- 1. Trump Media & Technology Group Corp: A Quick Introduction

- 2. DJT: Public Listing and Market Entry

- 3. Trump Media Bets on Crypto

- 4. DJT Stock: Price History

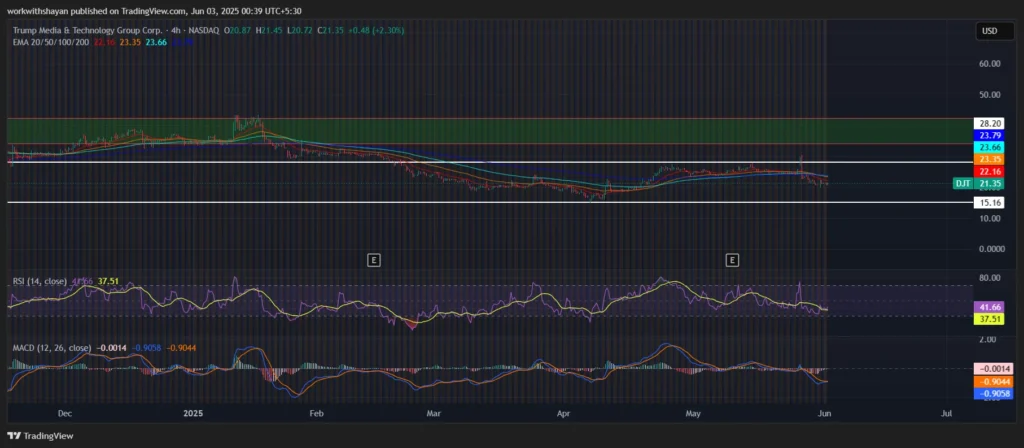

- 5. DJT Stock Price Prediction: Technical Analysis

- 6. DJT Stock Price Prediction by Blockchain Reporter

- 6.1. DJT Stock Price Prediction 2025

- 6.2. DJT Stock Price Prediction 2026

- 6.3. DJT Stock Price Prediction 2027

- 6.4. DJT Stock Price Prediction 2028

- 6.5. DJT Stock Price Prediction 2029

- 6.6. DJT Stock Price Prediction 2030

- 6.7. DJT Stock Price Prediction 2031

- 6.8. DJT Stock Price Prediction 2032

- 6.9. DJT Stock Price Prediction 2033

- 6.10. DJT Stock Price Prediction 2034

- 7. DJT Stock Price Forecast: By Experts

- 8. Is DJT Stock a Good Investment? When to Buy?

- 9. Conclusion

Trump Media & Technology Group Corp., listed on the stock market under the symbol DJT, is a media and tech company started by President Donald Trump. Its main product is Truth Social, a social media platform aimed at users who want a space that supports conservative viewpoints. The company has also talked about plans to expand into video streaming and other digital services under the brand name TMTG+.

Since going public, DJT has gotten a lot of attention, not just from investors, but also from political commentators, everyday traders, and the media. The stock is considered highly volatile, and its price often rises or falls based on political events, news coverage, or public opinion about Trump himself. In many ways, DJT is a mix of politics and market sentiments, making it one of the more unusual and unpredictable stocks in the U.S. market.

When analyzing DJT stock performance, it’s crucial to consider not only financial indicators but also strategic moves, market positioning, and political trends. In this article, we’ll explore DJT stock price prediction and its future market performance through technical insights and market sentiment, aiming to guide investors toward informed decisions.

Trump Media & Technology Group Corp: A Quick Introduction

Trump Media & Technology Group Corp. (TMTG), listed on the NASDAQ under the ticker DJT, is a U.S. media and tech company founded by President Donald J. Trump. The company started to take on large tech companies, which it believes are too dominant and biased, by creating platforms that promote free speech and support conservative values.

Its main product is Truth Social, a social media platform designed to compete with major sites like Facebook and X (formerly Twitter). Truth Social aims to be a space where users can speak freely, especially those who feel their views aren’t welcome on traditional social media.

