- 1. Algorand: A Quick Overview

- 2. Algorand: Working Module And Whitepaper

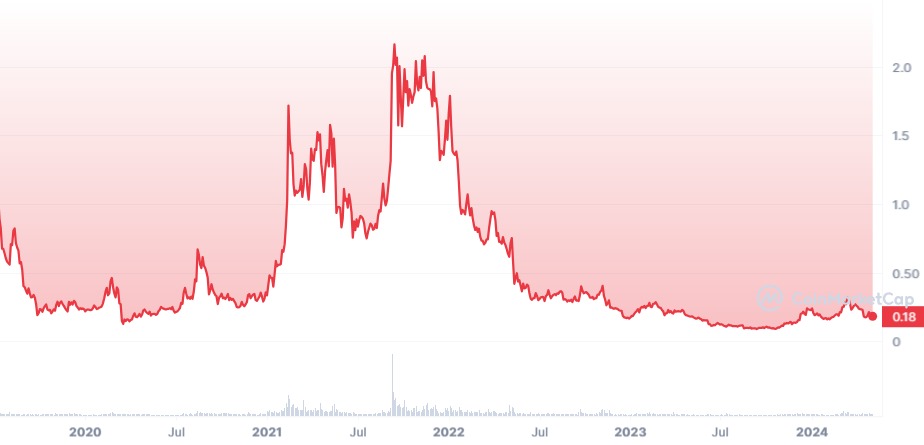

- 3. Algorand Price Prediction: Price History

- 4. Algorand Price Prediction: Technical Analysis

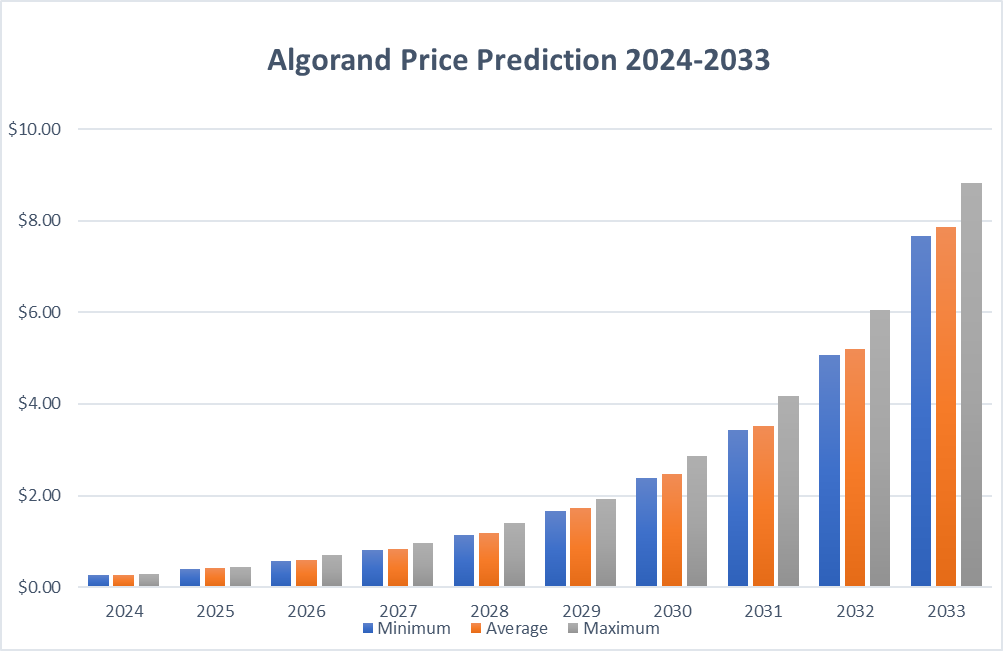

- 5. Algorand Price Prediction By Blockchain Reporter

- 5.0.1. Algorand Price Prediction 2024

- 5.0.2. Algorand Price Prediction 2025

- 5.0.3. ALGO Price Forecast for 2026

- 5.0.4. Algorand (ALGO) Price Prediction 2027

- 5.0.5. Algorand Price Prediction 2028

- 5.0.6. Algorand Price Prediction 2029

- 5.0.7. Algorand (ALGO) Price Prediction 2030

- 5.0.8. Algorand Price Forecast 2031

- 5.0.9. Algorand (ALGO) Price Prediction 2032

- 5.0.10. Algorand Price Prediction 2033

- 6. Algorand Price Forecast: By Experts

- 7. Is Algorand A Good Investment In 2024?

- 8. Conclusion

Algorand is a cryptocurrency and blockchain platform known for its distinct way of ensuring decentralization, speed, and security. It uses a consensus method called Pure Proof-of-Stake (PPoS), which solves some of the issues older blockchain systems like Bitcoin and Ethereum faced. Unlike Bitcoin’s energy-intensive Proof-of-Work (PoW) or the traditional Proof-of-Stake mechanisms, Algorand’s PPoS is more energy-efficient and inclusive. It lets all ALGO cryptocurrency holders help make decisions, leading to a more open and secure network. The platform can process thousands of transactions every second and completes transactions in just a few seconds. This makes Algorand suitable for various uses, from financial services to decentralized apps (dApps).

Algorand aims to build a seamless global economy where exchanging value is as easy as sharing information online. Its ongoing updates and the introduction of features like smart contracts, which are simpler and safer than those on other platforms, support this goal. Algorand’s adaptability was showcased in September when it joined the OpenWallet Foundation (OWF). The OWF is an open-source project aimed at advancing digital identity technologies, highlighting Algorand’s potential in areas beyond its main blockchain functions. In this article, we will look at Algorand’s price predictions, analyze the current market sentiment, and offer guidance for investors looking for profitable opportunities.

Algorand: A Quick Overview

