- 1. HBAR: A Quick Introduction

- 2. Hedera’s HBAR: Working Module

- 3. HBAR Price Prediction: Price History

- 4. HBAR Price: Technical Analysis

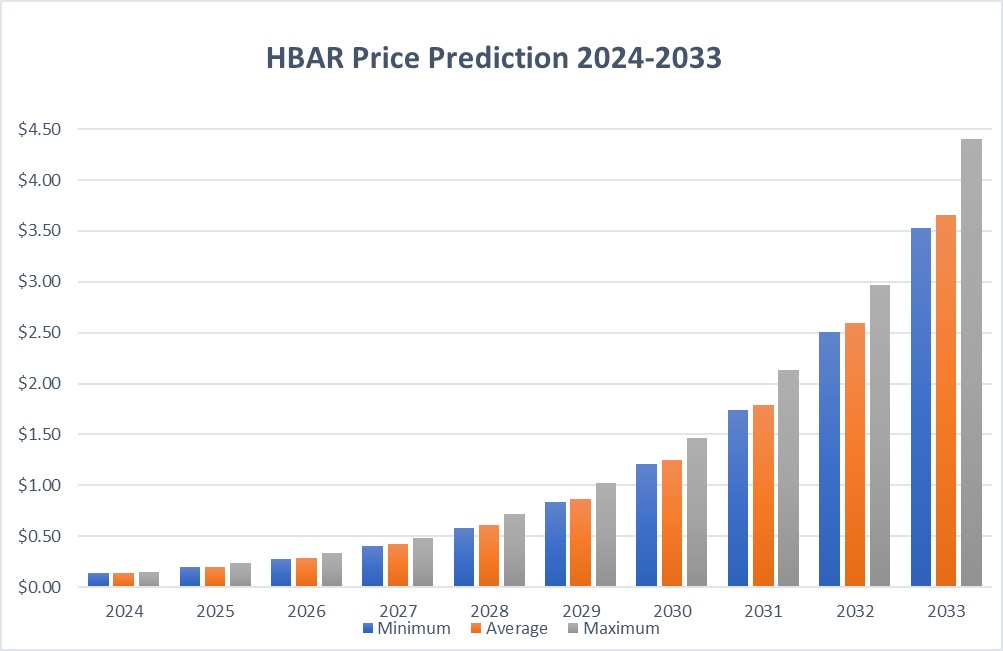

- 5. HBAR Price Prediction By Blockchain Reporter

- 5.0.1. Hedera Price Prediction 2024

- 5.0.2. Hedera Price Prediction 2025

- 5.0.3. HBAR Price Forecast for 2026

- 5.0.4. Hedera (HBAR) Price Prediction 2027

- 5.0.5. Hedera Price Prediction 2028

- 5.0.6. Hedera Price Prediction 2029

- 5.0.7. Hedera (HBAR) Price Prediction 2030

- 5.0.8. Hedera Price Forecast 2031

- 5.0.9. Hedera (HBAR) Price Prediction 2032

- 5.0.10. Hedera Price Prediction 2033

- 6. Hedera Price Forecast: By Experts

- 7. Is HBAR A Good Investment? When To Buy?

- 8. Conclusion

Hedera Hashgraph, commonly known as HBAR, has gained investors’ attention recently. Unlike traditional blockchains, Hedera uses a unique approach called hashgraph. This technology is designed to overcome some of the limitations of older blockchain systems, like *BTC* or *ETH*. The Hedera Hashgraph Foundation represents a solid development in the Internet of Things (IoT) sector. Designed with a focus on overcoming scalability issues, the Hedera Hashgraph network aims to enhance efficiency and empowerment in daily life.

This network addresses key challenges faced by traditional blockchain technology, such as limited data access and high operational costs. Hedera Hashgraph stands out by offering a stable digital currency system that is not prone to inflation or sluggish performance. Moreover, it operates with minimal bandwidth usage.

Hedera’s use of distributed ledger technology (DLT) marks a significant advancement over conventional blockchain solutions. It provides comprehensive solutions to problems that have been unresolved in the blockchain space. The foundation of the Hedera ecosystem, and its native token, HBAR, is rooted in this innovative DLT approach. In terms of governance, Hedera stands out too. It is governed by a council of diverse organizations, which includes big names from various industries. This council ensures that the network is not controlled by a single entity, promoting fairness and stability.

Over the last few weeks, the HBAR token witnessed a robust comeback in its trend as it broke above multiple resistance lines, surging to new monthly highs. However, as the price faces bearish pressure, there are concerns of a decline. In this article, we’ll explore HBAR price prediction with current market sentiment and technical analysis.

