- 1. Reliance Power: Introduction

- 2. Reliance Power: Portfolio

- 3. Reliance’s Loans And Controversies

- 4. Reliance Power Stock: Price History

- 5. Reliance Power Stock: Technical Analysis

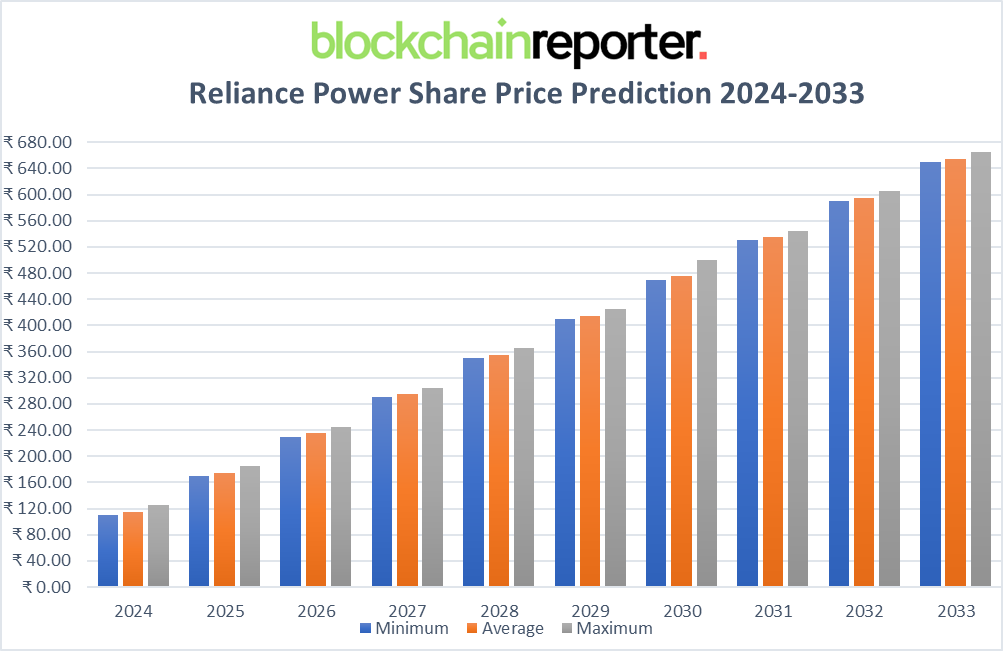

- 6. Reliance Power Share Price Prediction By BlockchainReporter

- 6.0.1. Reliance Power Share Price Future Prediction 2024

- 6.0.2. Reliance Power Share Price Future Prediction 2025

- 6.0.3. Reliance Power Share Price Future Prediction 2026

- 6.0.4. Reliance Power Share Price Future Prediction 2027

- 6.0.5. Reliance Power Share Price Future Prediction 2028

- 6.0.6. Reliance Power Share Price Future Prediction 2029

- 6.0.7. Reliance Power Share Price Future Prediction 2030

- 6.0.8. Reliance Power Share Price Future Prediction 2031

- 6.0.9. Reliance Power Share Price Future Prediction 2032

- 6.0.10. Reliance Power Share Price Future Prediction 2033

- 7. Reliance Power Share Price Prediction: Industry Experts

- 8. Reliance Power Financial Report: FY23

- 9. Reliance Power Offers ₹1,200 Crore In One-Time Settlement

- 10. Conclusion

- 11. FAQ

- 11.0.1. What is Reliance Power Limited?

- 11.0.2. Where does Reliance Power operate?

- 11.0.3. What types of power projects does Reliance Power develop?

- 11.0.4. What was the controversy surrounding Reliance Power's IPO?

- 11.0.5. How has Reliance Power's stock price performed historically?

- 11.0.6. What is the future prediction for Reliance Power's share price?

- 11.0.7. What was the financial performance of Reliance Power in FY23?

- 11.0.8. What is Reliance Power's proposal to lenders of its subsidiary, VIPL?

- 11.0.9. What factors influence Reliance Power's future stock price?

