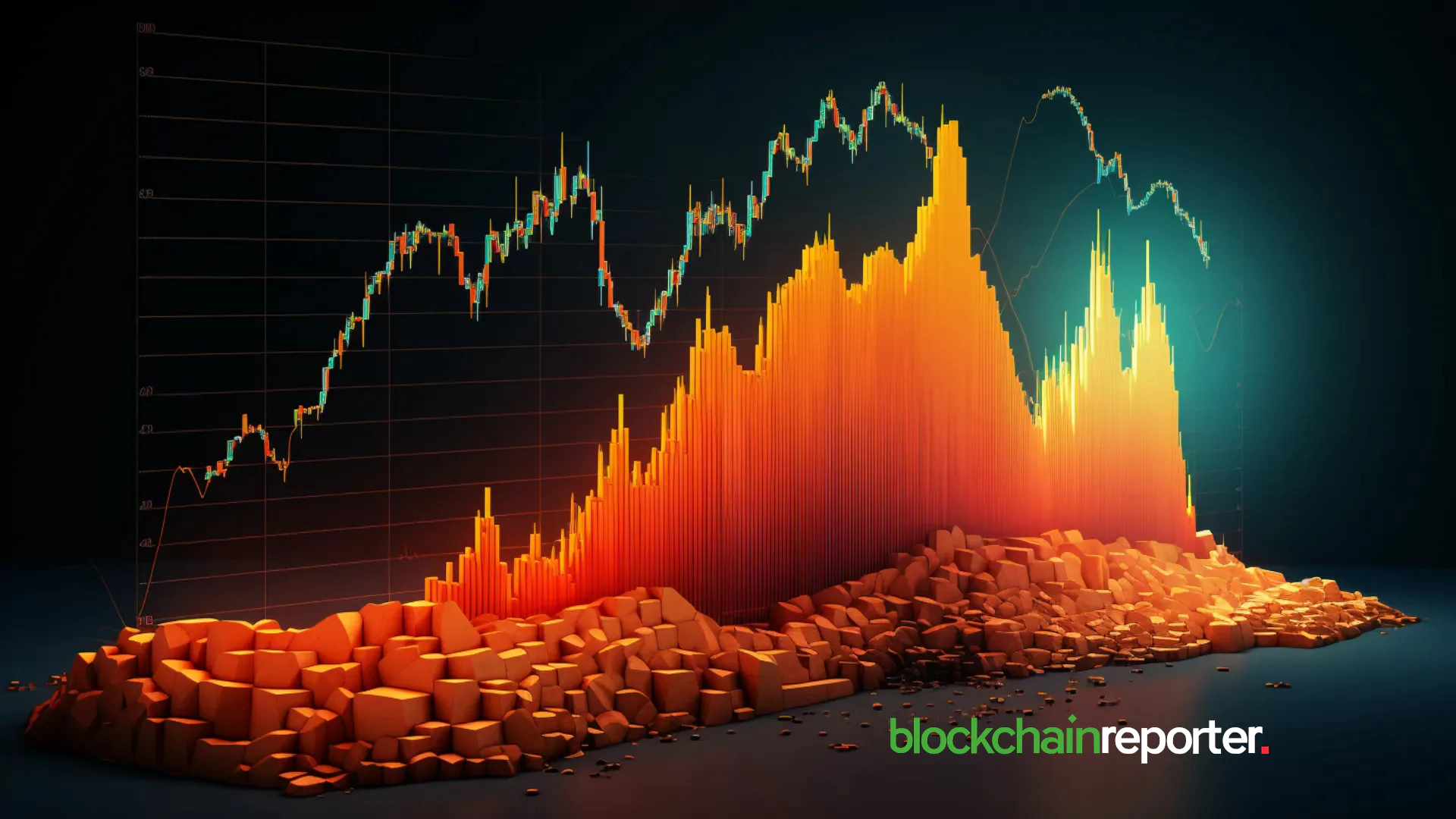

The Render Token ($RNDR), trading against Tether (USDT), is currently consolidating within a defined range on the weekly chart, showing signs of potential for a breakout. Recent technical analysis suggests that if the token manages to surpass the $9.66 to $11.00 resistance range, it could move towards a significant price target of $44.76. The breakout is expected to lead to a substantial upward movement, presenting potential opportunities for traders and investors.

According to@ best_ analyst, At present, RNDR/USDT is consolidating within a relatively narrow price range, between the key levels of $3.35 and $4.15, which are considered the critical support levels. These support zones indicate areas where demand for the token is strong enough to halt further downward movement, providing a foundation for future growth.

As the consolidation continues, the token is likely to face resistance in the $9.66 to $11.00 range. This zone is essential for determining whether RNDR can break out of its current pattern. A successful breakout past these levels would be seen as a significant bullish signal, with many analysts projecting a swift move toward the $44.76 price target.

The Path to $44.76 and Market Outlook

Looking at the broader chart, the technical indicators suggest that if RNDR can breach the resistance zone, the price could quickly escalate toward the $44.76 level. This price target is based on the projected path of the token as it moves through the immediate supply zone. If the token successfully navigates the consolidation phase and manages to break out of this crucial range, it could trigger a significant rally, potentially marking a new high for $RNDR.

However, for this scenario to materialize, the token must first maintain its position above the support levels. If the price dips below $3.35, it could signal a more bearish outlook, leading to further downward consolidation or even a reversal of the current trend. In the short term, the market sentiment for RNDR remains neutral as it continues to consolidate. This range-bound price action is typical before a breakout, and many traders are closely watching for signs of a trend reversal. If the token can break through the resistance levels, it would indicate that the market is preparing for a more substantial upward move, possibly pushing $RNDR towards new highs.

On the other hand, if the price fails to break the $9.66-$11.00 resistance zone and begins to fall towards the lower support levels, market participants may need to reassess their outlook for the token. A dip below the support range could indicate a prolonged period of consolidation or the beginning of a bearish phase, forcing traders to reconsider their positions.

The outlook for RNDR/USDT is currently in a phase of neutral consolidation, but the potential for a breakout is real. A successful move past the $9.66 to $11.00 resistance zone could send the price soaring towards $44.76, making it an exciting prospect for traders who are anticipating upward movement. However, the token’s ability to hold the critical support levels between $3.35 and $4.15 will be pivotal in determining its future direction. Market participants should closely monitor these levels for any signs of a breakout or breakdown.