HBAR: A Quick Introduction

HBAR, the cryptocurrency of Hedera Hashgraph, was launched in 2018 by co-founders Dr. Leemon Baird, the former chief scientist and CEO of Mance Harmon. This innovative crypto concept stands out for its potential speed advantages.

The core technology behind HBAR, as explained on the company’s website, is highly efficient. It boasts a capability of processing over 10,000 transactions per second, due to its unique ‘gossip about gossip’ protocol and virtual voting, ensuring swift and irreversible transactions that are publicly recorded.

Hedera’s whitepaper highlights its governance structure, which is overseen by a diverse council of global enterprises from various industries and locations. This governance aims to create a secure and trustworthy online environment free from the control of any centralized authority. The approach also prevents network forks, maintains the integrity of the code, and ensures transparency by allowing public access to the software code.

Decentralized governance is a key aspect of the Hedera network, which is managed by the Hedera Governing Council. This council consists of members with limited terms, rotating in to ensure equal voting rights on crucial platform decisions.

Essential to any crypto network is its native token, and in Hedera’s case, it’s the aptly named Hedera cryptocurrency, or HBAR. Holders of HBAR can execute transactions within the Hedera network, leveraging the unique benefits and governance structure of this advanced blockchain alternative.

Hedera’s HBAR: Working Module

HBAR serves dual purposes within its blockchain system. Firstly, it acts as a medium to facilitate various services such as conducting transactions, storing files, and running smart contracts. Secondly, HBAR plays a crucial role in strengthening the security of the blockchain network. This is achieved through a process called staking, where HBAR holders commit their tokens to support and uphold the stability and integrity of the blockchain platform.

In the Hedera network, decentralized consensus places the power of validation in the hands of its users. This network operates on a unique ledger system, utilizing a directed acyclic graph to implement an asynchronous Byzantine Fault-Tolerant (aBFT) consensus algorithm. Within this framework, the authorized ledger is exclusively Hedera Hashgraph.

Contrary to some blockchain models, HBAR does not facilitate smart contracts. Instead, it employs a Byzantine Fault-Tolerant (BFT) consensus mechanism. This system incorporates various nodes, including Validator nodes, Witness nodes, Accelerator nodes, and others. These nodes collectively contribute to the processes of transaction handling, validation, and authentication at different stages.

The HBAR blockchain offers a robust and flexible platform, enabling the trading of other virtual tokens. It also supports a range of payment methods, including credit and debit cards, cryptocurrencies, and mobile app transactions. This versatility positions the HBAR foundation as an ideal environment for the development of decentralized applications (dApps) on a global scale. The platform’s features, such as controlled mutability and time-based file expiry, further enhance its appeal for dApp development.

Uniqueness Of HBAR

Hedera Hashgraph stands out with its capacity to process over 10,000 transactions per second, significantly surpassing the transaction capabilities of established blockchains like Bitcoin and Ethereum. While transactions on Bitcoin and Ethereum can take anywhere from 10 to 60 minutes to confirm, Hedera Hashgraph achieves this in just 3-5 seconds.

In terms of transaction costs, Hedera Hashgraph is remarkably economical compared to many blockchain networks. The average fee for a transaction on Hedera is just $0.0001, whereas a single transaction on the Bitcoin blockchain can cost as much as $22.57.

Hedera Hashgraph also boasts several key features that make it an attractive blockchain platform for its users, including:

- Smart contract functionality, enabling developers to create sophisticated decentralized applications (DApps).

- The ability to mint both fungible and non-fungible tokens (NFTs) for use in DApps was developed on the Hedera Hashgraph platform.

- Implementation of a Proof of Stake (PoS) consensus algorithm, which not only secures the network but also offers HBAR holders the opportunity to earn passive income through staking their tokens.

- A decentralized file storage system that incorporates features such as controlled mutability, time-based file expiry, and proof-of-deletion, enhancing the platform’s functionality and user experience.

HBAR Price Prediction: Price History

Understanding HBAR’s historical price trends can provide valuable insights for both formulating and evaluating future Hedera price forecasts, although it’s important to remember that past performance is not a reliable indicator of future results.

From its inception until the beginning of 2021, the price of Hedera’s coin fluctuated between $0.01 and $0.08. In 2021, HBAR’s value saw a notable increase, starting the year at $0.03181. This growth was part of a broader upswing in the cryptocurrency market, culminating in a peak value of $0.4495 on March 15. However, following this high, the price of HBAR started to decline in April, mirroring a downturn in the broader crypto markets. It eventually reached a low point of $0.1559 on July 21, 2021.

