- 1. Ethereum Classic: A Quick Introduction

- 2. ETC: Working Module And Concerns

- 3. ETC Historical Price Sentiment

- 4. ETC Price Forecast: Technical Analysis

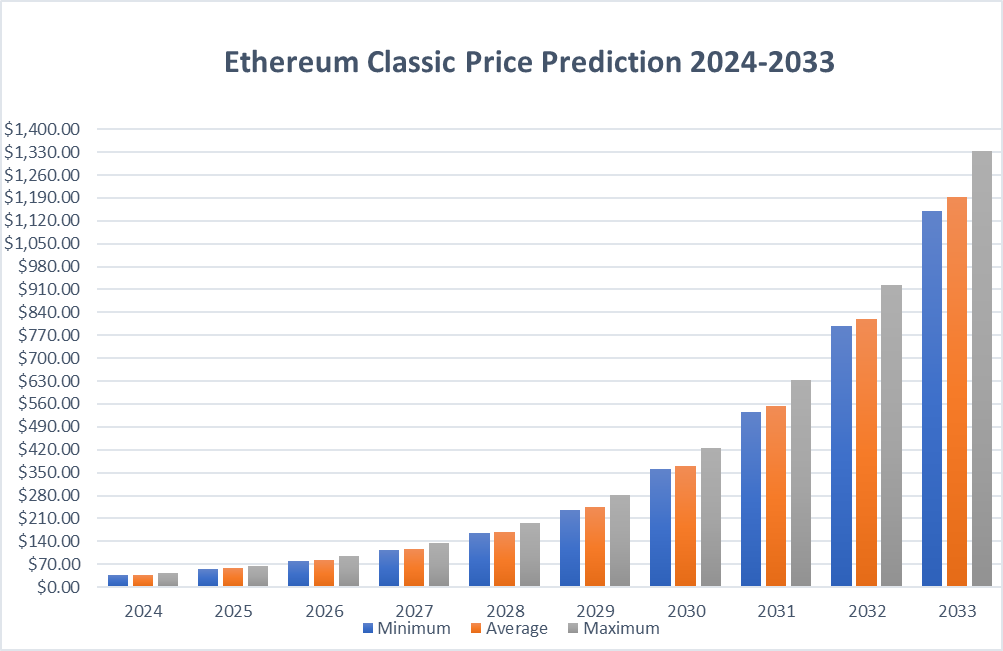

- 5. Ethereum Classic Price Prediction By Blockchain Reporter

- 5.0.1. Ethereum Classic Price Prediction 2024

- 5.0.2. Ethereum Classic Price Prediction 2025

- 5.0.3. ETC Price Forecast for 2026

- 5.0.4. Ethereum Classic (ETC) Price Prediction 2027

- 5.0.5. Ethereum Classic Price Prediction 2028

- 5.0.6. Ethereum Classic Price Prediction 2029

- 5.0.7. Ethereum Classic (ETC) Price Prediction 2030

- 5.0.8. Ethereum Classic Price Forecast 2031

- 5.0.9. Ethereum Classic (ETC) Price Prediction 2032

- 5.0.10. Ethereum Classic Price Prediction 2033

- 6. ETC Price Forecast: By Experts

- 7. Is ETC a Good Investment? When to Buy?

- 8. Conclusion

Ethereum Classic is a digital platform where smart contracts are implemented and also several actions are performed on blockchain. For example, if one user decides to sell an item to another at a particular price, it is automatically managed through smart contract by initiating the payment procedure and transfers ownership hence eliminating the third party. The blockchain was segregated into ETC and Ethereum due to the hacking catastrophe. It was clear that the Ethereum project was philosophically divided when the split occurred. Some of the developers and miners admitted the fact that code is law and hence appreciated the view that DAO investors should incur a loss through investing in a wrong project. But more than 50% of the Ethereum community individually agreed to revert the blockchain, which, in plain English, means investors got bailed out. Many enhancements and updates have been made in the ETC project after the split between Shenzhen Linkiang and Cosmos. The focus for the project remains to strive to be a global payment network enabled by smart contracts, and the system would run without top-down control. Like most other cryptocurrencies, Ethereum Classic will try to remain a decentralized means of virtual savings and payments, meaning people can keep, spend, and trade it without losing its worth. In this article, we’ll explore ETC price prediction to find out the current market sentiment of Ethereum classic and its future market potential.