TMTG also plans to expand into digital media with projects like TMTG+, a streaming service in development that would offer entertainment, podcasts, and political content. It has a strong dominance in the crypto sector due to Trump’s active crypto involvement.

DJT: Public Listing and Market Entry

DJT stock began trading publicly in March 2024 following a long-anticipated merger with Digital World Acquisition Corp. (DWAC), a SPAC (Special Purpose Acquisition Company). The merger had faced several regulatory delays and scrutiny, including investigations by the U.S. Securities and Exchange Commission (SEC). Despite these hurdles, the company completed its merger, and DJT officially debuted on the NASDAQ.

Since its listing, DJT has become one of the most talked-about stocks in the U.S. market, garnering attention not just from investors but also from political analysts, retail traders, and media outlets. The stock quickly developed a reputation for high volatility, with price movements heavily influenced by political headlines and Trump-related developments.

Business Model and Growth Ambitions

TMTG’s business model is still in its formative stages. The company currently generates limited revenue and is primarily focused on building its user base and brand awareness. While Truth Social serves as the entry point, TMTG’s vision includes:

- TMTG+: A subscription-based streaming platform featuring news, documentaries, and entertainment programming.

- Cloud and Infrastructure Solutions: Long-term goals include creating alternatives to existing cloud service providers, potentially offering a fully independent conservative tech stack.

However, these ambitions remain largely aspirational, with minimal operational details disclosed as of mid-2025. The company is still navigating early-stage growth and is considered by many analysts to be in a pre-revenue or speculative phase.

DJT’s movements often correlate with Trump’s media visibility, crypto initiatives, legal battles, or political campaigns. DJT has been dubbed by some as a “political meme stock” due to its cult-like following among retail investors and its potential to spike or plunge based on political developments rather than earnings reports.

Trump Media Bets on Crypto

Shares of Trump Media & Technology Group (NASDAQ: DJT) are back in the spotlight as the company recently rolled out ambitious plans to reshape its financial and crypto strategy. Backed by U.S. President Donald Trump, the firm has proposed a $2.5 billion investment to establish a bitcoin treasury and a high-profile ETF partnership with Crypto.com, that could impact the company’s long-term value and DJT stock performance.

A Bold Bet on Bitcoin

Since the victory in elections, Trump has been taking active measures to gain the complete support of the crypto community. The promises he made during his campaign regarding the crypto market are now taking shape. Trump Media is aiming to raise $2.5 billion to create its bitcoin treasury. This marks one of the most aggressive crypto plays yet by a public company with political ties. The idea is to utilize the treasury as a long-term store of value, similar to strategies previously adopted by companies such as MicroStrategy.

According to analysts, this move could attract a new wave of retail and institutional investors who are bullish on Bitcoin, especially as it becomes more mainstream in the U.S. economy.

Partnership with Crypto.com

Additionally, in March, Trump Media had inked an ETF-related deal with Crypto.com. While exact details remain confidential, the partnership aims to launch crypto-based financial products that will offer investors exposure to digital assets through traditional market channels.

This strengthens the market demand of DJT stock among investors. The announcement of the ETF deal led to a notable spike in DJT stock, signaling strong buying volume.

Despite these bold moves, DJT remains a volatile stock. After going public via a SPAC deal in early 2024, the stock surged on its debut but later saw dramatic declines. According to Wikipedia, shares dropped over 20% in a single day after the company’s first financial results, and Trump’s stake, once valued at over $3 billion, fell below $2 billion by September 2024.

DJT Stock: Price History

Trump Media & Technology Group, now trading under the ticker DJT, went live into the public market through a highly publicized SPAC merger. The journey began in October 2021 when Digital World Acquisition Corp. (DWAC) announced its intention to merge with Trump Media. The announcement triggered an explosive market reaction, with DWAC stock skyrocketing from around $10 to over $175 within days. This initial demand was driven not by business fundamentals but by political branding and the enthusiasm of retail traders.

