The cryptocurrency market has been experiencing some serious turbulence over the past few weeks due to several factors, including the US Securities and Exchange Commission’s (SEC) investigation into the industry and Silvergate Bank’s recent collapse. These events have triggered a downward trend in the value of Bitcoin, which has also been influenced by several macroeconomic factors, such as the Federal Open Market Committee (FOMC) meeting, the Bitcoin difficulty adjustment, and the potential for interest rate hikes. Amid all of these, it has been reported that nearly 40,000 bitcoins are currently on the move, belonging to the U.S. government.

US Government Moves $1B Of Seized Bitcoin

According to a report by Glassnode, a provider of on-chain data, there has been a movement of nearly 40,000 Bitcoins from wallets connected to US Government law enforcement seizures. Although most of the transfers seem to be internal, some of them have also been made to the popular crypto exchange, Coinbase.

Recent reports indicate that the US government has been seen moving approximately $1 billion worth of Bitcoin among its wallets. One of the more significant transfers included a $217 million transaction to the popular cryptocurrency exchange, Coinbase.

As news of these transfers spread, concerns have been raised within the crypto community that this could potentially be a precursor to a significant sale of Bitcoin by the government. If such a sale were to occur, it would likely lead to a sharp drop in the value of Bitcoin, given the size of the potential transaction.

A total of 9,861 Bitcoins were transferred to Coinbase. Additionally, Glassnode noted that there were movements of another 40,000 Bitcoins, which were believed to be associated with US government law enforcement seizures, being transferred between wallets controlled by the government.

Later, PeckShield, an on-chain security firm, revealed on Twitter that the approximately 40,000 Bitcoins had been consolidated into two wallets.

Silk Road Seizure By The US Government

According to PeckShield, the funds involved in the recent Bitcoin transfers may have originated from the notorious darknet market, Silk Road. Additionally, PeckShield suggested that the US government had seized over 51,000 Bitcoins from an individual who had previously hacked the platform between November 2021 and March 2022.

At present, the cryptocurrency market appears to be favoring Bitcoin bears over bulls. However, with Bitcoin continuing to dip below key support levels, there is growing concern among analysts that the price of BTC could drop even further, potentially falling below $20,000.

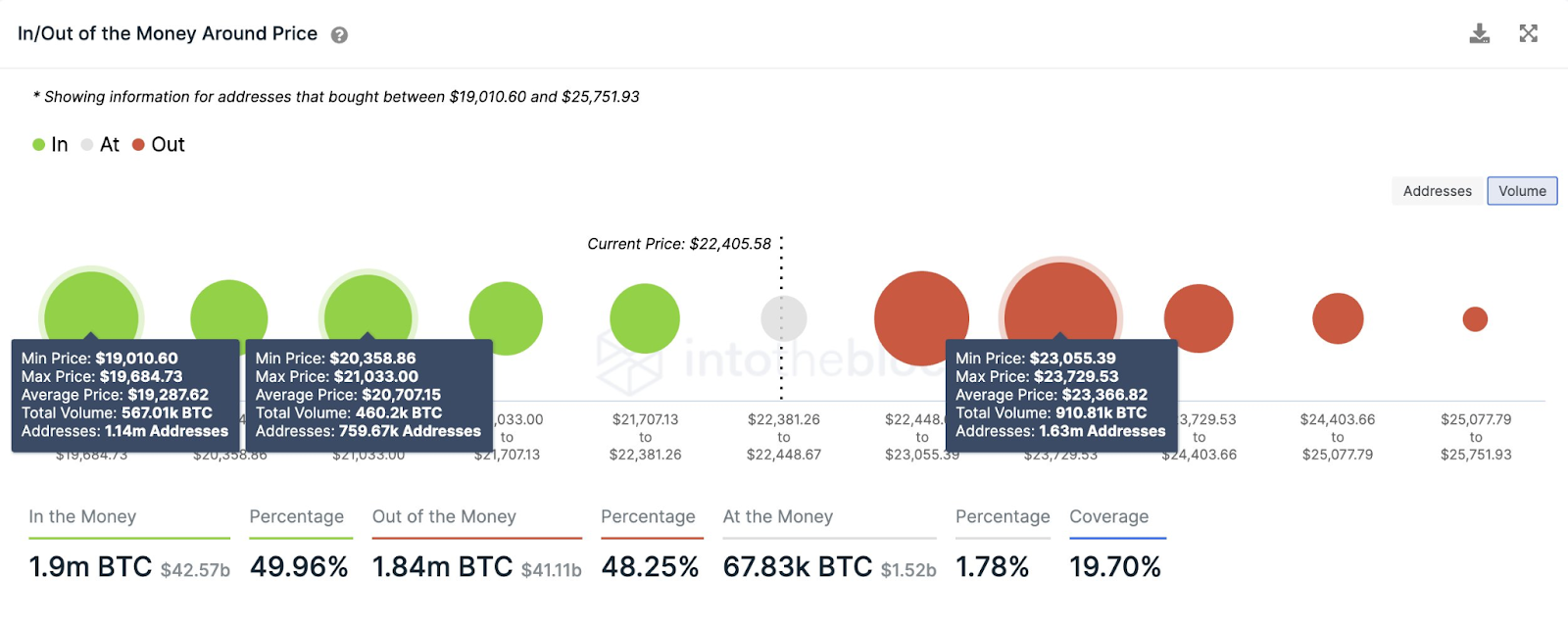

Citing data from IntoTheBlock, popular crypto analyst Ali Martinez said, “Bitcoin dropped below a critical area of support between $23,050 and $23,730, where 1.63 million addresses bought over 910,000 $BTC. Failing to regain this area as support could trigger a sell-off that pushes #BTC to $20,700 or even $19,300.”