Algorand was started in 2019 by Silvio Micali, a professor in computer science at MIT and winner of the 2012 Turing Award for his contributions to digital currencies and blockchain technologies.

As a Layer 1 blockchain, Algorand is designed to challenge Ethereum by solving problems related to decentralization, scalability, and security. The blockchain doesn’t require forking, meaning it doesn’t have to split into different branches to make significant updates or improvements.

Algorand uses a unique system it calls a permissionless, Pure Proof-of-Stake (PPoS) consensus mechanism, which processes blocks in just a few seconds. This allows it to handle transactions as quickly as traditional payment and financial systems.

The network is capable of processing 1,200 transactions every second. The Algorand Foundation points out that its Proof of Stake (PoS) method is environmentally friendly.

ALGO is Algorand’s own cryptocurrency. It is essential for protecting the network and covering transaction fees.

Algorand: Working Module And Whitepaper

Algorand supports smart contracts and offers fast transaction processing, aiming to enhance the adoption of decentralized finance (DeFi), payment systems, and regulated digital assets. The platform also allows developers to create non-fungible tokens (NFTs) using its Algorand Standard Assets (ASA) feature.

According to its whitepaper, Algorand is well-suited to handle the expanding needs of NFT ecosystems, addressing challenges related to scalability, speed, cost, and environmental impact as NFTs become increasingly popular.

Algorand uses a Pure Proof of Stake (PPoS) system to manage its blockchain and produce coins. This method involves randomly selecting individuals to add blocks to the blockchain, favoring those who own more ALGO coins. After selection, a voting process determines the winner, and a randomly chosen committee of users then verifies the new block.

Algorand’s blockchain structure consists of two layers. The first layer handles basic functions, supporting simple smart contracts — automated computer programs that activate under certain conditions — as well as NFTs and cryptocurrency tokens. The second layer is designed for more complex smart contracts and the building of decentralized applications (DApps).

The ALGO coin itself has several roles: it secures the network, aids in processing transactions, and can be bought, sold, or traded on various exchanges.

