- 1. Paytm: A Quick Introduction

- 2. Paytm: Evolution And Roadmap

- 3. Paytm’s Controversies: A Turning Point

- 4. Paytm Stock Price History

- 5. Paytm Share Price Prediction: Technical Analysis

- 6. Paytm Share Price Prediction By BlockchainReporter

- 6.1. Paytm Share Price Prediction 2023

- 6.2. Paytm Share Price Prediction 2024

- 6.3. Paytm Share Price Prediction 2025

- 6.4. Paytm Share Price Prediction 2026

- 6.5. Paytm Share Price Prediction 2027

- 6.6. Paytm Share Price Prediction 2028

- 6.7. Paytm Share Price Prediction 2029

- 6.8. Paytm Share Price Prediction 2030

- 7. Paytm Share Price Prediction By Industry Experts

- 8. Should You Invest In Paytm Before Q4 Results?

- 9. Conclusion

- 10. FAQ

- 10.0.1. What is Paytm?

- 10.0.2. What is Paytm's history?

- 10.0.3. What controversies has Paytm faced?

- 10.0.4. How has Paytm's stock price performed since the IPO?

- 10.0.5. What is the prediction for Paytm's stock price for the next few years?

- 10.0.6. What does the technical analysis reveal about Paytm's stock price?

- 10.0.7. Should you invest in Paytm before Q4 results?

- 10.0.8. What predictions have industry experts made for Paytm's stock price?

- Paytm: A Quick Introduction

- Paytm: Evolution And Roadmap

- Paytm’s Controversies: A Turning Point

- Paytm Stock Price History

- Paytm Share Price Prediction: Technical Analysis

- Paytm Share Price Prediction By BlockchainReporter

- Paytm Share Price Prediction 2023

- Paytm Share Price Prediction 2024

- Paytm Share Price Prediction 2025

- Paytm Share Price Prediction 2026

- Paytm Share Price Prediction 2027

- Paytm Share Price Prediction 2028

- Paytm Share Price Prediction 2029

- Paytm Share Price Prediction 2030

- Paytm Share Price Prediction By Industry Experts

- Should You Invest In Paytm Before Q4 Results?

- Conclusion

- FAQ

The advent of Paytm in 2010 marked a new dawn in India’s digital landscape, propelling the country into a new era of digital commerce and financial transactions. Prior to this, the Indian economy was largely cash-driven, with digital payments and e-commerce in their nascent stages. The majority of the population, especially in rural and semi-urban areas, was outside the fold of the digital economy due to limited digital literacy and inadequate infrastructure. Traditional banking systems and brick-and-mortar businesses dominated, with limited scope for online transactions. During this time, a profound change was quietly brewing in the entrepreneurial mind of Vijay Shekhar Sharma. His vision was to bridge this digital divide and bring the benefits of the digital economy to the fingertips of every Indian. His brainchild, Paytm, which stands for ‘Pay Through Mobile,’ emerged as the harbinger of this digital transformation. Offering a plethora of services ranging from mobile recharging to financial services, Paytm soon became synonymous with digital payments in India. Its phenomenal growth and widespread adoption heralded a new era in India’s economic landscape, redefining the way people transact and interact with the economy. However, despite robust fundamentals, the Paytm stock has been on a downward trajectory for the last few years. Hence, we will dive deeper into our Paytm share price prediction to get an in-depth analysis of its market trends and future price projections.

Paytm: A Quick Introduction

Paytm, an abbreviation for “pay through mobile,” is a multinational fintech corporation headquartered in Noida, India, specializing in digital payments and a wide array of financial services. Established in 2010 by Vijay Shekhar Sharma as part of One97 Communications, Paytm primarily provides mobile payment services to users and equips merchants with the tools to accept payments through diverse methods such as QR code scanning, point-of-sale transactions, and online payment gateways.

In collaboration with various financial institutions, Paytm delivers additional financial services, including micro-financing and ‘buy now, pay later’ options for both individual users and merchants. Besides facilitating bill payments and money transfers, the company’s range of services extends to ticketing, retail brokerage products, and interactive online gaming.