- 11.0.10. Header text

- Reliance Power: Introduction

- Reliance Power: Portfolio

- Reliance’s Loans And Controversies

- Reliance Power Stock: Price History

- Reliance Power Stock: Technical Analysis

- Reliance Power Share Price Prediction By BlockchainReporter

- Reliance Power Share Price Future Prediction 2024

- Reliance Power Share Price Future Prediction 2025

- Reliance Power Share Price Future Prediction 2026

- Reliance Power Share Price Future Prediction 2027

- Reliance Power Share Price Future Prediction 2028

- Reliance Power Share Price Future Prediction 2029

- Reliance Power Share Price Future Prediction 2030

- Reliance Power Share Price Future Prediction 2031

- Reliance Power Share Price Future Prediction 2032

- Reliance Power Share Price Future Prediction 2033

- Reliance Power Share Price Prediction: Industry Experts

- Reliance Power Financial Report: FY23

- Reliance Power Offers ₹1,200 Crore In One-Time Settlement

- Conclusion

- FAQ

India’s energy sector is a dynamic and rapidly evolving landscape, playing a crucial role in the country’s economic development and sustainability goals. As the third-largest energy consumer in the world, India’s demand for power is immense and growing, driven by its burgeoning population, rapid urbanization, and economic growth. The sector is characterized by a diverse mix of energy sources, including coal, natural gas, hydro, nuclear, and increasingly, renewable sources such as solar and wind energy. The government’s ambitious targets for renewable energy, aiming for 450 GW of renewable energy capacity by 2030, underscore the country’s commitment to a sustainable and clean energy future. This transition towards renewable energy presents significant opportunities for power companies but also poses challenges, including the need for substantial capital investment, technological innovation, and regulatory adaptation. In this challenging sector, Reliance Power has emerged as a significant player. A part of the Reliance Group, Reliance Power is one of the leading private-sector power companies in India. Established in 1995, the company has grown to have a diverse portfolio of power projects, encompassing thermal, hydroelectric, solar, and wind energy. Reliance Power’s journey is marked by its ambitious projects, strategic vision, and commitment to contributing to India’s growing power needs. The company’s initial public offering (IPO) in 2008 was India’s largest at the time, demonstrating the market’s confidence in its potential. In this article, we will dive deeper into Reliance power share future price prediction 2025, its significant contributions to India’s energy sector, its future prospects, market potential, and future trends of the stock price.

Reliance Power: Introduction

Reliance Power Limited, also known as R-Power, was formerly recognized as Reliance Energy Generation Limited (REGL). It is a significant part of the Reliance Anil Dhirubhai Ambani Group. The company was established with the objective of developing, constructing, operating, and maintaining power projects in both the Indian and international markets. Promoted by Reliance Infrastructure, a leading private sector power utility company, and the Reliance ADA Group, Reliance Power has been making strides in the energy sector under the leadership of its current CEO, K. Raja Gopal, who took the helm on May 2, 2018.

Previously, the company held the exclusive rights to distribute electricity to consumers in Mumbai’s suburbs. However, in 2017, it sold its Mumbai operations to Adani Power. Today, it operates power generation, transmission, and distribution businesses in other regions of Maharashtra, Goa, and Andhra Pradesh. Along with its subsidiaries, Reliance Power is developing 13 medium and large-scale power projects, which together have a planned installed capacity of 33,480 MW.

In 2010, shortly after its initial public offering, Reliance Natural Resources merged with Reliance Power. As of March 2018, Reliance Power has 50 subsidiaries. The company’s significant contributions to the power sector have not gone unnoticed. In the Fortune India 500 list of 2019, R-Power was ranked as the 176th largest corporation in India, securing the 9th rank in the ‘Power sector’ category.

Reliance Power: Portfolio

Reliance Power has a diverse portfolio of power generation capacities, both operational and under development. The company’s thermal power plants, with a combined installed capacity of over 6,000 MW, are located in Maharashtra, Madhya Pradesh, Jharkhand, and Andhra Pradesh. These plants use coal, gas, and liquid fuels to generate power, contributing significantly to India’s energy mix.

In the renewable energy sector, Reliance Power has made substantial strides. The company operates wind and solar power projects in Maharashtra, Rajasthan, and Gujarat, with a combined installed capacity of over 300 MW. These projects underscore the company’s commitment to sustainable and clean energy.

