- 1. Aerodrome Finance: A Quick Overview

- 2. Aerodrome Finance: How Does It Work?

- 3. AERO Historical Price Sentiment

- 4. AERO Price: Technical Analysis

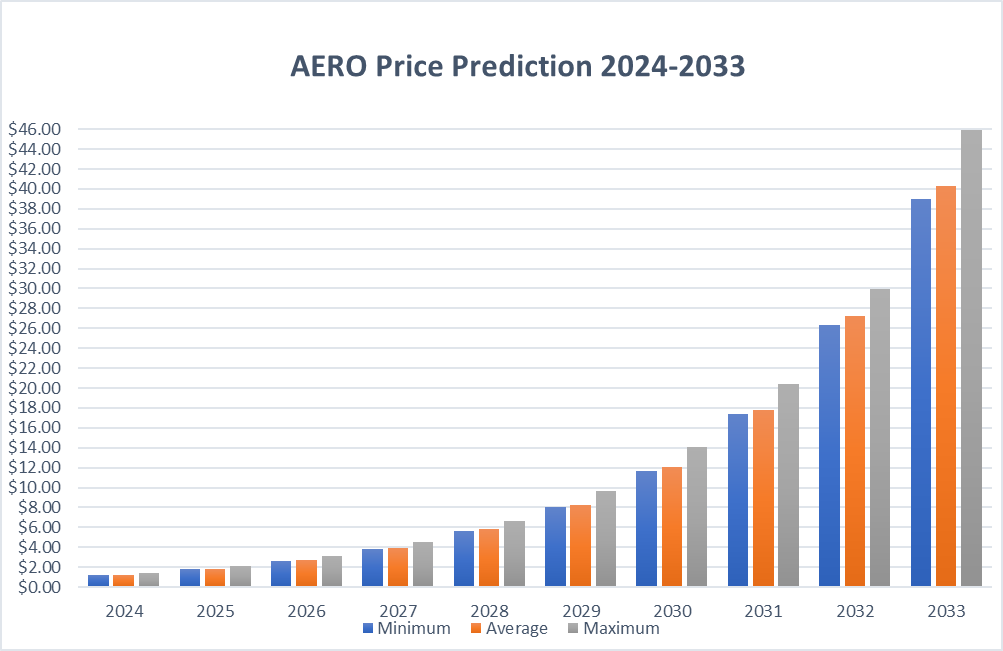

- 5. Aerodrome Finance Price Prediction By Blockchain Reporter

- 5.0.1. Aerodrome Finance Price Prediction 2024

- 5.0.2. Aerodrome Finance Price Prediction 2025

- 5.0.3. AERO Price Forecast for 2026

- 5.0.4. Aerodrome Finance (AERO) Price Prediction 2027

- 5.0.5. Aerodrome Finance Price Prediction 2028

- 5.0.6. Aerodrome Finance Price Prediction 2029

- 5.0.7. Aerodrome Finance (AERO) Price Prediction 2030

- 5.0.8. Aerodrome Finance Price Forecast 2031

- 5.0.9. Aerodrome Finance (AERO) Price Prediction 2032

- 5.0.10. Aerodrome Finance Price Prediction 2033

- 6. AERO Price Forecast: Experts And Analysts

- 7. Features Of Aerodrome Finance

- 8. Is AERO a Good Investment? When To Invest?

- 9. Conclusion

The crypto market is gaining massive institutional adoption, opening up more opportunities for users and investors each year. In 2024, the investment landscape is vast, offering many ways for people to earn significant rewards by using their assets. One popular method is through liquidity pools. Liquidity pools allow users to deposit their cryptocurrency into different platforms. This money is then used in various financial activities like trading, lending, and funding on decentralized exchanges, helping to keep these platforms running smoothly. It’s important to know that decentralized finance (DeFi) platforms and decentralized exchanges (DEXs) operate with something called automated market makers (AMMs). These systems use pools of funds instead of traditional brokers, which cuts out the need for central financial intermediaries. Today, we’ll look at a new type of AMM called Aerodrome Finance, which lets users put in their funds and earn rewards through participating in these liquidity pools. We’ll explore the current market sentiment with in-depth technical analysis of the AERO token from our Aerodrome Finance price prediction.

