- 1. Rumble: A Quick Introduction

- 2. Rumble: Infrastructure

- 3. Rumble Stock: Price History

- 4. Rumble Stock: Technical Analysis

- 5. Rumble Stock Price Prediction By Blockchain Reporter

- 5.1. Rumble Stock Price Prediction 2023

- 5.2. Rumble Stock Price Prediction 2024

- 5.3. Rumble Stock Price Prediction 2025

- 5.4. Rumble Stock Price Prediction 2026

- 5.5. Rumble Stock Price Prediction 2027

- 5.6. Rumble Stock Price Prediction 2028

- 5.7. Rumble Stock Price Prediction 2029

- 5.8. Rumble Stock Price Prediction 2030

- 6. Rumble Stock Price Forecast: By Experts

- 7. Rumble Stock: Q2 Financial Results

- 8. Conclusion

- Rumble: A Quick Introduction

- Rumble: Infrastructure

- Rumble Stock: Price History

- Rumble Stock: Technical Analysis

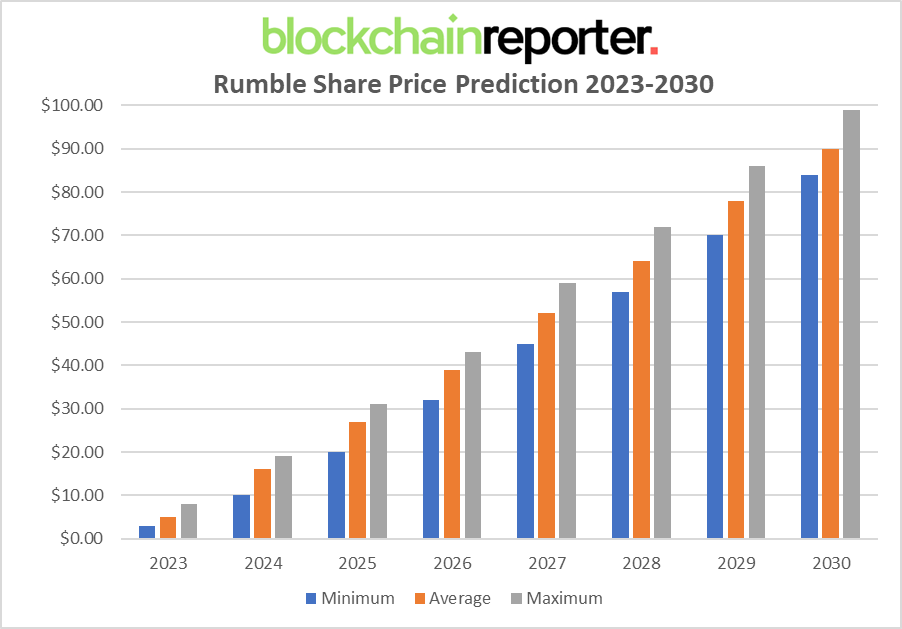

- Rumble Stock Price Prediction By Blockchain Reporter

- Rumble Stock Price Prediction 2023

- Rumble Stock Price Prediction 2024

- Rumble Stock Price Prediction 2025

- Rumble Stock Price Prediction 2026

- Rumble Stock Price Prediction 2027

- Rumble Stock Price Prediction 2028

- Rumble Stock Price Prediction 2029

- Rumble Stock Price Prediction 2030

- Rumble Stock Price Forecast: By Experts

- Rumble Stock: Q2 Financial Results

- Conclusion

Rumble Inc. emerged on the digital scene as a plucky newcomer, making its way into a space dominated by giants like YouTube. Founded in 2013 by Chris Pavlovski, Rumble provided an alternative platform for video creators who felt overshadowed by the influencer culture prevalent on established platforms. It was Pavlovski’s response to what he saw as a biased ecosystem that favored established creators and corporations over the smaller, independent ones. Rumble was built on the promise of giving a voice to the voiceless and ensuring that all content creators had equal opportunity to be seen and heard. When the world was hit by the COVID-19 pandemic, digital content consumption skyrocketed as people were confined to their homes. Rumble seized this opportunity and witnessed a dramatic increase in viewership. Its commitment to less restrictive content moderation policies made it attractive to a diverse set of voices, some of whom felt marginalized by the stringent policies of other platforms. As a result, by the third quarter of 2021, Rumble’s monthly active users soared to 36 million, a staggering increase from the 1.6 million pre-pandemic figures. This upsurge in user engagement translated into financial growth and an elevated stock market profile when Rumble went public. Its stock price, traded on NASDAQ under the ticker RUM, became a new barometer for the company’s worth, capturing investor interest and speculation about the platform’s future in a growing digital content market. In this article, we’ll explore Rumble stock price with in-depth technical analysis, its future market trajectory and analysts’ forecast from Rumble share price prediction.