Reliance Power’s hydroelectric projects in Arunachal Pradesh and Uttarakhand, with a combined potential of over 3,000 MW, further diversify its energy portfolio. These projects, once operational, will significantly boost India’s hydroelectric power generation capacity.

Reliance Power has also ventured into international markets. The company’s major international project is a 750 MW gas-based combined cycle power project in Bangladesh. This project, being developed in collaboration with JERA Co. Inc. of Japan, is the largest Foreign Direct Investment (FDI) in Bangladesh’s power sector.

Reliance’s Loans And Controversies

In 2010, Reliance Power Ltd. entered into a significant agreement with the US Export-Import Bank for a loan amounting to $5 billion aimed at financing various power projects. This loan was earmarked to fund 900 megawatts of renewable energy projects, including solar and wind energy, and up to 8000 MW of gas-based power generation technology, as per the statement released by the Indian company. This substantial agreement of $5 billion came in addition to the $917 million that the Ex-Im Bank had already approved for Reliance Power’s coal-fired power plant situated in Sasan, central India.

This agreement was beneficial for Reliance Power as it allowed the company to access products and services at competitive rates, and it also facilitated the creation of manufacturing and services jobs in the US. Additionally, the loan enabled the company to have quicker access to the bank’s long-term dollar loans. In a significant move, Reliance Power also signed a pact worth ₹100 billion ($2.2 billion) with the US’s General Electric Co. (GE) to establish a 2400 MW power plant. This plant is to be set up in the southern Indian town of Samalkot, and the agreement was signed during the visit of President Barack Obama.

In 2007, Reliance Power announced its intention to go public with an Initial Public Offering (IPO) through a red herring notice. The IPO was planned to raise funds for the development of six power projects across India, with completion dates ranging from December 2009 to March 2014. However, the Securities and Exchange Board of India, the regulatory body for the Indian stock market, imposed certain restrictions following a complaint about the IPO’s formulation. This complaint also led to a public interest litigation filed against the company. Despite these challenges, the Supreme Court of India ruled that the IPO could proceed, regardless of any orders passed by other Indian courts against the venture.

The IPO was launched on January 15, 2008, and it set a record in India by attracting $27.5 billion of bids on the first day, which was 10.5 times the stock on offer. The maximum bid price was set at ₹450. Media reports suggested that if the company’s stock price exceeded ₹650–700, Anil Ambani would surpass L. N. Mittal to become the wealthiest Indian. Reflecting on the IPO, Indian Finance Minister P. Chidambaram stated that it demonstrated global confidence in the future of the Indian economy.

Reliance Power made its debut on the stock markets on February 11, 2008. However, the markets were still recovering from the volatility experienced in January 2008, and concerns about overpricing led to a sharp drop in the stock’s value shortly after its listing. By the end of the first day, the stock was trading 17 percent below its issue price of ₹450. Investors who had anticipated the stock reaching 1.5 or even twice its issue price incurred significant losses. To alleviate investor losses, Reliance Power decided to issue 3 bonus shares for every 5 shares held on February 25.

Reliance Power Stock: Price History

To get a detailed Reliance Power share value outlook, it is essential for investors to get an idea of Reliance Power stock’s price history to determine its future growth potential. However, it is to be noted that past performance is not an indicator of Reliance Power’s future price points and financial projections.

Reliance Power, a key player in India’s energy sector, has had an intriguing journey in the stock market. The company’s share price history was connected to various events, and factors that have influenced its performance over the years are discussed in depth.

In 2008, Reliance Power made its debut on the stock markets on February 11. The IPO was launched on January 15, 2008, and it set a record in India by attracting $27.5 billion of bids on the first day, which was 10.5 times the stock on offer. Reliance Power stock started trading at ₹240, and after a few hours, the stock climbed past the ₹260 level. However, in April, RPOWER stock met a sharp collapse, plunging by over 50% in just a few weeks. By the end of 2008, Reliance power stock touched the ground at ₹100.