HBAR experienced significant volatility in its value over a period extending from August 2021 to March 2023. Initially, the interest in NFTs contributed to its growth, pushing its value to $0.30 in early September 2021 and then to an all-time high of $0.5701 on September 16, 2021. This surge coincided with the Hedera Governing Council’s decision to allocate 20% of HBAR’s supply (10.7 billion coins valued at $5bn) for the development of the Hedera ecosystem. The HBAR Foundation, led by Shayne Higdon, was established with an initial allocation of 5.35 billion HBAR coins (worth about $2.5bn).

However, by 21 September, HBAR’s value dropped to $0.2918, then rose again to $0.4768 on November 12, 2021, before ending the year at $0.2905. It reached $0.3396 on January 5, 2022, but closed at $0.2883 and struggled to surpass $0.30 afterward. The price further declined to $0.1927 on April 11 and fell below $0.10 in May due to market turmoil caused by the UST stablecoin depegging and the collapse of LUNA, hitting a low of $0.07503 on May 12.

Despite some recovery, the bear market was confirmed with the Celsius Network’s withdrawal cancellation, leading HBAR to a low of $0.05867 on June 18. The anticipation of its listing on Coinbase saw a brief price increase to $0.07393 on September 12, but it fell again to $0.05597 by October 3. After Coinbase listed HBAR on October 13, its value reached $0.06677, slightly down from the previous day’s high.

HBAR remained around $0.06 until the collapse of the FTX exchange in late 2022, which resulted in a year-end price of $0.03643, marking an annual loss of over 87%. The new year brought a mild recovery, with HBAR trading at $0.09839 on February 12, its highest since May, but it dropped to $0.05458 following the collapse of Silvergate Bank.

However, in recent weeks of 2024, HBAR price witnessed renewed buying interest as it experienced increasing buying pressure due to Bitcoin’s surge toward $70K.

HBAR Price: Technical Analysis

HBAR price rebounded from the $0.072 support level, showing strong buying interest from the bulls. Despite the bears’ efforts to halt the recovery at the 20-day EMA ($0.077), the bulls successfully broke through this resistance. However, the price is struggling around the descending uptrend line, resulting in strong rejection. As of writing, HBAR price trades at $0.079, surging over 4.4% in the last 24 hours.

The 20-day EMA is starting to level off, and the RSI has moved into positive territory, signaling a weakening of bearish momentum. If the bulls manage to keep the price above the 50-day SMA ($0.0823) and break above the descending trend line, the HBAR/USDT pair might climb to $0.095.

On the other hand, if the price declines from the 50-day SMA and falls below the immediate EMA trend lines, it would indicate that the bears are capitalizing on slight increases. This could lead the pair to revisit the critical support at $0.072.

HBAR Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 0.1343 | 0.1385 | 0.1501 |

| 2025 | 0.1957 | 0.2013 | 0.2329 |

| 2026 | 0.2713 | 0.2813 | 0.3378 |

| 2027 | 0.4067 | 0.4208 | 0.4789 |

| 2028 | 0.5844 | 0.6055 | 0.7181 |

| 2029 | 0.8326 | 0.8629 | 1.02 |

| 2030 | 1.21 | 1.25 | 1.47 |

| 2031 | 1.74 | 1.79 | 2.13 |

| 2032 | 2.51 | 2.6 | 2.97 |

| 2033 | 3.53 | 3.66 | 4.4 |

Hedera Price Prediction 2024

2024 might be a pivotal year for Hedera, shaped by various internal developments and wider market movements. Its emphasis on enhancing its technical framework and the general market’s recovery are major factors for its possible price rise.

Hedera is working to modularize its services, which means breaking them down into simpler, more manageable parts. This should make development, problem-solving, and updates easier. This approach could lead to smoother network operations and attract developers looking for an easy-to-use platform.

Additionally, Hedera is upgrading its network infrastructure to boost reliability and robustness. These upgrades demonstrate a strong commitment to maintaining a stable network, an important aspect for businesses considering using the platform.

