- 1. Lucid Group Inc: A Quick Introduction

- 2. Lucid Motors (LCID): Evolution

- 3. Lucid Stock Market Performance: Price History

- 4. Lucid Stock Price Prediction: Technical Analysis

- 5. Lucid Stock Price Prediction By BlockchainReporter

- 5.1. Lucid Stock Price Prediction 2023

- 5.2. Lucid Stock Price Prediction 2024

- 5.3. Lucid Stock Price Prediction 2025

- 5.4. Lucid Stock Price Prediction 2026

- 5.5. Lucid Stock Price Prediction 2027

- 5.6. Lucid Stock Price Prediction 2028

- 5.7. Lucid Stock Price Prediction 2029

- 5.8. Lucid Stock Price Prediction 2030

- 6. Lucid Stock Price Prediction: Market Analysts

- 7. What Affects The Price Of LCID? Is It A Good Investment Option?

- 8. Conclusion

- 9. FAQ

- Lucid Group Inc: A Quick Introduction

- Lucid Motors (LCID): Evolution

- Lucid Stock Market Performance: Price History

- Lucid Stock Price Prediction: Technical Analysis

- Lucid Stock Price Prediction By BlockchainReporter

- Lucid Stock Price Prediction 2023

- Lucid Stock Price Prediction 2024

- Lucid Stock Price Prediction 2025

- Lucid Stock Price Prediction 2026

- Lucid Stock Price Prediction 2027

- Lucid Stock Price Prediction 2028

- Lucid Stock Price Prediction 2029

- Lucid Stock Price Prediction 2030

- Lucid Stock Price Prediction: Market Analysts

- What Affects The Price Of LCID? Is It A Good Investment Option?

- Conclusion

- FAQ

Electric vehicles (EVs) are revolutionizing the automotive industry, and the advancements in EV technology are driving this transformation. The shift towards electric mobility is not just an environmental imperative but also a technological challenge. The growing demand for EVs has created a market for companies that specialize in developing and manufacturing advanced EV motors. Among these companies, Lucid Group is a standout player. Lucid Group Inc. is a California-based technology company that is redefining the electric vehicle (EV) market. Founded in 2007, the company has a clear mission: to create electric cars that are more efficient, more luxurious, and more sustainable than traditional gasoline-powered cars. Lucid is making headlines with its groundbreaking technology, and it’s no surprise why it is leading it. However, there has been increased selling pressure on the LCID stock for the past few days, leaving investors worried about its future price potential. Hence, our Lucid stock price forecast 2025 seeks to give you a detailed analysis of the company and LCID stock to guide investors in making a profitable investment decision amid a downward market trajectory.

Lucid Group Inc: A Quick Introduction

Based in Newark, California, Lucid Group Inc. is an American electric vehicle manufacturer that was established in 2007. On October 30, 2021, the company started delivering the Dream Edition launch versions to the first group of 520 reservation holders. In the electric vehicle industry, Lucid Motor is a prominent name and is currently leading the league with its innovative EV products.

Lucid’s flagship product is the Lucid Air, an all-electric luxury sedan that boasts a range of over 500 miles on a single charge. The car is a technological marvel featuring a highly efficient electric motor that is the most power-dense in the world, with a power density of 14.4 kilowatts per kilogram. The Lucid Air’s battery pack, developed in partnership with LG Chem, is also the largest in the industry, with a capacity of 113 kWh.

But the Lucid Air isn’t just a green car with a long range. It’s also a luxurious car that has competitors like Tesla, BMW, and Mercedes-Benz. The car’s interior is spacious, elegant, and well-designed, featuring premium materials and state-of-the-art technology. The Lucid Air is a car that not only appeals to environmentally conscious drivers but also to those who demand luxury and performance.

Moreover, Lucid Motors has unveiled its role as the supplier of the front electric motors for the current Gen3 Formula E racing cars. The motorsport drive unit, which includes a motor, inverter, differential, and gearbox, boasts a powerful output of 350 kW.

