- 1. Ripple’s XRP: A Quick Introduction

- 2. XRP: Working Module

- 3. Ripple Vs The SEC: Case Status

- 4. XRP Price Prediction: Price History

- 5. XRP Price Prediction: Technical Analysis

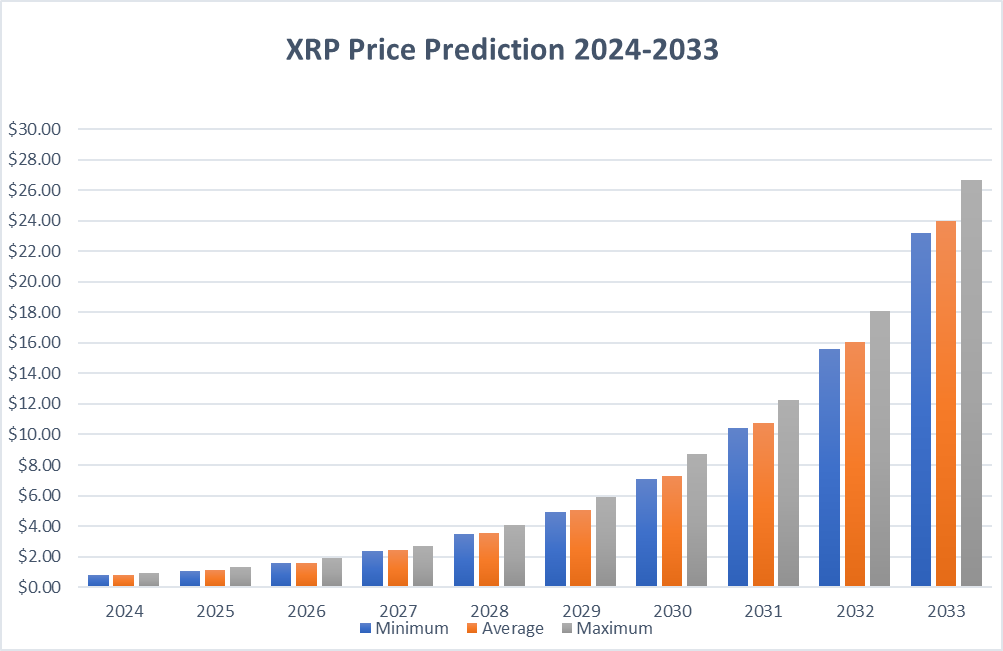

- 6. XRP Price Prediction By Blockchain Reporter

- 6.0.1. XRP Price Prediction 2024

- 6.0.2. XRP Price Prediction 2025

- 6.0.3. XRP Price Forecast for 2026

- 6.0.4. XRP (XRP) Price Prediction 2027

- 6.0.5. XRP Price Prediction 2028

- 6.0.6. XRP Price Prediction 2029

- 6.0.7. XRP (XRP) Price Prediction 2030

- 6.0.8. XRP Price Forecast 2031

- 6.0.9. XRP (XRP) Price Prediction 2032

- 6.0.10. XRP Price Prediction 2033

- 7. XRP Price Forecast: By Experts

- 8. Is XRP A Good Investment? When To Buy?

- 9. Hype Around XRP ETF

- 10. Conclusion

The cryptocurrency XRP, developed by Ripple, recently made headlines following a decision by New York Judge Analisa Torres. On July 13, 2023, she determined that XRP is not considered a security when sold on cryptocurrency exchanges. This verdict concluded nearly three years of legal battles, with the U.S. Securities and Exchange Commission (SEC) achieving only a partial victory in its effort to classify XRP as a security. However, Judge Torres did rule that *XRP* qualifies as a security when sold directly by Ripple Labs. Despite this, exchanges resumed listing XRP. The SEC’s subsequent appeal was dismissed in October. This ruling may influence the SEC’s ongoing cases against the Binance and Coinbase exchanges. Nonetheless, the SEC continues to pursue legal action against the executives of Ripple, demanding the company disclose details of audits, sales of XRP to non-employees, and revenue from XRP sales post-lawsuit in 2020. Ripple managed to leverage a strong market at the end of 2023 but has faced challenges in 2024. Developments in November 2023, such as the upgrade of the Ripple Payments platform, a partnership with Georgia’s central bank for a digital currency project, and acceptance by the Dubai International Finance Centre, have sparked renewed interest in Ripple. However, despite bullish developments and Bitcoin’s surge above $50K, XRP price is yet to reach milestones, triggering concerns among investors. In this article, we’ll explore XRP price prediction and its future market potential with in-depth technical analysis to guide investors with a profitable investment plan.