Aerodrome Finance: A Quick Overview

Aerodrome Finance is a key trading and liquidity platform on the Base blockchain, functioning as a cutting-edge automated market maker (AMM) intended to be Base’s main source of liquidity. It merges an advanced liquidity reward system, a governance structure based on vote-locking, and an easy-to-use interface. Aerodrome incorporates the newest features from its predecessor, Velodrome V2.

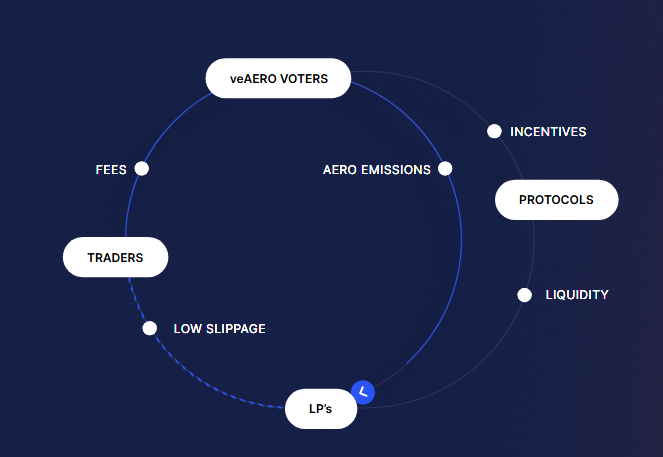

The distinctiveness of Aerodrome Finance is about creative incentive and governance structures. It benefits users who help the protocol grow sustainably by directing all the protocol’s incentives and fees to those who vote using veAERO tokens. These users lock their AERO tokens to change them into veAERO, a unique token representing their voting rights. The longer they lock their tokens, the more their voting power increases. They can then decide which liquidity pools will receive AERO rewards, promoting cost-effective liquidity creation.

In operation, Aerodrome Finance draws liquidity from both traders and those providing liquidity. Traders experience less price difference when swapping tokens and pay lower fees to those who lock AERO tokens. Liquidity providers contribute their trading tokens in exchange for AERO rewards. The protocol uses incentives for veAERO voters to draw votes and channel AERO rewards to their selected pools. Voters receive all the incentives and fees from the pools they support. This efficient cycle of liquidity and adjustments that prevent dilution of benefits ensure the ongoing growth of the protocol.

Aerodrome Finance: How Does It Work?

Decentralized exchanges often face the issue of rewards being linked to total liquidity instead of trading volume, which actually generates fees for the protocol. To tackle this, platforms like Aerodrome introduce a novel method. They allow holders of AERO tokens to lock their tokens for periods ranging from one week to four years in return for veAERO, which are AERO tokens with vested rights.

The length of time a token is locked significantly influences the amount of veAERO a user receives, thereby enhancing their role in making governance decisions. This setup is similar to the system used by Velodrome.

These veAERO tokens are treated as NFTs and can be traded on various NFT marketplaces. This feature allows other users to engage with the ecosystem indirectly, without the need to buy and lock tokens themselves.

Owners of veAERO tokens have a say in the governance of the platform, and they also help set reward levels for the trading pools. In exchange, these voters collect 100% of the fees and incentives from the pools they support.

Such features develop a self-reinforcing cycle of liquidity. The prospect of rewards attracts users to the platform, leading to more purchases of AERO tokens. These active participants are key in deciding which project tokens to support, thus influencing the platform’s expansion and enhancing rewards. Even project teams can lock $veAERO to incentivize voters to support their liquidity pools, increasing interest in their offerings.

Tokens Of Aerodrome Finance

Aerodrome Finance operates with two key types of tokens, AERO and veAERO, which are central to its governance and functionality.

