- 1. Ethereum ETFs Experience Major Outflows

- 2. BullZilla Presale Smashes $300k, Sells Almost 24B Tokens

- 3. BullZilla ($BZIL) Presale Snapshot

- 4. Conclusion: ETF Sentiment vs. Retail Momentum

- 5. For More Information:

- 6. Frequently Asked Questions About Ethereum ETF Outflows and BullZilla Presale’s Momentum

- 6.1. Why are Ethereum ETF inflows dropping?

- 6.2. How does this affect Ethe thereum price?

- 6.3. What is BullZilla ($BZIL)?

- 6.4. How much has BullZilla raised so far?

- 6.5. What’s the ROI potential for BullZilla investors?

- 6.6. When is the next price increase for BullZilla?

- 6.7. Is Ethereum still considered a good long-term investment?

- 6.8. Glossary of Key Terms

- 6.9. Article Summary

- 6.10. Disclaimer

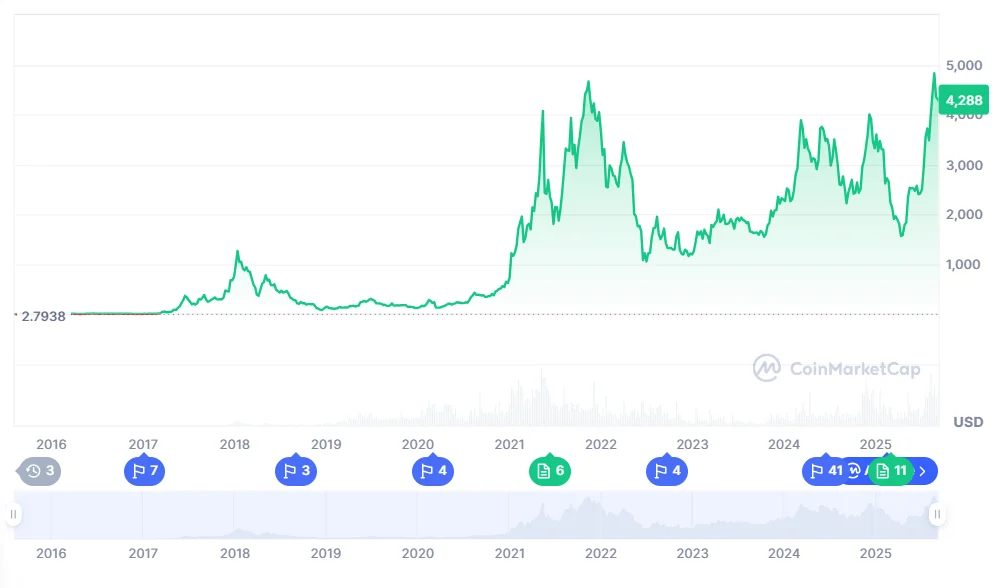

Ethereum, the world’s second-largest cryptocurrency by market cap, is facing an unexpected slowdown as institutional ETF inflows drop to their lowest levels in months. The recent Bitfinex Alpha report stated that demand for Ethereum ETFs was dropping drastically, which raises questions about the short-term outlook for the crypto market.

As the Ethereum price stays approximately 15 percent below its all-time peak, the pullback is coupled with the hesitancy of large investors amid the more general economic uncertainty. Conversely, retail-oriented tokens, such as BullZilla ($BZIL), keep growing. Still in Stage 2 of its presale, BullZilla has already raised over 320,000 and sold 23.8 billion tokens, and is rapidly gaining the attention of both meme coin traders and DeFi enthusiasts.

Ethereum ETFs Experience Major Outflows

In a pivotal moment for the Ethereum ecosystem, the final week of August saw Ethereum ETF net flows drop to an average of just 16,600 ETH per day, down from a 3-month high of over 85,000 ETH. By the beginning of September, the tide had turned completely around, with 41,400 average ETH daily outflows, and a whopping 104,100 ETH (value exceeding 447 million) was withdrawn in one day.

Analysts attribute the increase in investor reluctance to indecision about U.S. monetary policy, inflation statistics, and geopolitical risk. Although short-term, these outflows indicate how Ethereum is currently holding onto the ETF momentum to propel the price.

The Ethereum price, which had been pushing toward previous highs earlier this year, has since consolidated, mirroring investor indecision.

Bitcoin Holds, While Ethereum Wobbles

Interestingly, Bitcoin has continued to flow into ETFs fairly steadily. This activity has been mainly driven by direct spot exposure, implying a greater degree of long-term conviction amongst BTC investors. Ethereum, however, is being increasingly drawn to more systematic trading schemes, such as cash-and-carry arbitrage, which seem more vulnerable to market volatility in the short term.

This deviation has seen Ethereum fall behind in recent weeks, though it is expected to rebound if the macro conditions improve.

