- 1. XLM: A Quick Introduction

- 2. XLM: How Does It Work?

- 3. XLM Price Prediction: Price History

- 4. XLM Price Prediction: Technical Analysis

- 5. XLM Price Prediction By Blockchain Reporter

- 5.1. Stellar Price Prediction 2024

- 5.2. Stellar Price Prediction 2025

- 5.3. Stellar Price Prediction 2026

- 5.4. Stellar Price Prediction 2027

- 5.5. Stellar Price Prediction 2028

- 5.6. Stellar Price Prediction 2029

- 5.7. Stellar Price Prediction 2030

- 5.8. Stellar Price Prediction 2031

- 5.9. Stellar Price Prediction 2032

- 5.10. Stellar Price Prediction 2033

- 6. XLM Price Prediction: By Experts

- 7. Is Stellar a Good Investment?

- 8. Conclusion

Sometimes you might hear “Stellar Lumens” when referring to Stellar, but this is a misconception. Stellar is the network, and Lumens are its cryptocurrency units. Stellar is a decentralized peer-to-peer network, and Lumens (XLM) are the tokens that fuel its operations. Stellar’s design allows users to transfer various assets—from conventional currencies to tokens representing new and existing assets (like dollars, euros, bitcoin, stocks, gold, and other valuable tokens). These assets can be exchanged with less friction using Lumens. For users, Stellar offers several applications and third-party services, known as network anchors, that facilitate easy fund transfers to others, regardless of location. It also provides a means to acquire digital versions of various currencies, an advantageous feature particularly for those in countries with weak national currencies who wish to hold savings in a different currency. As an open-source platform, Stellar’s infrastructure is open for anyone to utilize and expand upon. Companies can build their own blockchain wallets, apps, or crypto tokens using Stellar. They can also leverage the Stellar network for payments and for converting digital currencies to cash, and vice versa. Additionally, the Stellar Development Foundation has recently expanded support for Stellar, promoting its use for NFT minting and smart contracts. In this article, we’ll explore XLM price prediction with an in-depth analysis of the current market sentiment and future XLM price forecasts.

XLM: A Quick Introduction

Launched in 2014, Stellar (XLM) is a decentralized platform designed to streamline cross-border transactions and promote financial inclusivity. Co-founded by Jed McCaleb, also a co-founder of Ripple, and Joyce Kim, Stellar aims to connect banks, payment systems, and individuals globally through its decentralized protocol. The platform focuses on delivering efficient and affordable financial services, especially to the unbanked and underbanked communities.

Jed McCaleb, who also played pivotal roles in Ripple (XRP) and Mt. Gox, co-founded Stellar with the goal of overcoming the shortcomings of the traditional financial system by enabling fast, low-cost international transactions. To steer the development and encourage the adoption of Stellar worldwide, the Stellar Development Foundation (SDF) was established.

Since its inception, Stellar has grown into a comprehensive network that supports a wide array of applications beyond basic peer-to-peer transactions, demonstrating its versatility and broad utility in the digital finance space.

Stellar’s development has seen pivotal achievements that have significantly influenced its growth and broader acceptance. These milestones include:

- Introduction of the Stellar Consensus Protocol (SCP): Stellar deployed the SCP, a federated Byzantine agreement (FBA) consensus mechanism. This method ensures quick and secure transaction validation, eliminating the need for mining.

- Launch of Stellar Lumens (XLM): Stellar Lumens (XLM) is the native cryptocurrency of the Stellar network, designed to facilitate transactions and serve as a mediator among various currencies. Its launch was intended to simplify the process of transferring value across the Stellar network.

- Expansion of Use Cases: Stellar has extended its functionality beyond mere cross-border payments to include the tokenization of assets, decentralized exchanges, and micropayments. These developments highlight Stellar’s adaptability and its potential to transform various facets of the financial sector.

XLM: How Does It Work?

Stellar operates as a decentralized network comprising a series of independent servers on the blockchain. Each node in this network is linked to others yet operates without oversight from any central authority. The network achieves transaction consensus by synchronizing across these nodes, thereby allowing for a broadly and evenly distributed ledger. Anyone can participate as a verification node in this system by utilizing the Stellar Core and adhering to the Stellar Consensus Protocol (SCP).

The Stellar Consensus Protocol (SCP) is the mechanism Stellar uses to validate transactions. It enables the network to scale more efficiently and rapidly than many traditional proof-of-work blockchains, like *BTC*. Stellar’s network architecture is also potentially more decentralized due to a unique feature known as “anchors.”