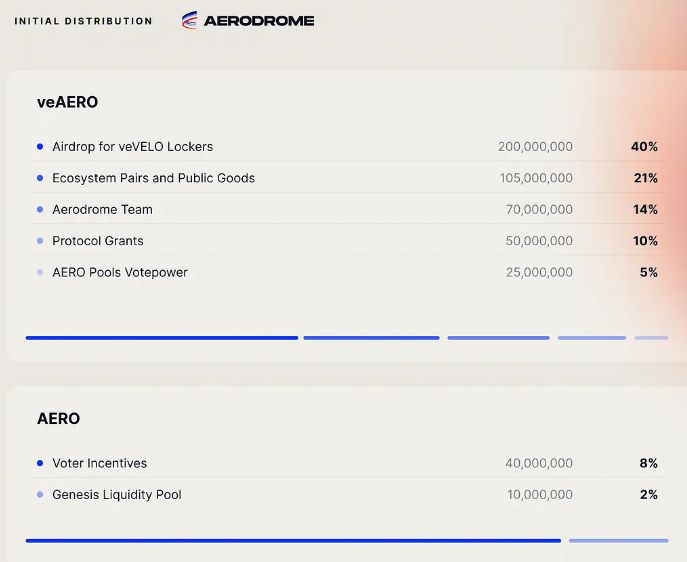

AERO is the main ERC-20 token used on the platform for various utility purposes. It serves as a reward for liquidity providers who deposit their cryptocurrency into Aerodrome’s pools. These providers receive AERO tokens in proportion to the amount of support their pools get through voting. Initially, Aerodrome has issued 500 million AERO tokens, with 450 million designated as vote-locked veAERO tokens.

veAERO, on the other hand, is an ERC-721 non-fungible token (NFT) that plays a crucial role in the governance of Aerodrome. Holders of AERO tokens can choose to lock these tokens in a vote-escrow agreement, receiving veAERO tokens in return. One special feature of veAERO is the Auto-Max Lock. This means that these tokens are considered to be locked for the maximum possible duration of four years, during which their voting power remains intact without any decay.

AERO Historical Price Sentiment

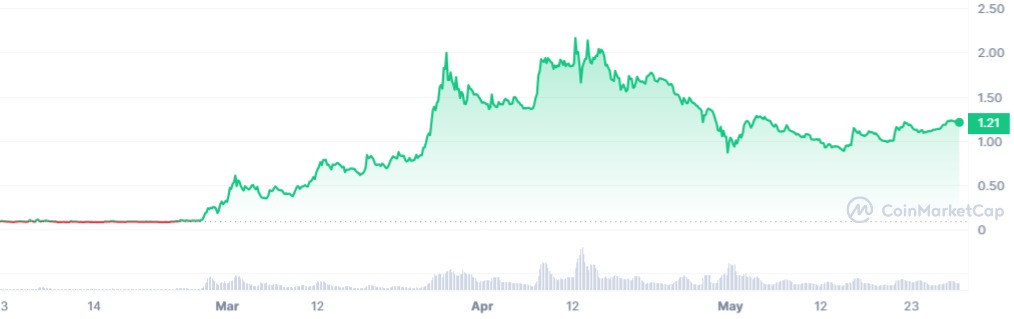

Let’s explore the significant fluctuations in the price history of Aerodrome Finance. Understanding the historical performance of this cryptocurrency, although not a direct predictor of future outcomes, can provide valuable insights for both making and analyzing price forecasts for Aerodrome Finance.

Aerodrome Finance debuted in the open market on February 2, 2024, with an initial price of $0.09207. The value experienced a notable surge in March, peaking at $1.9787, followed by a slight pullback in early April. However, by the end of April, AERO reached its highest value to date at $2.2175. Subsequently, the price fell to $1.03 by May 2, 2024. However, the AERO token price has recovered since then and it holds momentum above $1.2, as of writing.

