- About 91,200 bitcoins have been removed from exchanges in the past month.

- Bitcoin’s price remains flat as traders wait for direction from the opening of S&P 500 futures.

- Market participants are watching both crypto and traditional finance closely for the next big move.

According to on-chain data, over 91,900 Bitcoin ($BTC) have been taken out from centralized exchanges in the past month. This significant outflow reflects an increase in investor risk aversion or longer-term investment plans. The exchange balance of Bitcoin reached around 2.63 million as of April 4 from 2.73 million Bitcoin when the breakdown began on March 9.

The trend of decline in exchange-held BTC can be explained by the increased volatility observed across different markets. Historically, large outflows have pointed more to lower selling pressure and higher accumulation. While most assets have left exchanges, the price of Bitcoin has remained largely unchanged for the last 24 hours and is currently trading at $83,500.

Network Activity Offers Mixed Signals

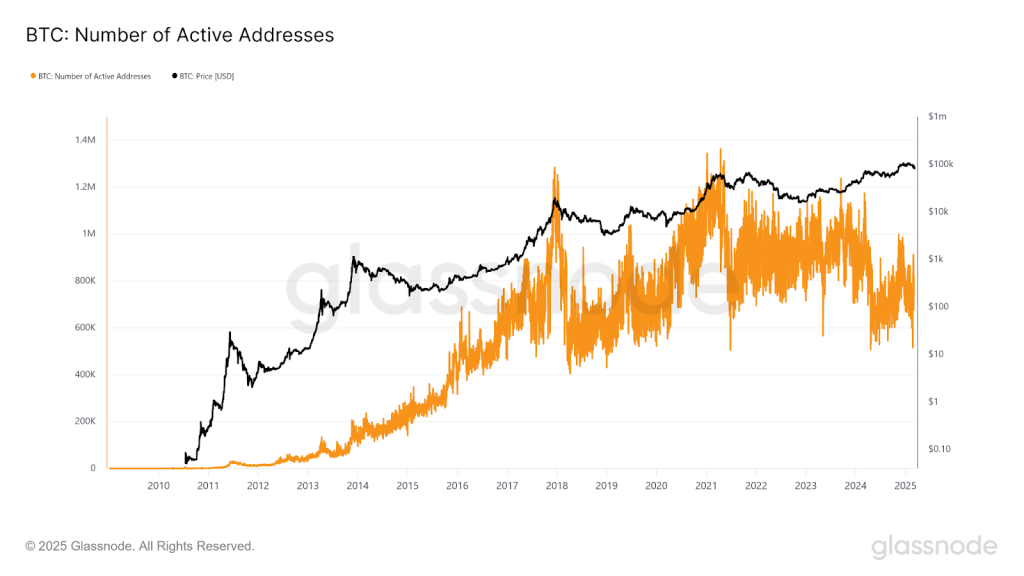

While exchange balances are falling, network activity paints a more nuanced picture. Glassnode charts show that the number of active addresses has retreated from its record highs over the past few years but is still significantly high. The number of sending addresses has also registered a relative decline, which may imply a reduction in transactional usage in the short term.

However, the overall readiness and usage continue to remain favorable among the masses. Both metrics have shown greater lows over time, indicating that the application’s fundamental level of usage is still sustainable despite periods of fluctuating interest. This may indicate that Bitcoin has experienced a shift towards having more investors interested in holding assets for the longer term.

These on-chain trends point to a direction that could reflect speculation and strong belief. This is suggestive of long-term holders loading up on coins in order to avoid the fluctuations within the short term.

All Eyes on S&P 500 Futures Opening

Former BitMex CEO Arthur Hayes highlighted a critical market moment: the 6 p.m. GMT opening of U.S. S&P 500 futures. According to Hayes, this time frame may hold the key to how markets behave in the short term, especially with digital currencies such as Bitcoin. His commentary indicates that such behavior of the traditional financial market might be the signal Bitcoin traders have been waiting for.

The timing is particularly relevant to Asian markets since they overlap with the US, and the latter’s futures are going to be active. This exposes it to volatility as traders within the region may make an immediate response to any directional move made by Bitcoin. Such a cross-market interconnection has become more apparent as institutional interest expands in both crypto and traditional financial markets.

Bitcoin price has not changed much over the weekend, which increased expectations for the futures market open. Low volatility has shown this, indicating that both the bulls and bears are waiting on the fence for a signal to direct the trend.

Hayes is drawing parallels between the current market and the previous crises, including the event in March 2020, famously known as Black Monday. It remains one of the biggest calamities in the history of the markets as halls were shut down due to the COVID-19 virus and business recession looming on the horizon. Bitcoin plunged as the stocks did, proving its vulnerability to macroeconomic factors.