Applications Of Algorand

Using Algorand in decentralized applications (dApps) for payments allows for instant settlements around the world, with transactions being verified within seconds and at low costs. Algorand’s Smart Contracts, called ASC1s, function as trustless programs that run directly on the blockchain, ensuring that they operate smoothly without any interference in the results. These ASC1s are integrated into Algorand’s primary layer, providing strong security, speed, scalability, finality, and cost-effectiveness.

ASC1s can independently enforce custom rules and logic, ranging from basic asset transfer rules to complex application logic and workflows. These contracts are written in a specialized language called Transaction Execution Approval Language (TEAL), and PyTeal, a Python-based language extension. Meanwhile, the ALGO coin, as Algorand’s native cryptocurrency, is expanding into areas like NFTs, virtual currencies, and decentralized finance (DeFi).

Algorand has also improved gaming networks by speeding up their transaction processing times, facilitating fast and efficient transactions. Users on the Algorand platform can easily send and receive payments in their preferred currencies, with Algorand smart contracts supporting these processes by enabling conversions and exchanges through swaps.

Algorand Price Prediction: Price History

Let’s take a look at ALGO’s price history. It’s important to remember that past performance doesn’t necessarily predict future results, but it can give us a better understanding of the coin’s track record.

ALGO entered the market in the summer of 2019, quickly rising to its highest value of $3.28 on June 21 of that year. Since then, the market has generally viewed it as overpriced, and that peak still stands as its highest price. It fell sharply to its lowest point of $0.1024 on March 13, 2020, as global markets reeled from the impact of the Covid-19 pandemic.

The year 2021 saw a revival for ALGO, along with many other cryptocurrencies. Its price remained above one dollar from February to May. However, it struggled over the summer, but regained strength later in the year, reaching $2.54 on September 13, before gradually falling to end the year at $1.66.

In 2022, the markets faced challenges, and Algorand’s price reflected this downturn. The coin’s value dropped below one dollar amid tough economic conditions and a series of crashes in the crypto market, finishing the year at about $0.17.

In 2023, ALGO experienced a brief recovery, reaching $0.29 in early February. However, the situation soon deteriorated. The SEC’s classification of the coin as an unregistered security, along with legal issues facing Binance and Coinbase, raised fears of delisting, which led to a drop in its price.

On June 10, ALGO hit a new all-time low of $0.0958. It managed a slight recovery to $0.1405 by June 25, but faced another decline following the shutdown of Algofi, dropping to $0.1031 on July 13.

The news on that same day of a favorable ruling for Ripple in its SEC lawsuit sparked a brief rally. By January 2, 2024, ALGO was trading at around $0.22.

The upward trend continued into 2024, and by March 8, Algorand’s value had risen to approximately $0.2755. However, in recent weeks the price of ALGO dropped heavily and is currently hovering within a consolidated zone of $0.18.

Algorand Price Prediction: Technical Analysis

ALGO price attempted to initiate a rebound from the critical $0.166 mark, yet the bullish momentum seems to be struggling around the uptrend line, which might soon result in a bearish pullback.

Persistent selling pressure from the bears forced the price below $0.16, thereby paving the way for a potential reevaluation of the robust support. However, buyers successfully defended the level strongly. Market observers anticipate a robust defense of the price zone spanning from $0.16 to $0.17, as breaching this range could signal the onset of a bearish trend.

Conversely, should the price rebound from $0.16 and surpass the 50-day Simple Moving Average (SMA) at $0.2, it would indicate a weakening grip by the bears. In such a scenario, the ALGO/USDT pair may prolong its consolidation within the range of $0.2 to $0.26 for an extended period.