AERO Price: Technical Analysis

AERO price surged toward the high of $1.27; however, it failed to meet buyers’ demand. This resulted in a strong rejection and the price of AERO dropped below its 23.6% Fib channel and bears are now aiming for a retest of the immediate support line. As of writing, AERO price trades at $1.21, declining over 2.2% in the last 24 hours.

The 20-day EMA (at $1.2) is leveling off, and the RSI hovers just over the midpoint, suggesting a slight bullish bias. If this consolidation holds, the bulls might attempt to send the AERO/USDT pair towards $1.3 and then towards the key resistance at $1.8.

Conversely, if the price declines and breaks below the ascending support line, it would indicate that the bulls have retreated. This could lead to a decrease in price to $0.87, and potentially down to $0.6. It is anticipated that the bulls will robustly defend this level.

Aerodrome Finance Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 1.21 | 1.26 | 1.43 |

| 2025 | 1.78 | 1.84 | 2.09 |

| 2026 | 2.61 | 2.70 | 3.10 |

| 2027 | 3.78 | 3.89 | 4.55 |

| 2028 | 5.62 | 5.82 | 6.62 |

| 2029 | 8.06 | 8.29 | 9.70 |

| 2030 | 11.71 | 12.05 | 14.06 |

| 2031 | 17.36 | 17.84 | 20.38 |

| 2032 | 26.32 | 27.21 | 29.95 |

| 2033 | 38.96 | 40.32 | 45.95 |

Aerodrome Finance Price Prediction 2024

In 2024, Aerodrome Finance is expected to achieve a minimum price of $1.21. It may reach a peak of $1.43, with the average trading price hovering around $1.26 for the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $1.09 | $1.13 | $1.29 |

| February | $1.10 | $1.15 | $1.30 |

| March | $1.11 | $1.16 | $1.31 |

| April | $1.12 | $1.17 | $1.33 |

| May | $1.13 | $1.18 | $1.34 |

| June | $1.14 | $1.19 | $1.35 |

| July | $1.16 | $1.20 | $1.36 |

| August | $1.17 | $1.21 | $1.38 |

| September | $1.18 | $1.23 | $1.39 |

| October | $1.19 | $1.24 | $1.40 |

| November | $1.20 | $1.25 | $1.42 |

| December | $1.21 | $1.26 | $1.43 |

Aerodrome Finance Price Prediction 2025

For 2025, the minimum price of Aerodrome Finance is anticipated to be $1.78. The maximum price could climb to $2.09, averaging around $1.84 across the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $1.60 | $1.66 | $1.88 |

| February | $1.62 | $1.67 | $1.90 |

| March | $1.63 | $1.69 | $1.92 |

| April | $1.65 | $1.71 | $1.94 |

| May | $1.67 | $1.72 | $1.96 |

| June | $1.68 | $1.74 | $1.98 |

| July | $1.70 | $1.76 | $2.00 |

| August | $1.72 | $1.77 | $2.01 |

| September | $1.73 | $1.79 | $2.03 |

| October | $1.75 | $1.81 | $2.05 |

| November | $1.76 | $1.82 | $2.07 |

| December | $1.78 | $1.84 | $2.09 |

AERO Price Forecast for 2026

Based on detailed technical analysis of past performance, the price of Aerodrome Finance in 2026 is projected to start at a minimum of $2.61. It might ascend to a maximum of $3.10, with an average price of $2.70 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $2.35 | $2.43 | $2.79 |

| February | $2.37 | $2.45 | $2.82 |

| March | $2.40 | $2.48 | $2.85 |

| April | $2.42 | $2.50 | $2.87 |

| May | $2.44 | $2.53 | $2.90 |

| June | $2.47 | $2.55 | $2.93 |

| July | $2.49 | $2.58 | $2.96 |

| August | $2.52 | $2.60 | $2.99 |

| September | $2.54 | $2.63 | $3.02 |

| October | $2.56 | $2.65 | $3.04 |

| November | $2.59 | $2.68 | $3.07 |

| December | $2.61 | $2.70 | $3.10 |

Aerodrome Finance (AERO) Price Prediction 2027

The forecast for 2027 indicates a minimum price of $3.78 for Aerodrome Finance. The price could escalate to a maximum of $4.55, with an average likely around $3.89.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $3.40 | $3.50 | $4.10 |