For the next two years, Reliance power stock witnessed a significant surge but remained in a consolidation range near ₹160. In early 2011, the stock price started to decline following several loan controversies. It dropped below the ₹100 mark for the first time in August, and since then, the stock price has gone on a severe bearish path. In 2014, RPOWER stock touched the ₹60 mark, forcing long-term holders to exit their investment positions.

However, in June, the stock reclaimed the ₹100 level but failed to gain enough investors, resulting in another collapse in the upcoming weeks. RPOWER share’s price plummeted heavily from 2019 as the price dropped below ₹10. In August, the share value reached a low of ₹3, and it further dropped to ₹1 by the end of that year. However, in 2021, the price again climbed and is currently maintaining a range between ₹20-₹30.

Reliance Power Stock: Technical Analysis

Lately, Reliance Power’s stock has seen a noticeable surge in value, causing a push in its upward journey. However, bears continue to defend the resistance channels, resulting in a minor correction for the RPOWER stock. Market conditions, largely driven by the company’s financial results and settlements, have had a positive effect on the company’s share price. An in-depth examination of Reliance Power’s technical charts reveals some bullish signs, although they might soon fade if sellers intensify their bearish dominance. Investors are encouraged to exercise caution, given the uncertain short-term growth prospects of Reliance Power. The durability of a surge appears uncertain, raising doubts about Reliance Power’s capacity to maintain its top-tier investment status.

TradingView reports that Reliance Power shares currently stand at ₹30.2, showcasing a slight uptick of more than 2.03 % in the past day. An in-depth examination of Reliance Power stocks indicates that while the downward trend may still be present, there’s a strong possibility for a bullish turnaround as the stock previously witnessed a strong bullish surge. Despite the stock facing challenges at its immediate resistance levels, there’s an underlying potential for increased buying interest near immediate Fib channels that could drive a positive momentum shift. A glance at the daily price chart reveals that Reliance Power shares have found a support line around the ₹28 mark, a point from which the share price could aim to overcome the next resistance barrier. With Reliance Power’s price recently crossing multiple EMA trend lines following a breakout above ₹25.2, it’s plausible that investors may be lured to enter long positions, potentially driving the share price upwards in the following days. The Balance of Power (BoP) indicator currently resides in a bullish area at 0.31, suggesting further upward correction could be on the horizon.

To thoroughly analyze the price of Reliance Power shares, it is crucial to take a look at the RSI-14 indicator. The RSI indicator recently experienced a surge above the midline as it hovers in a buying region at 57-level. It is anticipated that Reliance Power’s price will soon attempt to break above its 38.6% Fibonacci level to achieve its short-term bullish goals. If it fails to climb above this Fibonacci region, a downtrend might occur.

As the SMA-14 continues its upward swing near the 53-level, it trades below the RSI line, potentially accelerating the stock’s downward correction on the price chart. However, if Reliance Power shares break above the consolidation zone and surge way above the EMA20 trend line, it can pave the way to the crucial resistance of ₹33. A breakout above the strong resistance will drive the share price toward the upper limit of the Bollinger band at ₹39.2

Conversely, if Reliance Power fails to hold above the critical support level of ₹28, a sudden collapse may occur, resulting in further price declines and causing the Reliance Power share to trade near the breakout point at ₹25.

Reliance Power Share Price Prediction By BlockchainReporter

| Years | Minimum (₹) | Average (₹) | Maximum (₹) |

| 2024 | 110 | 115 | 125 |

| 2025 | 170 | 175 | 185 |

| 2026 | 230 | 235 | 245 |

| 2027 | 290 | 295 | 305 |

| 2028 | 350 | 355 | 365 |

| 2029 | 410 | 415 | 425 |

| 2030 | 470 | 475 | 500 |

| 2031 | 530 | 535 | 545 |

| 2032 | 590 | 595 | 605 |

| 2033 | 650 | 655 | 665 |

Reliance Power Share Price Future Prediction 2024

Moving into 2024, Reliance Power is expected to continue its upward trajectory. The company’s ongoing projects and potential new ventures could drive the average stock price up to ₹115. The year might see the stock price ranging between a low of ₹110 and a high of ₹125.