BullZilla Presale Smashes $300k, Sells Almost 24B Tokens

While institutional capital momentarily cools on Ethereum, BullZilla ($BZIL) is making waves in the retail space. This Ethereum-based meme token has sold over 23.8 billion tokens, attracted 1,100+ holders, and raised more than $320,000, all within just a few weeks of its presale launch.

Now in Stage 2B of its presale, the token is priced at $0.00003908. Early investors have already seen an ROI of up to 579.65%, with the potential for 13,388.76% returns by the time it reaches its projected listing price of $0.00527.

Stage 2C will bring a 17% increase, pushing the token price to $0.00004575.

BullZilla ($BZIL) Presale Snapshot

| Metric | Value |

| Current Stage | 2nd – “Dead Wallets Don’t Lie” |

| Current Price | $0.00003908 |

| Tokens Sold | 23.8 Billion |

| Presale Raised | Over $320,000 |

| Token Holders | 1,100+ |

| ROI (to Listing) | 13,388.76% |

| Next Price Increase | +17% to $0.00004575 |

As Ethereum ETF flows fluctuate, BullZilla is becoming one of the Trending Meme Coins 2025, with a deflationary tokenomics model (“Roar Burns”) and staking mechanics designed to incentivize long-term holding.

Conclusion: ETF Sentiment vs. Retail Momentum

Ethereum’s recent ETF outflows mark a moment of caution among large investors, but not a complete reversal of interest. With over $11.2 billion in Ethereum ETF inflows in 2025 so far, the asset remains a core component of institutional portfolios.

However, in times of uncertainty, retail-driven narratives take center stage. The rise of Bull Zilla shows how new projects are capitalizing on community energy and speculative appeal to carve out space, even when institutional capital retreats.

As Q4 2025 begins, Ethereum’s path may depend heavily on ETF demand returning. In the meantime, the altcoin space continues to evolve and grow.

For More Information:

Follow BZIL on X (Formerly Twitter)

Frequently Asked Questions About Ethereum ETF Outflows and BullZilla Presale’s Momentum

Why are Ethereum ETF inflows dropping?

Ethereum ETFs have seen outflows due to macroeconomic uncertainty and temporary investor caution.

How does this affect Ethe thereum price?

When there is lower inflow of ETF, the buying pressure is low resulting in price stagnation or slight correction.

What is BullZilla ($BZIL)?

BullZilla is a meme-based DeFi token built on Ethereum, now in its second presale stage.

How much has BullZilla raised so far?

Over $320,000 has been raised during its presale, with more than 23.8 billion tokens sold.

What’s the ROI potential for BullZilla investors?

Early-stage investors could see up to 13,388.76% ROI based on the projected listing price.

When is the next price increase for BullZilla?

Stage 2C will feature a 17% price jump to $0.00004575.

Is Ethereum still considered a good long-term investment?

Yes. Despite short-term ETF outflows, Ethereum remains a foundational blockchain in crypto.

Glossary of Key Terms

- Ethereum (ETH): A decentralized blockchain supporting smart contracts and DeFi apps.

- Ethereum Price: Market value of ETH; often affected by institutional and retail demand.

- ETF (Exchange-Traded Fund): A regulated investment vehicle tracking an asset like ETH or BTC.

- Outflows: Withdrawal of capital from funds or investment products.

- Cash-and-Carry Strategy: Arbitrage method involving spot purchases and futures sales.

- BullZilla ($BZIL): A meme-inspired crypto project with aggressive tokenomics and high ROI potential.

- Presale: An early-stage token sale before exchange listing.

- Roar Burns: BullZilla’s deflationary burn mechanism reducing total token supply.

- Tokenomics: The economic design of a crypto project, including supply, burn rates, and incentives.

- Retail Investor: Individual, non-institutional participant in crypto markets.

Article Summary

Ethereum ETF inflows have dropped sharply, with over 104,000 ETH exiting in a single day, signaling short-term institutional caution. As Ethereum price consolidates around key levels, analysts believe renewed ETF momentum will be critical for a Q4 breakout. Meanwhile, meme coin BullZilla ($BZIL) is outperforming expectations in its second presale stage, selling over 23.8 billion tokens, raising $320,000+, and projecting ROI as high as 13,388.76%. With the next price jump coming in Stage 2C, BullZilla is being recognized as one of the Trending Meme Coins 2025. As institutional flows slow, retail-driven tokens are keeping market energy alive, highlighting a market split between caution and high-stakes optimism.

Disclaimer

This article is just informational and it is not financial or investment advice. Bitcoins are risky and volatile. You should never make any investment decision without first investigating it yourself or without talking to a licensed financial advisor. Neither the author nor the publisher is liable to financial losses on matters of investment choice based on this material.

This article is not intended as financial advice. Educational purposes only.