Ripple’s XRP: A Quick Introduction

XRP operates on the XRP Ledger, a blockchain crafted by Jed McCaleb, Arthur Britto, and David Schwartz, who later founded Ripple to utilize *XRP* in facilitating transactions within its network.

Investors can purchase XRP for various purposes: as an investment, to exchange for other cryptocurrencies, or to finance operations on the Ripple network.

The XRP Ledger distinguishes itself from other cryptocurrencies by its unique approach to transaction verification. Unlike typical cryptocurrencies that allow any participant to verify transactions by solving complex problems, the XRP Ledger employs a consensus protocol. This protocol enables users to download validation software and choose from specific node lists for transaction verification, based on trustworthiness, thereby centralizing the process to a degree.

Validators on the Ripple network synchronize their ledgers every three to five seconds, ensuring consistency and halting for discrepancies to maintain secure and efficient transaction validation. This method offers a significant advantage in speed and cost compared to other cryptocurrencies, such as *BTC*. According to Lee, while Bitcoin transactions can take minutes to hours with high fees, XRP transactions are confirmed within approximately four to five seconds at a substantially lower cost.

Ripple And XRP

While XRP and Ripple are often used interchangeably, it’s crucial to distinguish between the two. XRP is an open-source digital currency that operates independently, while Ripple is a tech company leveraging XRP for its efficient, reliable, and carbon-neutral payment solutions to ensure compliance for its clients.

XRP functions on a decentralized, open-source blockchain called the XRP Ledger (XRPL), with transactions supported by the Ripple Transaction Protocol (RTXP). Setting it apart from many cryptocurrencies, XRP was created through pre-mining, with a capped total supply of 100 billion tokens. The distribution of these tokens was executed in a structured manner:

Initially, 80 billion XRP tokens were designated for Ripple. To manage the token’s availability, Ripple placed 55 billion of these tokens into an escrow account. The co-founders and the primary team were allotted the subsequent 20 billion XRP. The remainder of the XRP is scheduled for release at a rate of under 1 billion per month, adhering to a planned timeline of 55 months.

XRP was conceived as a peer-to-peer trust network, emphasizing its role as a digital asset that surpasses many in terms of transaction speed, cost-effectiveness, and energy efficiency. Ripple highlights XRP’s capabilities to execute transactions in seconds and its low energy consumption compared to other digital currencies.

XRP: Working Module

Ripple has established collaborations with over 200 financial institutions, focusing on delivering seamless tools for executing cross-border payments without friction.

Distinct from Bitcoin’s Proof-of-Work (PoW) and Ethereum’s Proof-of-Stake (PoS) consensus mechanisms, the Ripple network employs a Unique Node List for the selection of validators to oversee its operations.

The choice of validators from this list is made by Ripple itself, a process that does not involve financial rewards for validators, as seen in PoW or PoS systems. This approach raises concerns regarding centralization and the potential for validators to engage in collusion, either to introduce fraudulent transactions or to block certain transactions on the network.

With the capability to handle 1,500 transactions per second (TPS), Ripple’s network boasts significantly higher throughput compared to Ethereum’s capacity of about 15 TPS. Ripple has expressed ambitions to reach or even surpass Visa’s processing speed of 65,000 TPS in the future.

Ripple Vs The SEC: Case Status

Ripple is bullish about winning in its legal battle against the SEC, a conflict that has seen significant developments throughout 2023. A trial is scheduled for April 2024, although the SEC might appeal any decision made.

