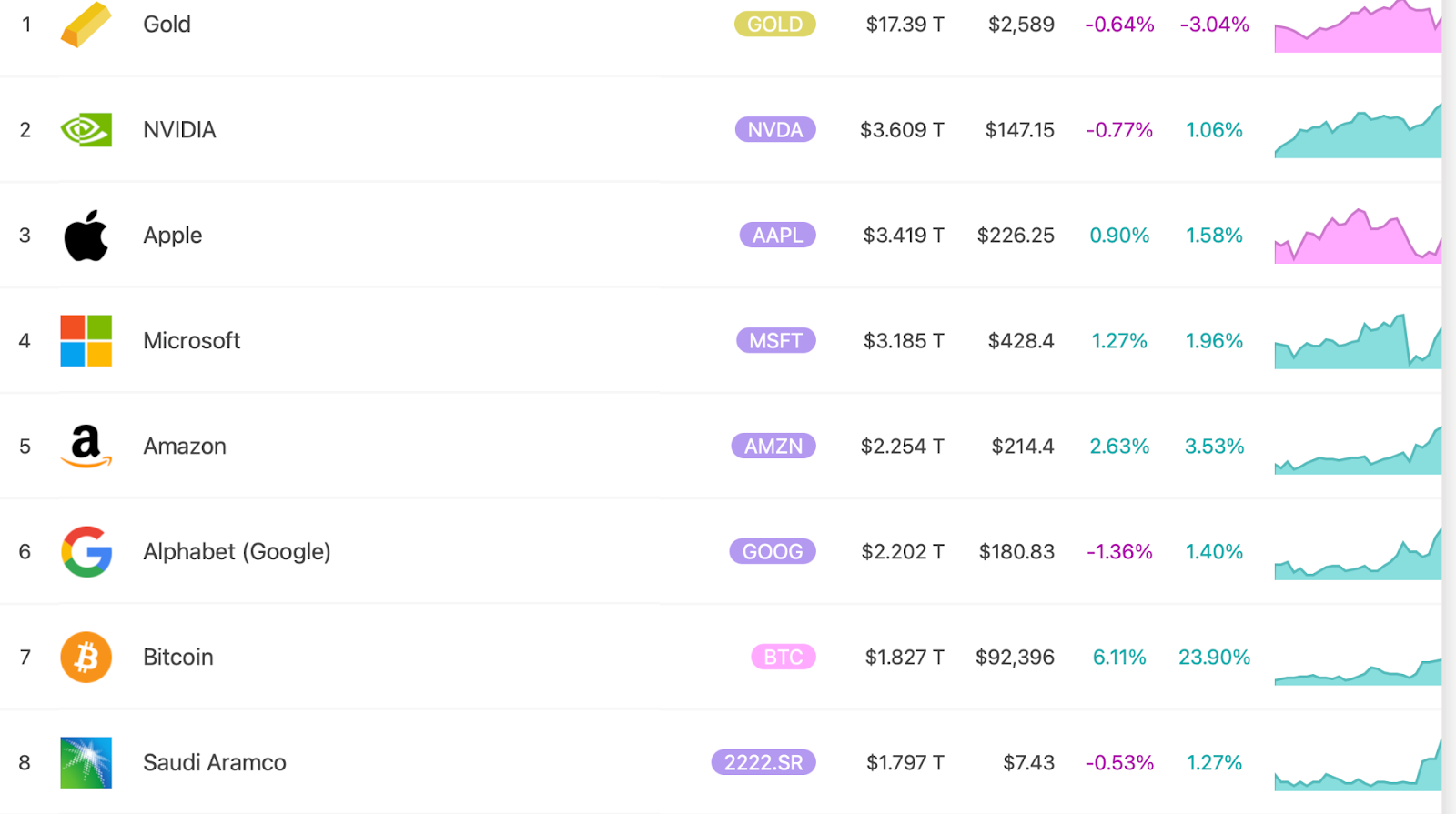

The world’s largest cryptocurrency, Bitcoin, has surged past $92,000, marking a significant increase since Donald Trump’s win on November 5. The renewed momentum has led to optimistic predictions that Bitcoin could reach $100,000 by January 2025, as Trump takes office. This year alone, Bitcoin has risen an impressive 93% year-to-date, sparking further excitement about its price growth among both retail and institutional investors. Currently, Bitcoin is trading at $92,166.73, with a total market cap of $1.82 trillion. This made Bitcoin the world’s 7the largest asset surpassing the Oil giant Saudi Aramco.