Rumble: A Quick Introduction

Rumble operates as an online hub for video sharing, website hosting, and cloud-based services. With dual headquarters in Toronto, Ontario, and Longboat Key, Florida, Rumble caters to a global audience. The platform came to life under the guidance of Chris Pavlovski, a visionary in the Canadian tech industry, in October 2013. Known for its support of Truth Social, Rumble has become a favored space for conservative American voices, ranging from mainstream right-wing to far-right ideologies. The service is often referred to within the context of alternative technology, or “alt-tech,” distinguishing itself from mainstream tech networks.

From its inception, Rumble aimed to provide a free and open internet platform, capitalizing on creators’ discontent with the growing influence of ‘cancel culture’ and the control large platforms held over content distribution and earnings. It positioned itself as an alternative that offers creators direct revenue streams, unfettered by corporate advertisers and special interests. This stance on free speech and creator empowerment has led to significant growth during the COVID-19 pandemic, with a jump from 1.6 million average monthly users in the third quarter of 2020 to a record 36 million by the same period in 2021.

Rumble: Infrastructure

Chris Pavlovski founded Rumble at the end of 2013 as a haven for independent video creators who felt neglected by Google’s preference for prominent influencers on YouTube. The platform’s popularity surged among conservatives, especially after Congressman Devin Nunes and other right-wing figures migrated there, alleging censorship on YouTube. This ideological shift coincided with Rumble’s aggressive legal stance against Google, accusing the tech giant of unfair search practices and seeking over $2 billion in damages. The lawsuit underscored the broader contention over big tech’s influence on public discourse.

In 2021, Rumble’s valuation soared with backing from Peter Thiel and J.D. Vance, pegging the company’s worth at $500 million. The acquisition of Locals and a partnership with Trump Media & Technology Group marked Rumble’s foray into broader media and technology ventures. By 2022, Rumble was not only launching its own advertising platform but also going public on NASDAQ, reflecting its escalating influence. The purchase of CallIn the following year marked its latest strategic expansion, underscoring Rumble’s ongoing commitment to cultivating a diverse and open digital media landscape.

Rumble asserts its resilience against “cancel culture,” positioning itself as a platform that supports freedom of expression. Its user interface includes sections like “recommended channels” to help users discover new content creators and an “Earnings” section that enables creators to profit from their work. Creators can monetize their content by licensing videos to Rumble’s partners, including Yahoo! and Microsoft News, with earnings directly credited to their Rumble accounts.

The service maintains specific content guidelines, prohibiting pornography, harassment, hate speech, and copyright violation, aligning with legal standards and moral codes. These policies, aimed at fostering a respectful community, have nonetheless faced scrutiny from some alternative tech circles for their stance against hate speech.

Rumble’s commitment to technical autonomy is evident in its proprietary cloud services and video streaming technology. However, its adherence to such standards led to the platform being blocked in France as of November 2022, following Rumble’s non-compliance with French demands to deactivate Russian state media channels amidst wider geopolitical tensions.

The platform, which hosts Truth Social and welcomes diverse political figures like Tulsi Gabbard and Glenn Greenwald, has seen user numbers swell to 78 million MAUs. Despite controversies involving figures like Andrew Tate, Rumble actively moderates content to a degree, distinguishing it from peers like BitChute and Odysee. Its user base is predominantly Republican, with many also active on other social platforms. Rumble recently ventured into sports broadcasting, showcasing its versatility and reach beyond political content.

Rumble Stock: Price History

Rumble’s entrance into the stock market could be characterized by strong investor interest, given its niche in the digital content space. Rumble stock started trading on NASDAQ at a price of $10 in April 2021. Following its debut, the company’s stock price saw low volatility due to market sentiment, product launches, and varying quarterly results. Seasonal trends and industry-specific news, such as changes in content policy or new feature rollouts, led to significant swings in stock value.