The estimated minimum price of Hedera for 2024 stands at $0.1343. According to our analysis, the highest price could touch $0.1501, with the average price likely hovering around $0.1385.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.1276 | 0.1316 | 0.1426 |

| February | 0.1282 | 0.1322 | 0.1433 |

| March | 0.1288 | 0.1328 | 0.144 |

| April | 0.1294 | 0.1335 | 0.1446 |

| May | 0.13 | 0.1341 | 0.1453 |

| June | 0.1306 | 0.1347 | 0.146 |

| July | 0.1312 | 0.1354 | 0.1467 |

| August | 0.1319 | 0.136 | 0.1474 |

| September | 0.1325 | 0.1366 | 0.1481 |

| October | 0.1331 | 0.1372 | 0.1487 |

| November | 0.1337 | 0.1379 | 0.1494 |

| December | 0.1343 | 0.1385 | 0.1501 |

Hedera Price Prediction 2025

As we move into 2025, Hedera’s prospects look promising with upcoming network enhancements and developments.

Hedera aims to push further towards greater decentralization. They plan to set up permissioned, community-managed mainnet nodes. This step will spread out the network’s control more widely and build greater trust among users and developers, possibly leading to increased engagement and adoption.

Another significant update involves allowing Hedera mirror nodes to show verified source code for the smart contracts they deploy. This kind of transparency is crucial for security, boosting confidence among developers and users by ensuring a safer platform for both developing and using applications. By allowing developers to monitor, troubleshoot, and refine deployed smart contracts, Hedera can create a more inviting environment for developers. This improvement could attract more and better-quality applications to Hedera, further encouraging its use and growth.

With these strategic enhancements likely enhancing Hedera’s network, HBAR could attract more interest from investors.

For 2025, the expected minimum price of Hedera is $0.1957. Our analysis suggests the price could peak at $0.2329, with an average value of $0.2013.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.1859 | 0.1912 | 0.2213 |

| February | 0.1868 | 0.1921 | 0.2223 |

| March | 0.1877 | 0.1931 | 0.2234 |

| April | 0.1886 | 0.194 | 0.2244 |

| May | 0.1895 | 0.1949 | 0.2255 |

| June | 0.1904 | 0.1958 | 0.2265 |

| July | 0.1913 | 0.1967 | 0.2276 |

| August | 0.1921 | 0.1976 | 0.2287 |

| September | 0.193 | 0.1986 | 0.2297 |

| October | 0.1939 | 0.1995 | 0.2308 |

| November | 0.1948 | 0.2004 | 0.2318 |

| December | 0.1957 | 0.2013 | 0.2329 |

HBAR Price Forecast for 2026

Based on technical analysis, the minimum price of Hedera in 2026 is expected to be $0.2713. The price could escalate to a maximum of $0.3378, with the mean trading price at $0.2813.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.2577 | 0.2672 | 0.3209 |

| February | 0.259 | 0.2685 | 0.3224 |

| March | 0.2602 | 0.2698 | 0.324 |

| April | 0.2614 | 0.2711 | 0.3255 |

| May | 0.2627 | 0.2723 | 0.3271 |

| June | 0.2639 | 0.2736 | 0.3286 |

| July | 0.2651 | 0.2749 | 0.3301 |

| August | 0.2664 | 0.2762 | 0.3317 |

| September | 0.2676 | 0.2775 | 0.3332 |

| October | 0.2688 | 0.2787 | 0.3347 |

| November | 0.2701 | 0.28 | 0.3363 |

| December | 0.2713 | 0.2813 | 0.3378 |

Hedera (HBAR) Price Prediction 2027

Our comprehensive technical analysis indicates that in 2027, Hedera’s price could start at $0.4067 and might climb to a maximum of $0.4789. The expected average trading price is $0.4208.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.3864 | 0.3998 | 0.455 |

| February | 0.3882 | 0.4017 | 0.4571 |

| March | 0.3901 | 0.4036 | 0.4593 |

| April | 0.3919 | 0.4055 | 0.4615 |

| May | 0.3938 | 0.4074 | 0.4637 |

| June | 0.3956 | 0.4093 | 0.4658 |

| July | 0.3975 | 0.4112 | 0.468 |

| August | 0.3993 | 0.4131 | 0.4702 |

| September | 0.4012 | 0.4151 | 0.4724 |

| October | 0.403 | 0.417 | 0.4745 |

| November | 0.4049 | 0.4189 | 0.4767 |

| December | 0.4067 | 0.4208 | 0.4789 |

Hedera Price Prediction 2028

It is predicted that the minimum price of Hedera in 2028 could be $0.5844, potentially rising to a maximum of $0.7181. The projected average price throughout the year is expected to be $0.6055.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.5552 | 0.5752 | 0.6822 |

