If you are looking for how to buy Bitcoin on BYDFi, we are here to help you on your journey. Founded in 2020, BYDFi has quickly established itself as a trusted platform for crypto enthusiasts and investors. With a commitment to providing a user-friendly experience, BYDFi offers a range of features that set it apart from other exchanges. Whether you’re a beginner or an experienced trader, BYDFi offers intuitive interfaces and advanced trading tools to cater to your needs.

One of the key advantages of BYDFi is its diverse range of crypto conversion tools. The platform provides various trading options, including demo, perpetual, copy, and leveraged trading. These features allow users to explore different trading strategies and maximize their potential returns. In this guide, we will focus specifically on buying Bitcoin on BYDFi so you can join the exciting world of digital currency and potentially benefit from its growth.

How to Create An Account on BYDFi

If you are wondering how to buy Bitcoin on BYDFi, start by creating your account. Registering a new account on BYDFi is a straightforward process. You’ll notice a registration button at the top right corner when you visit the official website. It’s important to provide a valid email address as you’ll need to verify it immediately with a code in order to complete the registration. Keep in mind that it may take a few moments to receive the verification code. If you don’t receive it initially, you can request a new code after a minute.

After successfully creating your account, it is crucial to prioritize security measures. Access the Account Security tab and click on the Manage button in the security center. Follow the steps provided, which include verifying your phone number, email, setting up Google Authenticator, creating a fund password, and more. Additionally, you can enhance security by creating a whitelist of withdrawal addresses and exclusively using those when you want to withdraw funds from your BYDFi account.

While it is technically possible to use the exchange without completing the Know Your Customer (KYC) procedure, it comes with limitations that can make it challenging. To overcome these restrictions, it is recommended to verify your identity, as it is a standard requirement for most reputable exchanges. The identity verification process is relatively simple and involves just a few steps. Once you’ve completed all the aforementioned steps, you’ll be ready to start utilizing the platform to buy Bitcoin.

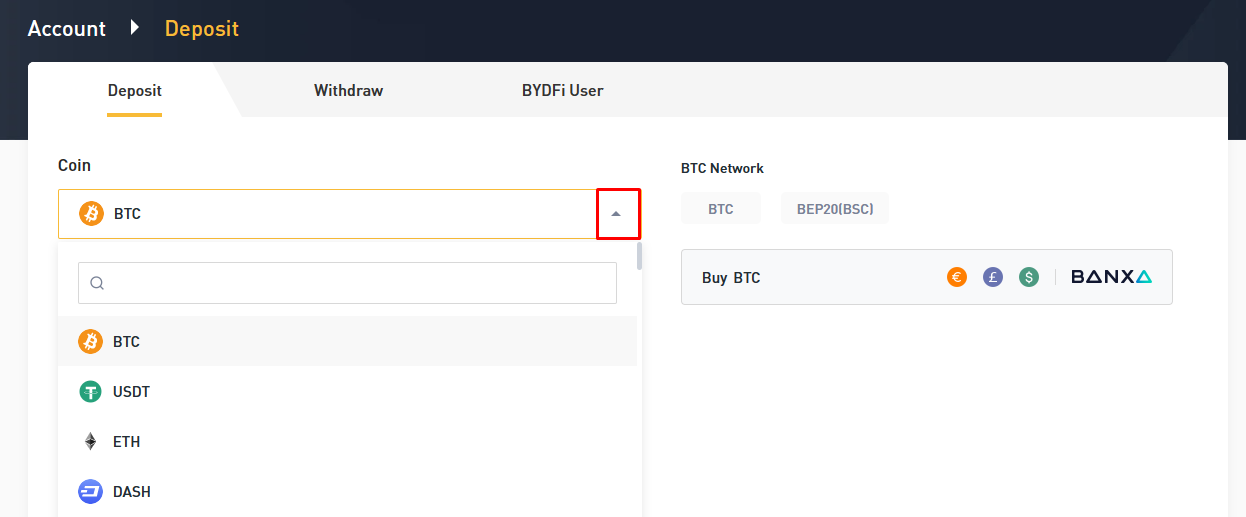

How to Buy Bitcoin on BYDFi: Deposits & Withdrawals

If you have experience using other cryptocurrency exchanges, you should find this step to be familiar and you will understand how to buy Bitcoin on BYDFi. On the top navigation menu, locate the Assets tab, and hover over it to reveal a drop-down menu. Click on the Deposit button within this menu.