| Months | Minimum (₹) | Average (₹) | Maximum (₹) |

| January | 20.00 | 25.0 | 39.00 |

| February | 28.18 | 37.5 | 46.82 |

| March | 36.36 | 45.5 | 54.64 |

| April | 44.55 | 53.5 | 62.45 |

| May | 52.73 | 61.5 | 70.27 |

| June | 60.91 | 69.5 | 78.09 |

| July | 69.09 | 77.5 | 85.91 |

| August | 77.27 | 85.5 | 93.73 |

| September | 85.45 | 93.5 | 101.55 |

| October | 93.64 | 101.5 | 109.36 |

| November | 101.82 | 109.5 | 117.18 |

| December | 110.00 | 115.0 | 125.00 |

Reliance Power Share Price Future Prediction 2025

By 2025, the company’s strategic investments and expansion plans are anticipated to yield significant returns. The average stock price is predicted to reach ₹175, with a potential minimum and maximum price of ₹170 and ₹185, respectively.

| Months | Minimum (₹) | Average (₹) | Maximum (₹) |

| January | 110.00 | 117.50 | 125.00 |

| February | 115.45 | 122.95 | 130.45 |

| March | 120.91 | 128.41 | 135.91 |

| April | 126.36 | 133.86 | 141.36 |

| May | 131.82 | 139.32 | 146.82 |

| June | 137.27 | 144.77 | 152.27 |

| July | 142.73 | 150.23 | 157.73 |

| August | 148.18 | 155.68 | 163.18 |

| September | 153.64 | 161.14 | 168.64 |

| October | 159.09 | 166.59 | 174.09 |

| November | 164.55 | 172.05 | 179.55 |

| December | 170.00 | 175.00 | 185.00 |

Reliance Power Share Price Future Prediction 2026

In 2026, Reliance Power’s share price is expected to continue its upward trend, reaching an average price of ₹235. The stock price could vary between ₹230 and ₹245, reflecting the company’s steady growth and the market’s positive sentiment.

| Months | Minimum (₹) | Average (₹) | Maximum (₹) |

| January | 170.00 | 177.50 | 185.00 |

| February | 175.45 | 182.95 | 190.45 |

| March | 180.91 | 188.41 | 195.91 |

| April | 186.36 | 193.86 | 201.36 |

| May | 191.82 | 199.32 | 206.82 |

| June | 197.27 | 204.77 | 212.27 |

| July | 202.73 | 210.23 | 217.73 |

| August | 208.18 | 215.68 | 223.18 |

| September | 213.64 | 221.14 | 228.64 |

| October | 219.09 | 226.59 | 234.09 |

| November | 224.55 | 232.05 | 239.55 |

| December | 230.00 | 235.00 | 245.00 |

Reliance Power Share Price Future Prediction 2027

By 2027, the company’s consistent performance and strategic initiatives could push the average stock price to ₹295. The stock price might fluctuate between a minimum of ₹290 and a maximum of ₹305, reflecting the market’s confidence in the company’s growth prospects.

| Months | Minimum (₹) | Average (₹) | Maximum (₹) |

| January | 230.00 | 237.50 | 245.00 |

| February | 235.45 | 242.95 | 250.45 |

| March | 240.91 | 248.41 | 255.91 |

| April | 246.36 | 253.86 | 261.36 |

| May | 251.82 | 259.32 | 266.82 |

| June | 257.27 | 264.77 | 272.27 |

| July | 262.73 | 270.23 | 277.73 |

| August | 268.18 | 275.68 | 283.18 |

| September | 273.64 | 281.14 | 288.64 |

| October | 279.09 | 286.59 | 294.09 |

| November | 284.55 | 292.05 | 299.55 |

| December | 290.00 | 295.00 | 305.00 |

Reliance Power Share Price Future Prediction 2028

In 2028, Reliance Power’s share price is predicted to reach an average price of ₹355. The stock price could vary between ₹350 and ₹365, reflecting the company’s continued growth and the positive market sentiment.