| February | 0.5578 | 0.578 | 0.6855 |

| March | 0.5605 | 0.5807 | 0.6887 |

| April | 0.5631 | 0.5835 | 0.692 |

| May | 0.5658 | 0.5862 | 0.6953 |

| June | 0.5685 | 0.589 | 0.6985 |

| July | 0.5711 | 0.5917 | 0.7018 |

| August | 0.5738 | 0.5945 | 0.705 |

| September | 0.5764 | 0.5972 | 0.7083 |

| October | 0.5791 | 0.6 | 0.7116 |

| November | 0.5817 | 0.6027 | 0.7148 |

| December | 0.5844 | 0.6055 | 0.7181 |

Hedera Price Prediction 2029

Following in-depth analysis, we foresee the minimum price of Hedera in 2029 to be approximately $0.8326. The maximum price could reach $1.02, with an average trading price of $0.8629.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.791 | 0.8198 | 0.969 |

| February | 0.7948 | 0.8237 | 0.9736 |

| March | 0.7985 | 0.8276 | 0.9783 |

| April | 0.8023 | 0.8315 | 0.9829 |

| May | 0.8061 | 0.8354 | 0.9875 |

| June | 0.8099 | 0.8394 | 0.9922 |

| July | 0.8137 | 0.8433 | 0.9968 |

| August | 0.8175 | 0.8472 | 1.0015 |

| September | 0.8212 | 0.8511 | 1.0061 |

| October | 0.825 | 0.8551 | 1.0107 |

| November | 0.8288 | 0.859 | 1.0154 |

| December | 0.8326 | 0.8629 | 1.02 |

Hedera (HBAR) Price Prediction 2030

In 2030, the minimum forecasted price of Hedera is $1.21, while the maximum could go up to $1.47. The average trading price for the year is anticipated to be $1.25.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 1.1495 | 1.1875 | 1.3965 |

| February | 1.155 | 1.1932 | 1.4032 |

| March | 1.1605 | 1.1989 | 1.4099 |

| April | 1.166 | 1.2045 | 1.4165 |

| May | 1.1715 | 1.2102 | 1.4232 |

| June | 1.177 | 1.2159 | 1.4299 |

| July | 1.1825 | 1.2216 | 1.4366 |

| August | 1.188 | 1.2273 | 1.4433 |

| September | 1.1935 | 1.233 | 1.45 |

| October | 1.199 | 1.2386 | 1.4566 |

| November | 1.2045 | 1.2443 | 1.4633 |

| December | 1.21 | 1.25 | 1.47 |

Hedera Price Forecast 2031

For 2031, the minimum expected price of Hedera is $1.74, with a potential maximum reaching $2.13. The average price is predicted to stabilize around $1.79.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 1.653 | 1.7005 | 2.0235 |

| February | 1.6609 | 1.7086 | 2.0332 |

| March | 1.6688 | 1.7168 | 2.0429 |

| April | 1.6767 | 1.7249 | 2.0525 |

| May | 1.6846 | 1.733 | 2.0622 |

| June | 1.6925 | 1.7412 | 2.0719 |

| July | 1.7005 | 1.7493 | 2.0816 |

| August | 1.7084 | 1.7575 | 2.0913 |

| September | 1.7163 | 1.7656 | 2.101 |

| October | 1.7242 | 1.7737 | 2.1106 |

| November | 1.7321 | 1.7819 | 2.1203 |

| December | 1.74 | 1.79 | 2.13 |

Hedera (HBAR) Price Prediction 2032

The minimum price level for Hedera in 2032 is projected at $2.51, and it might reach a maximum of $2.97. The average trading price is anticipated to be around $2.60.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 2.3845 | 2.47 | 2.8215 |

| February | 2.3959 | 2.4818 | 2.835 |

| March | 2.4073 | 2.4936 | 2.8485 |

| April | 2.4187 | 2.5055 | 2.862 |

| May | 2.4301 | 2.5173 | 2.8755 |

| June | 2.4415 | 2.5291 | 2.889 |

| July | 2.453 | 2.5409 | 2.9025 |

| August | 2.4644 | 2.5527 | 2.916 |

| September | 2.4758 | 2.5645 | 2.9295 |

| October | 2.4872 | 2.5764 | 2.943 |

| November | 2.4986 | 2.5882 | 2.9565 |

| December | 2.51 | 2.6 | 2.97 |

Hedera Price Prediction 2033

In 2033, according to forecast and technical analysis, the minimum price of Hedera might reach $3.53, while the maximum could ascend to $4.40. The average expected trading price is projected at $3.66.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 3.3535 | 3.477 | 4.18 |