Once you’re on the deposit page, simply choose the network you wish to utilize. Upon selecting the network, the platform will automatically generate a unique deposit address for you to send your funds to. It is crucial to double-check the network you are using to avoid sending funds to the wrong address, as this could result in an irreversible loss of funds.

There is no minimum deposit requirement, but please note that network fees will be applicable. Once your funds are successfully deposited, you will need to transfer them to the respective sub-accounts based on whether you intend to use the spot exchange, derivatives exchange, or other available products. Once this step is completed, you’re ready to begin trading Bitcoin.

Spot Trading on BYDFi

Let’s start understanding how to buy Bitcoin on BYDFi by exploring the spot trading option. BYDFi offers an advanced version of their spot trading platform, but for the sake of familiarity and user comfort, we’ll focus on the classic version, which most users are likely accustomed to. The interface is fairly standard and straightforward. On the left side, you’ll find a list of available cryptocurrencies. In the middle, there’s a chart displaying price movements, along with options for different order types.

On the right, you’ll see the order book. BYDFi supports a diverse range of cryptocurrencies on its spot platform, including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Cardano (ADA), Polkadot (DOT), and more. Since this guide is specifically for purchasing Bitcoin, you can select Bitcoin from the list. There are two types of orders you can use: Limit orders and Market orders.

If you want to open a position at a specific price, you can use a Limit order. This order is placed in the order book and executed once the price reaches the specified level, provided there is sufficient liquidity. It’s important to note that limit orders can be partially filled. On the other hand, if you want to open a position immediately at the best available price in the order book, you can use a Market order. This ensures swift execution at the prevailing market price.

In this “how to buy Bitcoin on BYDFi” guide, we will use a simple market order to open a position. For example, let’s say we want to buy BTC for 50 USDT. By clicking the “Buy BTC” button, the market order will be executed, and we will acquire BTC worth 50 USDT. Given the current price of $25,016, this will result in approximately 0.002 BTC. To close a position in the spot exchange, all you need to do is sell your cryptocurrency, in this case, BTC. Once again, a simple market order can be used for this purpose.

In our scenario, the 50 USDT purchase yielded 0.002 BTC, and to close the position, we simply sell all of it. It’s worth noting that you also have the option to partially close the position by selling only a portion of your holdings. That covers the basics of trading on the spot platform. Utilizing limit orders is equally straightforward, with the only difference being that you specify a particular price and wait for the market to reach and fulfill it.

Derivatives Trading on BYDFi

Now, let’s see how to buy Bitcoin on BYDFi on its derivatives option. When you hover over the derivatives button in the main navigation menu, you’ll notice several options available. The USDT-M option allows you to trade perpetual contracts denominated in USDT. COIN-M offers perpetual contracts settled in cryptocurrencies, while lite contracts provide simplified trading, and leveraged tokens present additional opportunities. For the purpose of this guide, we will focus on the USDT-M option.

It’s important to understand that a perpetual contract is a futures contract without an expiration or settlement date. This means you can buy and sell it at any time, providing flexibility. However, derivatives trading introduces the use of leverage, which significantly increases the risk involved. It’s crucial to note that leverage trading carries a substantial risk of capital loss and should only be undertaken by experienced users. Utilizing leverage above 5x is exceptionally risky and should be approached with extreme caution.