Ethereum Classic: A Quick Introduction

Ethereum is composed of a decentralized platform that was developed by Vitalik Buterin and Gavin Wood in 2015 after two years of its idea’s creation by these two geniuses plus Charles Hoskinson and Anthony Di Iorio.

In mid-June 2016, members of the Ethereum community began a heated discussion of a possible decision on a hard fork, or the division of the network, after a cyberattack on the DAO, in which 3.6 million ether coins were lost.

While the members of the community are unknown, the side calling for a change to the blockchain won this debate and split Ethereum on 20 July 2016, creating the second-largest crypto by market cap today: ETH.

Ethereum Classic was created due to a mistake of a centralized organization making a decision that was unanimously wrong and went against the basic principle that such an organization was trying to propagate. As Ethereum Classic emerged from the fork, its focus seemed clear: to continue with the mantra that code is law and decentralization is key.

Ethereum Classic has its own foundation. It does not have any input on the project although it can provide support if needed. It is defined as an idea, and acts as an information resource for Ethereum Classic—There is no main board or committee that regulates the platform’s actions deciding what’s best.

On this count, Ethereum Classic also shares the same thinking as that of Bitcoin. The community builds consensus without a roadmap in its development and advances through the actual discussions that take place within that community.

ETC: Working Module And Concerns

In its technical paper, or whitepaper, Ethereum Classic states that the platform was created because “Ethereum has to be free from censorship, fraud or third-party intermediary.”

It says: “In realizing, that the blockchain represents absolute truth, we stand by it, supporting its immutability and its future.”

Similar to BTC, ETC adopted the Proof of Work algorithm to verify its transactions. Security in the network, however, is kept by the miners who invest their time and computation work on transactions and create blocks. When using the network, there must be the ability to track back transactions that have occurred so as to ensure they are executed in order of their occurrence.

This is achieved by miners as they solve complex algorithms to create blocks and this provides a method of ensuring that no attackers shuffle the network. One of the notable features of Ethereum classic is that it enables users on the system to run smart contracts. These smart contracts consist of terms or even simple propositions that, should they meet certain specifications such as if/then statements, can execute themselves. For this reason, the process is completely internal and there is no need for an external party, acting as an intermediary between a buyer and a seller.

Ethereum Classic clearly declared it will maintain using Proof of Work mining to ensure the integrity of the blockchain network and will not be receiving any updates from the Ethereum forked chain. ETC has also adopted the fixed monetary policy which was also proposed by the government.

ETC Historical Price Sentiment

We can delve deeper into the analysis of ETC/USD and explore some key milestones it has reached. Smart investors refrain from putting money into a particular asset, such as Ethereum Classic, solely based on past performance, as it does not predict future outcomes. Nonetheless, understanding its historical behavior is crucial, as it sets the context for any predictions about Ethereum Classic’s price.

Ethereum Classic was first traded openly in the market in 2016, starting at $2.08. Although its price dipped to a dollar, it rebounded significantly during the late 2017 to early 2018 market bubble, with the price soaring above $40.

Following this peak, the price fell during the period known as the crypto winter but climbed again in early 2021 when the market was thriving. Attracting many who sought a more affordable alternative to Ethereum, ETC’s price frequently reached $100 and peaked at an intra-week high of $176.16 on May 6, before ending the year at $34.12.

2022 was a challenging year for cryptocurrencies. Ethereum Classic stood out as a better option compared to Bitcoin and most other altcoins, as by the end of the year, its holders experienced less financial decline. In March, the ETC price climbed above $50, but faced several market downturns, dropping to $12.60 by June 18. It rebounded to around $40 by the end of July and early August before dipping again.

ETC struggled throughout the year due to various setbacks, including the collapse of the FTX exchange in November, which pulled its price down to $15.69 by year’s end. Despite a 55% decline over the year, it still outperformed the broader crypto market, which saw over a 60% reduction.

2023 was a year of ups and downs for the Ethereum Classic. It reached $24.79 on February 4, but fell to $16.25 after the Silvergate bank collapsed.