| February | 3.3695 | 3.4936 | 4.2 |

| March | 3.3856 | 3.5103 | 4.22 |

| April | 3.4016 | 3.5269 | 4.24 |

| May | 3.4177 | 3.5435 | 4.26 |

| June | 3.4337 | 3.5602 | 4.28 |

| July | 3.4498 | 3.5768 | 4.3 |

| August | 3.4658 | 3.5935 | 4.32 |

| September | 3.4819 | 3.6101 | 4.34 |

| October | 3.4979 | 3.6267 | 4.36 |

| November | 3.514 | 3.6434 | 4.38 |

| December | 3.53 | 3.66 | 4.4 |

Hedera Price Forecast: By Experts

According to Coincodex, the current price prediction for Hedera Hashgraph indicates a rise of 37.69%, with the price expected to reach $0.107215 by July 19, 2024. Technical indicators suggest a Bearish current sentiment, while the Fear & Greed Index displays a score of 64, indicating Greed. Over the past 30 days, Hedera Hashgraph has seen 9 out of 30 green days, with a price volatility of 10.26%. Coincodex’s forecast suggests that it is currently not an ideal time to purchase Hedera Hashgraph. Drawing on historical price data and Bitcoin halving cycles, the forecast for 2025 predicts a yearly low for Hedera Hashgraph at $0.077614, while the price could climb as high as $0.369321 in the next year.

According to market analysts and experts, by 2026, HBAR is expected to begin the year at $0.24 and hover around $0.29. Digital Coin Price suggests that this would represent a significant increase from the previous year, marking an appreciable rise for Hedera. As the year 2030 approaches, price predictions and technical analysis indicate that the cost of Hedera will open at $0.58, maintaining this level through to the year’s end. Furthermore, HBAR could potentially peak at $0.54 within the same period. The span from 2024 to 2030 is anticipated to be a critical phase for Hedera’s growth.

Is HBAR A Good Investment? When To Buy?

Indeed! Based on the HBAR price prediction, it is considered a promising investment. Being a major player in blockchain scalability, Hedera coin has gained attention among many crypto market enthusiasts regarding its future price potential. An investment near $0.05 might turn profitable in the long term.

Conclusion

The HBAR team has recently introduced smart contract verification in their ecosystem. This addition aims to enhance trust and transparency by allowing for the evaluation of smart contracts.

Hedera Hashgraph has been doing really well lately. From what’s been happening with it, it seems like its value is going to go up. Our prediction is that its price will rise, and in the long run, it could reach $2.49 by 2032. We’re pretty optimistic about this cryptocurrency, but you should still do your own research before you decide to invest in it. Remember, Hedera is a good crypto option with some cool tech behind it, but like all cryptocurrencies, its price can go up and down a lot.

Frequently Asked Questions

What is HBAR and how does it work?

HBAR is the native cryptocurrency of the Hedera Hashgraph network, a public network that extends beyond traditional blockchain by using hashgraph technology to improve speed, cost, and scalability. It supports transactions, file storage, and smart contracts, leveraging a unique consensus mechanism for validation and security.

How does Hedera Hashgraph differ from traditional blockchains?

Unlike traditional blockchains, Hedera Hashgraph uses a hashgraph consensus mechanism, allowing for faster transaction speeds (over 10,000 transactions per second) and lower costs, while preventing network forks and ensuring decentralized governance through the Hedera Governing Council.

What are the main features of Hedera Hashgraph?

Hedera boasts high transaction speeds, low fees, smart contract functionality, the ability to create NFTs, a Proof of Stake (PoS) consensus for network security and passive income through staking, and decentralized file storage with enhanced features like controlled mutability.

What was HBAR's price history and trend?

Since its launch, HBAR's price experienced significant volatility, with notable increases in 2021 and fluctuations influenced by broader market trends. Despite periods of decline, there has been renewed interest in HBAR, particularly with Bitcoin's recent price movements.

How does Hedera aim to enhance the IoT sector?

Hedera Hashgraph is designed to address scalability and efficiency challenges in the IoT sector, providing a stable, efficient platform for transactions and data management without the high costs and slow performance of traditional blockchains.

Is HBAR a good investment?

Based on current predictions and its technological foundation, HBAR is considered a promising investment for its potential to address blockchain scalability and efficiency. However, potential investors are advised to conduct their own research due to the volatile nature of cryptocurrency markets.