There are notable differences, particularly on the right side of the screen, where you have access to more order types and the ability to adjust your leverage. For the BTC trading pair, BYDFi allows leverage of up to 150x, but in this guide, we will only utilize 5x leverage, as explained earlier. Leverage functions by amplifying your position size by the chosen factor. So, with 5x leverage, you can open a position that is five times larger than your available capital. For instance, you could use $10 to open a position worth $50.

However, there is a significant risk associated with leverage trading. If the price moves against you to the extent that you lose your initial capital (referred to as margin), you will face liquidation. In the previous example, if the price moves against you and you incur a $10 loss, your entire position will be liquidated. With 5x leverage, the price would need to move 20% against your position to trigger liquidation. The higher the leverage, the lower this percentage becomes, and the riskier your trade becomes.

Continuing with our previous example, we will use a simple market order to open a position. By clicking the Long button, we will purchase BTC worth 100 USDT, but we will only need to provide 17.61 USDT as collateral due to the leverage we are utilizing. It’s important to note that with derivatives, you also have the option to speculate on the price going down. In that case, you would click the red Short button, and your position would generate a profit if the price decreased.

Just below the chart, you will find a tab where you can manage your positions. Here, you can monitor important details such as position size, margin mode, entry price, liquidation price, margin ratio, and PNL (Profit and Loss). To close your position, simply use the market button for an immediate exit or place a limit order with your desired exit price. Additionally, you have the option to utilize stop-loss or take-profit orders, which allow you to automate the closing of your position. To do this, click the stop limit button and select the appropriate order type.

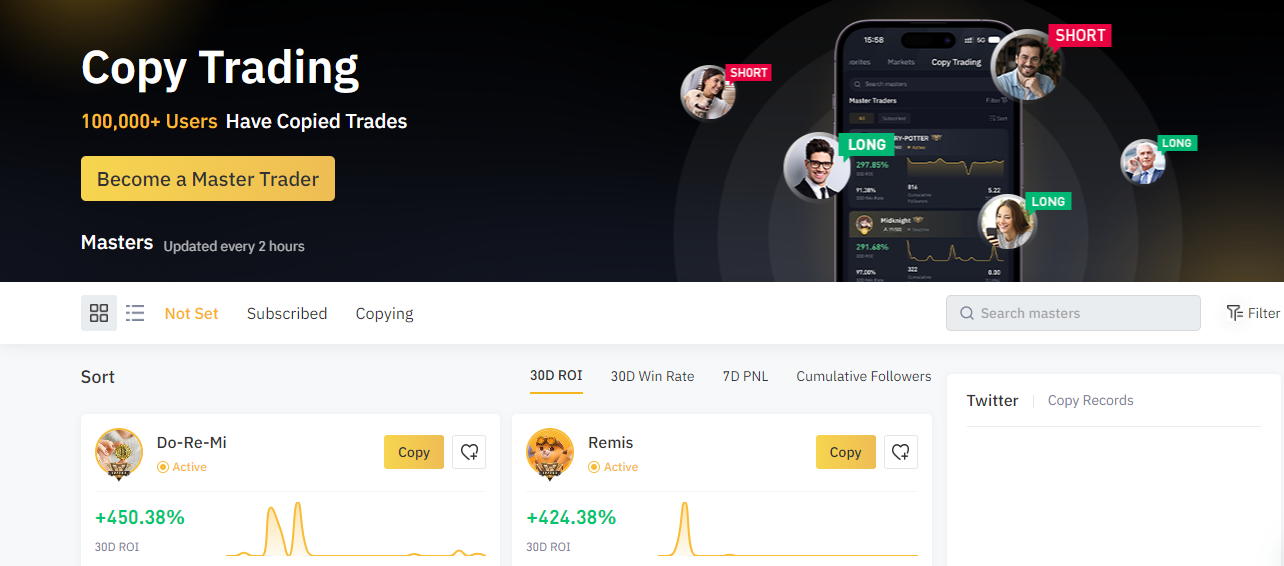

Copy Trading on BYDFi

If you are a beginner looking for how to buy Bitcoin on BYDFi, copy trading can be a good start for you. Copy trading is a form of social trading that enables you to automatically replicate the trades of other individuals. While this strategy can be profitable, it is crucial to closely monitor your positions and ensure that you diligently follow them. Copy trading involves considering multiple factors that may impact the trades being copied. To initiate the copy trading process, you simply need to click the Copy button and customize the settings to align with your trading style and preferences.