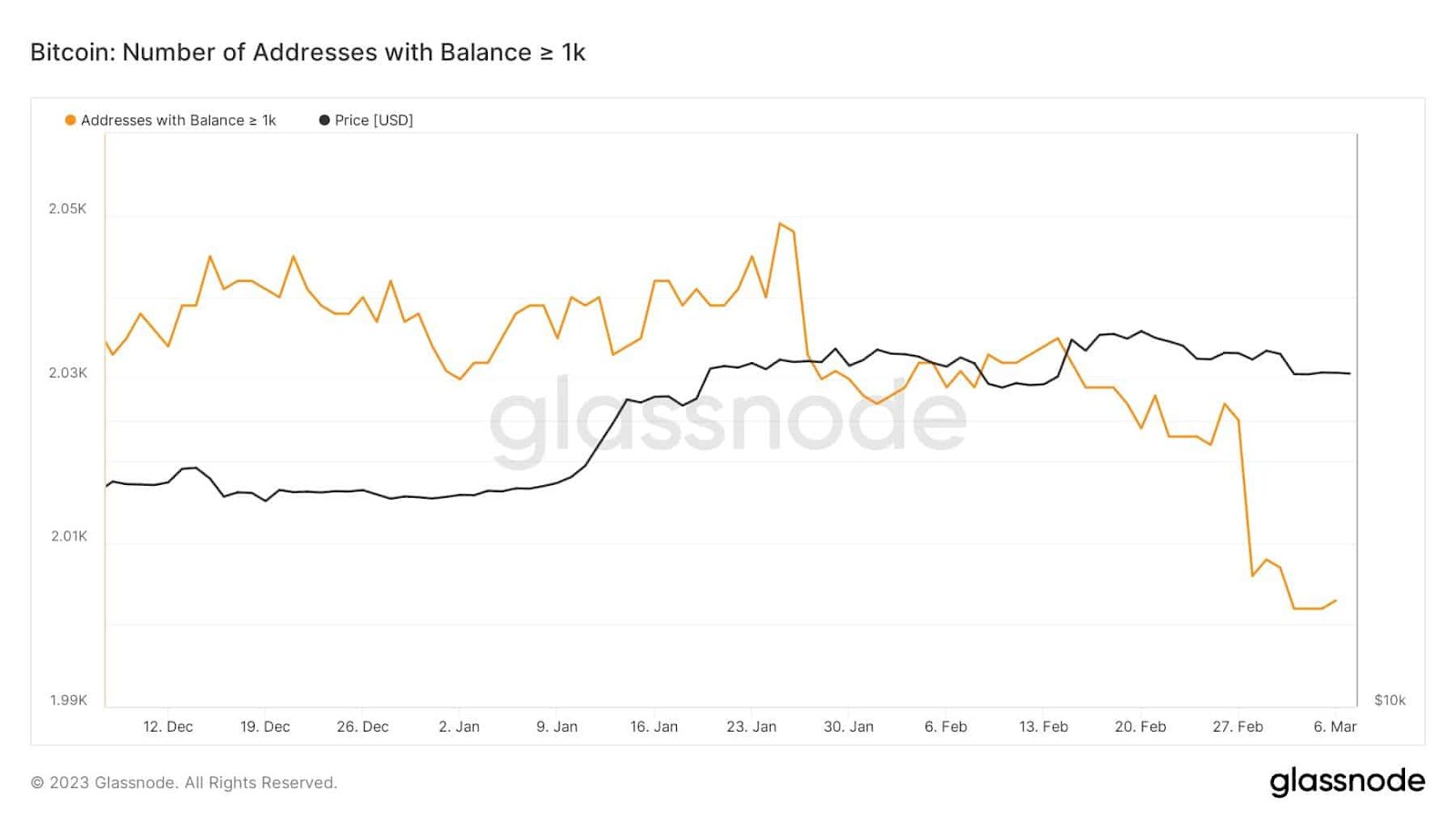

Conversely, it has been reported that the total number of Bitcoin addresses holding over 1,000 BTC has decreased over the past week. Specifically, nearly 24 of these addresses have redistributed their Bitcoins and subsequently dropped from the network.

Moreover, the current macroeconomic conditions do not appear to be supportive of a Bitcoin rally. During his testimony before the US Congress on Tuesday, Fed Chairman Jerome Powell confirmed that the central bank would continue to pursue more interest rate hikes and is committed to bringing inflation under control, with a target of 2%.

Meanwhile, on the same day, a judge in a US court questioned the SEC about its decision to deny the spot Bitcoin ETF. This event caused a further increase in the share price of Grayscale Bitcoin Trust (GBTC).