| February | $3.44 | $3.54 | $4.14 |

| March | $3.47 | $3.57 | $4.18 |

| April | $3.51 | $3.61 | $4.22 |

| May | $3.54 | $3.64 | $4.26 |

| June | $3.57 | $3.68 | $4.30 |

| July | $3.61 | $3.71 | $4.34 |

| August | $3.64 | $3.75 | $4.38 |

| September | $3.68 | $3.78 | $4.43 |

| October | $3.71 | $3.82 | $4.47 |

| November | $3.75 | $3.85 | $4.51 |

| December | $3.78 | $3.89 | $4.55 |

Aerodrome Finance Price Prediction 2028

In 2028, Aerodrome Finance is projected to reach a minimum price of $5.62. The potential maximum price is expected to be $6.62, with an average trading price of $5.82.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $5.06 | $5.24 | $5.96 |

| February | $5.11 | $5.29 | $6.02 |

| March | $5.16 | $5.34 | $6.08 |

| April | $5.21 | $5.40 | $6.14 |

| May | $5.26 | $5.45 | $6.20 |

| June | $5.31 | $5.50 | $6.26 |

| July | $5.36 | $5.56 | $6.32 |

| August | $5.42 | $5.61 | $6.38 |

| September | $5.47 | $5.66 | $6.44 |

| October | $5.52 | $5.71 | $6.50 |

| November | $5.57 | $5.77 | $6.56 |

| December | $5.62 | $5.82 | $6.62 |

Aerodrome Finance Price Prediction 2029

Forecasts for 2029 predict that Aerodrome Finance will start at a minimum price of $8.06. It might reach a high of $9.70, with the average price throughout the year at $8.29.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $7.25 | $7.46 | $8.73 |

| February | $7.33 | $7.54 | $8.82 |

| March | $7.40 | $7.61 | $8.91 |

| April | $7.47 | $7.69 | $8.99 |

| May | $7.55 | $7.76 | $9.08 |

| June | $7.62 | $7.84 | $9.17 |

| July | $7.69 | $7.91 | $9.26 |

| August | $7.77 | $7.99 | $9.35 |

| September | $7.84 | $8.06 | $9.44 |

| October | $7.91 | $8.14 | $9.52 |

| November | $7.99 | $8.21 | $9.61 |

| December | $8.06 | $8.29 | $9.70 |

Aerodrome Finance (AERO) Price Prediction 2030

By 2030, the price of Aerodrome Finance is forecasted to hit a minimum of $11.71. The maximum price could be $14.06, with an average of $12.05 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $10.54 | $10.84 | $12.65 |

| February | $10.65 | $10.95 | $12.78 |

| March | $10.75 | $11.06 | $12.91 |

| April | $10.86 | $11.17 | $13.04 |

| May | $10.96 | $11.28 | $13.17 |

| June | $11.07 | $11.39 | $13.29 |

| July | $11.18 | $11.50 | $13.42 |

| August | $11.28 | $11.61 | $13.55 |

| September | $11.39 | $11.72 | $13.68 |

| October | $11.50 | $11.83 | $13.80 |

| November | $11.60 | $11.94 | $13.93 |

| December | $11.71 | $12.05 | $14.06 |

Aerodrome Finance Price Forecast 2031

In 2031, the minimum price of Aerodrome Finance could be $17.36, reaching up to $20.38 with an average trading price of $17.84 for the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $15.62 | $16.06 | $18.34 |

