The price of Chainlink has experienced significant upward momentum following the market’s recovery from its January lows, following Bitcoin’s ambitious surge towards the $44K mark. Impressively, Chainlink has exceeded the performance of other leading altcoins by achieving a substantial breakout above its resistance levels. Nonetheless, there is growing concern about a possible price correction as Netflow surges, indicating a substantial influx of sellers preparing to liquidate their holdings at a significant resistance point.

Chainlink Flashes Strong On-chain Signals

Investor interest in Chainlink has surged notably in recent days, fueled by the growing hype in the Real-World Assets (RWA) sector, which has served as a potent catalyst for the LINK token’s price. Furthermore, LINK has seen an impressive increase of over 15% in the past day and more than 30% in the past week, signaling a robust bullish trend for the cryptocurrency in the altcoin market.

On February 1st, analytics firm Santiment reported a notable activation of about 5.38 billion coins from previously dormant wallets. This activity led to a significant increase in the Age Consumed metric, indicating a short-term shift in the behavior of long-term holders. Typically, a spike in Age Consumed is often seen before market bottoms, potentially leading to a price rebound.

However, this wasn’t the only factor at play. On-chain data revealed that certain addresses had liquidated their Chainlink holdings, a move often driven by Fear, Uncertainty, and Doubt (FUD) surrounding a project. Interestingly, in the case of Chainlink, this FUD may have had a paradoxical effect, seemingly boosting the token’s market price.

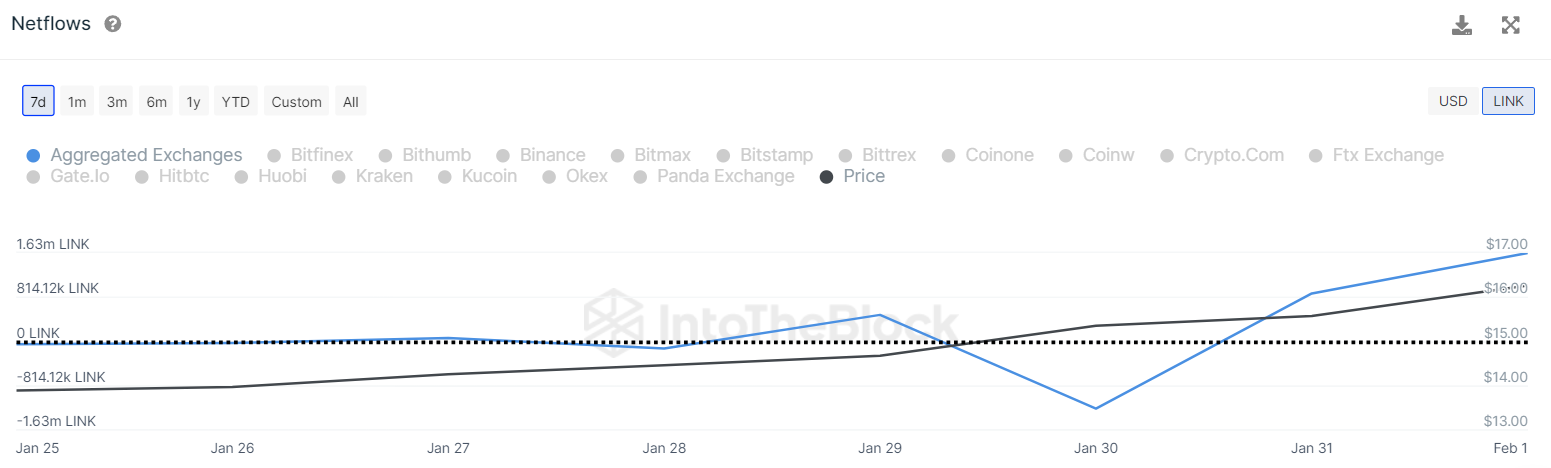

In the past 24 hours, Chainlink has experienced a substantial amount of liquidation, totaling nearly $4.3 million. Notably, sellers accounted for approximately $3.8 million of this, indicating rising selling pressure as the LINK price moves opposite to their positions, leading to losses. Presently, on-chain data from IntoTheBlock shows an increase in Netflow, now trading in the positive region at 1.63 million LINK. This trend suggests that holders are actively transferring their LINK tokens to exchanges for sale, as inflows exceed outflows, raising concerns about mounting selling pressure.