A pivotal moment came on July 13th when a judge ruled that Ripple Labs did not breach federal securities laws by selling XRP on public exchanges, leading to a 73% surge in XRP’s value that day. However, on August 17th, the SEC secured the right to a mid-trial appeal regarding this decision, a matter that remains unresolved. These developments have notably influenced XRP’s market value.

Although the lawsuit primarily affects the U.S. market and its participants, its outcome is anticipated to have global repercussions, potentially shaping investor sentiments and regulatory frameworks worldwide.

The prevailing belief is that Ripple will emerge victorious against the SEC. Such an outcome would uniquely position XRP as the only cryptocurrency to have judicially affirmed its status as not a security, potentially catalyzing a bullish market response.

Conversely, an SEC victory could adversely affect XRP’s price in 2024, imposing a significant fine on Ripple. Nonetheless, the XRP blockchain’s open-source nature and the ability for anyone to operate a validating node ensure its continued functionality regardless of the lawsuit’s outcome.

Another factor to consider is the anticipated crypto bull run in 2024, spurred by the Bitcoin Halving event. A favorable legal outcome for Ripple in this context could significantly enhance XRP’s market position.

XRP Price Prediction: Price History

Founded in 2012 by Ripple Labs (originally known as OpenCoin before rebranding in 2013), XRP was developed to facilitate seamless, cross-border transactions with rapid settlements and minimal fees.

CoinMarketCap data reveals that XRP debuted at $0.005875 in 2013. It experienced a notable surge in November 2013, reaching $0.05238, but subsequently fell, trading under $0.01 until the second quarter of 2017. At this point, the price dramatically increased to $0.3532.

After a period of stabilization, XRP’s value skyrocketed to an all-time high (ATH) of $3.84 on January 4, 2018. This peak was followed by a downturn, with the price dipping to $0.1432 during a crypto bear market. December 2020 saw the SEC filing a lawsuit against Ripple for the sale of unregistered securities, which hindered XRP’s ability to reach a new ATH during the 2021 bull market, peaking at $1.9637.

Post-April 2021, XRP exhibited a downtrend until September 2022, when it broke this pattern. The price then retested the trendline, subsequently rallying on positive developments, marking a series of higher lows and highs.

2023 showed some positive developments for XRP, starting with a value of approximately $0.504 on June 1. However, the landscape became challenging when the SEC initiated lawsuits against Binance and Coinbase, impacting Ripple’s performance and leading to a decrease in XRP’s value to $0.4593 by June 16. The situation improved with a court ruling, propelling XRP to $0.8875 on July 13, before it fell again, reaching $0.4671 by September 11.

The coin saw a recovery, boosted by the market’s positive response to the SEC’s appeal rejection, climbing to $0.7299 by November 6. It experienced a minor dip afterward, trading at $0.59 on November 17, and ended the year at $0.6149. Entering 2024, Ripple’s value further declined, with XRP standing at about $0.5 in June.

XRP Price Prediction: Technical Analysis

XRP experienced a decline from the 50-day simple moving average (SMA) priced at $0.51, but it managed to find support at $0.47. In recent hours, buyers are attempting to validate a clear upward trend above immediate resistance channels; however, the price faces bearish correction around $0.5. As of writing, XRP price trades at $0.498, surging over 1.92% in the last 24 hours.

The 20-day exponential moving average (EMA) at $0.50 is leveling off, and the Relative Strength Index (RSI) is slightly above the midpoint, indicating a slight edge for the bulls. To shift momentum in their favor, the bulls need to drive the price above the 50-day SMA.

Conversely, if the price breaks and closes below the $0.46 support, it will indicate that the bears have gained the upper hand. Under this scenario, the XRP/USDT pair might drop to $0.41. The bulls are likely to put up a strong defense in the range from $0.46 to $0.41.