Anchors are trusted entities responsible for holding deposits and issuing credits on the blockchain. They serve as vital links between various digital assets and the Stellar blockchain, facilitating the smooth transfer of value across different financial systems.

Adoption and Partnerships

Stellar has seen increasing recognition and adoption across various sectors, enhancing its role within the global financial ecosystem. Notable highlights include:

- Financial Inclusion Initiatives: Stellar is committed to enhancing financial access for underserved communities. This commitment is evident in partnerships with organizations focused on financial inclusion, supported by initiatives like the Stellar Development Fund which targets projects in emerging markets.

- Integration with Remittance Services: Due to its efficient and cost-effective transaction capabilities, Stellar is becoming a favored choice for remittance services that aim to lower costs and accelerate transaction speeds. Integrations with these services allow users worldwide to send and receive money with minimal fees.

- Exploration of Central Bank Digital Currencies (CBDCs): As central banks and governments delve into blockchain technology for issuing digital currencies, Stellar’s scalable and interoperable platform makes it a strong candidate for CBDC initiatives. This role involves fostering collaborations with regulatory authorities and policymakers.

XLM Price Prediction: Price History

Let’s examine some important dates in Stellar’s price history. While it’s crucial to remember that past performance is not a reliable indicator of future results, understanding the historical performance of the coin can provide valuable context for making or assessing a Stellar price prediction.

- Initial Launch: Jade MacCaleb established XLM in 2014 and subsequently founded the Stellar Development Foundation (SDF) to manage the token’s operations. The foundation successfully raised $35 million through an initial token sale.

- First Token Supply: At its inception, 100 million XLM tokens were issued, initially featuring a 1% annual inflation rate which was later eliminated.

- 2017 Bull Run: From 2014 to 2017, XLM traded below $0.001. During the global cryptocurrency market boom in 2017, XLM reached a peak value of $0.86.

- Post-Bull Market Decline: Following the 2017 surge, XLM’s value significantly declined, settling at around $0.03 by the end of 2018.

- Recovery Efforts: In 2019, nearly half of XLM’s total supply was burned, reducing the circulating supply to 50 million tokens, which led to a 14% increase in its value.

- 2021 Surge: XLM experienced a notable rally in May 2021, where it reached $0.73, marking the highest value post-2017 peak.

- Trends for 2022 and 2023: Throughout 2022 and 2023, XLM saw a period of price stagnation, with values oscillating between $0.10 and $0.20. This trend is expected to persist through the end of 2024.

2024 has been a year of fluctuations for Stellar, with the token experiencing varying degrees of volatility in recent months. Our comprehensive technical analysis of the token’s performance could provide insights that support the earlier price predictions. Here’s a closer look:

Stellar started 2024 trading at approximately $0.1216. In the first quarter, the token showed resilience, breaking past its previous highest resistance level of $0.1422 by early March. However, this peak was followed by a period of stagnation, with XLM struggling to exceed this high point again, leading to a downturn as April approached.

By mid-April, the token’s price had decreased, stabilizing above $0.1108. This level persisted until late May, followed by a further decline below its lowest support level at $0.0928 by June.

In July, a modest recovery was observed, with XLM trading at around $0.1024, still below its opening price for the year.

In the following months, the price of XLM declined steeply as it headed toward $0.09 in October.

XLM Price Prediction: Technical Analysis

XLM price has dropped below its 20-day exponential moving average (EMA), with bears maintaining the price around $0.095 support level. Currently trading at $0.095—dpwn over 3.8% in the past 24 hours—bears are now aiming for a drop below the immediate Fibonacci channel.

Sellers are attempting to hold the price below the 20-day EMA. If they succeed, the XLM/USDT pair could decline to the 50-day simple moving average (SMA) at $0.084. The support zone between the 50-day SMA and $0.079 is critical for bulls; a break below this level could lead to a further drop to $0.06.

Conversely, if the price moves above the 20-day EMA, it would suggest that bulls are still in control. In this scenario, the pair could rally to $0.1, a potential resistance level. If bulls break through this resistance, the uptrend could extend to $0.15.