As Bitcoin’s dominance continues, other sectors of the crypto market are also seeing upward trends. The Real-World Asset (RWA) sector, for instance, has quietly gained traction, experiencing a breakout year in 2024. A report released on October 29 by global consulting firm Boston Consulting Group (BCG) calls RWA tokenization “the third revolution in asset management,” projecting that the sector could reach $600 billion in assets under management by 2030.

These metrics come as Bitcoin continues to set new milestones, signaling that this may be an ideal time to accumulate RWA tokens amid Bitcoin’s high dominance.

Let’s look into some of the potential RWA tokens making waves amidst the crypto bull market.

VeChain

VeChain is currently trading at $0.02678, reflecting a 25% increase over the past seven days, with a market cap of $2.17 billion. As of the latest data, its 24-hour trading volume stands at $1.89 million. The token is available on major crypto exchanges, including Binance, Coinbase, and Upbit.

At its core, VeChain tokenizes high-value and traditionally illiquid assets like art, pre-IPO shares, and real estate, enabling fractional ownership and trading. The platform leverages NFC/RFID tags and smart contracts to ensure the authenticity and traceability of assets, attracting businesses focused on building robust supply chains with transparent, verifiable data. Moreover, VeChain aligns with global sustainability goals through its energy-efficient approach.

VeChain has built partnerships with industry leaders such as LVMH, BMW, and Walmart China to enhance transparency in the RWA sector. Through these collaborations, VeChain improves supply chain visibility, facilitating better tracking of components and reducing the risk of counterfeit parts. With blockchain at its core, the project supports companies in seamless data transfer, supply chain management, and in preserving the value of luxury products within secondary markets.

Landshare ($LAND)

With a market cap of over $6.6 million, Landshare stands out as one of the promising projects in the RWA space. At the press time, the token price increased by 38%, now standing at $1.72.

Landshare aims to simplify real estate investment on the blockchain, offering users a seamless way to earn passive income from real-world assets while enhancing their investment through a suite of DeFi features. By tokenizing real estate, Landshare allows users with as little as $1 in Landshare tokens to access real estate and earn passive income from multiple assets with a single token investment.

As a DeFi-compatible platform, Landshare enables users to transform their real estate holdings into liquid on-chain assets seamlessly. Unlike traditional real estate investments, which often involve extensive documentation, Landshare provides detailed financial information for each RWA asset, including cash flows, property values, expenses, and more.

In addition to tokenizing properties, the platform also offers yield aggregation. This feature allows Landshare to lease and manage properties on behalf of users, enabling them to earn passive income from rental properties without the usual management hassles.

Ondo ($ONDO)

Ondo is a promising RWA project with a current market cap of $1.25 billion. The project has gained momentum, rising by 30% over the past seven days and trading at $0.89. The token is available for trading on top exchanges, including Bybit, Coinbase, OKX, and Uniswap.

As an RWA-focused project, ONDO allows investors to access tokenized versions of traditional assets such as corporate debt, money market funds, and U.S. Treasury bonds. ONDO has captured a notable share of the RWA sector, with its community eagerly anticipating a potential listing on Binance. Many in the community view $ONDO as being in a favorable accumulation phase, with its total value locked (TVL) reaching new all-time highs and significant whale accumulation underway.

Conclusively, the RWA tokenization market is projected to expand up to 50 times by the end of the decade, according to a report from BCG. With Bitcoin continuing to perform strongly and dominate the market, it’s an ideal time to explore and accumulate potentially high-performing RWA tokens like Landshare. Even under more conservative estimates, Citigroup suggests that the sector could reach $4 to $5 trillion in tokenized digital securities by 2030. These metrics indicate that the RWA sector is well-positioned for long-term growth.