On 18th November 2021, Paytm’s parent organization, One97 Communications, made its debut on the Indian stock exchanges through an initial public offering. At the time, it was the largest IPO in India’s history. For the financial year of 2021-22, Paytm reported a gross merchandise value (GMV) of ₹8,500 billion, equivalent to approximately US$110 billion.

Paytm: Evolution And Roadmap

The growth trajectory of Paytm took a positive turn in October 2011 when Sapphire Ventures invested $10 million in One97 Communications Ltd., Paytm’s parent company. The Paytm Wallet, launched in January 2014, was subsequently integrated into the payment options of Indian Railways and Uber. The company delved into e-commerce by providing online deals and bus ticketing, and by 2015, it added services, including education fees, metro recharges, and utility bill payments. Paytm’s user base saw impressive growth, from 11.8 million in August 2014 to 104 million in August 2015. During this period, the company’s travel business also surged, crossing $500 million in annualized GMV run rate, with 2 million tickets booked monthly.

A significant turning point arrived in March 2015 when Chinese e-commerce giant Alibaba Group and its affiliate Ant Financial Services Group invested in Paytm, acquiring a 40% stake as part of a strategic agreement. This was soon followed by support from Ratan Tata, MD of Tata Sons. In August 2016, Paytm secured funding from Mountain Capital, a Taiwan-based MediaTek’s investment fund, raising its valuation to over $5 billion. That year, Paytm expanded its services to include movie, event, and amusement park ticketing and flight bookings and introduced Paytm QR and rail bookings.

A monumental investment came from SoftBank in May 2017, propelling Paytm’s valuation to an estimated $10 billion. By August 2018, Berkshire Hathaway had invested $356 million for a 3-4% stake in Paytm. In 2017, Paytm became India’s first payment app to achieve over 100 million app downloads. In the same year, it launched several innovative products and services like Paytm Gold, Paytm Payments Bank, and ‘Inbox,’ a messaging platform with in-chat payments.

By 2018, it facilitated merchants to accept Paytm, UPI, and card payments directly into their bank accounts at 0% charge, launching the ‘Paytm for Business’ app. It launched two wealth management products – Paytm Gold Savings Plan and Gold Gifting. It also entered a joint venture with Alibaba Group’s gaming company AGTech Holdings to launch a mobile gaming platform, which was rebranded as Paytm First Games in June 2019.

March 2018 saw the initiation of Paytm Money with an investment of ₹9 crores for investment and wealth management. In 2019, the firm introduced a subscription-based loyalty program, Paytm First, and launched the Paytm First credit card in partnership with Citibank. Paytm raised $1 billion in a funding round in November 2019 and partnered with Tata Starbucks in July 2020 to facilitate online food ordering during the COVID-19 pandemic.

In July 2021, One97 Communications took a major step by filing a draft red herring prospectus for its initial public offering (IPO) with the Securities and Exchange Board of India. Paytm’s IPO launched in November 2021, raising ₹18,300 crores (US$2.3 billion) at a valuation of US$20 billion, marking the largest-ever IPO in India. The shares commenced trading on 18 November 2021, and despite a significant drop on the listing day, Paytm continued to innovate and expand, launching Paytm Wealth Academy in December 2021.

Paytm’s Controversies: A Turning Point

In November 2016, American company PayPal lodged a complaint against Paytm at the Indian trademark office, alleging that Paytm’s logo used a color scheme too similar to its own.

In a controversial episode in May 2018, India’s investigative news agency, Cobrapost, published a video in which Paytm’s vice president, Ajay Shekhar Sharma – the brother of founder Vijay Shekhar Sharma, was covertly recorded during a meeting. It was alleged that Sharma claimed Paytm had shared the personal data of its users from the Indian state of Jammu and Kashmir with the Indian Government in violation of user privacy and company policies. Subsequent reporting by BuzzFeed highlighted that Sharma has close connections with India’s ruling party, the Bharatiya Janata Party. However, Paytm categorically denied these allegations, asserting via Twitter that it had never shared user data with third parties and had never received such requests from law enforcement. Paytm clarified that any person stating otherwise was not privy to the company’s policies and was not authorized to represent the company.