XLM Price Prediction By Blockchain Reporter

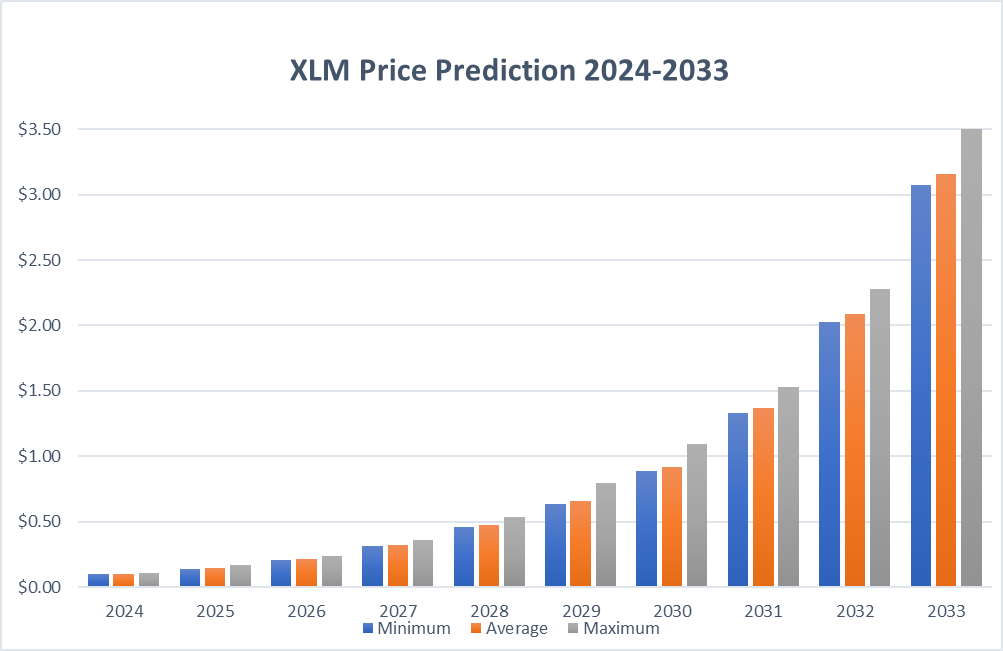

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 0.0966 | 0.1011 | 0.1078 |

| 2025 | 0.1377 | 0.1427 | 0.1708 |

| 2026 | 0.2058 | 0.2115 | 0.2392 |

| 2027 | 0.311 | 0.3194 | 0.3584 |

| 2028 | 0.4573 | 0.4732 | 0.538 |

| 2029 | 0.6314 | 0.655 | 0.7977 |

| 2030 | 0.8892 | 0.9154 | 1.09 |

| 2031 | 1.33 | 1.37 | 1.53 |

| 2032 | 2.03 | 2.09 | 2.28 |

| 2033 | 3.07 | 3.16 | 3.57 |

Stellar Price Prediction 2024

Stellar Lumens’ recent rise coincides with a drop in US consumer inflation. Data from June indicated an annual increase of just 3%, the smallest rise since March 2021.

With lower inflation rates, cryptocurrencies like Stellar may become more attractive to investors as a potential hedge against inflation. This shift could support Stellar’s expansion and bolster its market standing, enhancing its prospects for 2024.

Based on extensive technical analysis of XLM’s historical price data, the expected minimum price of Stellar in 2024 is $0.0966. It may reach a maximum of $0.1078, with an average trading price around $0.1011.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.08694 | 0.09099 | 0.09702 |

| February | 0.08782 | 0.09191 | 0.098 |

| March | 0.0887 | 0.09283 | 0.09898 |

| April | 0.08957 | 0.09375 | 0.09996 |

| May | 0.09045 | 0.09467 | 0.10094 |

| June | 0.09133 | 0.09559 | 0.10192 |

| July | 0.09221 | 0.09651 | 0.1029 |

| August | 0.09309 | 0.09742 | 0.10388 |

| September | 0.09397 | 0.09834 | 0.10486 |

| October | 0.09484 | 0.09926 | 0.10584 |

| November | 0.09572 | 0.10018 | 0.10682 |

| December | 0.0966 | 0.1011 | 0.1078 |

Stellar Price Prediction 2025

A key factor in predicting XLM’s price for 2025 is the evolution and innovation of the Stellar network. To foster growth, Stellar needs to streamline the development process on its platform by either improving existing services or integrating advanced DeFi smart contract protocols. Such adaptability is crucial for enlarging its developer ecosystem and making it more accessible to creators of various scales.

In pursuit of this, Stellar aims to provide a scalable tech stack that promotes widespread adoption and integrates developers into a thriving DeFi landscape. Stellar has identified several strategic initiatives to simplify and amplify innovation:

- Wallet Tools: These are designed to simplify the process for developers to create wallets on the Stellar network, which could significantly enhance the network’s capabilities and potentially elevate XLM’s price.