| Months | Minimum (₹) | Average (₹) | Maximum (₹) |

| January | 290.00 | 297.50 | 305.00 |

| February | 295.45 | 302.95 | 310.45 |

| March | 300.91 | 308.41 | 315.91 |

| April | 306.36 | 313.86 | 321.36 |

| May | 311.82 | 319.32 | 326.82 |

| June | 317.27 | 324.77 | 332.27 |

| July | 322.73 | 330.23 | 337.73 |

| August | 328.18 | 335.68 | 343.18 |

| September | 333.64 | 341.14 | 348.64 |

| October | 339.09 | 346.59 | 354.09 |

| November | 344.55 | 352.05 | 359.55 |

| December | 350.00 | 355.00 | 365.00 |

Reliance Power Share Price Future Prediction 2029

By 2029, the company’s strategic investments and expansion plans are expected to yield significant returns. The average stock price is predicted to reach ₹415, with a potential minimum and maximum price of ₹410 and ₹425, respectively.

| Months | Minimum (₹) | Average (₹) | Maximum (₹) |

| January | 350.00 | 357.50 | 365.00 |

| February | 355.45 | 362.95 | 370.45 |

| March | 360.91 | 368.41 | 375.91 |

| April | 366.36 | 373.86 | 381.36 |

| May | 371.82 | 379.32 | 386.82 |

| June | 377.27 | 384.77 | 392.27 |

| July | 382.73 | 390.23 | 397.73 |

| August | 388.18 | 395.68 | 403.18 |

| September | 393.64 | 401.14 | 408.64 |

| October | 399.09 | 406.59 | 414.09 |

| November | 404.55 | 412.05 | 419.55 |

| December | 410.00 | 415.00 | 425.00 |

Reliance Power Share Price Future Prediction 2030

As we move into 2030, Reliance Power’s share price is expected to continue its upward trajectory, reaching an average price of ₹475. The stock price could vary between ₹470 and ₹500, reflecting the company’s steady growth and the market’s positive sentiment.

| Months | Minimum (₹) | Average (₹) | Maximum (₹) |

| January | 350.00 | 357.50 | 365.00 |

| February | 360.91 | 369.09 | 377.27 |

| March | 371.82 | 380.68 | 389.55 |

| April | 382.73 | 392.27 | 401.82 |

| May | 393.64 | 403.87 | 414.09 |

| June | 404.55 | 415.46 | 426.36 |

| July | 415.45 | 427.05 | 438.64 |

| August | 426.36 | 438.64 | 450.91 |

| September | 437.27 | 450.23 | 463.18 |

| October | 448.18 | 461.82 | 475.45 |

| November | 459.09 | 473.41 | 487.73 |

| December | 470.00 | 475.00 | 500.00 |

Reliance Power Share Price Future Prediction 2031

In 2031, the upward trajectory of Reliance Power’s share price is expected to persist. The average stock price is projected to be around ₹535, with the stock price ranging between a minimum of ₹530 and a maximum of ₹545.

| Months | Minimum (₹) | Average (₹) | Maximum (₹) |

| January | 470.00 | 485.00 | 500.00 |

| February | 475.45 | 489.77 | 504.09 |

| March | 480.91 | 494.55 | 508.18 |

| April | 486.36 | 499.31 | 512.27 |

| May | 491.82 | 504.09 | 516.36 |

| June | 497.27 | 508.86 | 520.45 |

| July | 502.73 | 513.64 | 524.55 |

| August | 508.18 | 518.41 | 528.64 |

| September | 513.64 | 523.18 | 532.73 |

| October | 519.09 | 527.95 | 536.82 |

| November | 524.55 | 532.73 | 540.91 |

| December | 530.00 | 535.00 | 545.00 |

Reliance Power Share Price Future Prediction 2032

By 2032, Reliance Power’s strategic growth and market positioning are anticipated to further enhance the company’s valuation. The average stock price is predicted to reach ₹595, with potential fluctuations between ₹590 and ₹605.

| Months | Minimum (₹) | Average (₹) | Maximum (₹) |

| January | 530.00 | 537.50 | 545.00 |

| February | 535.45 | 542.95 | 550.45 |

| March | 540.91 | 548.41 | 555.91 |

| April | 546.36 | 553.86 | 561.36 |

| May | 551.82 | 559.32 | 566.82 |

| June | 557.27 | 564.77 | 572.27 |

| July | 562.73 | 570.23 | 577.73 |

| August | 568.18 | 575.68 | 583.18 |

| September | 573.64 | 581.14 | 588.64 |

| October | 579.09 | 586.59 | 594.09 |

| November | 584.55 | 592.05 | 599.55 |

| December | 590.00 | 595.00 | 605.00 |

Reliance Power Share Price Future Prediction 2033

Moving into 2033, the company’s continued success and market influence are likely to push the average stock price to ₹655. The stock price might vary between ₹650 and ₹665, reflecting ongoing positive market sentiment and robust company performance.

