The United States Securities and Exchange Commission (SEC) issued a strategic plan covering the fiscal years between 2022 and 2026. One of the chief targets of the respective strategy is to shield consumers from scams in trading. The other goals take into account the maintenance of a resilient and adequate regulatory agenda as well as the provision of support for a diverse workforce.

SEC Introduces Strategic Plan for Workforce Diversity, Enhanced Regulation, and Investor Protection

In this respect, Gary Gensler (the chair of the SEC) stated that the capital markets are associated with the majority of US residents’ lives. As per him, these take into account mortgage borrowing, acquisition of auto loans, or else operating for a firm involved in collecting funds from people. The chair stated that this is the reason requiring the regulator to keep on modernizing per the demand. In the words of Gensler, the SEC should continuously evolve its set of rules to be compatible with the latest requirements.

The chair added that the changing business models, and technologies, as well as the markets’ transformation, are the stimulating factors. Gensler asserted that their strategy would be assistive for the people residing in the US. It would also lead the suitable endeavours to advance the market and spend capital on skilled staff.

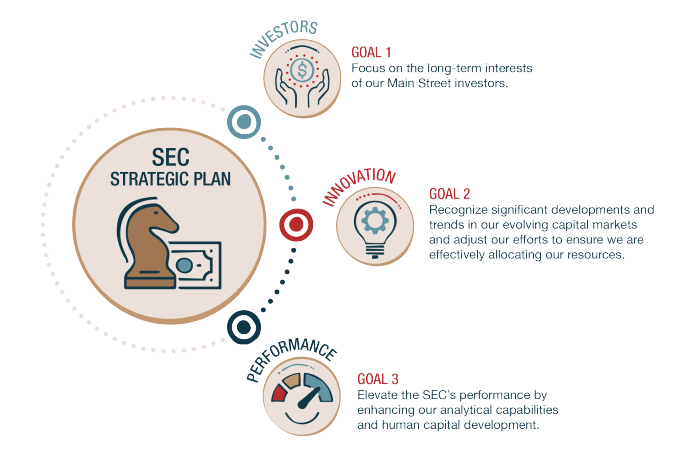

A draft of the SEC’s strategic plan was published by it in August. This was done to obtain comments from the public. The plan’s conclusive version pointed out that there were 3 chief objectives mentioned by the agency. The initial was to protect the investing community from scams, misconduct, and manipulation. The 2nd point dealt with the creation and enforcement of a vigorous regulatory agenda including advanced technologies, markets, and business models.

The Strategic Plan to Improve Disclosures and Let Investors Make Learned Decisions

While the 3rd goal was to assist a professional workforce having inclusivity, equitability, and diversity. The talented workforce would also be completely prepared to further the objectives of the organization. For the safeguard of the investors, the SEC disclosed to pursue examination and enforcement endeavors targeted at addressing the misconduct and risks.

The agency additionally has a strategy to improve the utilization of data as well as to update the disclosures’ content, design, and delivery. This would let the investors make learned decisions, in line with the strategic plan.