XRP Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | $0.6145 | $0.6395 | $0.7127 |

| 2025 | $0.8768 | $0.9023 | $1.06 |

| 2026 | $1.24 | $1.29 | $1.52 |

| 2027 | $1.75 | $1.80 | $2.14 |

| 2028 | $2.59 | $2.66 | $3.02 |

| 2029 | $3.95 | $4.06 | $4.45 |

| 2030 | $5.74 | $5.90 | $6.85 |

| 2031 | $8.53 | $8.82 | $10.13 |

| 2032 | $12.59 | $12.95 | $14.78 |

| 2033 | $19.23 | $19.75 | $22.45 |

XRP Price Prediction 2024

While this legal battle between the SEC and Ripple primarily concerns the US markets and participants, its outcome will resonate globally among investors and regulatory frameworks.

There is a belief that Ripple will win over the SEC in this lawsuit. Should this outcome materialize, XRP would stand as the only cryptocurrency to secure a court ruling affirming its non-security status, potentially leading to significant bullish sentiment for XRP.

Conversely, there remains the possibility of the SEC winning the case, which could severely impact XRP’s price trajectory in 2024. Despite the distinction between the XRP blockchain and Ripple Labs, their interconnectedness typically means developments involving Ripple Labs influence XRP’s market trends.

Stepping back to observe the broader cryptocurrency landscape, early 2024 appears to be witnessing a robust bull run, characterized by Bitcoin achieving new all-time highs and widespread meme-driven market enthusiasm.

In 2024, XRP is expected to reach a minimum price of $0.6145. The maximum price could reach up to $0.7127, with an average price around $0.6395.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.5531 | $0.5756 | $0.6414 |

| February | $0.5586 | $0.5814 | $0.6479 |

| March | $0.5642 | $0.5872 | $0.6544 |

| April | $0.5698 | $0.5930 | $0.6609 |

| May | $0.5754 | $0.5988 | $0.6673 |

| June | $0.5810 | $0.6046 | $0.6738 |

| July | $0.5866 | $0.6104 | $0.6803 |

| August | $0.5922 | $0.6162 | $0.6868 |

| September | $0.5977 | $0.6221 | $0.6933 |

| October | $0.6033 | $0.6279 | $0.6997 |

| November | $0.6089 | $0.6337 | $0.7062 |

| December | $0.6145 | $0.6395 | $0.7127 |

XRP Price Prediction 2025

Currently, XRP’s circulating supply amounts to only 54.74% of its maximum supply of 100 billion tokens. The remaining tokens are locked in smart contracts, with 1% (one billion tokens) being released monthly.

At this rate, all tokens could be fully released into the market within 48 months. Ripple typically sells these tokens through over-the-counter (OTC) trading to mitigate direct impact on the XRP price. However, the ongoing release schedule raises concerns about potential future sell pressure.

Additionally, there’s a hope for XRP ETF in the future, which might strengthen the buying interest for XRP price.

XRP’s price in 2025 is forecasted to range from a minimum of $0.8768 to a maximum of $1.06, averaging around $0.9023.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.7891 | $0.8121 | $0.9540 |

| February | $0.7971 | $0.8203 | $0.9636 |

| March | $0.8051 | $0.8285 | $0.9733 |

| April | $0.8130 | $0.8367 | $0.9829 |

| May | $0.8210 | $0.8449 | $0.9925 |

| June | $0.8290 | $0.8531 | $1.0022 |

| July | $0.8369 | $0.8613 | $1.0118 |

| August | $0.8449 | $0.8695 | $1.0215 |

| September | $0.8529 | $0.8777 | $1.0311 |

| October | $0.8609 | $0.8859 | $1.0407 |

| November | $0.8688 | $0.8941 | $1.0504 |

| December | $0.8768 | $0.9023 | $1.0600 |

XRP Price Forecast for 2026

In 2026, XRP is predicted to trade between $1.24 and $1.52, with an average price of $1.29 based on detailed technical analysis.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $1.1160 | $1.1610 | $1.3680 |