Paytm later raised allegations against Indian telecom companies, accusing them of failing to block numbers used for phishing activities, leading to a lawsuit filed in the Delhi High Court for ₹100 crores.

In September 2020, Paytm’s official app was temporarily removed from the Google Play Store, purportedly due to infringements of the Play Store’s gambling policy. Paytm contested this action, maintaining that Google did not provide any advance warning or an opportunity for the company to clarify its stance on the disputed ‘cashback’ offers. Paytm further argued that Google’s own payment app, Google Pay, offered similar ‘cashback’ incentives without facing any sanctions.

In a significant development in March 2022, the Reserve Bank of India suspended Paytm Payments Bank from enrolling new customers. This action followed an inspection that reportedly uncovered evidence of the company sharing customer data with China-based entities that held an indirect stake in Paytm Payments Bank.

Paytm Stock Price History

To get a detailed Paytm share value outlook, it is essential for investors to get an idea of Paytm stock’s price history to determine its future growth potential. However, it is to be noted that past performance is not an indicator of Paytm’s future price points and financial projections.

The curtain lifted on Paytm’s stock market story in November 2021 when it executed the largest-ever initial public offering (IPO) in India. Priced at ₹2,150 per share, the IPO aimed to raise ₹18,300 crore (US$2.3 billion), propelling Paytm’s valuation to a staggering US$20 billion.

However, the company faced a tumultuous start. Paytm’s shares opened at ₹1,950 on the National Stock Exchange, which was 9.3% below the IPO price range. The debut ended with a closing price of ₹1,560, marking the largest fall on a listing day in India’s IPO history.

In the following months, Paytm’s stock price saw multiple fluctuations. The year 2021 ended with Paytm grappling with concerns over its path to profitability, which put downward pressure on its stock price.

By the end of 2021, Paytm’s stock price started to decline as it crossed below the ₹1,000 mark. The share price continued to decline in the following months. In early 2022, several events transpired that positively influenced Paytm’s stock price. Despite the rocky start, the company’s strong Q3 performance, along with the positive market sentiment and favorable policy changes in the fintech sector, contributed to a rebound in Paytm’s stock price. An increased user base, bolstered by the launch of new and innovative services, also played a role in restoring investor confidence.

However, March 2022 brought a significant setback, as the Reserve Bank of India (RBI) suspended Paytm Payments Bank from enrolling new customers due to findings that customer data was being leaked to China-based entities. This news adversely affected Paytm’s stock price, reflecting the sensitivity of stock prices to company news and market sentiments.

On 25 March, Paytm stock made a bottom level near ₹540; however, it then slowly recovered in the next few months, reaching the ₹700 mark in July. Since then, the stock price continued to witness downward pressure as it reached another bottom level at ₹465 on 25 November 2022.

Following positive news in the Indian stock market and Paytm’s promising financial result, the stock price has gained its previous level of ₹700 and is now aiming for a bull run in 2023.

Paytm Share Price Prediction: Technical Analysis

Lately, Paytm’s stock has seen a brief dip in value, causing a pause in its upward journey. Market conditions, largely driven by the Federal Reserve’s recent hike in interest rates, have had an adverse effect on the company’s share price. However, despite significant barriers, the resilience of Paytm’s stock has been noteworthy. An in-depth examination of Paytm’s technical charts reveals some bullish signs, although they’re overshadowed by prevailing bearish tendencies. Investors are advised to tread carefully, as Paytm’s long-term growth prospects seem indeterminate. The sustainability of the current uptick is questionable, casting shadows over Paytm’s ability to preserve its premier investment stature.

TradingView reports that Paytm shares currently stand at ₹710, showcasing a slight drop of more than 0.5% in the past day. A detailed analysis of Paytm stocks suggests that the downward trend might not have fully subsided, with a potential resurgence of bearish tendencies as the stock struggles to gather sufficient buying interest near its immediate support levels. A glance at the daily price chart reveals that Paytm shares have found a support line around the ₹702 mark, a point from which the share price could aim to overcome the next resistance barrier. With Paytm’s price recently crossing multiple EMA trend lines at ₹650, it’s plausible that investors may be emboldened to enter long positions, potentially driving the share price upwards in the following days prior to any bearish swing. The Balance of Power (BoP) indicator currently resides in a bearish area at 0.33, suggesting a minor dip could be on the horizon.