However, the hype cooled quickly. Over the next several months, DWAC stock gradually declined as the SEC launched investigations into potential securities law violations surrounding the merger. Throughout 2022, the merger faced continued delays, and the lack of transparency from Trump Media tested investors’ confidence. By the end of 2022, DWAC shares had settled back to a much more modest valuation, closing the year near $15.

In 2023, there was still a lot of uncertainty around regulations, which made things unclear for Trump Media. Investigations by the SEC and FINRA were still ongoing, and the company hadn’t shared much financial information. Progress toward making a profit was slow, and there weren’t many updates about its main product, Truth Social. As a result, the stock (DWAC) didn’t move much and mostly stayed between $13 and $18 for most of the year, reflecting mixed investor interest.

Things changed in early 2024 when the long-awaited merger finally happened. On March 26, 2024, Trump Media & Technology Group officially began trading on the NASDAQ under the ticker symbol DJT. The stock opened at $70.90, rose to a high of $79.38, and closed the day at $57.99. This gave the company a brief market value of over $7 billion, a number that didn’t match its financial results. A lot of retail investors got interested again, largely because of Donald Trump’s name and the political meaning attached to the stock.

However, the excitement didn’t last. The stock became very unstable, especially after the company released its 2023 financial results. It had only brought in $4.1 million in revenue but lost nearly $58 million. These weak numbers didn’t support the high stock price, and by the end of April 2024, DJT had fallen below $35. Through the rest of 2024 and into 2025, the stock continued to swing sharply, often reacting to political news rather than company progress. In March 2025, it even dropped close to $15.

Financial reports in early 2025 showed the company was still losing money and hadn’t figured out how to make much revenue. Although there were brief jumps in the stock price after election-related media coverage, it soon fell again.

By May 2025, DJT was trading around $25, well below its launch-day peak but still above its original SPAC price from 2021. As of mid-2025, the company’s future is still uncertain, and much will depend on whether it can grow its user base and create a solid way to make money.

DJT Stock Price Prediction: Technical Analysis

DJT stock dropped below the moving averages, suggesting that bears are working to keep the price around support channels. However, bulls are strongly defending a drop below immediate Fib level. As of writing, DJT stock price trades at $21.23, declining over 0.4% in the last 24 hours.

The bears will likely try to keep the price below the EMA20 trend line, which stands as a key short-term support level. However, if buyers manage to break through the $28 resistance, the DJT stock price could break the bearish channel pattern. This may trigger a rally to $40 with significant buying volume.

On the other hand, if the price holds below the moving averages, it could lead to a drop toward the support at $15. Buyers are expected to defend this level strongly, as a break below it could drive the price down to $11.

DJT Stock Price Prediction by Blockchain Reporter

| Years | Minimum ($) | Average ($) | Maximum ($) |

| 2025 | $129.89 | $231.84 | $333.78 |

| 2026 | $267.83 | $382.81 | $497.78 |

| 2027 | $393.23 | $535.71 | $678.18 |

| 2028 | $531.17 | $686.68 | $842.19 |

| 2029 | $656.57 | $839.58 | $1,022.59 |

| 2030 | $781.97 | $984.28 | $1,186.59 |

| 2031 | $919.17 | $1,157.00 | $1,394.83 |

| 2032 | $1,062.80 | $1,350.55 | $1,638.30 |

| 2033 | $1,215.22 | $1,552.13 | $1,889.04 |

| 2034 | $1,374.08 | $1,758.18 | $2,142.28 |

DJT Stock Price Prediction 2025

Heading into the second half of 2025, DJT stock is expected to experience a large growth.By December, DJT stock may reach an average price of approximately $279, with minimum and maximum prices around $255 and $334, respectively, marking a strong finish to the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| July | $192.59 | $230.39 | $268.18 |