| February | $1.1273 | $1.1727 | $1.3818 |

| March | $1.1385 | $1.1845 | $1.3956 |

| April | $1.1498 | $1.1962 | $1.4095 |

| May | $1.1611 | $1.2079 | $1.4233 |

| June | $1.1724 | $1.2196 | $1.4371 |

| July | $1.1836 | $1.2314 | $1.4509 |

| August | $1.1949 | $1.2431 | $1.4647 |

| September | $1.2062 | $1.2548 | $1.4785 |

| October | $1.2175 | $1.2665 | $1.4924 |

| November | $1.2287 | $1.2783 | $1.5062 |

| December | $1.2400 | $1.2900 | $1.5200 |

XRP (XRP) Price Prediction 2027

For 2027, XRP’s price is expected to range from $1.75 to $2.14, averaging approximately $1.80.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $1.5750 | $1.6200 | $1.9260 |

| February | $1.5909 | $1.6364 | $1.9455 |

| March | $1.6068 | $1.6527 | $1.9649 |

| April | $1.6227 | $1.6691 | $1.9844 |

| May | $1.6386 | $1.6855 | $2.0038 |

| June | $1.6545 | $1.7018 | $2.0233 |

| July | $1.6705 | $1.7182 | $2.0427 |

| August | $1.6864 | $1.7345 | $2.0622 |

| September | $1.7023 | $1.7509 | $2.0816 |

| October | $1.7182 | $1.7673 | $2.1011 |

| November | $1.7341 | $1.7836 | $2.1205 |

| December | $1.7500 | $1.8000 | $2.1400 |

XRP Price Prediction 2028

In 2028, XRP could see prices ranging from $2.59 to $3.02, with an average trading price of $2.66.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $2.3310 | $2.3940 | $2.7180 |

| February | $2.3545 | $2.4182 | $2.7455 |

| March | $2.3781 | $2.4424 | $2.7729 |

| April | $2.4016 | $2.4665 | $2.8004 |

| May | $2.4252 | $2.4907 | $2.8278 |

| June | $2.4487 | $2.5149 | $2.8553 |

| July | $2.4723 | $2.5391 | $2.8827 |

| August | $2.4958 | $2.5633 | $2.9102 |

| September | $2.5194 | $2.5875 | $2.9376 |

| October | $2.5429 | $2.6116 | $2.9651 |

| November | $2.5665 | $2.6358 | $2.9925 |

| December | $2.5900 | $2.6600 | $3.0200 |

XRP Price Prediction 2029

Looking ahead to 2029, XRP’s price is forecasted to range from $3.95 to $4.45, averaging around $4.06.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $3.5550 | $3.6540 | $4.0050 |

| February | $3.5909 | $3.6909 | $4.0455 |

| March | $3.6268 | $3.7278 | $4.0859 |

| April | $3.6627 | $3.7647 | $4.1264 |

| May | $3.6986 | $3.8016 | $4.1668 |

| June | $3.7345 | $3.8385 | $4.2073 |

| July | $3.7705 | $3.8755 | $4.2477 |

| August | $3.8064 | $3.9124 | $4.2882 |

| September | $3.8423 | $3.9493 | $4.3286 |

| October | $3.8782 | $3.9862 | $4.3691 |

| November | $3.9141 | $4.0231 | $4.4095 |

| December | $3.9500 | $4.0600 | $4.4500 |

XRP (XRP) Price Prediction 2030

By 2030, XRP’s price is anticipated to range from $5.74 to $6.85, with an average forecasted price of $5.90.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $5.1660 | $5.3100 | $6.1650 |

| February | $5.2182 | $5.3636 | $6.2273 |

| March | $5.2704 | $5.4173 | $6.2895 |

| April | $5.3225 | $5.4709 | $6.3518 |

| May | $5.3747 | $5.5245 | $6.4141 |

| June | $5.4269 | $5.5782 | $6.4764 |

| July | $5.4791 | $5.6318 | $6.5386 |

| August | $5.5313 | $5.6855 | $6.6009 |

| September | $5.5835 | $5.7391 | $6.6632 |

| October | $5.6356 | $5.7927 | $6.7255 |

| November | $5.6878 | $5.8464 | $6.7877 |

| December | $5.7400 | $5.9000 | $6.8500 |

XRP Price Forecast 2031

In 2031, XRP’s price could range from $8.53 to $10.13, with an average forecasted price of $8.82.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $7.6770 | $7.9380 | $9.1170 |