BYDFi’s copy trading feature provides novice traders with a valuable opportunity to leverage the extensive knowledge and skills of seasoned traders. By copying the trade positions of these accomplished traders, beginners can gain access to their expertise and potentially replicate their success. This feature is particularly advantageous for individuals who may have limited familiarity with technical analysis but aspire to capitalize on the achievements of experienced traders who have established track records.

Bitcoin Trading Fees on BYDFi

Now if you understand how to buy Bitcoin on BYDFi, you might be wondering about its trading fee. BYDFi prides itself on offering traders a clear and transparent fee structure. The fees vary depending on the specific products and services chosen. Spot trading pairs and USDT/Inverse contracts have the same transaction fee. The maker and taker fees for spot trading pairs typically range from 0.1% to 0.3%.

It’s worth noting that opening and closing fees may differ for different arrangements, so we recommend checking BYDFi’s official website for the most up-to-date information on trading fees. Additionally, there may be an overnight fee (margin * leverage * 0.045% * days) applicable to keep a trade order open overnight. Deposits on BYDFi are fee-free, which is great news for BYDFi users. However, withdrawals do incur a flat fee to cover the transaction costs associated with transferring cryptocurrencies from your BYDFi account.

Is it Safe to Buy Bitcoin on BYDFi

In addition to wondering about how to buy Bitcoin on BYDFi, many people wonder about the safety and security of the platform. The development team at BYDFi is fully committed to implementing precise, comprehensive, rigorous, and strict security standards to ensure the highest level of protection for digital client assets. Numerous layers of safeguards are in place to prevent threats and unintended incidents. Various security measures have been put into effect for trading systems, fund custody, auditing, network transmission, customer accounts, and client insurance funds.

To bolster customer account security, BYDFi employs dual authentication via Google Authenticator, commonly known as two-factor authentication (2FA). This two-step verification process adds an extra layer of security compared to traditional one-step verification, effectively thwarting unauthorized access by third-party agents or users. Additionally, wallet security is of paramount importance at BYDFi. All digital wallets are stored in secure cold storage wallets, eliminating the risk of a single point of failure. Layered deterministic cold wallets are utilized to further enhance security.

BYDFi Customer Support

For those wondering about how to buy Bitcoin on BYDFi, the platform distinguishes itself in the Bitcoin trading market with its highly efficient customer support services. The support agents at BYDFi not only exhibit friendliness but also display responsiveness and promptness in assisting traders. Traders can conveniently reach the customer support team through various channels, including 24/7 live chat, Facebook, Twitter, Telegram, and Instagram.

For those who prefer email communication, traders can direct their queries to cs@BYDFi.com. The live chat feature ensures instant responses, promptly addressing any customer concerns. Moreover, BYDFi offers an extensive Help Center that covers a wide range of topics, such as announcements, spot smart market, trading strategies, derivatives, copy trading, market liquidity, leveraged tokens, and other relevant articles.

Final Thoughts

In conclusion, if you’re looking for how to buy Bitcoin on BYDFi, you’re in good hands. Established in 2020, BYDFi has quickly become a trusted platform for crypto enthusiasts and investors. With its user-friendly experience and a range of features, it caters to both beginners and experienced traders. BYDFi offers a reliable and user-friendly platform for buying Bitcoin and engaging in cryptocurrency trading. With its commitment to security, diverse trading options, transparent fee structure, and efficient customer support, BYDFi is well-equipped to support you on your crypto journey.