| August | $205.13 | $266.02 | $266.84 |

| September | $217.67 | $258.59 | $284.58 |

| October | $230.21 | $273.06 | $300.98 |

| November | $242.75 | $265.97 | $317.38 |

| December | $255.29 | $279.47 | $333.78 |

DJT Stock Price Prediction 2026

For the year 2026, the projection for DJT’s stock price suggests an average value of around $382.81. The stock is expected to have a minimum price of approximately $267.83 and could climb to a maximum of $497.78.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $267.83 | $270.85 | $350.18 |

| February | $279.15 | $322.86 | $366.58 |

| March | $280.37 | $358.63 | $359.45 |

| April | $292.91 | $374.07 | $382.98 |

| May | $305.45 | $359.88 | $399.38 |

| June | $317.99 | $347.00 | $415.78 |

| July | $330.53 | $360.50 | $432.18 |

| August | $343.07 | $346.09 | $448.58 |

| September | $355.61 | $358.63 | $464.98 |

| October | $373.68 | $427.53 | $481.38 |

| November | $368.15 | $466.68 | $467.50 |

| December | $380.69 | $482.11 | $497.78 |

DJT Stock Price Prediction 2027

For the year 2027, DJT’s stock price is projected to average around $535.71, with a minimum value near $393.23 and a maximum of up to $678.18.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $393.23 | $461.17 | $514.18 |

| February | $405.77 | $441.53 | $530.58 |

| March | $418.31 | $455.04 | $546.98 |

| April | $430.85 | $433.87 | $563.38 |

| May | $454.71 | $517.25 | $579.78 |

| June | $443.39 | $519.79 | $596.18 |

| July | $455.93 | $574.72 | $575.54 |

| August | $468.47 | $547.99 | $612.58 |

| September | $481.01 | $562.46 | $628.98 |

| October | $493.55 | $536.07 | $645.38 |

| November | $506.09 | $509.11 | $661.78 |

| December | $518.63 | $521.65 | $678.18 |

DJT Stock Price Prediction 2028

In 2028, DJT’s stock price is forecasted to reach an average of approximately $686.68, with the lowest price estimated at $531.17 and a potential high of $842.19.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $549.25 | $621.92 | $694.58 |

| February | $531.17 | $667.33 | $668.15 |

| March | $543.71 | $682.77 | $710.98 |

| April | $556.25 | $649.28 | $727.38 |

| May | $568.79 | $663.75 | $743.79 |

| June | $581.33 | $630.60 | $760.19 |

| July | $593.87 | $596.89 | $776.59 |

| August | $606.41 | $609.43 | $792.99 |

| September | $643.78 | $726.58 | $809.39 |

| October | $618.95 | $775.38 | $776.20 |

| November | $631.49 | $790.81 | $825.79 |

| December | $644.03 | $750.57 | $842.19 |

DJT Stock Price Prediction 2029

In 2029, DJT’s stock price is projected to have an average value of approximately $839.58, with a minimum estimate of $656.57 and a potential high reaching $1,022.59.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $656.57 | $765.04 | $858.59 |

| February | $669.11 | $725.14 | $874.99 |

| March | $681.65 | $684.67 | $891.39 |

| April | $724.81 | $816.30 | $907.79 |

| May | $694.19 | $809.19 | $924.19 |

| June | $706.73 | $883.42 | $884.24 |

| July | $719.27 | $837.39 | $940.59 |

| August | $731.81 | $851.86 | $956.99 |

| September | $744.35 | $806.17 | $973.39 |

| October | $756.89 | $819.67 | $989.79 |

| November | $769.43 | $772.45 | $1,006.19 |

| December | $819.35 | $920.97 | $1,022.59 |

DJT Stock Price Prediction 2030

In 2030, DJT’s stock price is projected to reach an average of approximately $984.28, with a minimum value near $781.97 and a potential high of up to $1,186.59.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $781.97 | $910.48 | $1,038.99 |