To thoroughly analyze the price of Paytm shares, it is crucial to take a look at the RSI-14 indicator. The RSI indicator recently experienced a decline from the 62-level following selling pressure, and it has dropped to the 57-level, suggesting pressure to push the stock price to ₹700. It is anticipated that Paytm’s price will soon attempt to break above its 38.6% Fibonacci level to achieve its short-term bullish goals. If it fails to climb above this Fibonacci region, a downtrend might occur.

As the SMA-14 continues its upward swing near the 62-level, it trades way above the RSI line, potentially accelerating the stock’s upward correction on the price chart. If Paytm shares break above the consolidation zone, it can pave the way to the crucial resistance of ₹ 742. A breakout above the strong resistance will drive the share price toward the upper limit of the Bollinger band at ₹841.

Conversely, if Paytm fails to hold above the critical support level of ₹682, a sudden collapse may occur, resulting in further price declines and causing the Paytm share to trade near the Bollinger band’s lower limit of ₹638.

Paytm Share Price Prediction By BlockchainReporter

Paytm Share Price Prediction 2023

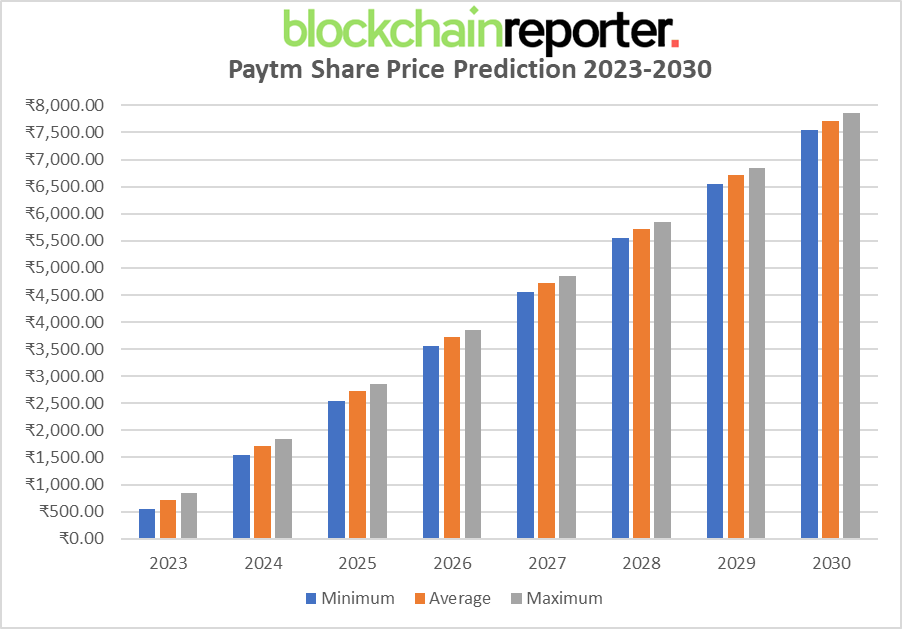

In 2023, Paytm is poised to show solid financial results as the company is heading toward acquiring more users for the platform. According to our technical analysis, Paytm’s share value may attain a minimum price of ₹550, with an average trading price of ₹720 and a maximum price of ₹850.

Paytm Share Price Prediction 2024

In 2024, Paytm is expected to maintain its upward trend in share prices. Their continuous efforts to add innovative features to their app and extend their reach to uncharted markets are anticipated to pay off. The share value is expected to reach a minimum price of ₹1550, average trading price around ₹1720, and may skyrocket up to ₹1850.

