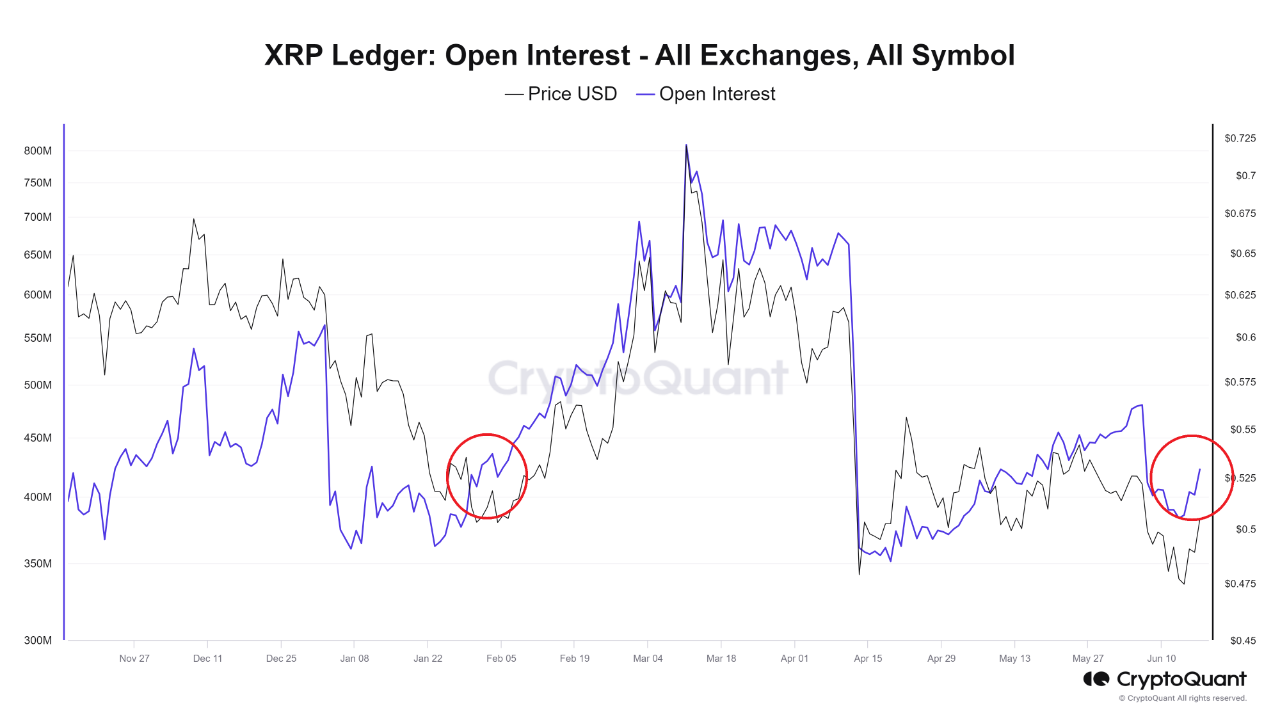

Recently, XRP has captured the spotlight with a noticeable spike in market performance. A seasoned analyst shared an analysis on CryptoQuant, in which he notes that *XRP* has witnessed a significant rise in its open interest, something not many other digital assets are replicating.

As a result, the increase in open interest, especially in the derivatives market, indicates that market traders and participants are beginning to feel bullish due to recent regulatory developments with the SEC.

For XRP, open interest (OI) or the number of outstanding derivative contracts like options or futures that have not been settled has increased considerably.

Source: CryptoQuant

It is, very often, a measure of how strong or weak a price trend is, and highlights the flow of money into/out of futures and options markets. The rising OI for XRP suggests that fresh money is pouring into the market i.e. speculation about the future price movements.

Navigating Market Volatility with Strategic Risk Management

Despite the positive signals from increased open interest, the current market scenario for XRP demands careful analysis and prudent risk management. As XRP’s price mirrors the uptick in open interest, trading volumes have expanded, suggesting heightened trading activity.

Currently, XRP is trading at $0.49, experiencing a slight decline of 1.8% over the last 24 hours. Nevertheless, it has maintained a 2.3% increase over the past week, underscoring its resilience amid fluctuating market conditions.

Traders and investors alike are urged to pay close attention, and as the open interest ticks higher on the back of higher prices, it could mean even more volatility for the market. Anyways, environments like these, require a wise risk management technique which makes a forceful urge for loving those stop-losses and applying strategies which avoids possible losses.

The relation between open interest and price can give useful hints about potential price levels. But that should not be the indicator to trade and there are many factors which the market should take into consideration before making any trade based on only one news of macros and/or sector.