| Months | Minimum (₹) | Average (₹) | Maximum (₹) |

| January | 590.00 | 597.50 | 605.00 |

| February | 595.45 | 602.95 | 610.45 |

| March | 600.91 | 608.41 | 615.91 |

| April | 606.36 | 613.86 | 621.36 |

| May | 611.82 | 619.32 | 626.82 |

| June | 617.27 | 624.77 | 632.27 |

| July | 622.73 | 630.23 | 637.73 |

| August | 628.18 | 635.68 | 643.18 |

| September | 633.64 | 641.14 | 648.64 |

| October | 639.09 | 646.59 | 654.09 |

| November | 644.55 | 652.05 | 659.55 |

| December | 650.00 | 655.00 | 665.00 |

Reliance Power Share Price Prediction: Industry Experts

Shares of Reliance Power, supported by Anil Ambani, have been experiencing a rising trend since the onset of the fiscal year 2023-24. The company’s stock reached its lowest point at ₹9.15 per share at the close of March 2023. Following this, there has been a consistent upward movement in the stock’s performance.

Anticipating additional growth in Reliance Power’s stock value, Sumeet Bagadia, Executive Director at Choice Broking, commented, “The outlook for Reliance Power shares is optimistic. Investors who are comfortable with high risk might consider retaining the stock for a short-term goal of ₹28 and ₹30. Nonetheless, it’s crucial to set a firm stop loss at ₹21 when investing in this stock associated with Anil Ambani.”

Osho Krishan, Senior Research Analyst – Technical & Derivatives at Angel One, remarked, “Reliance Power has been following a pattern of achieving successive higher highs and lows, and has recently seen considerable momentum. The 21-DEMA is acting as a solid support for the stock. Therefore, any short-term dip towards the Rs 24-23 range should be favorable for buyers. The stock appears ready to sustain its upward trajectory.”

Shiju Koothupalakkal, Technical Research Analyst at Prabhudas Lilladher, commented, “The stock has shown a marked increase. It appears set to extend this positive trend in the upcoming period. The key support zone is around the Rs 25 mark, with the next anticipated targets being Rs 35 and Rs 43. A decisive fall below Rs 23 could, however, weaken this positive outlook.”

Reliance Power Financial Report: FY23

The consolidated net loss of Reliance Power Ltd expanded to ₹292 crore in the third quarter, a significant increase from the ₹97 crore loss in the same quarter of the previous year. This was primarily due to total expenses surpassing total income.

The consolidated financial outcomes of Reliance Power incorporate the results of 36 subsidiaries (including step-down subsidiaries) and three associate companies.

There was a slight 4 percent year-on-year increase in total income, reaching ₹1,936 crores, up from ₹1,859 crores in the corresponding period of the previous year. However, total expenses also saw a rise, increasing by 12 percent year-on-year to ₹2,126 crore, compared to ₹1,900 crore in the same period of the previous year.

According to the notes to accounts, during this quarter and following the quarter ending December 31, 2022, the parent company, Reliance Power, issued and allotted approximately 22.85 crores and 10.65 crores fully paid-up equity shares of ₹10 each to Reliance Infrastructure Ltd. This was done upon the exercise of its right to convert an equivalent number of warrants held by it, with underlying payments made through debt conversion.

As a result, 39.49 crore warrants remain unexercised, leading to the forfeiture of the warrant subscription amount. The newly issued equity shares will rank equally in all respects with the existing equity shares of the parent company, as per the notes to accounts.

Reliance Power Offers ₹1,200 Crore In One-Time Settlement

Reliance Power, a firm under the Anil Ambani group, has proposed a one-time settlement offer to the lenders of its subsidiary, VIPL. The proposal involves a payment of approximately ₹1,200 crore, according to sources.

