- 1. Rivian Automotive Inc: An Overview

- 2. Rivian: Rise Of Dominance In the EV Market

- 3. Rivian Stock Price Forecast: Past Performance

- 4. Rivian Stock Price Prediction: Technical Analysis

- 5. Rivian Stock Price Prediction By Blockchain Reporter

- 5.1. Rivian Stock Price Prediction 2023

- 5.2. Rivian Stock Price Prediction 2024

- 5.3. Rivian Stock Price Prediction 2025

- 5.4. Rivian Stock Price Prediction 2026

- 5.5. Rivian Stock Price Prediction 2027

- 5.6. Rivian Stock Price Prediction 2028

- 5.7. Rivian Stock Price Prediction 2029

- 5.8. Rivian Stock Price Prediction 2030

- 6. Rivian Stock Forecast: Market Analysts

- 7. Green Flags For RIVN’s Future Performance

- 8. Conclusion

- 9. FAQ

- 9.0.1. What is Rivian?

- 9.0.2. Who founded Rivian and when?

- 9.0.3. What is the Rivian stock price prediction for 2025 and 2030?

- 9.0.4. What are the key factors affecting Rivian's stock price?

- 9.0.5. What are some recent developments in Rivian's business?

- 9.0.6. What is the consensus among market analysts for Rivian stock?