In December, Rumble stock price started making moves as Covid pandemic boosted the company’s user engagement and investor interest. The RUM share value made a high of $15 but faced minor selloff later, resulting in massive volatility on the price chart. After hovering around $10 for a few weeks, Rumble stock price again gained momentum as it skyrocketed toward $18.5. However, this upward rally was soon capitalized by investors as it faced further selling pressure and declined. As a result, RUM share price consolidated near $10 for several months.

In September 2022, Rumble stock price again gained buying demand but the surge was short lived. After reaching a high of $17, the RUM share price declined and the selling pressure was more intensified this time. Rumble reached a low of $6. With minor volatility above $10, Rumble triggered intense bearish momentum in June 2023 as its price dropped toward a new low near $4.

Rumble Stock: Technical Analysis

Recently, the Rumble share price experienced intense bearish sentiment, which has triggered sellers near the immediate support levels. The price has been on a steady downward trajectory over the last few weeks due to low engagement from users. After dropping below the $6.8-mark, Rumble’s price sparked an intense selling momentum and plunged exponentially. As the market was previously heavily influenced by declining investor interest in the platform, Rumble stock price failed to escape its bearish region. The price has been facing intense selling pressure recently, and it was forced to break below multiple Fib levels. A thorough technical analysis of Rumble share price reveals mixed indicators, which may soon send the price either to new lows or highs.

According to TradingView, the RUM share price is currently trading at $4.7, reflecting a decrease of 0.42% in the last 24 hours. Our technical evaluation of Rumble stock price indicates that the current bearish momentum may soon intensify as bears are attempting to reverse the trend near the upcoming support level; however, bulls are trying to prevent the price from dropping below the support level of $4.5. Examining the daily price chart, Rumble stock price has found resistance near the $9 level, from which the price gained bearish momentum and broke below multiple Fib channels. As Rumble’s price continues to trade below the EMA20 trend line, sellers are gaining confidence to open further short positions and send the price to test its upcoming support. The Balance of Power (BoP) indicator is currently trading in a negative region zone at 0.34 as sellers are increasing their domination on the price chart.

To thoroughly analyze the price of a Rumble share value, it is crucial to take a look at the RSI-14 indicator. The RSI indicator recently experienced a decline as the Rumble stock price failed to hold buyers’ demand near $6. The trend line is currently hovering below the midline as it trades at level 41, hinting that further downward correction is on the horizon. It is anticipated that the Rumble share price will soon attempt to break above its 23.6% Fibonacci level to achieve its short-term bullish goals of around $5.5. If bears fail to plunge below the current 38.2% Fibonacci region, an upward trend might be on the horizon.

As the SMA-14 continues its downward swing by trading at 45, it trades slightly above the RSI line, potentially holding hopes about the stock’s upward movement on the chart. If the Rumble stock price makes a bullish reversal, it can pave the way to resistance at $6.8. A breakout above will drive the share’s price toward the upper limit of the Bollinger band at $8.7.

Conversely, if the stock fails to hold above the critical support region of $4.5, a sudden collapse may occur, resulting in further price declines and causing the share price to trade near the Bollinger Band’s lower limit of $3.2. If the price fails to continue a trade above, it may trigger a more significant bearish downtrend to $2.5.

Rumble Stock Price Prediction By Blockchain Reporter

Rumble Stock Price Prediction 2023

In 2023, Rumble’s share price is expected to have an average value of $5, with potential fluctuations causing the price to dip to a minimum of $3 and climb to a maximum of $8. The anticipated variability in the stock’s performance can be due to current market performance and the company’s aggressive marketing strategies aimed at expanding its consumer base.

Rumble Stock Price Prediction 2024

For the year 2024, Rumble’s stock is predicted to increase its average price to $16, considering the added value from its advancements in UI and market presence. The minimum price for the year is forecasted to be $10, with the possibility of a maximum price reaching $19.

Rumble Stock Price Prediction 2025

Heading into 2025, Rumble’s stock is forecasted to sustain its upward momentum, with an average price of $27. The price’s lower spectrum is expected to be around $20, while the higher end may extend up to $31. This growth is projected based on Rumble’s continuous innovation and the expansion of its product line.