In the proposed plan, Reliance Power intends to make an upfront cash payment to lenders, which include SBI, Axis Bank, Bank of Baroda, PNB, Canara Bank, and Bank of Maharashtra. However, as of March 31, 2022, the outstanding loan of VIPL stood at around ₹2,200 crore.

Sources indicate that Reliance Power’s proposal is backed by Varde Partners of Singapore, an investor in another group company, Reliance Infrastructure Ltd. The lenders of VIPL are expected to convene soon to discuss and consider this proposal.

Conclusion

Reliance Power, as a key player in India’s energy sector, holds significant potential for future growth. The company’s strategic initiatives, focus on reducing debt, and potential shift towards renewable energy sources could play a pivotal role in shaping its future trajectory.

The stock’s future potential is tied to these factors and the overall health of the energy sector. While the past has seen some volatility, the company’s commitment to improving operational efficiency and financial performance could lead to a brighter future.

However, it’s important to remember that the stock market is influenced by a multitude of factors, including macroeconomic indicators and global events. Therefore, potential investors should conduct thorough research and possibly seek advice from financial advisors before making investment decisions.

FAQ

What is Reliance Power Limited?

Reliance Power Limited, also known as R-Power, is a significant part of the Reliance Anil Dhirubhai Ambani Group. It was established with the objective of developing, constructing, operating, and maintaining power projects in both the Indian and international markets.

Where does Reliance Power operate?

Reliance Power operates power generation, transmission, and distribution businesses in various regions of Maharashtra, Goa, and Andhra Pradesh in India. The company also has a significant international project, a 750 MW gas-based combined cycle power project in Bangladesh.

What types of power projects does Reliance Power develop?

Reliance Power has a diverse portfolio of power generation capacities, both operational and under development. It operates thermal power plants, wind and solar power projects, hydroelectric projects, and a gas-based combined cycle power project.

What was the controversy surrounding Reliance Power’s IPO?

Reliance Power’s Initial Public Offering (IPO) in 2007 faced certain restrictions imposed by the Securities and Exchange Board of India following a complaint about the IPO’s formulation. Despite these challenges, the IPO was eventually launched, setting a record by attracting $27.5 billion of bids on the first day.

How has Reliance Power’s stock price performed historically?

Reliance Power’s stock price has had a tumultuous journey since its listing in 2008. The stock price has fluctuated significantly over the years due to various events and factors, including loan controversies and issues in the energy sector.

What is the future prediction for Reliance Power’s share price?

The future prediction for Reliance Power’s share price indicates a potential upward trend, with the average stock price expected to reach ₹115 by the end of 2024 and possibly ₹475 by 2030, according to BlockchainReporter’s predictions. However, these predictions are not guaranteed and are subject to various factors influencing the stock market.

What was the financial performance of Reliance Power in FY23?

In FY23, Reliance Power reported a consolidated net loss of ₹292 crore in the third quarter, primarily due to total expenses surpassing total income. Despite this, there was a 4 percent year-on-year increase in total income.

What is Reliance Power’s proposal to lenders of its subsidiary, VIPL?

Reliance Power proposed a one-time settlement offer to the lenders of its subsidiary, VIPL. The proposal involves a payment of approximately ₹1,200 crore.

What factors influence Reliance Power’s future stock price?

Factors such as the company’s performance, strategic initiatives, expansion plans, and the overall state of the energy sector can significantly influence the future price of Reliance Power’s stock.

Header text

READ MORE:

Xxc Renegade 1000 Xxc Price Prediction: Will This ATV Gain Popularity In 2023?

Yes Bank Share Price Prediction 2025: Will Yes Bank Stock Recover from Crisis?

Lucid Stock Price Prediction 2025: Can LCID Stock Recover Amid Bearish Sentiment?

Wrapped LUNA Classic (WLUNC) Price Prediction

Rivian Stock Price Prediction 2025 & 2030: What Lies Ahead for RIVN Stock Price?

Bitgert Price Prediction: Is Bitgert a Good Investment?

EverGrow Coin Price Prediction: Will EGC Skyrocket to $1 Soon?

Nio Stock Price Prediction 2030: Will There Be a Bullish Reversal for Nio Stock?