- Soroban Development: This involves developing an intuitive and scalable smart contract platform that integrates seamlessly with the Stellar network.

- Scaling & Decentralization: This strategy focuses on expanding Stellar’s infrastructure and ecosystem to efficiently handle increased traffic.

In 2025, the price of Stellar is anticipated to achieve a minimum of $0.1377. It could climb to a maximum of $0.1708, with an average price of $0.1427 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.0961 | $0.1062 | $0.1092 |

| February | $0.1033 | $0.1083 | $0.1145 |

| March | $0.1075 | $0.1116 | $0.1200 |

| April | $0.1109 | $0.1149 | $0.1255 |

| May | $0.1143 | $0.1184 | $0.1313 |

| June | $0.1167 | $0.1207 | $0.1360 |

| July | $0.1181 | $0.1231 | $0.1421 |

| August | $0.1216 | $0.1256 | $0.1470 |

| September | $0.1266 | $0.1306 | $0.1520 |

| October | $0.1295 | $0.1346 | $0.1585 |

| November | $0.1335 | $0.1386 | $0.1639 |

| December | $0.1377 | $0.1427 | $0.1708 |

Stellar Price Prediction 2026

Our analysis predicts that Stellar’s price in 2026 will start at a minimum of $0.2058. The maximum price could be $0.2392, with an average value of $0.2115 during the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.1356 | $0.1499 | $0.1542 |

| February | $0.1457 | $0.1529 | $0.1602 |

| March | $0.1502 | $0.1559 | $0.1678 |

| April | $0.1535 | $0.1606 | $0.1740 |

| May | $0.1599 | $0.1670 | $0.1805 |

| June | $0.1663 | $0.1721 | $0.1888 |

| July | $0.1701 | $0.1772 | $0.1974 |

| August | $0.1772 | $0.1843 | $0.2063 |

| September | $0.1841 | $0.1898 | $0.2155 |

| October | $0.1903 | $0.1974 | $0.2231 |

| November | $0.1982 | $0.2053 | $0.2310 |

| December | $0.2058 | $0.2115 | $0.2392 |

Stellar Price Prediction 2027

For 2027, Stellar’s price is projected to reach a minimum of $0.3110. The maximum price might ascend to $0.3584, with an average price of $0.3194 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.2030 | $0.2221 | $0.2284 |

| February | $0.2204 | $0.2309 | $0.2373 |

| March | $0.2271 | $0.2356 | $0.2465 |

| April | $0.2344 | $0.2450 | $0.2559 |

| May | $0.2418 | $0.2523 | $0.2682 |

| June | $0.2514 | $0.2599 | $0.2783 |

| July | $0.2618 | $0.2703 | $0.2913 |

| August | $0.2705 | $0.2811 | $0.3048 |

| September | $0.2818 | $0.2924 | $0.3160 |

| October | $0.2956 | $0.3040 | $0.3307 |

| November | $0.3026 | $0.3132 | $0.3459 |

| December | $0.3110 | $0.3194 | $0.3584 |

Stellar Price Prediction 2028

The price of Stellar in 2028 is forecasted to be at least $0.4573. It could peak at $0.5380, maintaining an average price of $0.4732 for the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.3067 | $0.3354 | $0.3450 |

| February | $0.3360 | $0.3488 | $0.3618 |

| March | $0.3465 | $0.3593 | $0.3792 |

| April | $0.3609 | $0.3737 | $0.3936 |

| May | $0.3721 | $0.3849 | $0.4085 |

| June | $0.3836 | $0.3964 | $0.4239 |

| July | $0.3955 | $0.4083 | $0.4437 |

| August | $0.4005 | $0.4165 | $0.4641 |

| September | $0.4162 | $0.4290 | $0.4808 |

| October | $0.4216 | $0.4375 | $0.4980 |

| November | $0.4423 | $0.4550 | $0.5198 |

| December | $0.4573 | $0.4732 | $0.5380 |

Stellar Price Prediction 2029

According to forecasts, the price of Stellar in 2029 could be as low as $0.6314 and may rise to a maximum of $0.7977, with an average of $0.6550 across the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.4496 | $0.4969 | $0.5111 |