Paytm Share Price Prediction 2025

By 2025, as Paytm expands its services and partnerships with various businesses, a significant rise in share price is predicted. Bolstered by robust growth in the fintech industry, the minimum share price for Paytm could be ₹2550. The average trading price might be around ₹2720, while the maximum could reach a peak of ₹2850.

Paytm Share Price Prediction 2026

In 2026, Paytm’s share prices are projected to see a steady surge as their digital payment services continue to permeate deeper into the Indian market. The minimum share price could reach ₹3550, the average trading price could be ₹3720, and the maximum price could ascend to ₹3850.

Paytm Share Price Prediction 2027

The year 2027 could be another pivotal year for Paytm, as they aim to revolutionize the fintech ecosystem in India. With a probable minimum share price of ₹4550, an average trading price of ₹4720, and a maximum price of ₹4850, Paytm is set to reaffirm its standing in the market.

Paytm Share Price Prediction 2028

By 2028, Paytm is forecasted to further strengthen its foothold in the market, pushing share prices to an anticipated minimum of ₹5550. The average trading price could be around ₹5720, and the maximum could reach a significant ₹5850.

Paytm Share Price Prediction 2029

As we move towards the end of the decade, Paytm’s continued growth and solidified position in the Indian fintech sector could see its share prices hitting a minimum of ₹6550. The average trading price could be approximately ₹6720, while the maximum price could reach a notable ₹6850.

Paytm Share Price Prediction 2030

Rounding off the decade in 2030, Paytm’s consistent growth trajectory could see it hitting new highs. Our technical analysis projects a minimum price of ₹7550, an average trading price of ₹7720, and a maximum price of ₹7850 for Paytm shares.

Paytm Share Price Prediction By Industry Experts

According to FinancesRule’s Paytm stock price prediction, the average trading price of Paytm could be around ₹840, with a minimum price of ₹747 and a maximum price of ₹971 by the end of 2024.

By the end of 2030, one Paytm stock price may reach an average trading price of ₹2250, with a minimum value of ₹1980 and a maximum value of ₹2600.35.

Business Standard’s Paytm stock price prediction expects a slow increase in the upcoming years. According to the website, Paytm’s share price may attain an average price of ₹1250 in 2025, with a maximum trading price of ₹1800 and a minimum price of ₹1000.

A prominent public figure, Motilal Oswal, said, “Digital payments industry is forecasted to double to USD16t by 2026, within which the mix of digital payments is likely to increase to 65%. Thus, digital payments are expected to surge ~3x to USD10t by 2026 from USD3t in 2021. Mobile payments are projected to grow even faster at ~5x to USD 3 t by 2026. Further, an increase in QR deployment will drive merchant payment, which is likely to jump ~6x to USD 2.7 t by 2026. Paytm will thus be a big beneficiary from this surge as it has a strong positioning in both digital payments and lending businesses.”

Should You Invest In Paytm Before Q4 Results?

Since reaching its all-time low of ₹438.35 per share on the NSE in November 2022, the stock price of Paytm has been on a bullish trajectory. Over the last six months, shares of One97 Communications, the parent company of Paytm, have rallied from their all-time low to ₹650.55 per share, recording a nearly 50 percent increase in the last five months alone. In terms of the year-to-date (YTD) performance, Paytm’s share value has grown by approximately 22 percent, capturing the interest of numerous stock market analysts.

Stock market analysts anticipate that Paytm will report robust quarter-on-quarter revenue growth in Q4FY23, as it is projected to improve loan disbursement and increase the addition of new devices. As of now, Paytm’s share price is fluctuating between ₹600 and ₹700. If the stock price breaks through the ₹700 mark, it may potentially climb up to ₹780 in the short term. The experts, therefore, suggest that strategic investors maintain a ‘buy on dips’ approach toward Paytm’s shares.

Conclusion

Paytm is seemingly set to script a compelling narrative in the world of fintech, powered by its potential for robust revenue growth and strategic advances in loan disbursement and device addition. Its stock has demonstrated a resilient uptrend from its all-time low and promises to maintain this positive momentum. As it continues to navigate the ₹600-₹700 range with the potential to breach the ₹700 mark, the stock exhibits substantial short-term growth prospects.