- Rivian Automotive Inc: An Overview

- Rivian: Rise Of Dominance In the EV Market

- MoU With Mercedes-Benz

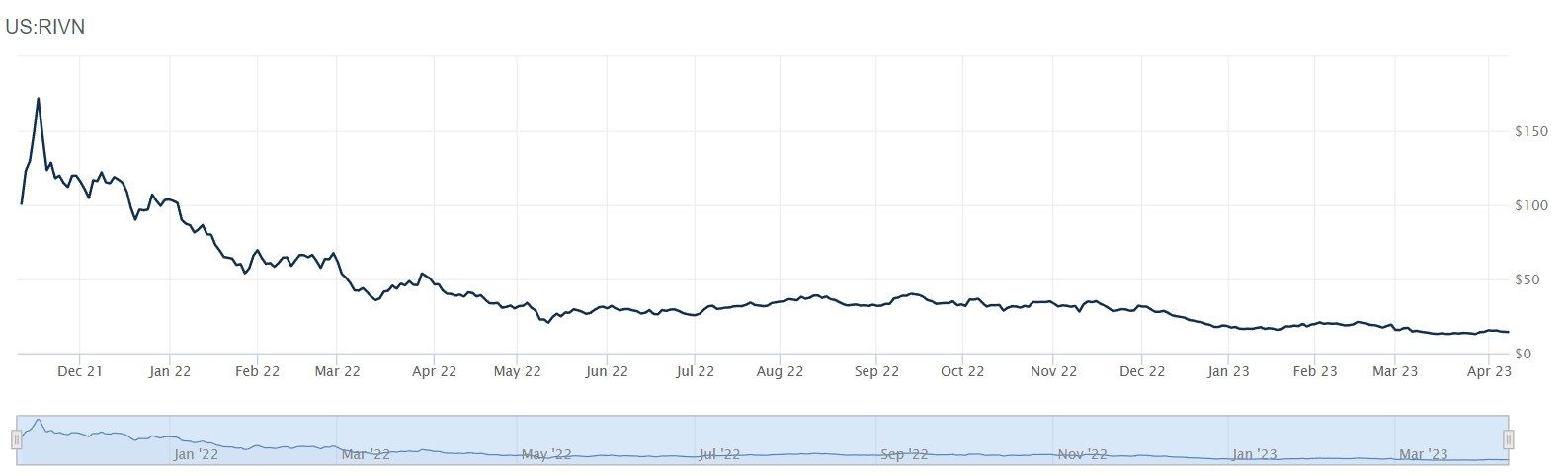

- Rivian Stock Price Forecast: Past Performance

- Rivian Stock Price Prediction: Technical Analysis

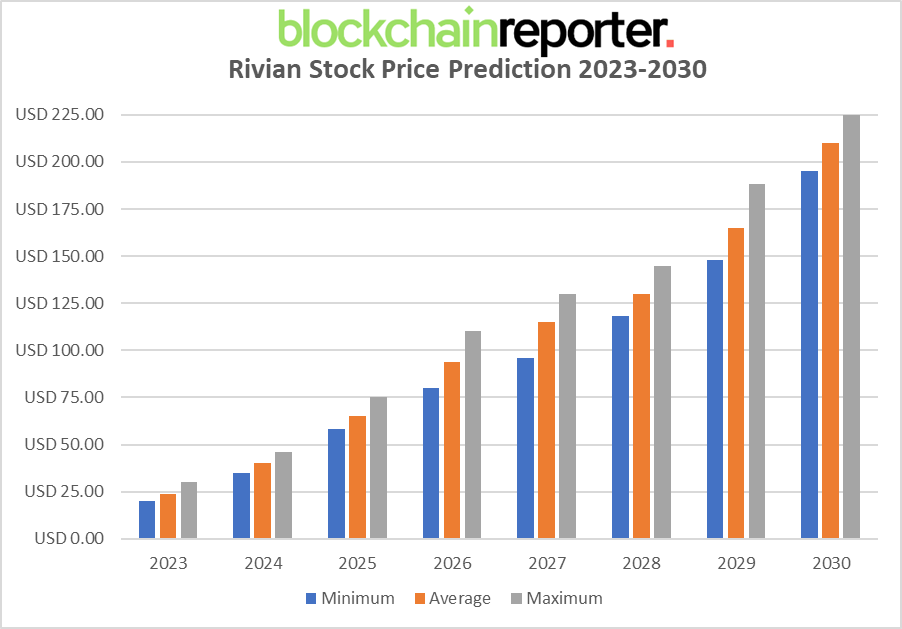

- Rivian Stock Price Prediction By Blockchain Reporter

- Rivian Stock Price Prediction 2023

- Rivian Stock Price Prediction 2024

- Rivian Stock Price Prediction 2025

- Rivian Stock Price Prediction 2026

- Rivian Stock Price Prediction 2027

- Rivian Stock Price Prediction 2028

- Rivian Stock Price Prediction 2029

- Rivian Stock Price Prediction 2030

- Rivian Stock Forecast: Market Analysts

- Green Flags For RIVN’s Future Performance

- Conclusion

- FAQ

Imagine the perfect blend of eco-friendliness and ruggedness in a vehicle designed to empower your adventurous side. This has been made possible by Rivian Automotive Inc, the innovative electric vehicle manufacturer that has captured the imagination of consumers and industry experts alike. With a keen focus on sustainability and performance, Rivian is carving out a niche in the electric vehicle (EV) market by delivering unparalleled driving experiences. The vision of sustainability, performance, and adventure embodies the spirit of Rivian Automotive Inc, which is boldly reshaping the electric vehicle (EV) landscape. As pioneers in the world of electric adventure vehicles, Rivian is committed to pushing the boundaries of technology and sustainability, taking the driving experience to new heights. However, Rivian faces competition from various segments of the market as the demand for electric vehicles continues to rise with the increasing number of competitors in the space. Companies like Tesla and Volkswagen have created tough competition in the market, while China’s booming EV market has brought NIO, BYD, and XPeng as strong contenders. As a result, there is an intense price fluctuation in RIVN stock, leaving investors confused about its future potential and market trends. Our Rivian stock price prediction 2025 & 2030 aims to bring you a detailed analysis of the company and RIVN stock to guide you through a profitable investment plan.

Rivian Automotive Inc: An Overview

Founded in 2009 by RJ Scaringe, Rivian began as a dream to create sustainable vehicles without sacrificing performance or off-road capabilities. Over the years, the company has grown into a formidable force in the EV industry. With substantial investments from major players like Amazon and Ford, Rivian has accelerated its vision and successfully brought two robust models to market: the R1T electric pickup truck and the R1S electric SUV.

Rivian is developing the electric SUV and pickup truck based on a versatile “skateboard” platform. This platform can support future vehicles and even be adopted by other companies. Alongside these projects, Rivian is also working on an electric delivery van through a partnership with Amazon. Deliveries for the R1T pickup truck commenced in late 2021, and the company aims to establish an exclusive charging network across the United States and Canada by the end of 2023.

Headquartered in Irvine, California, Rivian operates a manufacturing plant in Normal, Illinois, and maintains additional facilities in Palo Alto, California; Carson, California; Plymouth, Michigan; Vancouver, British Columbia; Wittmann, Arizona; and Woking, England. Moreover, the company has plans to construct a new $5 billion factory in Georgia to further expand its operations.