ETC managed to bounce back and climbed above $20 again shortly afterwards. However, it began to fall in May and declined further in June when the U.S. Securities and Exchange Commission (SEC) filed lawsuits against the Binance and Coinbase crypto exchanges.

On June 10, after Crypto.com paused its operations with American institutional clients, ETC’s price dropped to $13.42.

The second half of the year saw some recovery, and it closed the year at $21.92. This marked a 40% increase for the year, which was less than the broader crypto market that more than doubled in value.

In 2024, it surged to $32.36 on January 12 but dropped again. By February 21, it was priced at about $25.95. Following the market’s recovery, it reached $39.62 on March 9. However, on April 12, it plummeted from a high of $34.04 to $27.01 and has mostly stagnated since then. On April 29, it was priced at about $27.10. Following the SEC’s approval of an ETH ETF on May 23, Ethereum Classic’s price went up to $31.37 the next day.

ETC Price Forecast: Technical Analysis

ETC price faced a heavy decline over the last two days due to the intense bearish market sentiment. The ETC price made a low near $21.5; however, bulls successfully defended that support line and initiated a bullish surge. As of writing, ETC price trades at $23.4, surging over 0.13% in the last 24 hours.

The $21 support is crucial to monitor, as a break and close below it could complete a bearish pattern, potentially initiating a decline to $18 and then to $14. The target for this bearish pattern is $12.

If the price surges above the descending resistance line, it will suggest continued bullish buying on dips, likely keeping the ETC/USDT pair range-bound between the 50-day SMA and $27. A break and close above $27 could pave the way for a retest of $33.

Ethereum Classic Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 36 | 37.51 | 42.44 |

| 2025 | 55.33 | 57.2 | 64.31 |

| 2026 | 80.02 | 82.3 | 96.3 |

| 2027 | 113.17 | 117.28 | 135.75 |

| 2028 | 164.05 | 168.74 | 195.57 |

| 2029 | 236.77 | 245.21 | 282.47 |

| 2030 | 360.53 | 370.34 | 424.06 |

| 2031 | 535.48 | 554 | 631.71 |

| 2032 | 798.6 | 820.76 | 922.23 |

| 2033 | 1,151.00 | 1,192.00 | 1,333.00 |

Ethereum Classic Price Prediction 2024

Without a roadmap, predicting the future of Ethereum Classic is challenging. Unlike other cryptocurrencies that typically face uncertainty and scrutiny when they lack a clear roadmap, Ethereum Classic does not usually have one, which may lessen the impact on its price.

Ethereum, which Ethereum Classic closely mirrors in price, recently executed the Dencun upgrade. This upgrade is likely to increase Ethereum’s price, and Ethereum Classic is expected to follow suit. Ethereum Classic plans to implement these upgrades 3–6 months after they are introduced on Ethereum.

In 2024, the price of Ethereum Classic is expected to hit a minimum of $36.0. Its price could peak at $42.44, with an average trading price of $37.51 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 28.8 | 30.01 | 33.95 |

| February | 29.45 | 30.69 | 34.72 |

| March | 30.11 | 31.37 | 35.5 |

| April | 30.76 | 32.05 | 36.27 |

| May | 31.42 | 32.74 | 37.04 |

| June | 32.07 | 33.42 | 37.81 |

| July | 32.73 | 34.1 | 38.58 |

| August | 33.38 | 34.78 | 39.35 |

| September | 34.04 | 35.46 | 40.13 |

| October | 34.69 | 36.15 | 40.9 |

| November | 35.35 | 36.83 | 41.67 |

| December | 36 | 37.51 | 42.44 |

Ethereum Classic Price Prediction 2025

If a bull market kicks off in 2024 coinciding with the Bitcoin Halving, it’s likely to extend into 2025, during which we might see cryptocurrencies hitting new all-time highs (ATHs). Traditionally, Ethereum Classic has mirrored Ethereum’s price movements closely, often achieving new ATHs even before Ethereum.

Given Ethereum’s solidification as the second-largest cryptocurrency and its rising popularity as a proof-of-stake and deflationary asset over the past year, ETC is poised to reach new highs in the upcoming bull market.