| February | $0.4879 | $0.5068 | $0.5310 |

| March | $0.5082 | $0.5271 | $0.5563 |

| April | $0.5187 | $0.5377 | $0.5774 |

| May | $0.5295 | $0.5484 | $0.6043 |

| June | $0.5357 | $0.5594 | $0.6317 |

| July | $0.5469 | $0.5706 | $0.6597 |

| August | $0.5640 | $0.5877 | $0.6882 |

| September | $0.5758 | $0.5994 | $0.7176 |

| October | $0.5985 | $0.6174 | $0.7476 |

| November | $0.6123 | $0.6359 | $0.7723 |

| December | $0.6314 | $0.6550 | $0.7977 |

Stellar Price Prediction 2030

In 2030, Stellar is expected to reach a minimum price of $0.8892 and may achieve a maximum of $1.09, with an average trading price around $0.9154.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.6223 | $0.6878 | $0.7074 |

| February | $0.6757 | $0.7084 | $0.7349 |

| March | $0.6898 | $0.7226 | $0.7704 |

| April | $0.7187 | $0.7515 | $0.7993 |

| May | $0.7338 | $0.7665 | $0.8368 |

| June | $0.7710 | $0.7972 | $0.8752 |

| July | $0.7869 | $0.8131 | $0.9070 |

| August | $0.8032 | $0.8294 | $0.9477 |

| September | $0.8198 | $0.8460 | $0.9809 |

| October | $0.8451 | $0.8713 | $1.01 |

| November | $0.8560 | $0.8888 | $1.05 |

| December | $0.8892 | $0.9154 | $1.09 |

Stellar Price Prediction 2031

The price of Stellar in 2031 could hit a low of $1.33 and a high of $1.53, with an average trading price of $1.37 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.8697 | $0.9612 | $0.9887 |

| February | $0.9539 | $0.9997 | $1.04 |

| March | $0.9830 | $1.02 | $1.08 |

| April | $1.00 | $1.05 | $1.13 |

| May | $1.06 | $1.09 | $1.17 |

| June | $1.08 | $1.11 | $1.21 |

| July | $1.12 | $1.16 | $1.26 |

| August | $1.16 | $1.21 | $1.30 |

| September | $1.20 | $1.24 | $1.36 |

| October | $1.24 | $1.28 | $1.41 |

| November | $1.27 | $1.32 | $1.47 |

| December | $1.33 | $1.37 | $1.53 |

Stellar Price Prediction 2032

For 2032, Stellar is predicted to have a minimum price of $2.03 and could reach a maximum of $2.28, averaging $2.09 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $1.30 | $1.44 | $1.48 |

| February | $1.44 | $1.50 | $1.54 |

| March | $1.49 | $1.54 | $1.61 |

| April | $1.52 | $1.59 | $1.67 |

| May | $1.57 | $1.63 | $1.75 |

| June | $1.64 | $1.70 | $1.82 |

| July | $1.71 | $1.77 | $1.89 |

| August | $1.77 | $1.84 | $1.96 |

| September | $1.86 | $1.91 | $2.03 |

| October | $1.90 | $1.95 | $2.11 |

| November | $1.94 | $2.01 | $2.18 |

| December | $2.03 | $2.09 | $2.28 |

Stellar Price Prediction 2033

In 2033, the price of Stellar is forecasted to reach at least $3.07. The price might peak at $3.57, with an average of $3.16 for the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $1.98 | $2.19 | $2.26 |

| February | $2.18 | $2.26 | $2.37 |

| March | $2.22 | $2.33 | $2.48 |

| April | $2.29 | $2.40 | $2.59 |

| May | $2.41 | $2.49 | $2.71 |

| June | $2.44 | $2.54 | $2.81 |

| July | $2.56 | $2.64 | $2.94 |

| August | $2.67 | $2.75 | $3.05 |

| September | $2.78 | $2.86 | $3.18 |

| October | $2.84 | $2.95 | $3.33 |

| November | $2.96 | $3.06 | $3.45 |

| December | $3.07 | $3.16 | $3.57 |

XLM Price Prediction: By Experts

According to Coincodex’s current Stellar price prediction, the price of Stellar is expected to increase by 57.94% and reach $0.152027 by November 24, 2024. Coincodex’s technical indicators suggest a neutral market sentiment, while the Fear & Greed Index indicates a level of 72, showing a state of greed. Over the past 30 days, Stellar has seen 16/30 green days, with a price volatility of 3.31%. According to this forecast, it is considered a good time to buy Stellar.