Before moving further, let’s take a look at RIVN stock’s current market details to clarify our Rivian stock price prediction 2025 & 2030 better.

| Company | Rivian Automotive Inc |

| Stock Symbol | RIVN |

| Price | $14.53 |

| 52 Week High | $41.99 |

| 52 Week Low | $12.58 |

| Share Volume | 7,569,985 |

| Average Volume | 32,382,903 |

| Forward P/E 1 Yr | -2.62 |

| Earnings Per Share(EPS) | $-7.41 |

| Market Cap | 13,271,293,536 |

Rivian: Rise Of Dominance In the EV Market

Established in 2009 as Mainstream Motors, the company underwent a series of name changes, becoming Avera Automotive (or Avera Motors) and finally settling on Rivian Automotive in 2011. The name Rivian is inspired by the Indian River in Florida, where Scaringe grew up. From its inception, the company has been committed to the development of electric and autonomous vehicles.

Initially, Rivian’s first car model was planned to be a sports car called the R1, a mid-engine hybrid coupe for the U.S. market designed by Peter Stevens. However, the project was put on hold in late 2011 as the company pivoted its focus to maximize its impact on the automotive industry.

Rivian experienced significant growth in 2015, following a substantial investment that allowed it to open research facilities in Michigan and the Bay Area. With this expansion plan, the company shifted its efforts exclusively to autonomous electric vehicles, intending to create a network of interconnected products. Rivian also began orienting its prototypes towards the burgeoning ride-sharing and driverless car markets.

In September 2016, Rivian entered negotiations to acquire a manufacturing plant previously owned by Mitsubishi Motors in Normal, Illinois. By January 2017, the company successfully purchased the plant and its manufacturing contents for $16 million, designating it as Rivian’s primary North American manufacturing facility. Rivian’s decision to acquire a nearly production-ready facility instead of constructing a new factory has drawn comparisons to Tesla’s acquisition of the NUMMI plant in California.

In December 2017, Rivian unveiled its first two products: a five-passenger electric pickup truck and a seven-passenger electric SUV, tentatively named the A1T and A1C, respectively. By November 2018, these vehicles were rebranded as the R1T and R1S and showcased at the LA Auto Show. Both vehicles were designed for rugged terrain and equipped with semi-autonomous capabilities, while Rivian expressed plans for future models to be fully autonomous. Production was initially slated to commence in 2020.

MoU With Mercedes-Benz

In September 2022, Rivian and Mercedes-Benz Group signed a Memorandum of Understanding (MoU) to form a joint venture focusing on the investment and operation of a European factory dedicated to producing large commercial electric vans. Production was expected to begin within a “few years,” with the facility featuring a shared assembly line to manufacture distinct designs for each company. The New York Times described this partnership as “a rare example of cooperation between a traditional carmaker and a new challenger,” highlighting that Mercedes’ extensive manufacturing capacity could potentially help Rivian overcome its production challenges. However, in December 2022, Rivian announced that the planned partnership would not proceed as initially outlined while leaving the door open for possible future collaborations.

In January 2023, The Wall Street Journal reported that Rivian had faced a challenging period marked by the departure of several top executives in recent months, including some of its longest-serving employees. This wave of exits raised concerns about the company’s stability during a crucial phase in its growth.

Rivian Stock Price Forecast: Past Performance

To get a detailed Rivian share value outlook, it is essential for investors to get a rough idea of RIVN stock’s price history to determine its future growth potential. However, it is to be noted that past performance is not an indicator of RIVN’s future price targets and financial projections.

Rivian made its debut on the stock market with an initial public offering (IPO) on November 10, 2021. The company’s shares were priced at $78, raising a staggering $11.9 billion and giving Rivian a market valuation of over $66 billion. On its first day of trading, the stock soared nearly 30% to close at $100.73 per share, making it one of the largest IPOs in history.

In the weeks following its IPO, Rivian’s stock price continued to climb, fueled by investor optimism and enthusiasm for the electric vehicle market. By late November 2021, the stock reached an all-time high of around $179.47, briefly pushing Rivian’s market capitalization beyond $150 billion. This milestone made Rivian the third most valuable automaker globally, surpassing legacy manufacturers like Volkswagen and Ford.

However, Rivian’s meteoric rise was followed by a period of price correction as investors reassessed the stock’s valuation in light of the company’s production challenges and the competitive landscape. In December 2021, the stock experienced a significant decline, with shares falling below $100. Despite these fluctuations, Rivian’s stock price remained resilient, and the company continued to focus on expanding its production capabilities and delivering its electric vehicles to customers.

In 2022, Rivian’s stock got negatively impacted due to the rise of Covid, significantly reducing the production and sales rate. The RIVN stock’s price went below $50 by mid-2022. In early January 2023, Rivian witnessed its key staff’s departures, causing more price drops in the RIVN stock.

