Switzerland-based 21Shares has unveiled the first exchange-traded product (ETP) tied to dYdX, a decentralized exchange specializing in perpetual futures contracts. The move is another important bridge between traditional finance and crypto derivatives. It will provide regulated exposure for big-money players.

At the same time, Pi Network price prediction metrics are flashing bearish signals after weeks of sluggish performance. However, the current market’s general interest extends beyond institutional inflows and bearish projects. Right now, many investors are looking for the next crypto that can multiply their portfolios.

Meanwhile, analysts say DeepSnitch AI is likely to see massive hype this altseason. Whales are already buying in, as Stage 1 alone has pulled nearly $200K and is close to selling out.

Institutions circle DeFi with dYdX ETP

The newly launched 21Shares dYdX ETP offers investors a regulated path to participate in decentralized perpetual futures. According to an announcement shared to Cointelegraph, dYdX has already processed over $1.4 trillion in cumulative trading volume and lists more than 230 perpetual markets. The product is physically backed and supported by the dYdX Treasury subDAO through a DeFi treasury manager, kpk.

According to Mandy Chiu, 21Shares’ head of product development, the launch represents a milestone moment in DeFi adoption. Mandy noted that it would change how institutions approach crypto. It would allow institutions to access dYdX through an ETP wrapper, using the same infrastructure already in use for traditional financial assets. In other words, it won’t be a complicated transition.

The ETP launch shows that institutions are increasingly willing to tap DeFi’s growing liquidity. It also adds fresh momentum to crypto-derivatives trading, even as retail investors weigh bearish forecasts for popular tokens like Pi Network.

With more traditional capital flowing into the crypto industry, many retail traders are asking where the next breakout opportunity lies. DeepSnitch AI appears to be the answer many people want.

Whales drive DeepSnitch AI presale stage 1 toward sellout

DeepSnitch AI has become the presale that provides more than just hype. Although it offers a 100x potential opportunity, DeepSnitch AI has a solid utility to back it up.

Unlike many AI coins pitching vague infrastructure plays, DeepSnitch AI is being built as a practical trading tool. It will scan contracts and wallets to flag scams early, monitor market sentiment, and give actionable signals. In simple terms, DeepSnitch AI is essentially selling time back to traders.

It will provide retail traders with a sophisticated AI-powered alert system that filters market noise and spots on-chain risks before they explode. An attractive aspect of what DeepSnitch AI is building is the distribution channel. Most crypto projects don’t have it.

By plugging directly into Telegram’s user base of more than 1 billion, the platform aims to give small traders the kind of real-time data that whales have long monopolized. There’s hype, there’s utility, and there’s an already made user base waiting for when everything will roll out.

This makes DeepSnitch AI a rare presale with maximum potential. And with the AI crypto market expected to triple by 2030, many believe DeepSnitch AI could capture outsized demand as adoption grows.

Investors are piling in fast, with nearly $200K already raised in DeepSnitch AI’s presale. DSNT tokens are still just $0.01634, but with the next stage about to push prices higher, analysts warn this may be the cheapest entry.

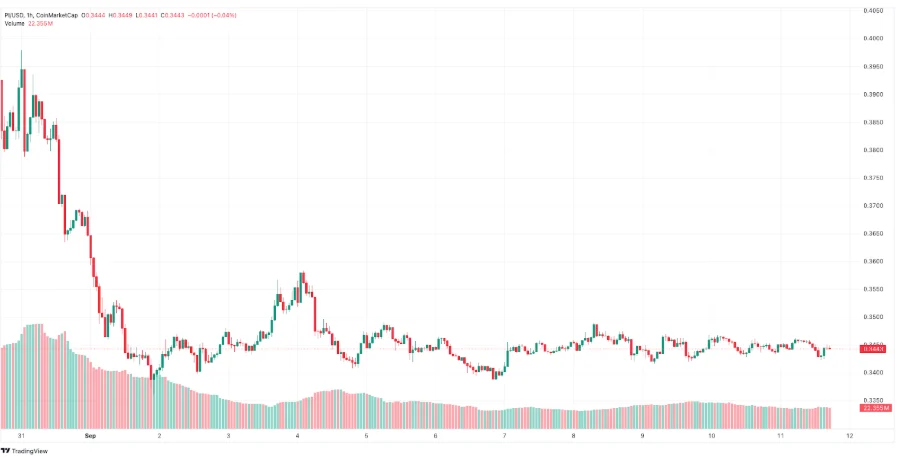

Pi Network price prediction

Pi Network has struggled to maintain momentum. On September 11, Pi traded around $0.34, slipping after a minor 0.2% weekly gain. Subsequently, it is underperforming the crypto market’s 3.5% rise and lagging behind similar Layer-1 projects. Technical indicators paint a bearish picture. The 50-day SMA stands at $0.378731, the 14-day RSI sits at 43.58, and the Fear & Greed Index reads a neutral 54.

Analysts believe Pi Network’s price could drop by 23.31% to about $0.26 by December 10, with an average 2026 trading range of $0.24 to $0.94. However, June 2026 could bring a potential 173% rally from today’s levels.

Pudgy Penguins: Current performance and price prediction

NFT favorite Pudgy Penguins (PENGU) is enjoying a mini-bull run. The token increased by more than 17% over the past week, outpacing the general crypto market. Technical data also suggests that the token might be having a healthy momentum. As of September 11th, it had a 14-day RSI of 58.72 and a 50-day SMA of $0.034.

A recent strategic partnership between Sharps Technology and the Pudgy Penguins brand to expand Solana-based digital asset access has boosted sentiment. Still, the price is expected to decline by more than 24% and reach $ 0.025 in the next month.

Conclusion

The crypto industry is becoming more attractive than ever. Institutional players are betting on many projects while smaller traders are seeking opportunities that could 10x their portfolios.

However, many make the mistake of chasing speculative coins that rely on hype alone for growth. The few who understand the secret to 100x opportunity are aware that hype plus utility is important.

DeepSnitch AI has all these attributes. Already, momentum is building around its presale, but the window won’t be open for long.

Once it hits exchanges, a 100x run is firmly on the table.

Visit the official DeepSnitch AI presale website to learn more.

FAQs

What is the latest Pi Network price prediction?

Analysts expect Pi Network to fall about 23% to $0.26 by December 2025.

Is now a good time to buy PI?

Current technical indicators and sentiment suggest it’s not an ideal entry point. Pi Network price predictions look bearish.

Why is DeepSnitch AI considered the best crypto to buy now?

DeepSnitch AI will provide real-time, AI-driven trading alerts and scam detection, offering massive potential from its low presale price.

How does institutional interest in dYdX affect DeFi?

The 21Shares dYdX ETP makes DeFi derivatives more accessible to traditional investors, potentially boosting liquidity and market maturity.

This article is not intended as financial advice. Educational purposes only.