Hence, the future growth and current performance indicate upward market trends for the LCID stock price. Let’s take a look at the LCID stock market and its financial analysis for forecasting its future projections.

| Company | Lucid Motors |

| Stock Symbol | LCID |

| Price | $7.7 |

| 52 Week High | $23.6 |

| 52 Week Low | $6.09 |

| Share Volume | 95,935 |

| Average Volume | 28,080,920 |

| Forward P/E 1 Yr | -5.64 |

| Earnings Per Share(EPS) | $-1.06 |

| Market Cap | 14,022,149,088 |

Lucid Motors (LCID): Evolution

Besides gaining the spotlight in renewable and sustainable energy, Lucid Motors is also making its dominance in the luxury car market. Initially founded under the name Atieva in 2007, Lucid’s original focus was on developing electric vehicle batteries and powertrains for other automakers. The company’s CEO and CTO, Peter Rawlinson, had previously served as VP of Engineering and Chief Engineer for the Model S at Tesla, while Vice President Derek Jenkins was formerly Head of Design at Mazda North American Operations. Lucid has received investments from notable firms such as Tsing Capital, Mitsui, Venrock, and JAFCO.

In October 2016, the company underwent a rebranding to Lucid Motors and announced plans to develop a high-performance luxury vehicle powered entirely by electricity. On November 29, 2016, state and company officials revealed plans to construct Lucid’s manufacturing plant in Casa Grande, Arizona, at the cost of $700 million, which was projected to employ up to 2,000 workers by the mid-2020s. Initially, the factory was set to produce 20,000 cars annually, with plans to expand up to 130,000 per year, and a maximum capacity of 380,000 cars per year. In 2017, the company had intended to break ground and begin production by early 2019, but the first vehicles didn’t roll off the assembly line until September 28, 2021.

In September 2021, Lucid initiated the production of its first all-electric Air sedans at its Arizona plant and began delivering them to customers in late October of the same year. While the company had originally planned to produce 20,000 vehicles in 2022, it was forced to revise its outlook due to supply chain issues, lowering the estimate to 12,000-14,000 vehicles on February 28, 2022. However, the production outlook was further decreased to 6,000-7,000 vehicles upon the release of the company’s Q2 financial results on August 3, 2022. Despite the challenges, Lucid managed to produce 7,180 vehicles in 2022.

Lucid Stock Market Performance: Price History

Before diving deeper into LCID’s technical and trading analysis, it is important for investors to get an overview of its previous market performance to get an idea of its upcoming price trend amid market volatility.

LCID stock went live with a trading value of $9.8 on 9 September 2020. The stock started its upward journey in early 2021 and made a new high on 24 January with a price of $22.3. LCID stock price further accelerated to make a new high near $53 on 24 February due to the announcement of a merger with Churchill Capital Corp IV. The merger was finalized on July 23, 2021, just three days before the company’s IPO. The announcement of the merger led to a surge in investor interest, which helped to boost the stock price.

However, after this initial rise, the stock’s price went on a bearish rally and formed a consolidation level in Q2 of 2021. In early October 2021, LCID’s stock price started to rebound, with the stock reaching $26.58 per share on October 11, 2021. The stock price continued to climb in the following weeks, reaching a high of $53.80 per share on November 8, 2021.

However, the LCID stock market trend experienced some volatility in the following months. In late December 2021, the stock price dropped to $27.25 per share, which was attributed to supply chain issues affecting the production of Lucid Air. The stock price continued to fluctuate throughout the first half of 2022, with the stock reaching a low of $6.3 per share on 25 December 2022.

Despite the ups and downs, LCID’s stock price history shows that the company’s growth projections are optimistic toward becoming a leader in the EV market with emerging technologies. The company’s commitment to reducing environmental impact while developing luxury electric vehicles has generated investor interest and helped to boost the stock price. While there may be some volatility in the future, LCID’s stock price history suggests that the company’s future in the EV market is promising.