Based on deep technical analysis of past ETC price data, in 2025, Ethereum Classic’s price is projected to reach a minimum of $55.33. It could rise to a maximum of $64.31, with an average price of $57.20.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 44.26 | 45.76 | 51.45 |

| February | 45.27 | 46.8 | 52.62 |

| March | 46.28 | 47.84 | 53.79 |

| April | 47.28 | 48.88 | 54.96 |

| May | 48.29 | 49.92 | 56.13 |

| June | 49.29 | 50.96 | 57.29 |

| July | 50.3 | 52 | 58.46 |

| August | 51.31 | 53.04 | 59.63 |

| September | 52.31 | 54.08 | 60.8 |

| October | 53.32 | 55.12 | 61.97 |

| November | 54.32 | 56.16 | 63.14 |

| December | 55.33 | 57.2 | 64.31 |

ETC Price Forecast for 2026

Ethereum Classic’s price is forecasted to reach at least $80.02 in 2026. It might achieve a maximum of $96.30, with an average trading price of $82.30 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 64.02 | 65.84 | 77.04 |

| February | 65.47 | 67.34 | 78.79 |

| March | 66.93 | 68.83 | 80.54 |

| April | 68.38 | 70.33 | 82.29 |

| May | 69.84 | 71.83 | 84.04 |

| June | 71.29 | 73.32 | 85.79 |

| July | 72.75 | 74.82 | 87.55 |

| August | 74.2 | 76.31 | 89.3 |

| September | 75.66 | 77.81 | 91.05 |

| October | 77.11 | 79.31 | 92.8 |

| November | 78.57 | 80.8 | 94.55 |

| December | 80.02 | 82.3 | 96.3 |

Ethereum Classic (ETC) Price Prediction 2027

In 2027, the Ethereum Classic price is expected to reach a minimum of $113.17. It could climb to as high as $135.75, with the average trading price sitting around $117.28.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 100 | 104 | 108 |

| February | 102 | 106 | 110 |

| March | 104 | 108 | 112 |

| April | 106 | 110 | 114 |

| May | 108 | 112 | 116 |

| June | 110 | 114 | 118 |

| July | 112 | 116 | 120 |

| August | 114 | 118 | 122 |

| September | 116 | 120 | 124 |

| October | 118 | 122 | 126 |

| November | 120 | 124 | 128 |

| December | 113.17 | 117.28 | 135.75 |

Ethereum Classic Price Prediction 2028

Following a thorough analysis, in 2028, the price of Ethereum Classic is anticipated to be at least $164.05. It has the potential to reach a high of $195.57, with the average trading price being $168.74.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 150 | 154 | 158 |

| February | 152 | 156 | 160 |

| March | 154 | 158 | 162 |

| April | 156 | 160 | 164 |

| May | 158 | 162 | 166 |

| June | 160 | 164 | 168 |

| July | 162 | 166 | 170 |

| August | 164 | 168 | 172 |

| September | 166 | 170 | 174 |

| October | 168 | 172 | 176 |

| November | 170 | 174 | 178 |

| December | 164.05 | 168.74 | 195.57 |

Ethereum Classic Price Prediction 2029

According to predictions and technical analysis, in 2029, the minimum price of Ethereum Classic is expected to be $236.77. The maximum price could reach $282.47, with an average of $245.21.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 210 | 215 | 220 |

| February | 215 | 220 | 225 |

| March | 220 | 225 | 230 |

| April | 225 | 230 | 235 |

| May | 230 | 235 | 240 |

| June | 232 | 237 | 242 |

| July | 234 | 239 | 244 |

| August | 236 | 241 | 246 |

| September | 238 | 243 | 248 |

| October | 240 | 245 | 250 |

| November | 235 | 240 | 270 |

| December | 236.77 | 245.21 | 282.47 |

Ethereum Classic (ETC) Price Prediction 2030

In 2030, the price of Ethereum Classic is predicted to start at a minimum of $360.53. It could soar to a maximum of $424.06, with the average throughout the year being $370.34.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 320 | 330 | 340 |

| February | 330 | 340 | 350 |

| March | 340 | 350 | 360 |

| April | 350 | 360 | 370 |

| May | 360 | 370 | 380 |

| June | 365 | 375 | 385 |

| July | 370 | 380 | 390 |

| August | 375 | 385 | 395 |

| September | 380 | 390 | 400 |

| October | 385 | 395 | 405 |

| November | 355 | 365 | 405 |

| December | 360.53 | 370.34 | 424.06 |

Ethereum Classic Price Forecast 2031

In 2031, the price of one Ethereum Classic is expected to be no less than $535.48. It could rise to a maximum of $631.71, with an average price of $554.00 for the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 480 | 490 | 500 |