Algorand Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 0.2574 | 0.265 | 0.2841 |

| 2025 | 0.3988 | 0.4121 | 0.4464 |

| 2026 | 0.5609 | 0.5815 | 0.6969 |

| 2027 | 0.8077 | 0.8367 | 0.9699 |

| 2028 | 1.14 | 1.18 | 1.4 |

| 2029 | 1.67 | 1.72 | 1.92 |

| 2030 | 2.38 | 2.47 | 2.86 |

| 2031 | 3.42 | 3.52 | 4.17 |

| 2032 | 5.07 | 5.21 | 6.06 |

| 2033 | 7.66 | 7.87 | 8.82 |

Algorand Price Prediction 2024

The projected price of 1 Algorand is anticipated to hit a minimum of $0.2574 in 2024. It is also estimated that the ALGO price could attain a maximum of $0.2841, maintaining an average price of $0.2650 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.2317 | 0.2385 | 0.2557 |

| February | 0.2339 | 0.2409 | 0.2583 |

| March | 0.2361 | 0.2433 | 0.2609 |

| April | 0.2383 | 0.2457 | 0.2635 |

| May | 0.2405 | 0.2481 | 0.2661 |

| June | 0.2427 | 0.2505 | 0.2687 |

| July | 0.2449 | 0.2529 | 0.2713 |

| August | 0.2471 | 0.2553 | 0.2739 |

| September | 0.2493 | 0.2577 | 0.2765 |

| October | 0.2515 | 0.2601 | 0.2791 |

| November | 0.2537 | 0.2625 | 0.2817 |

| December | 0.2574 | 0.2650 | 0.2841 |

Algorand Price Prediction 2025

In 2025, the forecast suggests Algorand’s price could dip to a low of $0.3988. Conversely, it is anticipated that the ALGO price may surge to a high of $0.4464, with an average projected price of $0.4121.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.3589 | 0.3709 | 0.4017 |

| February | 0.3634 | 0.3756 | 0.4069 |

| March | 0.3678 | 0.3803 | 0.4122 |

| April | 0.3723 | 0.3850 | 0.4175 |

| May | 0.3768 | 0.3897 | 0.4227 |

| June | 0.3812 | 0.3944 | 0.4280 |

| July | 0.3857 | 0.3991 | 0.4333 |

| August | 0.3902 | 0.4038 | 0.4385 |

| September | 0.3947 | 0.4085 | 0.4438 |

| October | 0.3992 | 0.4132 | 0.4491 |

| November | 0.4036 | 0.4179 | 0.4544 |

| December | 0.3988 | 0.4121 | 0.4464 |

ALGO Price Forecast for 2026

Based on thorough technical analysis of past data, the 2026 forecast for Algorand predicts a minimum value of $0.5609. The potential peak for Algorand price is estimated at $0.6969, with an average trading value of $0.5815.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.5048 | 0.5234 | 0.6272 |

| February | 0.5097 | 0.5285 | 0.6340 |

| March | 0.5146 | 0.5336 | 0.6409 |

| April | 0.5196 | 0.5388 | 0.6477 |

| May | 0.5245 | 0.5439 | 0.6545 |

| June | 0.5294 | 0.5490 | 0.6613 |

| July | 0.5343 | 0.5541 | 0.6681 |

| August | 0.5393 | 0.5593 | 0.6749 |

| September | 0.5442 | 0.5644 | 0.6817 |

| October | 0.5491 | 0.5695 | 0.6885 |

| November | 0.5540 | 0.5746 | 0.6953 |

| December | 0.5609 | 0.5815 | 0.6969 |

Algorand (ALGO) Price Prediction 2027

The forecast for Algorand in 2027 indicates a possible low of $0.8077. Conversely, the ALGO price could surge to a high of $0.9699, maintaining an average forecast price of $0.8367.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.7269 | 0.7530 | 0.8729 |