Rumble Stock Price Prediction 2026

The year 2026 holds promise for Rumble as it navigates through expanding market opportunities in online streaming, with an average stock price projected at $39. The stock is likely to see a minimum price of $32 and may peak at $43.

Rumble Stock Price Prediction 2027

Rumble’s share price in 2027 is anticipated to average around $52, with a minimum and maximum projected at $45 and $59 respectively. This prediction assumes that Rumble will continue to capitalize on emerging technological trends and maintain robust financial health.

Rumble Stock Price Prediction 2028

Continuing its growth, Rumble’s share price in 2028 is expected to average $64, with the year’s prices ranging between a minimum of $57 and a maximum of $72. This estimate takes into account Rumble’s strategic plans to diversify its portfolio and enhance user experience.

Rumble Stock Price Prediction 2029

By 2029, Rumble’s average stock price is predicted to reach $78, supported by its established market position and solid operational performance. The stock may hit a low of $70 and a high of $86, reflecting both the company’s stability and potential market volatility.

Rumble Stock Price Prediction 2030

As we look towards 2030, Rumble’s stock is forecasted to solidify its gains with an average price of $90. The minimum price could potentially be at $84 with a maximum stretching to $99.

Rumble Stock Price Forecast: By Experts

Based on the latest data from TipRanks, the 12-month forecast for Rumble shares unanimously agrees on an average price target of $10.00. This target is consistent across the board, with both the highest and lowest predictions aligning at $10.00. Such a target suggests a significant increase of 113.22% when compared to Rumble’s recent trading price of $4.69.

CCN reports that the prevailing opinion among two surveyed analysts is to purchase Rumble Inc. shares. This recommendation has been consistent since December, maintaining the buy rating established at that time.

Rumble Stock: Q2 Financial Results

Rumble Inc., the rising video-sharing platform, has delivered an impressive financial performance for the second quarter of 2023, as revealed in their latest earnings report. The company’s revenue reached a record high of $25 million, marking a substantial increase of 468% compared to the same quarter the previous year. This remarkable growth is a testament to Rumble’s strategic diversification efforts and its successful cultivation of exclusive content.

Rumble’s financial success story of Q2 2023 is one of strategic innovation and targeted market expansion. The platform’s adoption of exclusive gaming, cultural, and lifestyle content has significantly contributed to this surge in revenue. Rumble’s ability to attract top influencers such as Kai Cenat and IShowSpeed, who command massive audiences, is reshaping the landscape for content-driven revenue.

The period saw an exceptional rise in user engagement, with an average of 11.8 billion minutes watched per month, up by 46% from the previous year. Content uploads have also seen a similar uptick, with a daily average of over 13,000 hours of video, a clear indicator of Rumble’s robust content pipeline and its appeal to creators. However, average monthly active users held steady at 44 million, reflective of market challenges and heightened competition.

Despite a slight decline in monthly active users from the previous quarter, Rumble has not slowed down its drive to strengthen its position in the digital space. The company’s cash reserves stood at an impressive $296.7 million, enabling continued investment in technology and content acquisitions.

Rumble’s content strategy has paid significant dividends, attracting a diverse audience with the addition of prominent figures like Robert F. Kennedy Jr., and further expanding into sports through a partnership with Bare Knuckle Fighting Championship. The platform’s strategic content acquisitions, including well-known creators such as DJ Akademiks, JiDion, The Quartering, and Mizkif, reflect its commitment to capturing the ever-elusive Gen Z demographic.

Post-quarter developments have kept the momentum going, with exclusive deals signed with influencers RiceGum and FaZe Kaysan, and popular streamer Steven Crowder’s ‘Mug Club’ community surpassing $7.5 million in subscription payments. Comedian JP Sears also launched his show ‘Lies You Can Trust,’ drawing in more viewers.

Conclusion

Rumble Inc. has demonstrated remarkable growth, with record-breaking quarterly revenue and strategic content expansion, including high-profile partnerships and acquisitions aimed at diversifying its user base. However, it faces challenges like market volatility and competition, affecting user metrics.

With solid financial reserves and a focus on innovative product development, Rumble’s stock may present an attractive opportunity for investors looking for high-growth potential in the tech and media sector.