| February | 490 | 500 | 510 |

| March | 500 | 510 | 520 |

| April | 510 | 520 | 530 |

| May | 520 | 530 | 540 |

| June | 525 | 535 | 545 |

| July | 530 | 540 | 550 |

| August | 535 | 545 | 555 |

| September | 540 | 550 | 560 |

| October | 545 | 555 | 565 |

| November | 530 | 540 | 580 |

| December | 535.48 | 554 | 631.71 |

Ethereum Classic (ETC) Price Prediction 2032

As per the forecast and analysis, in 2032, the price of Ethereum Classic is expected to be at least $798.60. It could reach a high of $922.23, with an average trading price of $820.76.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 700 | 720 | 740 |

| February | 720 | 740 | 760 |

| March | 740 | 760 | 780 |

| April | 760 | 780 | 800 |

| May | 780 | 800 | 820 |

| June | 790 | 810 | 830 |

| July | 795 | 815 | 835 |

| August | 798 | 818 | 838 |

| September | 800 | 820 | 840 |

| October | 805 | 825 | 845 |

| November | 790 | 810 | 850 |

| December | 798.6 | 820.76 | 922.23 |

Ethereum Classic Price Prediction 2033

In 2033, Ethereum Classic’s price is forecasted to reach at least $1,151. It could rise to a maximum of $1,333, with an average price expected to be around $1,192.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 1,000.00 | 1,040.00 | 1,080.00 |

| February | 1,020.00 | 1,060.00 | 1,100.00 |

| March | 1,040.00 | 1,080.00 | 1,120.00 |

| April | 1,060.00 | 1,100.00 | 1,140.00 |

| May | 1,080.00 | 1,120.00 | 1,160.00 |

| June | 1,100.00 | 1,140.00 | 1,180.00 |

| July | 1,120.00 | 1,160.00 | 1,200.00 |

| August | 1,140.00 | 1,180.00 | 1,220.00 |

| September | 1,150.00 | 1,190.00 | 1,240.00 |

| October | 1,160.00 | 1,200.00 | 1,260.00 |

| November | 1,140.00 | 1,180.00 | 1,280.00 |

| December | 1,151.00 | 1,192.00 | 1,333.00 |

ETC Price Forecast: By Experts

According to Coincodex’s current Ethereum Classic price prediction, the price of Ethereum Classic is expected to increase by 63.11% and reach $47.20 by July 4, 2024. Coincodex’s technical indicators suggest that the current market sentiment is neutral, while the Fear & Greed Index indicates a score of 73, pointing to ‘Greed’.

In the past 30 days, Ethereum Classic has experienced 14 green days, which constitutes 47% of the time, with a price volatility of 7.01%. Based on these forecasts, it is considered a favorable time to purchase Ethereum Classic.

Considering the historical price trends of Ethereum Classic and Bitcoin halving cycles, the annual low for Ethereum Classic in 2025 is projected to be $28.94. Conversely, the price of Ethereum Classic is expected to peak at $144.69 in the following year.

According to market analysts and forecasts from Digital Coin Price, by 2026, Ethereum Classic (ETC) is expected to start the year at $86.52 and could average around $103.61, marking a significant increase compared to the previous year. This represents a substantial rise in Ethereum Classic’s value.

Looking further ahead, their price prediction and technical analysis for 2030 estimate that Ethereum Classic will open the year at $215.10 and maintain this level through to the year’s end. Additionally, ETC could reach a high of $198.52 during the year. The period from 2024 to 2030 is anticipated to be crucial for the growth of Ethereum Classic.

Is ETC a Good Investment? When to Buy?

The price of Ethereum Classic is closely linked to Ethereum’s, largely influenced by Ethereum’s price movements. When Ethereum undergoes an upgrade, such as the significant transition away from proof-of-work during The Merge, Ethereum Classic’s price typically reflects these developments. Positive reactions to Ethereum’s upgrades often lead to similar uptrends in Ethereum Classic’s price.

