The Injective blockchain has set a new record today with 370 million on-chain transactions. However, Injective (INJ) is not just making waves with on-chain transactions and a $1 billion staking value; it’s also reaching unprecedented heights in its market value. The token has surged over 70% in the last 7 days, hitting an all-time high (ATH) of $31.30 early on Friday. This remarkable achievement signals a full recovery from previous losses, establishing INJ as a formidable player in the cryptocurrency market.

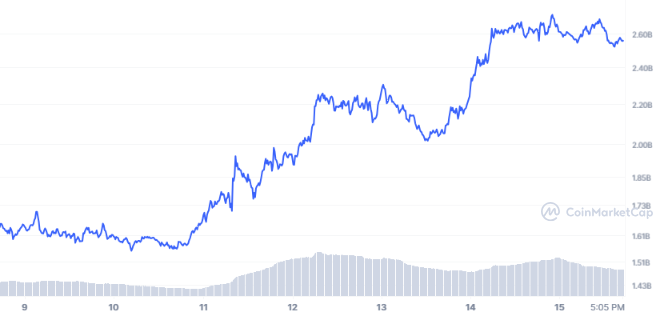

Altcoins Rising: INJ’s Steady Momentum towards $2.655 Billion Market Cap

In the dynamic landscape of cryptocurrencies, altcoins like INJ are gaining prominence, outperforming Bitcoin and contributing to the overall industry growth. Notable altcoins, including Avalanche, Cardano, Bonk, and Solana, have been making waves, but INJ’s steady momentum has captured the attention of investors.

As of now, INJ’s market cap stands impressively at $2.655 billion, underscoring its growing influence and robustness. The platform’s unique focus on financial applications and its utilization of blockchain technology set it apart in the evolving world of cryptocurrencies.

Developed as a Layer 2 (L2) application on the famous Cosmos blockchain, Injective leverages some cross-chain bridges to facilitate cryptocurrency access from Polkadot and Ethereum. This innovative approach positions Injective as a key player in reshaping the financial industry.

The recent surge in INJ’s price can be attributed to the excitement surrounding artificial intelligence (AI). The release of ChatGPT-4 and broader advancements in AI technology have generated significant enthusiasm, influencing market sentiments and contributing to INJ’s meteoric rise.

INJ Wallet Trends and Market Outlook: Decoding $2.18B Accumulation and the Future of Price Stability

Analyzing the data further, it’s evident that three wallets hold a substantial percentage of INJ accumulations, totalling $2.18 billion and comprising almost 80% of the entire INJ supply. Over the last three months, these wallets have added more than 7 million tokens to their holdings, according to Santiment.

While the market is buzzing with excitement about AI technologies and their potential influence, it remains uncertain whether the recent INJ price increases are sustainable in the long term. The influx of large-pocket investors taking profits adds an element of unpredictability to the trajectory of INJ’s value. The chances of market manipulation increase with maximum supply in fewer wallets.

In conclusion, Injective’s exceptional growth in on-chain transactions, staking value, and market capitalization paints a picture of a dynamic player in the cryptocurrency realm. As the market continues to evolve, all eyes are on INJ to see how it navigates the intersection of blockchain and artificial intelligence.