| February | $15.78 | $16.22 | $18.53 |

| March | $15.94 | $16.38 | $18.71 |

| April | $16.10 | $16.54 | $18.90 |

| May | $16.26 | $16.70 | $19.08 |

| June | $16.41 | $16.87 | $19.27 |

| July | $16.57 | $17.03 | $19.45 |

| August | $16.73 | $17.19 | $19.64 |

| September | $16.89 | $17.35 | $19.82 |

| October | $17.04 | $17.52 | $20.01 |

| November | $17.20 | $17.68 | $20.19 |

| December | $17.36 | $17.84 | $20.38 |

Aerodrome Finance (AERO) Price Prediction 2032

Based on extensive analysis of past data, in 2032, Aerodrome Finance is expected to have a minimum price of $26.32. The price may soar to a maximum of $29.95, with an average of $27.21.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $23.69 | $24.49 | $26.96 |

| February | $23.93 | $24.74 | $27.23 |

| March | $24.17 | $24.98 | $27.50 |

| April | $24.41 | $25.23 | $27.77 |

| May | $24.65 | $25.48 | $28.04 |

| June | $24.88 | $25.73 | $28.32 |

| July | $25.12 | $25.97 | $28.59 |

| August | $25.36 | $26.22 | $28.86 |

| September | $25.60 | $26.47 | $29.13 |

| October | $25.84 | $26.72 | $29.41 |

| November | $26.08 | $26.96 | $29.68 |

| December | $26.32 | $27.21 | $29.95 |

Aerodrome Finance Price Prediction 2033

For 2033, Aerodrome Finance is anticipated to maintain a minimum price of $38.96. The maximum price could spike to $45.95, with an average trading price of $40.32 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $35.06 | $36.29 | $41.36 |

| February | $35.42 | $36.65 | $41.77 |

| March | $35.77 | $37.02 | $42.19 |

| April | $36.13 | $37.39 | $42.61 |

| May | $36.48 | $37.75 | $43.03 |

| June | $36.83 | $38.12 | $43.44 |

| July | $37.19 | $38.49 | $43.86 |

| August | $37.54 | $38.85 | $44.28 |

| September | $37.90 | $39.22 | $44.70 |

| October | $38.25 | $39.59 | $45.11 |

| November | $38.61 | $39.95 | $45.53 |

| December | $38.96 | $40.32 | $45.95 |

AERO Price Forecast: Experts And Analysts

According to the current Aerodrome Finance price prediction by Coincodex, the price of Aerodrome Finance is expected to rise by 225.60% and reach $3.90 by June 27, 2024. Technical indicators suggest a neutral market sentiment, while the Fear & Greed Index indicates a score of 72, representing greed.

Over the past 30 days, Aerodrome Finance has seen 12 out of 30 green days, demonstrating a price volatility of 8.84%. Coincodex’s forecast suggests that now might be a good time to purchase Aerodrome Finance. Historical price data and Bitcoin halving cycles suggest that the lowest price of Aerodrome Finance in 2025 could be around $1.198524, with potential highs reaching up to $5.62 the following year.

By 2026, market analysts and experts, as reported by Digital Coin Price, forecast that AERO will commence the year at $3.55 and trade around $4.18. This represents a significant increase from the previous year, marking a notable upward trend for Aerodrome Finance.

By the beginning of 2030, according to Aerodrome Finance price predictions and technical analysis, the cost is expected to rise to $8.92, with the price of AERO projected to reach the same by year’s end. Furthermore, AERO could potentially climb to a high of $8.12 during the year. The period from 2024 to 2030 is anticipated to be pivotal for the growth of Aerodrome Finance.

Features Of Aerodrome Finance

- Affordable Trading for All Types of Crypto: Aerodrome offers a platform where you can trade both stable and volatile cryptocurrencies without high fees.

- Rewards Directly to Users: Anyone holding veAERO tokens gets a share of all earnings from the platform’s operations and trading fees based on the amount of AERO tokens they’ve locked in.

- Token Locking with NFT Benefits: By locking AERO tokens, users receive veAERO NFTs. These NFTs represent their locked tokens and can still be traded or transferred, keeping their liquidity.