Within the next five days, Stellar’s price is projected to hit a peak of $0.167839 on October 30, 2024, marking a 74.16% increase from its current price. This uptick comes after a 0.94% price change over the previous week. Projections for November anticipate a continuation of this upward trend, potentially raising the price to $0.175789. The expected price range is set between $0.116531 and $0.257699, reflecting the influence of the past month’s market dynamics. Investors might achieve a potential gain of 167.51% if they purchase XLM at the current rates and sell at the forecasted highs.

According to Digital Coin Price, market analysts and experts forecast that by 2026, XLM will open the year at $0.28 and is expected to trade around $0.34, marking a significant increase from the previous year. This projected rise represents a notable improvement in Stellar’s market value. By the start of 2030, technical analysis and price predictions from Digital Coin Price suggest that Stellar’s price will reach $0.71 at both the beginning and the end of the year, with potential highs up to $0.65 during the year. The period from 2024 to 2030 is anticipated to be a pivotal phase for Stellar’s growth.

Is Stellar a Good Investment?

Stellar has established itself as a mid-sized player in the cryptocurrency market and has consistently occupied the second tier.

The performance of its currency, XLM, has been somewhat lackluster over the past couple of years, and it remains uncertain whether it will leverage new opportunities effectively.

However, Stellar benefits from a solid foundation of developers and investors who continuously work on enhancing the platform.

As is the case with all cryptocurrencies, thorough research is recommended before making any investment decisions regarding XLM.

Conclusion

Stellar’s roadmap highlights several critical objectives and industry trends, underscoring its strategic direction for the near future. The platform is focused on enhancing scalability to manage a larger volume of transactions efficiently, catering to increasing network activity without compromising on speed or security. Furthermore, Stellar is looking to broaden its application spectrum beyond mere payment solutions. It plans to delve into decentralized finance (DeFi), non-fungible tokens (NFTs), and tokenized assets, which could greatly expand its utility and attractiveness to a wider range of users and developers.

In addition, Stellar is proactively engaging with regulators and policymakers to ensure it remains compliant with all applicable laws and regulations. This commitment to regulatory compliance is essential for building trust and facilitating adoption among financial institutions and users alike. Another significant aim for Stellar is to enhance its integration with the traditional financial systems. By improving interoperability with banks, payment processors, and other financial entities, Stellar seeks to enable smoother transitions and exchanges of assets, further bridging the gap between traditional and digital finance.

Stellar’s progress reflects the wider goals of the cryptocurrency community to create a fairer and more effective global financial system. Its focus on low-cost transactions and smooth currency exchanges makes it an important resource for encouraging economic involvement and empowerment.

As Stellar continues to develop, it is set to broaden its features and influence, opening up a future filled with opportunities for innovation and partnership. By participating in Stellar, both individuals and institutions are joining a movement that is transforming finance and technology at their core.

Frequently Asked Questions

What is Stellar and how is it different from Lumens (XLM)?

Stellar is a decentralized peer-to-peer network designed to facilitate asset transfers, while Lumens (XLM) are the tokens that fuel transactions on the Stellar network.

What is the Stellar Consensus Protocol (SCP)?

SCP is Stellar’s consensus mechanism allowing the network to achieve quick and secure transactions without mining. It supports decentralization and prevents double-spending.

What are Stellar’s main use cases?

Stellar enables cross-border payments, asset tokenization, and digital asset exchanges. It is especially useful for remittances and financial services in underbanked regions.

What is Stellar’s role in financial inclusion?

Stellar partners with organizations focused on financial inclusion to facilitate low-cost transactions, helping users in underserved areas access financial services.

How is Stellar involved in Central Bank Digital Currency (CBDC) projects?

Stellar’s scalability and interoperability make it a strong candidate for CBDC initiatives, which aim to digitize national currencies on the blockchain.

What has been XLM’s historical price trend?

Since its launch, XLM has experienced highs and lows, including a peak during the 2017 crypto boom and further gains in 2021, though recent prices have been lower.

What is the current technical analysis for XLM?

Currently, XLM has encountered resistance around $0.095. If it drops below support levels, it could fall further, while a break above resistance could spark a rally.

Is Stellar a good investment?

Stellar has strong fundamentals and a growing network, but as with all cryptocurrencies, thorough research and risk assessment are advised before investing.

What’s next for Stellar in terms of development and partnerships?

Stellar is focusing on scaling, DeFi applications, regulatory compliance, and traditional finance integration, aiming to broaden its reach and utility across various industries.