| February | $7.7545 | $8.0182 | $9.2091 |

| March | $7.8321 | $8.0984 | $9.3012 |

| April | $7.9096 | $8.1785 | $9.3933 |

| May | $7.9872 | $8.2587 | $9.4854 |

| June | $8.0647 | $8.3389 | $9.5775 |

| July | $8.1423 | $8.4191 | $9.6695 |

| August | $8.2198 | $8.4993 | $9.7616 |

| September | $8.2974 | $8.5795 | $9.8537 |

| October | $8.3749 | $8.6596 | $9.9458 |

| November | $8.4525 | $8.7398 | $10.0379 |

| December | $8.5300 | $8.8200 | $10.1300 |

XRP (XRP) Price Prediction 2032

For 2032, XRP is expected to see prices ranging from $12.59 to $14.78, with an average price around $12.95.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $11.3310 | $11.6550 | $13.3020 |

| February | $11.4455 | $11.7727 | $13.4364 |

| March | $11.5599 | $11.8905 | $13.5707 |

| April | $11.6744 | $12.0082 | $13.7051 |

| May | $11.7888 | $12.1259 | $13.8395 |

| June | $11.9033 | $12.2436 | $13.9738 |

| July | $12.0177 | $12.3614 | $14.1082 |

| August | $12.1322 | $12.4791 | $14.2425 |

| September | $12.2466 | $12.5968 | $14.3769 |

| October | $12.3611 | $12.7145 | $14.5113 |

| November | $12.4755 | $12.8323 | $14.6456 |

| December | $12.5900 | $12.9500 | $14.7800 |

XRP Price Prediction 2033

Looking further ahead to 2033, XRP’s price is predicted to range from $19.23 to $22.45, with an average trading price of approximately $19.75.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $17.3070 | $17.7750 | $20.2050 |

| February | $17.4818 | $17.9545 | $20.4091 |

| March | $17.6566 | $18.1341 | $20.6132 |

| April | $17.8315 | $18.3136 | $20.8173 |

| May | $18.0063 | $18.4932 | $21.0214 |

| June | $18.1811 | $18.6727 | $21.2255 |

| July | $18.3559 | $18.8523 | $21.4295 |

| August | $18.5307 | $19.0318 | $21.6336 |

| September | $18.7055 | $19.2114 | $21.8377 |

| October | $18.8804 | $19.3909 | $22.0418 |

| November | $19.0552 | $19.5705 | $22.2459 |

| December | $19.2300 | $19.7500 | $22.4500 |

XRP Price Forecast: By Experts

According to Coincodex’s current XRP price prediction, the cryptocurrency is expected to experience a 20.74% increase, reaching $0.59645 by July 20, 2024. Technical indicators suggest a Bearish sentiment, while the Fear & Greed Index stands at 60 (Greed). Over the past 30 days, XRP has seen 14 out of 30 days (47%) of positive price movement, with a volatility of 3.73%.

Given the XRP forecast, the current analysis advises against purchasing XRP at this time. Looking ahead to 2025, based on historical price trends and BTC halving cycles, Coincodex predicts a yearly low for XRP around $0.31235, with a potential high reaching $1.548702 next year.

According to Digital Coin Price, there is potential for XRP to surpass the $1.28 mark and stabilize in the market by the conclusion of 2025. The projected range for XRP’s lowest price is between $1.06 to $1.28, with the most likely price settling around $1.21 by the end of the year. Despite XRP’s volatility and concerns over its environmental impact, billionaire venture capitalist Tim Draper maintains his forecast that XRP could reach $1.28 either by late 2025 or early 2026.

Looking further ahead, beginning in 2030, XRP’s price is predicted to rise to $3.64 based on technical analysis. By the end of 2030, XRP could potentially reach up to $3.34. The years between 2024 and 2030 are expected to be pivotal for significant growth in XRP’s value.

Is XRP A Good Investment? When To Buy?

XRP is often cited as having one of the most solid and definitive use cases within the cryptocurrency sector. Yet, this advantage comes with a trade-off in terms of greater centralization. Furthermore, the ongoing lawsuit with the SEC adds a layer of risk, possibly making XRP a more precarious investment compared to other cryptocurrencies.