- Open Access to Create and Manage Pools: Aerodrome provides a flexible setup where anyone can set up new liquidity pools, stake liquidity in gauges, and manage rewards without needing special permissions.

- Automated Liquidity Management: The platform supports a self-regulating system for liquidity that continues to evolve based on user-created pools and incentives.

- Increasing Voting Power Over Time: The system ensures that as more AERO tokens are issued, the voting power of veAERO holders isn’t diluted, effectively increasing their influence in governance decisions over time.

Is AERO a Good Investment? When To Invest?

Protocols operating on Base may heavily rely on Aerodrome, especially if they are newer. To utilize the AMM for driving liquidity, they are required to acquire $AERO, which needs to be converted into $veAERO. This necessity is expected to channel substantial flows into $AERO.

Once a certain time period has elapsed, veAERO voters gain the ability to determine the emission rate on a weekly basis. This arrangement is likely to ensure that emissions proceed at a pace that benefits AERO holders, though it’s important to recognize that their control is restricted to approximately 0.02% of the initial supply each week, which somewhat limits the impact of this potentially bullish factor.

Aerodrome distinguishes itself with pools that are not only larger but also offer more favorable yields compared to its competitors, providing it with a modest competitive edge. Additionally, Aerodrome has a strong brand reputation, having been launched by Velodrome, the second-largest DEX on Optimism. The team is well-regarded for its track record of developing successful products and achieving commendable market traction. As a result, it is a good investment option in the long term. It is advised to invest in this coin at a price of $0.8 for a profitable return in the long term.

The coin has been in existence for approximately two months, and although it experienced significant growth following its launch, its price has declined in recent weeks. It is advised to do your own research before investing in the volatile market.

Conclusion

Aerodrome Finance stands out as a user-friendly AMM and DEX that balances innovation with medium risk. It boasts a significant Total Value Locked (TVL) and offers numerous investment approaches. The platform makes it easy for traders to exchange assets with minimal fees and slippage, while also providing opportunities for investors to profit from liquidity investments.

This platform features over 120 liquidity pools where users can deposit their assets to earn substantial passive income, with an average Annual Percentage Yield (APY) of 233.99%. Aerodrome Finance operates on its own with the help of its governance and utility tokens, AERO and veAERO, maintaining independence and gaining popularity quickly despite being relatively new.

Investors on Aerodrome Finance are rewarded with the AERO token, which has experienced remarkable growth over the last year. However, the token faced a decline in recent weeks.

Frequently Asked Questions

What is Aerodrome Finance?

Aerodrome Finance is a decentralized automated market maker (AMM) and liquidity platform built on the Base blockchain. It offers users the ability to participate in liquidity pools, trade cryptocurrencies, and earn rewards through a governance structure based on vote-locking with its native tokens, AERO and veAERO.

How does Aerodrome Finance work?

Aerodrome Finance allows users to lock their AERO tokens in exchange for veAERO tokens, which grant voting rights and control over which liquidity pools receive rewards. This decentralized governance system incentivizes liquidity providers and traders by distributing rewards based on participation in the platform.

What are AERO and veAERO tokens?

AERO is the primary utility token of Aerodrome Finance, used to reward liquidity providers. veAERO, an ERC-721 NFT, represents locked AERO tokens and gives users governance rights on the platform. The longer tokens are locked, the more voting power veAERO holders receive.

What are the price predictions for Aerodrome Finance?

By 2025, the price could range from $1.78 to $2.09, and by 2030, it is expected to rise significantly, reaching up to $14.06.

How can I stake AERO on Aerodrome Finance?

To stake AERO, users need to lock their tokens in the platform, converting them to veAERO. This grants voting rights and allows them to earn rewards based on the pools they support. The process involves selecting a staking option and confirming the amount of AERO to lock for veAERO tokens.

What makes Aerodrome Finance unique?

Aerodrome Finance stands out for its innovative governance system, which rewards active participants and liquidity providers. The platform's ability to offer favorable yields, minimal fees, and a strong brand reputation makes it a competitive player in the DeFi space.