| February | 0.7342 | 0.7606 | 0.8818 |

| March | 0.7415 | 0.7682 | 0.8908 |

| April | 0.7488 | 0.7758 | 0.8997 |

| May | 0.7561 | 0.7833 | 0.9087 |

| June | 0.7634 | 0.7909 | 0.9176 |

| July | 0.7707 | 0.7985 | 0.9265 |

| August | 0.7780 | 0.8061 | 0.9355 |

| September | 0.7853 | 0.8136 | 0.9444 |

| October | 0.7926 | 0.8212 | 0.9534 |

| November | 0.7999 | 0.8288 | 0.9623 |

| December | 0.8077 | 0.8367 | 0.9699 |

Algorand Price Prediction 2028

In 2028, Algorand’s price is expected to hit a minimum of $1.14 and could potentially reach a maximum of $1.40, averaging at $1.18.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 1.026 | 1.062 | 1.260 |

| February | 1.039 | 1.076 | 1.276 |

| March | 1.052 | 1.090 | 1.292 |

| April | 1.065 | 1.104 | 1.308 |

| May | 1.078 | 1.118 | 1.324 |

| June | 1.091 | 1.132 | 1.340 |

| July | 1.104 | 1.146 | 1.356 |

| August | 1.117 | 1.160 | 1.372 |

| September | 1.130 | 1.174 | 1.388 |

| October | 1.143 | 1.188 | 1.404 |

| November | 1.141 | 1.182 | 1.397 |

| December | 1.140 | 1.180 | 1.400 |

Algorand Price Prediction 2029

The forecast for 2029 predicts Algorand’s price to reach a low of $1.67, with a potential maximum of $1.92 and an average trading price of $1.72.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 1.503 | 1.548 | 1.728 |

| February | 1.518 | 1.563 | 1.745 |

| March | 1.533 | 1.578 | 1.762 |

| April | 1.548 | 1.593 | 1.779 |

| May | 1.563 | 1.608 | 1.796 |

| June | 1.578 | 1.623 | 1.813 |

| July | 1.593 | 1.638 | 1.830 |

| August | 1.608 | 1.653 | 1.847 |

| September | 1.623 | 1.668 | 1.864 |

| October | 1.638 | 1.683 | 1.881 |

| November | 1.653 | 1.698 | 1.898 |

| December | 1.670 | 1.720 | 1.920 |

Algorand (ALGO) Price Prediction 2030

By 2030, Algorand’s price is anticipated to hit a low of $2.38 and could reach a high of $2.86, maintaining an average price of $2.47 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 2.142 | 2.223 | 2.574 |

| February | 2.168 | 2.250 | 2.605 |

| March | 2.194 | 2.277 | 2.636 |

| April | 2.220 | 2.304 | 2.667 |

| May | 2.246 | 2.331 | 2.698 |

| June | 2.272 | 2.358 | 2.729 |

| July | 2.298 | 2.385 | 2.760 |

| August | 2.324 | 2.412 | 2.791 |

| September | 2.350 | 2.439 | 2.822 |

| October | 2.376 | 2.466 | 2.853 |

| November | 2.382 | 2.473 | 2.860 |

| December | 2.380 | 2.470 | 2.860 |

Algorand Price Forecast 2031

The forecast for 2031 suggests Algorand’s price might drop to a minimum of $3.42, with a potential maximum of $4.17, averaging at $3.52 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 3.078 | 3.167 | 3.753 |

| February | 3.111 | 3.219 | 3.887 |

| March | 3.144 | 3.271 | 4.021 |

| April | 3.178 | 3.323 | 4.155 |

| May | 3.211 | 3.375 | 4.289 |

| June | 3.244 | 3.427 | 4.423 |

| July | 3.278 | 3.479 | 4.557 |

| August | 3.311 | 3.531 | 4.691 |

| September | 3.344 | 3.583 | 4.825 |

| October | 3.378 | 3.635 | 4.959 |

| November | 3.411 | 3.687 | 4.985 |

| December | 3.420 | 3.520 | 4.170 |

Algorand (ALGO) Price Prediction 2032

In 2032, Algorand’s price is projected to reach a minimum level of $5.07 and could potentially reach a maximum level of $6.06, averaging at $5.21 based on deep technical analysis.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 4.563 | 4.707 | 5.454 |