Conversely, should Ripple emerge victorious against the SEC and demonstrate that XRP does not constitute a security, this could lead to a surge in its adoption, possibly driving the price upwards.

In summary, although XRP holds considerable promise, it’s important for investors to recognize the associated risks.

However, it is advised to invest in XRP at a price of $0.47 for a profitable return in the long term.

Hype Around XRP ETF

In a Bloomberg interview, Ripple’s CEO Brad Garlinghouse expressed enthusiasm for the idea of an exchange-traded fund (ETF) centered on the XRP token. On February 20, Garlinghouse revealed Ripple’s positive outlook toward the possibility of an XRP ETF, stating the company would “certainly welcome it.” He further anticipated the emergence of numerous ETFs focused on various tokens and mentioned the potential for ETFs that encompass a range of tokens, which, in his view, would help investors mitigate risks.

Garlinghouse argued for the benefits of having a variety of ETFs, drawing parallels between the nascent stage of cryptocurrency-focused ETFs and the early development of the stock market, where diversification beyond a single stock was crucial for investors. While he declined to confirm whether Ripple was currently engaging with ETF issuers, he reiterated the company’s supportive stance on the development of an XRP ETF, emphasizing its alignment with the interests of the XRP community.

Additionally, Garlinghouse shared his perspective on the broader significance of digital assets, emphasizing their utility and capacity to address real-world challenges. He acknowledged Bitcoin’s success as a store of value and positioned XRP as exceptionally suited for facilitating payments, underscoring Ripple’s long-term vision for digital assets’ role in solving practical problems.

Conclusion

During the last bull market, XRP failed to break its previous all-time highs (ATHs) from 2018, primarily due to two factors:

The first is the ongoing lawsuit with the SEC, which has caused many financial institutions to remain cautious and, on the sidelines, awaiting the outcome, similarly influencing investor sentiment. The second factor is the increased supply of XRP, which has led to price dilution.

Looking forward, while an increase in circulating supply is expected, the outcome of the SEC lawsuit holds significant potential to influence XRP’s price trajectory. A loss for Ripple Labs could result in fines and negatively affect the Ripple blockchain’s operations. On the other hand, a win would provide regulatory clarity and could lead to increased institutional adoption, potentially driving the price significantly higher.

Central Bank Digital Currencies (CBDCs) could also play a role in boosting XRP’s value, as banks might adopt *XRP* as a bridge currency among various CBDCs.

Retail investor sentiment is another crucial factor for XRP’s price. The “XRP Army,” a large and active online community, has been instrumental in driving XRP to its 2018 ATH, highlighting the influence of community support on the cryptocurrency’s value. However, it is advised to do your own research and conduct good investment analysis by experts before investing in the volatile market.

READ MORE:

Frequently Asked Questions

What was the outcome of Ripple's legal case with the SEC?

The case had a mixed outcome. New York Judge Analisa Torres ruled that XRP is not a security when sold on exchanges but qualifies as one when sold directly by Ripple Labs.

How does Ripple's XRP Ledger work?

The XRP Ledger uses a consensus protocol for transaction verification, which is quicker and more cost-effective than the proof-of-work system used by Bitcoin.

What is the relationship between Ripple and XRP?

Ripple is a technology company that utilizes XRP in its network to facilitate transactions, while XRP is a digital currency that operates on the XRP Ledger.

What differentiates XRP's consensus mechanism from others?

Unlike Bitcoin or Ethereum, XRP uses a Unique Node List for validator selection, which has raised concerns about centralization.

How fast can Ripple process transactions?

Ripple's network can handle 1,500 transactions per second and aims to reach or surpass Visa's processing speed in the future.

What is the price prediction for XRP?

As of the article's publication, the price of XRP is expected to increase and potentially reach $0.720354 by March 2024, but the sentiment is currently bearish.

What are the long-term predictions for XRP's value?

Predictions suggest that XRP's price could go as high as $1.694717 by 2025, with a potential to surpass the $1.41 mark by the end of 2025.