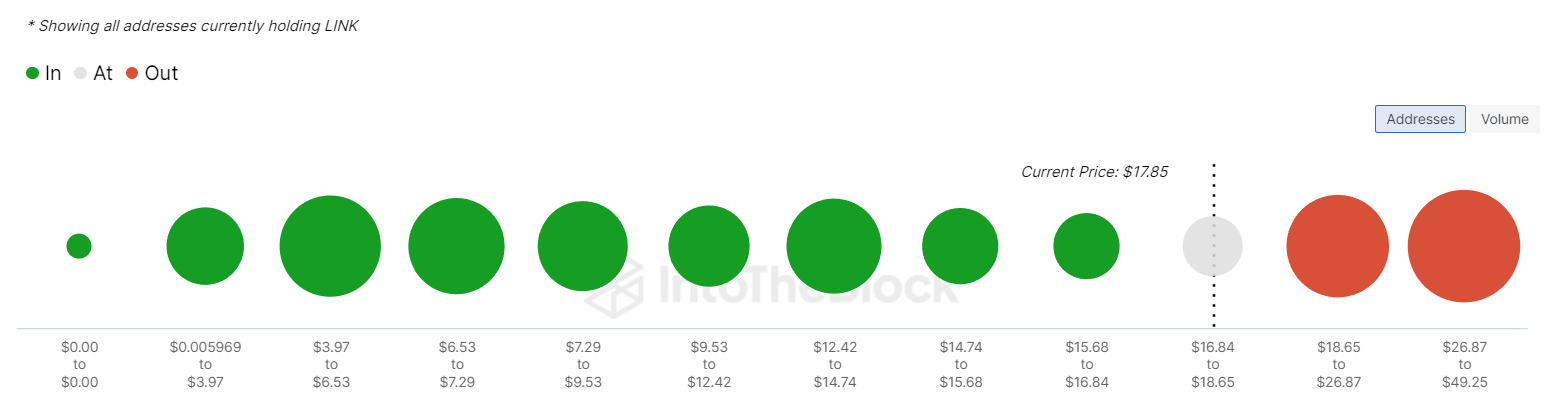

Adding to the above, a considerable number of holders are concentrated in the $19-$27 price range. Approximately 92.5K addresses hold a total of 50.4 million LINK tokens within this zone. These holders are likely to resist further price increases as they aim to sell off their holdings, thereby reducing their potential losses.

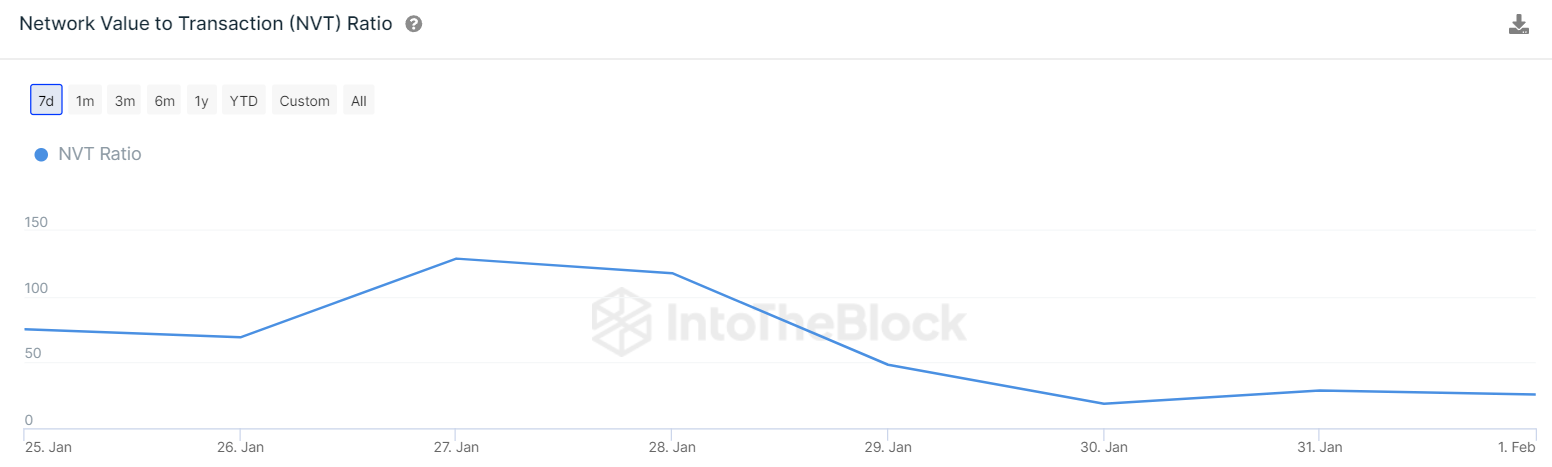

On the other hand, the NVT (Network Value to Transactions) ratio is indicating a bullish trend for Chainlink, having sharply decreased from a high of 128 to its current level of 25, even amidst an increase in network value. This decline suggests that Chainlink’s transaction volume has seen a significant rise alongside its price. This pattern of increased transaction activity with the price movement, hints at a potential undervaluation of Chainlink, which could lead to further upward movements in the LINK price.

What’s Next For LINK Price?

Chainlink has been trading within a bullish channel pattern and the price is set to test the resistance at $20. However, sellers will strongly defend a surge above that level. Currently, LINK price trades at $17.8, surging over 13/% from yesterday’s rate.

Typically, in such a tight range-bound market, traders tend to buy at the lower end, near the support level, and sell near the upper end, at the resistance. The recent breakthrough above the moving averages signaled the potential for a rally towards the upper resistance level at $19, a point where significant selling pressure from the bears is anticipated.

Should the price sharply reverse from the $19 mark, it’s likely that the LINK/USDT pair will continue to hover around $16.5-$17.5 for some additional days.

For a new uptrend to be confirmed, the bulls need to not only push the price above $19 but also maintain it above this level. If successful, the next target for the bulls is set at $22.