Rivian Stock Price Prediction: Technical Analysis

In recent times, RIVN stock has been exhibiting an intense bearish rally, with no immediate indication of a rebound. This downward trajectory is further triggered by the recent interest rate hikes and RIVN’s top executives’ departures, causing concerns about a potential sharp drop in the stock’s value. A comprehensive technical analysis of RIVN’s stock reveals several concerning bearish signals, advising investors to exercise caution when contemplating this investment.

As per TradingView, RIVN shares are presently trading at $14.53, reflecting an increase of over 0.41% in the last 24 hours. Our technical assessment for RIVN stocks suggests that the bearish momentum may continue for the next weeks, as there is potential for a significant downtrend. Analyzing the daily price chart, RIVN shares have established support near the $12.8 level, from which the stock price may attempt to break through its immediate resistance level. With RIVN’s price having dropped significantly below the crucial EMA-50 trend line, sellers may open more short positions to slump the stock’s price in the upcoming days before a new increase surfaces. The Balance of Power (BoP) indicator is currently trading in a bearish zone at 0.20, hinting at a 5% downward correction this week.

For a comprehensive price analysis of RIVN shares, it’s essential to consider the RSI-14 indicator. Though this indicator has recently experienced significant buying pressure, it has now dropped below the signal line and currently trades near the neutral region at 46, implying a clash between bears and bulls after RIVN stock failed to find resistance near $16. It is expected that RIVN’s price will soon attempt to break above its 38.6% Fib level to reach its short-term bullish objectives. If RIVN is unable to surge above this Fib channel, a downtrend could be on the horizon.

As the SMA-14 continues its fluctuating course, it trades below the RSI line, potentially hastening the stock’s upward correction on the price chart. If RIVN shares break above the EMA-50 trend line at the $16 resistance level, it could clear the path to the EMA-100 at $20. A breakout above the strong resistance at $29 would propel the share price toward the Bollinger band’s upper limit of $35.

On the other hand, if RIVN falls below the critical support level of $12, a sudden collapse might occur, leading to further price drops and pushing the RIVN share to trade near the Bollinger band’s lower limit of $8.62. If RIVN’s price fails to maintain trade above $8, it can trigger a more bearish bloodbath. The website BingoSites.co.uk commented “The BlockchainReporter’s analysis on Rivian’s stock forecasts a promising future for the electric vehicle manufacturer, suggesting a bullish trend by 2030.”

Rivian Stock Price Prediction By Blockchain Reporter

Rivian Stock Price Prediction 2023

It is anticipated that the EV market will witness significant expansion in 2023, owing to increased adoption, supportive government policies and regulation. Rivian’s innovation, along with its growing production capacity and expanding sales network, is likely to position it well for growth. As a result of these factors, Rivian’s stock price is projected to range from $20 to $30, with an average value of $24.

Rivian Stock Price Prediction 2024

By 2024, Rivian is expected to see significant results from its efforts to strengthen its position in the global EV market. Its expansion into international markets and increased focus on research and development are anticipated to fuel growth. However, the stock’s performance might be affected by macroeconomic indicators and market competition. Based on these factors, the stock price for Rivian is estimated to range between $35 and $46, with an average value of $40.

Rivian Stock Price Prediction 2025

In 2025, Rivian is expected to have a broader range of products, including more affordable models aimed at a wider customer base. The company’s investments in its expansion, partnerships and charging infrastructure are predicted to yield favorable results. If there are no unforeseen hurdles, the RIVN stock price is anticipated to reach a minimum of $58 and a maximum of $75, with an average value of $65.

Rivian Stock Price Prediction 2026

It is expected that by 2026, Rivian will have diversified its product line and improved its technology stack. Based on these factors, Rivian’s stock performance is projected to have a minimum level of $80 and a maximum level of $110, with an average value of $94.

Rivian Stock Price Prediction 2027

With the continued acceleration of EV adoption worldwide and China maintaining its position as the largest EV market, it is expected that Rivian’s sales and revenues will substantially increase by 2027. In such a scenario, Rivian’s stock price is predicted to range between $96 and $130, with an average trading value of $115.

Rivian Stock Price Prediction 2028

The ongoing global shift towards sustainable energy and transportation is expected to benefit Rivian in 2028. The company’s commitment to innovation, along with its expanding global presence, should drive further growth in the stock price. It is predicted that Rivian’s stock price in 2028 will range between $118 and $145, with an average value of $130.

Rivian Stock Price Prediction 2029

As Rivian nears the end of the decade, its ongoing development of promising EV technologies and expansion of market share is likely to enhance its stock performance. It is forecasted that in 2029, Rivian’s stock price will hit an average trading value of $165, with the potential to reach a minimum of $148 and a maximum of $188.