| February | $794.51 | $991.47 | $992.29 |

| March | $807.05 | $938.68 | $1,055.39 |

| April | $819.59 | $887.20 | $1,071.79 |

| May | $832.13 | $900.70 | $1,088.19 |

| June | $844.67 | $847.69 | $1,104.59 |

| July | $857.21 | $860.23 | $1,120.99 |

| August | $913.88 | $1,025.63 | $1,137.39 |

| September | $869.75 | $1,084.08 | $1,084.90 |

| October | $882.29 | $1,099.52 | $1,153.79 |

| November | $894.83 | $1,039.97 | $1,170.19 |

| December | $907.37 | $981.73 | $1,186.59 |

DJT Stock Price Prediction 2031

Looking ahead to 2031, DJT’s stock price is forecasted to maintain upward momentum, with an average projected value of around $1,157.00. The minimum price is expected to be approximately $919.17, while the maximum could reach $1,394.83.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $919.17 | $960.00 | $1,130.00 |

| February | $928.00 | $980.00 | $1,150.00 |

| March | $936.83 | $1,000.00 | $1,170.00 |

| April | $945.67 | $1,020.00 | $1,190.00 |

| May | $954.51 | $1,040.00 | $1,210.00 |

| June | $963.34 | $1,060.00 | $1,230.00 |

| July | $972.18 | $1,080.00 | $1,250.00 |

| August | $981.02 | $1,100.00 | $1,270.00 |

| September | $989.86 | $1,120.00 | $1,290.00 |

| October | $998.69 | $1,140.00 | $1,310.00 |

| November | $1,007.53 | $1,157.00 | $1,335.00 |

| December | $1,016.37 | $1,175.00 | $1,394.83 |

DJT Stock Price Prediction 2032

For 2032, DJT’s stock price is expected to continue its upward trajectory, with an average forecast of about $1,331.44. The stock’s minimum price could hover around $1,065.41, while the maximum value might reach approximately $1,601.90.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $1,065.41 | $1,200.00 | $1,400.00 |

| February | $1,075.00 | $1,230.00 | $1,430.00 |

| March | $1,084.59 | $1,260.00 | $1,460.00 |

| April | $1,094.18 | $1,290.00 | $1,490.00 |

| May | $1,103.77 | $1,320.00 | $1,520.00 |

| June | $1,113.36 | $1,350.00 | $1,550.00 |

| July | $1,122.95 | $1,380.00 | $1,580.00 |

| August | $1,132.54 | $1,410.00 | $1,610.00 |

| September | $1,142.13 | $1,440.00 | $1,630.00 |

| October | $1,151.72 | $1,470.00 | $1,650.00 |

| November | $1,161.31 | $1,310.00 | $1,580.00 |

| December | $1,170.90 | $1,331.44 | $1,601.90 |

DJT Stock Price Prediction 2033

In 2033, DJT’s stock price is expected to keep its growth momentum, with an average price forecast near $1,498.76. The minimum price could be around $1,198.00, while the maximum value may climb as high as $1,801.23.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $1,198.00 | $1,350.00 | $1,600.00 |

| February | $1,210.00 | $1,380.00 | $1,640.00 |

| March | $1,222.00 | $1,410.00 | $1,680.00 |

| April | $1,234.00 | $1,440.00 | $1,720.00 |

| May | $1,246.00 | $1,470.00 | $1,760.00 |

| June | $1,258.00 | $1,500.00 | $1,800.00 |

| July | $1,270.00 | $1,530.00 | $1,840.00 |

| August | $1,282.00 | $1,560.00 | $1,880.00 |

| September | $1,294.00 | $1,590.00 | $1,900.00 |

| October | $1,306.00 | $1,620.00 | $1,920.00 |

| November | $1,318.00 | $1,480.00 | $1,850.00 |

| December | $1,330.00 | $1,498.76 | $1,801.23 |

DJT Stock Price Prediction 2034

Looking ahead to 2034, DJT’s stock price is predicted to continue its upward trend, with an average price around $1,704.43. The lowest price could be near $1,362.00, while the maximum might peak at $2,170.00.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $1,362.00 | $1,550.00 | $1,900.00 |