| February | 4.614 | 4.739 | 5.663 |

| March | 4.665 | 4.771 | 5.872 |

| April | 4.716 | 4.803 | 6.081 |

| May | 4.767 | 4.835 | 6.290 |

| June | 4.818 | 4.867 | 6.499 |

| July | 4.869 | 4.899 | 6.708 |

| August | 4.920 | 4.931 | 6.917 |

| September | 4.971 | 4.963 | 7.126 |

| October | 5.022 | 4.995 | 7.335 |

| November | 5.073 | 5.027 | 7.544 |

| December | 5.070 | 5.210 | 6.060 |

Algorand Price Prediction 2033

By 2033, the price of Algorand is predicted to reach a minimum value of $7.66, with a potential maximum value of $8.82 and an average trading price of $7.87 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 6.894 | 7.083 | 8.002 |

| February | 6.982 | 7.167 | 8.202 |

| March | 7.071 | 7.252 | 8.402 |

| April | 7.159 | 7.336 | 8.602 |

| May | 7.247 | 7.420 | 8.802 |

| June | 7.335 | 7.504 | 9.002 |

| July | 7.424 | 7.589 | 9.202 |

| August | 7.512 | 7.673 | 9.402 |

| September | 7.600 | 7.757 | 9.602 |

| October | 7.688 | 7.841 | 9.802 |

| November | 7.776 | 7.925 | 9.902 |

| December | 7.660 | 7.870 | 8.820 |

Algorand Price Forecast: By Experts

According to Coincodex’s current Algorand price prediction, the price of Algorand is forecasted to decrease by -9.46% and reach $0.160754 by June 1, 2024. Coincodex’s technical indicators suggest a Bearish sentiment, while the Fear & Greed Index shows 43 (Fear). Over the last 30 days, Algorand has had 13/30 (43%) green days with a price volatility of 12.33%.

Based on Coincodex’s forecast, it’s currently not advisable to buy Algorand. Considering the historical price movements of Algorand and the BTC halving cycles, Coincodex estimates the yearly low Algorand price for 2025 to be around $0.150432. Additionally, Coincodex predicts that the price of Algorand could rise as high as $0.258222 next year.

According to Digital Coin Price’s analysis, market analysts and experts foresee ALGO commencing 2026 at $0.52 and maintaining a trading range around $0.65. They anticipate this to be a substantial increase compared to the previous year. Such a leap in Algorand’s value is deemed acceptable by analysts. Moving into 2030, both the Algorand Price Prediction and technical analysis project that Algorand’s price will soar to $1.31 at the start of the year, with expectations for it to maintain this level by year-end. Furthermore, projections suggest that ALGO could even reach $1.20. The period from 2024 to 2030 is anticipated to mark significant years for Algorand’s growth trajectory.

Is Algorand A Good Investment In 2024?

Looking forward to 2024, what will impact the price of Algorand the most are its practical applications, the story people tell about it, and how confident investors feel about it, as well as the data about how much it’s being used, like how many transactions are happening and how many people are actively using it. We’ll consider all these things to figure out how much it might be worth in 2024.

To start, it’s worth noting that many experts believe the crypto market will be strong in 2024, following a pattern tied to Bitcoin’s halving event every four years.

However, even though this pattern might benefit top cryptocurrencies, like Algorand, it doesn’t ensure they’ll reach new all-time highs. Algorand, for instance, struggled to reach its previous peak during the last bullish period.

Algorand stands out as a secure, decentralized, and scalable alternative to Ethereum, capable of handling thousands of transactions per second. Given Ethereum’s high fees during bullish phases, some crypto users might turn to Algorand for cheaper transactions.

Despite these advantages, Algorand’s Total Value Locked (TVL) has dropped to $99 million from its peak of over $300 million in 2022. Additionally, the number of active addresses on the network has declined significantly, currently at 20,000, down 66% from a year ago.