Lucid Stock Price Prediction: Technical Analysis

Since the past few weeks, LCID stock has been experiencing a severe downtrend, breaking below multiple support levels with high selling pressure among investors. LCID shares are currently trading near monthly lows, likely due to weakness across the electric vehicle (EV) sector following the release of delivery figures by Tesla Inc and Rivian Automotive Inc. However, investors are now hoping for a fresh reversal in the LCID price chart as the stock price may take support below the 23.6% Fib level and ignite fresh surges by this weekend. Hence, our advanced technical analysis of LCID shares aims to guide investors with a long-term profitable investment plan amid the turmoil.

According to TradingView, LCID shares are trading at $7.7, gaining over 0.15% in the last 24 hours. Our technical analysis for LCID stocks suggests that it may soon witness new highs as it builds potential for a bullish comeback. Looking at the daily price chart, LUCID shares have formed support near $7.1, from which the stock’s price may attempt to bring buying pressure. As LCID’s price faces a struggle to surpass its crucial trend line of EMA-20, it may trigger a more bearish rally in the next few days before sparking a fresh increase. The Balance of Power (BoP) indicator is currently trading in a negative region at 0.3, hinting at an extended bearish trajectory for the LCID price chart.

To get a more detailed price analysis of the LCID share price, the RSI-14 indicator is necessary to take a look at. The indicator has significantly faced a solid resistance near its midline and dropped to a consolidation level near the 42 level, indicating bearish domination in the price chart. It is expected that LCID will soon make an attempt to break its 38.6% Fib level to accomplish its short-term bullish goals. If LCID fails to test its resistance, a downtrend is forecasted. However, the SMA-14 continues to witness a swing path, aiming to surpass the RSI line in the next few days, which may accelerate the stock’s uptrend in the price chart. If the LCID share breaks above its resistance of $8, it may pave a smooth road to its EMA-100 resistance of $9.71, and if it manages to break its strong resistance of $12.5, the share price may attempt to surge higher to its Bollinger band’s upper limit of $14.67. On the other hand, if LCID drops below the crucial support level of $7, an intense bearish rally is expected, which may bring more price drops for the LCID share and force it to trade near its Bollinger band’s lower limit of $6.02. If LCID’s price fails to stay above $5.46, it may witness a sharp decline.