Rivian Stock Price Prediction 2030

With the increasing global transition to electric vehicles, Rivian’s prospects in the long term appear promising. By 2030, it is likely that Rivian will build more partnerships with industry leaders, significantly pushing RIVN stock’s price upward. With sustained growth and a strong competitive position, Rivian’s stock price could range from $195 to $225, with an average of around $210.

Rivian Stock Forecast: Market Analysts

CNN Money has provided 12-month price forecasts for Rivian Automotive Inc. Their median target is $27, with a high estimate of $44 and a low estimate of $16.00. The median estimate suggests an increase of +86.46% from the last price of $14.48. According to 21 polled investment analysts, the current consensus is to buy stock in Rivian Automotive Inc. This rating had remained steady since March when it was unchanged from a buy rating.

Wall Street analysts have provided 12-month price targets for Rivian Automotive. The average price target is $28.35, with a high forecast of $46 and a low forecast of $19. The average price target indicates a 95.92% change from the last price of $14.47.

Green Flags For RIVN’s Future Performance

Production Update: Rivian announced on April 3 that it had manufactured 9,395 vehicles and delivered 7,946 vehicles in the first quarter of 2023. It also confirmed its full-year production goal of 50,000 vehicles. Although investors will have to wait until May 9 for the full first-quarter financial report, this update implies that there will be no unpleasant surprises for optimistic investors in the near future.

Cost-Cutting Moves: In 2022, Rivian’s adjusted EBITDA loss expanded to $5.2 billion from $2.8 billion in 2021, and analysts only expect a slightly narrower loss of $4.5 billion in 2023. Despite ending 2022 with total liquidity of $12.1 billion, it represented a significant decrease from the previous year’s $18.4 billion.

The decision to reduce its workforce by 6% this year, matching last year’s 6% reduction, shows that Rivian is working to streamline its business and reduce losses. While the company may not reach break-even soon, these steps indicate a move in the right direction.

Amazon’s Latest Update: As of the end of March, Amazon announced that it was using over 3,000 Rivian EDVs to fulfill deliveries in more than 500 U.S. cities and regions. This number is three times higher than what Amazon reported in November and indicates a strong and closely monitored partnership between the two companies. Additionally, Amazon disclosed that it had delivered 75 million packages using Rivian’s EDVs, which is a positive development for RIVN’s price.

Conclusion

As Rivian continues to expand, the company plans to introduce more electric vehicle models tailored to different markets and applications. Additionally, Rivian’s partnership with Amazon has led to the development of a custom electric delivery van, with plans to deploy 100,000 units by 2030.

As the company navigates the competitive landscape, balances production challenges, and pushes the boundaries of sustainable mobility, the performance of RIVN shares will undoubtedly be a captivating subject for investors and EV enthusiasts.

FAQ

What is Rivian?

Rivian is an innovative electric vehicle manufacturer that focuses on sustainability and performance. It has developed the R1T electric pickup truck and the R1S electric SUV and has a partnership with Amazon for an electric delivery van.

Who founded Rivian and when?

Rivian was founded in 2009 by RJ Scaringe.

What is the Rivian stock price prediction for 2025 and 2030?

In 2025, the RIVN stock price is anticipated to reach an average value of $65. By 2030, the stock price could have an average value of around $210.

What are the key factors affecting Rivian’s stock price?

Factors that could impact Rivian’s stock price include EV market expansion, competition, production capacity, sales network, global adoption of EVs, and partnerships with industry leaders.

What are some recent developments in Rivian’s business?

Rivian has announced that it manufactured 9,395 vehicles and delivered 7,946 vehicles in Q1 2023, aiming to produce 50,000 vehicles for the full year. The company is also making cost-cutting moves to improve its financial position.

What is the consensus among market analysts for Rivian stock?

According to 21 polled investment analysts, the current consensus is to buy stock in Rivian Automotive Inc. CNN Money’s median target for RIVN is $27, with a high estimate of $44 and a low estimate of $16.00. Wall Street analysts’ average price target is $28.35, with a high forecast of $46 and a low forecast of $19.

READ MORE:

Baby Doge Coin (BABYDOGE) Price Prediction

Lucid Stock Price Prediction 2025: Can LCID Stock Recover Amid Bearish Sentiment?

EverGrow Coin Price Prediction: Will EGC Skyrocket to $1 Soon?

MANA Price Prediction $100 In 2022-2030: Will Decentraland Rise to $100?