These factors, along with Algorand’s struggling price, have led to negative sentiment among investors. As a result, the potential for Algorand’s price to rise is limited, even if overall market conditions improve.

However, there are factors that could boost investor confidence and Algorand’s price in 2024.

For one, the project continues to make technical improvements. Recently, Algorand reduced its network’s block time by half, demonstrating its commitment to advancing despite challenges.

Additionally, Algorand is among the few cryptocurrencies compliant with ISO 20022 standards, an international protocol for transferring value and data across borders. As this standard becomes more widely adopted, particularly by major banks globally, Algorand and other compliant cryptos could see increased liquidity as banks find it easier to integrate with their blockchains.

While full adoption of the ISO 20022 standard may not happen until 2025, the narrative surrounding it could positively impact Algorand’s price. Similar to how the XRP price is influenced by its association with cross-border payments for global banking, Algorand’s narrative could gain traction.

Conclusion

Algorand’s growth potential is held back by two main issues: ongoing regulatory problems with the SEC and difficulties in attracting users, liquidity, and development. However, since about 80% of its tokens are already in circulation and have faced significant selling pressure, demand for Algorand during a bull market will likely exceed its available supply.

With the rise of Central Bank Digital Currencies (CBDCs), Algorand has been concentrating on facilitating payments. This strategic focus could help Algorand recover a substantial part of its losses in the next bullish phase.

Additionally, the expected adoption of the ISO 20022 framework, likely in full effect by 2025, will make it easier for banks to enter the crypto space. Predicting Algorand’s long-term price is tricky. On one hand, it boasts innovative and adaptable technology, but on the other, it grapples with several challenges that could threaten its sustainability. If it succeeds in its goal of enabling secure, decentralized payments and fostering a vibrant DeFi ecosystem, we might witness ALGO rising toward the $1 mark.

Nevertheless, it’s crucial to consider the risks we’ve outlined. Any of these risks could potentially lead to Algorand hitting new lows.

Frequently Asked Questions

What is Algorand (ALGO)?

Algorand is a decentralized blockchain platform known for its fast transaction speeds, security, and energy-efficient Pure Proof-of-Stake (PPoS) consensus mechanism. It was founded by MIT professor Silvio Micali and aims to create a borderless economy by providing the infrastructure for decentralized finance (DeFi) applications, NFTs, and more.

How does Algorand’s consensus mechanism work?

Algorand uses a Pure Proof-of-Stake (PPoS) consensus mechanism, allowing anyone holding ALGO tokens to participate in the block production process. This system ensures decentralization and security while enabling thousands of transactions per second.

What are the main applications of Algorand?

Algorand supports decentralized applications (dApps), smart contracts, NFTs, and payment systems. It's also designed to enhance gaming networks and facilitate fast, low-cost global transactions.

What was Algorand’s price history?

Algorand's highest price was $3.28 in June 2019. The coin faced significant fluctuations, dropping to $0.1024 in March 2020 during the COVID-19 pandemic. It saw a revival in 2021 but struggled in 2022 and 2023 due to market challenges and regulatory issues, with its price dropping below $0.20. The current price of ALGO is $0.1198.

What is the price prediction for Algorand in 2024?

In 2024, Algorand’s price is expected to range between $0.2574 and $0.2841, with an average price of $0.2650. However, factors like market conditions, technological advancements, and regulatory developments could affect these predictions.

What are the long-term price predictions for Algorand?

Long-term predictions suggest that Algorand's price could reach $0.4464 by 2025 and potentially rise to $1.4 by 2028. The price may continue to grow, reaching up to $8.82 by 2033, depending on market trends and the adoption of its technology.

Will Algorand reach $1 in 2024?

While Algorand has the potential to approach the $1 mark, it is uncertain if it will break above this level in 2024. The coin's success will depend on overcoming current challenges and benefiting from favorable market conditions.