Events like the Bitcoin Halving are known to impact all cryptocurrencies, including Ethereum Classic. This trend is expected to persist during the halving events slated for 2024 and 2028.

Public statements regarding Ethereum Classic also play a crucial role in its market performance. For example, in 2022, during the ETHCC conference, Vitalik Buterin’s endorsement of Ethereum Classic as a viable option for those favoring proof-of-work led to a 20% surge in its price.

Considering the recent approval of spot Ethereum ETFs, we might see a skyrocketing trend in the coming days for ETC price. It is advised to invest in ETC at a price of $25 for a profitable return in the long term.

Ethereum Vs Ethereum Classic

Ethereum and Ethereum Classic represent the two branches of the original Ethereum blockchain before and after the hard fork. The fork occurred following the DAO hack, which led to a loss of $50 million. In response, Ethereum evolved its blockchain technology to address these security concerns and compensate the affected investors. This evolution marked the creation of *ETH* as we know it today, originally founded in late 2013 and significantly developed since.

On the other hand, Ethereum Classic (ETC) emerged in 2016 from a faction that chose to maintain the original blockchain technology without the post-hack modifications. This group resisted the changes, favoring the original, unaltered version of Ethereum, thus continuing under the banner of Ethereum Classic.

Conclusion

The outlook for Ethereum Classic (ETC) appears less promising compared to Ethereum, largely because Ethereum maintains greater popularity across the two networks.

Despite being actively traded on exchanges and mined by the community, ETC has struggled to secure a significant foothold in the market, gradually ceding ground to other prominent cryptocurrencies, including Bitcoin. Nevertheless, Ethereum Classic retains a dedicated group of traders and enthusiasts who support its ongoing presence in the market.

Similar to Ethereum, ETC features a process for improvement proposals. Since its separation from Ethereum through a hard fork, ETC has implemented various upgrades to enhance its system, including efforts to maintain compatibility with the latest developments in Ethereum.

Despite these enhancements, the demand for ETC remains robust, suggesting that it could continue to hold its ground as a competitive force in the cryptocurrency arena.

Frequently Asked Questions

What is Ethereum Classic?

Ethereum Classic (ETC) is a decentralized platform where smart contracts are implemented and several actions are performed on the blockchain, eliminating the need for third-party intermediaries. It originated from a split with Ethereum following a hacking incident.

Why did Ethereum Classic and Ethereum split?

The split occurred due to a philosophical divide after a cyberattack on the DAO. While some believed in reverting the blockchain to bail out investors, others adhered to the principle that "code is law," leading to the creation of Ethereum Classic (ETC).

What are smart contracts in Ethereum Classic?

Smart contracts in Ethereum Classic are self-executing contracts with the terms directly written into code. They facilitate, verify, and enforce the negotiation or performance of a contract automatically.

What consensus algorithm does Ethereum Classic use?

Ethereum Classic uses the Proof of Work (PoW) algorithm to verify transactions and maintain network security.

What was the significance of the DAO hack?

The DAO hack resulted in the loss of 3.6 million ether, leading to a heated debate within the Ethereum community and ultimately the split into Ethereum (ETH) and Ethereum Classic (ETC).

How has Ethereum Classic's price evolved historically?

Since its launch in 2016, Ethereum Classic’s price has experienced significant fluctuations, reaching a peak of $176.16 in 2021 and enduring various market downturns. Its price trends often mirror those of Ethereum.

Predictions for Ethereum Classic’s price suggest a potential increase, with projections indicating it could reach $42.44 in 2024 and up to $1,333 by 2033, depending on market conditions and adoption.

Predictions for Ethereum Classic’s price suggest a potential increase, with projections indicating it could reach $42.44 in 2024 and up to $1,333 by 2033, depending on market conditions and adoption.

What recent developments have impacted Ethereum Classic’s price?

Recent developments like the approval of an ETH ETF and legal issues with major exchanges have influenced Ethereum Classic’s price. The project’s alignment with Ethereum’s updates also plays a role in its market performance.

Is Ethereum Classic a good investment?

Ethereum Classic could be a good investment for those who believe in its principles of immutability and decentralization. Its price often correlates with Ethereum, and upcoming market trends and events could impact its value positively.