| February | $1,377.00 | $1,580.00 | $1,930.00 |

| March | $1,392.00 | $1,610.00 | $1,960.00 |

| April | $1,407.00 | $1,640.00 | $1,990.00 |

| May | $1,422.00 | $1,670.00 | $2,020.00 |

| June | $1,437.00 | $1,700.00 | $2,050.00 |

| July | $1,452.00 | $1,730.00 | $2,080.00 |

| August | $1,467.00 | $1,760.00 | $2,110.00 |

| September | $1,482.00 | $1,790.00 | $2,140.00 |

| October | $1,497.00 | $1,820.00 | $2,170.00 |

| November | $1,512.00 | $1,670.00 | $2,000.00 |

| December | $1,527.00 | $1,704.43 | $2,100.00 |

DJT Stock Price Forecast: By Experts

According to Coincodex, the current forecast for Trump Media & Technology Group Corp. (DJT) predicts a decline in share value by approximately 29.26%, reaching $14.74 per share by July 1, 2025. Technical indicators suggest a Bearish market sentiment, while the Fear & Greed Index registers at 39, indicating a state of fear among investors. Over the past 30 days, DJT stock recorded 15 green days out of 30, with a price volatility of 6.27%.

Based on this forecast, it is currently considered a poor time to buy DJT stock, as it is trading roughly 42.18% above the predicted value, suggesting it may be overvalued. Investors should exercise caution and closely monitor market signals before making investment decisions regarding DJT shares.

According to Coincodex, in 2025, Trump Media & Technology Group Corp. (DJT) is expected to trade within a range of $7.80 to $21.33, with an average annualized price of approximately $14.28. This forecast suggests a potential return on investment of around 2.42% compared to current price levels.

Is DJT Stock a Good Investment? When to Buy?

Before concluding whether DJT is a good investment or not, investors must weigh several crucial factors:

- Platform Engagement: Is Truth Social growing, stagnating, or losing users?

- Monetization Strategy: Can the company convert user engagement into real revenue through ads, subscriptions, or premium content?

- Regulatory Risk: Ongoing investigations or future policy changes could significantly impact the company’s operations.

- Brand Dependency: DJT’s success is closely tied to Donald Trump’s brand, which is both a powerful asset and a significant liability.

While the bitcoin treasury plan and ETF partnership offer upside potential for DJT, market experts caution that DJT remains a high-risk, high-reward stock, especially as much of its valuation is tied to media coverage and Trump’s political influence.

We advise to invest in DJT stock at a price of $17 for a profitable return in the long-term. However, it is also suggested to conduct expert opinion and investment advice before investing in the volatile stock market.

Conclusion

Trump’s recent tariffs impacted the stock market a lot, including DJT price. However, the overall sentiment for the stock remains positive due to promising initiatives made by Trump.

While market volatility and external political factors could impact short-term fluctuations, the overall bullish sentiment toward the market of Trump might boost DJT stock price. The recent plans to promote the crypto market might also help DJT stock to attain new highs. However, it is always advised to do your own research before investing in DJT stock.

Frequently Asked Questions

What is DJT and what does the company do?

DJT is the stock ticker for Trump Media & Technology Group Corp., a media and tech company founded by Donald Trump. Its main product is Truth Social, a social platform focused on free speech and conservative viewpoints.

What are Trump Media’s plans in crypto?

Trump Media announced a $2.5 billion bitcoin treasury plan and a crypto ETF partnership with Crypto.com, aiming to attract pro-crypto investors and strengthen its financial foundation.

Is DJT stock a good investment right now?

Analysts predict DJT may drop further, with a forecasted low of $14.74 by July 2025. Its current valuation is considered high relative to fundamentals, making it a high-risk, speculative investment.