Yet, like all investments, the possibility of risk prevails, warranting a diligent and well-informed approach. Investors are advised to keep an eye on Paytm’s performance and market trends, exercising a strategic ‘buy on dips’ strategy to optimize potential returns.

FAQ

What is Paytm?

Paytm is a leading Indian financial technology company that provides a broad range of services including digital payments, online shopping, ticket booking, and banking services. It was founded by Vijay Shekhar Sharma in 2010 under the parent company One97 Communications Ltd. Paytm started as a prepaid mobile and DTH recharge platform, but rapidly expanded its services to become a comprehensive digital wallet and e-commerce platform. It also offers services like utility bill payments, travel bookings, movie tickets, and event bookings. In recent years, Paytm has ventured into financial services with the launch of Paytm Payments Bank, Paytm Money for investment and wealth management, and various insurance services.

What is Paytm’s history?

Paytm, launched by One97 Communications Ltd., has grown significantly since its inception in 2011. Its user base skyrocketed from 11.8 million in August 2014 to 104 million in August 2015. Major investors include Sapphire Ventures, Alibaba Group, Ant Financial Services Group, Ratan Tata, Mountain Capital, and SoftBank. The company launched its IPO in November 2021, marking the largest-ever IPO in India.

What controversies has Paytm faced?

Paytm faced controversies involving an allegation from PayPal about their similar logos, accusations of sharing user data with the Indian Government, allegations against Indian telecom companies for failing to block phishing numbers, and removal from the Google Play Store due to gambling policy infringements. In March 2022, the Reserve Bank of India suspended Paytm Payments Bank from enrolling new customers.

How has Paytm’s stock price performed since the IPO?

Despite a significant drop on the IPO listing day, Paytm’s stock price saw multiple fluctuations over time. It hit a low at ₹540 on March 25, 2022, then recovered to ₹700 by July, later dropping to ₹465 on November 25, 2022. As of 2023, the stock has regained its ₹700 level, signaling a potential bull run.

What is the prediction for Paytm’s stock price for the next few years?

The stock price is predicted to see a steady increase over the next few years. By 2023, the stock price may range from ₹550 to ₹850. The range may rise to ₹1550 to ₹1850 by 2024, and by 2030, the price may reach between ₹7550 and ₹7850.

What does the technical analysis reveal about Paytm’s stock price?

The technical analysis reveals bullish signs overshadowed by prevailing bearish tendencies. Paytm’s stock could face a minor dip, as the Balance of Power (BoP) indicator resides in a bearish area. However, if Paytm shares break above the consolidation zone, it can pave the way to a resistance of ₹742.

Should you invest in Paytm before Q4 results?

Paytm’s share price has been on a bullish trajectory, growing by approximately 22 percent year-to-date (YTD). Stock market analysts anticipate that Paytm will report robust quarter-on-quarter revenue growth in Q4FY23, potentially influencing the stock price. However, individual investment decisions should consider personal financial situations and risk tolerance.

What predictions have industry experts made for Paytm’s stock price?

FinancesRule predicts that by the end of 2024, Paytm’s stock price could reach up to ₹971. By the end of 2030, it could reach up to ₹2600.35. Business Standard predicts Paytm’s share price to reach an average of ₹1250 in 2025. Motilal Oswal suggests that Paytm will benefit greatly from the expected surge in the digital payments industry.

READ MORE:

Xxc Renegade 1000 Xxc Price Prediction: Will This ATV Gain Popularity In 2023?

Yes Bank Share Price Prediction 2025: Will Yes Bank Stock Recover from Crisis?

Lucid Stock Price Prediction 2025: Can LCID Stock Recover Amid Bearish Sentiment?

Wrapped LUNA Classic (WLUNC) Price Prediction

Rivian Stock Price Prediction 2025 & 2030: What Lies Ahead for RIVN Stock Price?

Bitgert Price Prediction: Is Bitgert a Good Investment?

EverGrow Coin Price Prediction: Will EGC Skyrocket to $1 Soon?

Nio Stock Price Prediction 2030: Will There Be a Bullish Reversal for Nio Stock?