Lucid Stock Price Prediction By BlockchainReporter

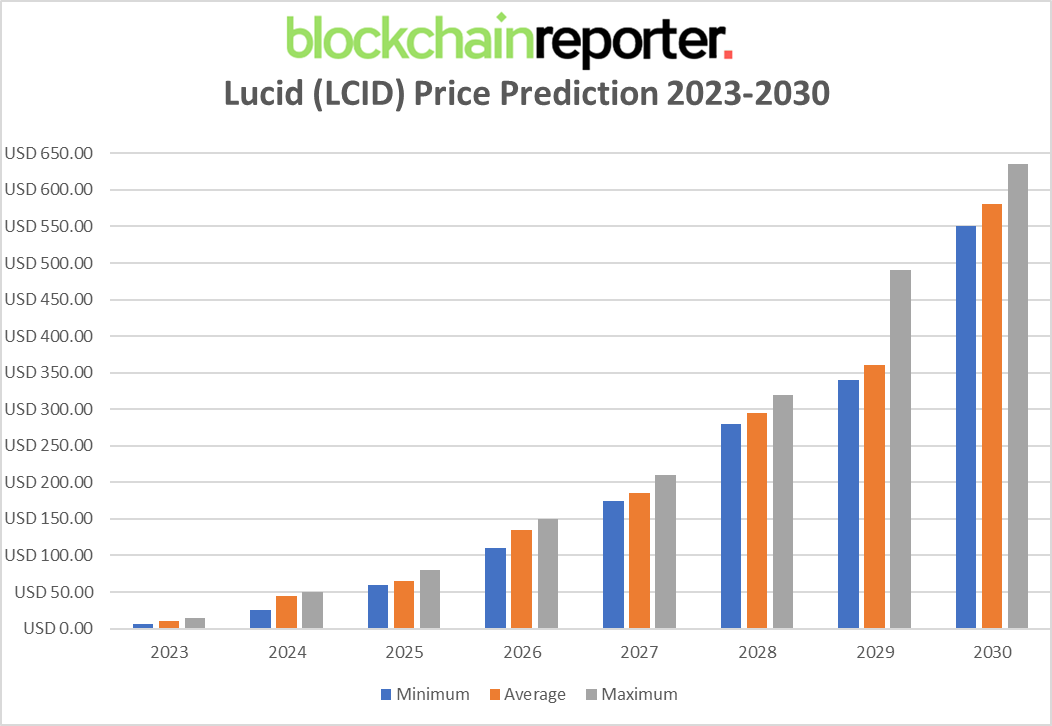

Lucid Stock Price Prediction 2023

In 2023, it’s likely that Lucid’s stock price will continue to see steady growth. The company is expected to produce a higher number of vehicles and expand its market presence, which should drive up demand for the stock. Based on current market trends, the LCID stock price is expected to attain an average price of $10, with a minimum price of $6 and a maximum price of $15.

Lucid Stock Price Prediction 2024

As Lucid continues to expand its production capabilities and increase its market share, the stock price is expected to see significant growth in 2024. Some industry experts predict that the stock price may reach an average price of $45 by the end of 2024. In addition, the LCID price may reach a maximum value of $50 and a minimum value of $25.

Lucid Stock Price Prediction 2025

In 2025, the LCID stock price is expected to continue its upward trajectory. With the launch of new vehicles and the company’s expanding market presence, the stock price could potentially reach a maximum price of $80. However, it can record a low of $60, with an average price of $65.

Lucid Stock Price Prediction 2026

By 2026, Lucid is expected to be a major player in the EV industry following its economic indicators. The company’s continued focus on innovation and sustainability, along with its luxury brand image, should continue to drive demand for its products and boost its stock price. The LCID stock price is predicted to hit a maximum price level of $150, with a minimum value of $110 and an average value of $135.

Lucid Stock Price Prediction 2027

While Lucid’s stock price is expected to continue growing, there may be some volatility in the LCID market in 2027. This could be due to external factors such as changes in the global economy or shifts in consumer preferences towards other EV manufacturers. However, despite potential fluctuations, the LCID stock price is predicted to hit a maximum price of $210 and a minimum price of $175. The average price of LCID can be $185.

Lucid Stock Price Prediction 2028

Lucid stock’s price may skyrocket in 2028 as its price can reach a maximum level of $320. However, on the bearish side, it may register a low of $280, with an average trading value of $295.

Lucid Stock Price Prediction 2029

By 2029, Lucid may tie up with significant partners in the industry and become a challenging competitor in the market. LCID stock may hit an average price of $360 in 2029, gaining the potential of reaching a maximum value of $490 and a minimum value of $340.

Lucid Stock Price Prediction 2030

In 2030, the LCID stock price is predicted to see a strong performance. LCID market may continue its bullish trend and reach a maximum level of $635 and an average price of $580. In addition, LCID stock may form a bottom level near $550 by 2030’s end.

Lucid Stock Price Prediction: Market Analysts

According to 8 analysts at CNN Business, Lucid Group Inc is expected to have a median target price of $10.75 over the next 12 months. The highest estimate for the target price is $16.00, while the lowest estimate is $5.00. Based on these estimates, the median target price represents a 39.61% increase from the current trading price of $7.70.

Invezz’s Lucid stock price prediction expects 2025 will build bullish momentum, and Lucid Motors’ shares have the potential to reach $100. However, several factors would need to align for this to occur. Lucid’s partnership with the Public Investment Fund of Saudi Arabia could facilitate its expansion into the Middle East.

