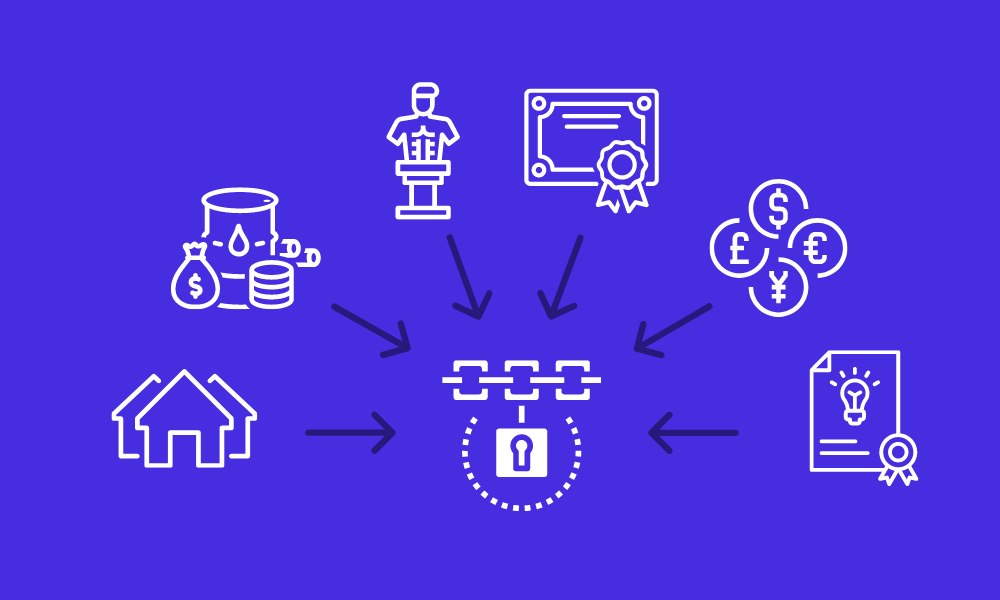

As we continue to witness the sweeping transformation of financial landscapes globally, blockchain technologies are offering more than just digital currencies. A new trend that has started to gain traction is the tokenization of real-world assets.

The introduction of blockchain technology in asset management has seen the dawn of an innovative platform, IBAX, that allows for the creation of digital proof of ownership for tangible assets and commodities.

IBAX, a leading-edge blockchain platform, has made an entry into this rapidly evolving market with a unique proposition. Its platform not only offers a system for managing a wide array of digital assets but also empowers owners to convert their tangible assets into a digital form, promoting enhanced security, transparency, and liquidity.

Tokenization Transforms Asset Management

IBAX Crypto’s asset and commodity-backed tokens distinguish themselves from conventional security tokens by embedding the inherent value of the real-world assets they represent.

This innovative approach presents a dual advantage: tokens possess the intrinsic worth of the underlying asset or commodity and the additional liquid value afforded by their digital nature. This feature propels the world of asset management into a realm of unlimited opportunities for both asset owners and investors.

A new era of financial innovation has dawned with the proliferation of digital assets. As a frontrunner in this digital revolution, IBAX is capitalizing on blockchain technology to provide a flexible and highly efficient mechanism for managing a wide range of digital assets.

The platform’s user-friendly tokenization process enables the transformation of assets into digital infrastructure, facilitating rapid, cross-border transactions without the need for intermediaries.

Unleashing A New Level Of Liquidity And Accessibility

“The launch of the IBAX Crypto platform marks a significant shift in the digital asset landscape,” said Joel Chifunyise, the Founder and CEO of IBAX. “Our platform not only allows individuals and businesses to tokenize their real-world assets and commodities, but it also opens up a whole new level of liquidity and accessibility.”

Chifunyise envisions a future where traditional assets coexist harmoniously within the digital sphere, and he believes IBAX can bring this vision to life. The platform’s potential to revolutionize how assets are managed and traded in the digital age seems promising, and it is certainly one to watch for anyone keen on understanding the evolution of digital asset management in this era of financial innovation.