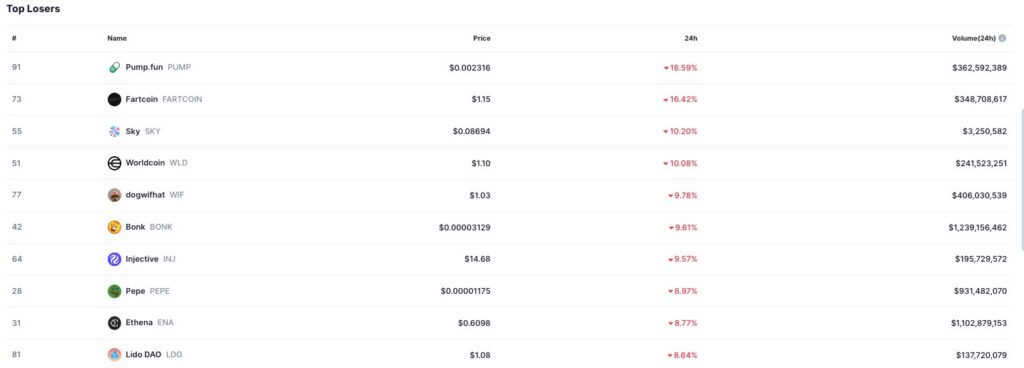

- Meme tokens led the losses with high trading volumes despite sharp price declines.

- Pump.fun and Fartcoin posted the steepest drops, falling over 16% in 24 hours.

- Broader market correction hit both meme coins and mid-cap tokens like INJ and WLD.

The crypto market faced large losses on Monday, with several top-traded tokens posting price declines over the 24 hours. Memecoins and mid-cap assets bore the brunt of the correction, with trading volumes suggesting major activity despite the decline.

Pump.fun (PUMP) recorded the largest single-day decline, falling by 18.59% to $0.002316. The token maintained a high trading volume of $362.59 million, indicating strong participation despite the drop. Fartcoin (FARTCOIN) followed with a 16.42% loss, settling at $1.15. The trading activity remained high, with $348.71 million changing hands within the same period.

The declines marked a large reversal for both tokens, which had seen increased attention in previous sessions. Market data showed heavy selling pressure, with price drops exceeding those of other digital assets during the session.

Meme Tokens and Mid-Caps Follow Trend

Other tokens registering large losses included dogwifhat (WIF), which fell 9.78% to $1.03. The memecoin recorded a 24-hour trading volume of $406.03 million, pointing to ongoing speculative activity. Bonk (BONK), another meme asset built on the Solana blockchain, dropped by 9.61% to $0.00003129. Despite the price decline, BONK led in trading volume among the top losers, with $1.24 billion recorded.

Pepe (PEPE) also registered an 8.97% loss, closing at $0.00001175. It maintained a high trading volume of $931.48 million, placing it among the more actively traded tokens during the downturn.

Broader Pullback Hits Diverse Tokens

The losses extended beyond meme tokens. Sky (SKY) dropped by 10.20% to $0.08694, while Worldcoin (WLD) saw a 10.08% decrease, ending at $1.10 with $241.52 million in daily trading volume. These moves underscored the market-wide nature of the retreat.

The list of losers also included injective (INJ), which declined by 9.57% to 14.68 dollars. The INJ trading volumes remained high but not as high as its meme competitors. Ethena (ENA) declined by 8.77% to $0.6098 and Lido DAO (LDO) retreated by 8.64% to $1.08. ENA recorded a trading volume of $1.10 billion, one of the largest volumes traded during the day whereas LDO recorded a volume of $137.72 million.

The declines were more volatile in various classes of tokens, with investor behavior that switched swiftly. Each drop was followed by high trading volumes, which indicates that both the large and retail holders conducted large transactions during the correction.