affiliate program provides an excellent opportunity to establish a thriving business and reap rewards for your referrals.

FixedFloat Customer Support

At FixedFloat, customer support is not just a service; it’s a commitment. The platform ensures round-the-clock availability, recognizing that the crypto market operates 24/7. This dedication to constant support reflects a proactive approach to meeting user needs irrespective of time zones or trading hours. In addition, FixedFloat offers users various communication channels to reach their support team.

For quick assistance, users can initiate a live chat directly on the website. This real-time option is ideal for resolving urgent queries and concerns promptly. Understanding the popularity of Telegram in the crypto community, FixedFloat exchange provides users with the option to connect via this platform. With an impressive response time of usually within 10 minutes, users can receive timely assistance and guidance on Telegram.

Conclusion

FixedFloat stands out as a cryptocurrency exchange that seamlessly blends user-friendly accessibility with advanced features. Emphasizing a non-custodial approach and bypassing KYC checks, the platform prioritizes user security and control. Offering flexible and competitive rates, minimal fees, transparent pricing, and swift network confirmations, FixedFloat establishes itself as a trustworthy option. In summary, FixedFloat is lauded for its reliability, security measures, and unwavering commitment to user convenience.

Frequently Asked Questions (FAQs)

What is FixedFloat and how does it work?

FixedFloat is an automated cryptocurrency exchange with favorable terms. Operating as a non-custodial platform, exchanges occur promptly upon receiving coins and the necessary network confirmations.

Are there any fees for using FixedFloat?

Yes, FixedFloat imposes trading fees for cryptocurrency exchanges. Users can opt for fixed or float rates, each with its distinct fee structure. The platform ensures transparency by clearly displaying all fees, including network fees, during the exchange process.

Is FixedFloat safe?

Yes, FixedFloat imposes trading fees for cryptocurrency exchanges. Users can opt for fixed or float rates, each with its distinct fee structure. The platform ensures transparency by clearly displaying all fees, including network fees, during the exchange process.

What is the difference between fixed and float rates?

Fixed rates maintain a constant exchange amount, while float rates dynamically adjust based on market fluctuations. Users choose between stability with fixed rates or potential gains/losses with float rates.