Assuming everything goes smoothly, Lucid’s stock could potentially exceed $200 by the end of the decade. However, the electric vehicle market is becoming increasingly competitive, and there are several factors that could affect the company’s performance in the future.

What Affects The Price Of LCID? Is It A Good Investment Option?

There are several reasons to have a positive outlook on Lucid Group. For example, Tesla plans to open up 7,500 of its charging stations to other electric vehicle brands by the end of 2024, which would benefit drivers of Lucid’s electric vehicles.

Moreover, Lucid Group has strong financial support from major investors. Recently, the Public Investment Fund (PIF) of Saudi Arabia purchased nearly 200 million additional shares of LCID stock, making it a profitable investment option in the long term.

However, the current investor sentiment and LCID’s competitive analysis are showing a bearish trend for the LCID stock market index. The financial projections of Lucid Motors may be affected by the following reasons:

EV Sales: Lucid Group’s success is heavily reliant on the demand for its electric vehicles, which is the company’s primary business. In its short history, Lucid has demonstrated the ability to produce a higher volume of cars, and it has received thousands of pre-orders. The continued demand for its electric vehicles will be a key factor in determining its stock price.

Increased Competition: The electric vehicle market is becoming increasingly crowded and competitive, with rivals such as Tesla, Rivian, and NIO competing with Lucid. Established automakers like Ford and Mercedes are also entering the EV space, making it essential for Lucid to effectively fend off competition to achieve success.

Saudi Arabia: Lucid Motors’ most significant shareholder is the Public Investment Fund of Saudi Arabia, which owns over 60% of the company. Lucid aims to penetrate the Middle Eastern market and plans to establish a factory in the region. However, if the PIF of Saudi Arabia decides to sell shares, it could significantly impact LCID.

Conclusion

Lucid Group, Inc. (NASDAQ: LCID) has set new standards with its longest-range, fastest-charging electric car on the market. The company recently received a prestigious honor, as the Lucid Air was named the 2023 World Luxury Car of the Year in the highly-regarded 2023 World Car Awards. As a result, the company has shown that it has the potential to dominate the luxury EV market. All of these factors make Lucid Group, Inc. (NASDAQ: LCID) a fascinating stock to watch in the coming years.

With its innovative technology and commitment to sustainability, Lucid Motors has established itself as a serious contender in the highly competitive EV market. As demand for electric vehicles continues to grow, Lucid’s future potential looks promising.

FAQ

What is Lucid Group Inc.?

Lucid Group Inc. is a California-based technology company that is redefining the electric vehicle (EV) market. Founded in 2007, the company aims to create electric cars that are more efficient, luxurious, and sustainable than traditional gasoline-powered cars.

What is Lucid’s flagship product?

Lucid’s flagship product is the Lucid Air, an all-electric luxury sedan that boasts a range of over 500 miles on a single charge.

What is the current stock price for LCID?

The current stock price for LCID is $7.7.

What are the stock price predictions for Lucid Group in 2025?

In 2025, the LCID stock price is expected to continue its upward trajectory, potentially reaching a maximum price of $80, a minimum price of $60, and an average price of $65.

What factors may affect the price of LCID stock?

Several factors may affect the price of LCID stock, such as the company’s growth, production capabilities, market share, and external factors like global economic changes or shifts in consumer preferences towards other EV manufacturers.

Is LCID a good investment option?

LCID can be considered a profitable investment option in the long term, given the company’s commitment to reducing environmental impact, developing luxury electric vehicles, and strong financial support from major investors like the Public Investment Fund (PIF) of Saudi Arabia. However, investors should be aware of the potential volatility and risks involved in the electric vehicle market.

READ MORE:

XRP Price Prediction $500: Long-Term Outlook & Market Analysis

Tamadoge (TAMA) Price Prediction

Wrapped LUNA Classic (WLUNC) Price Prediction

Ethereum (ETH) Price Prediction $100,000

EverGrow Coin Price Prediction: Will EGC Skyrocket to $1 Soon?