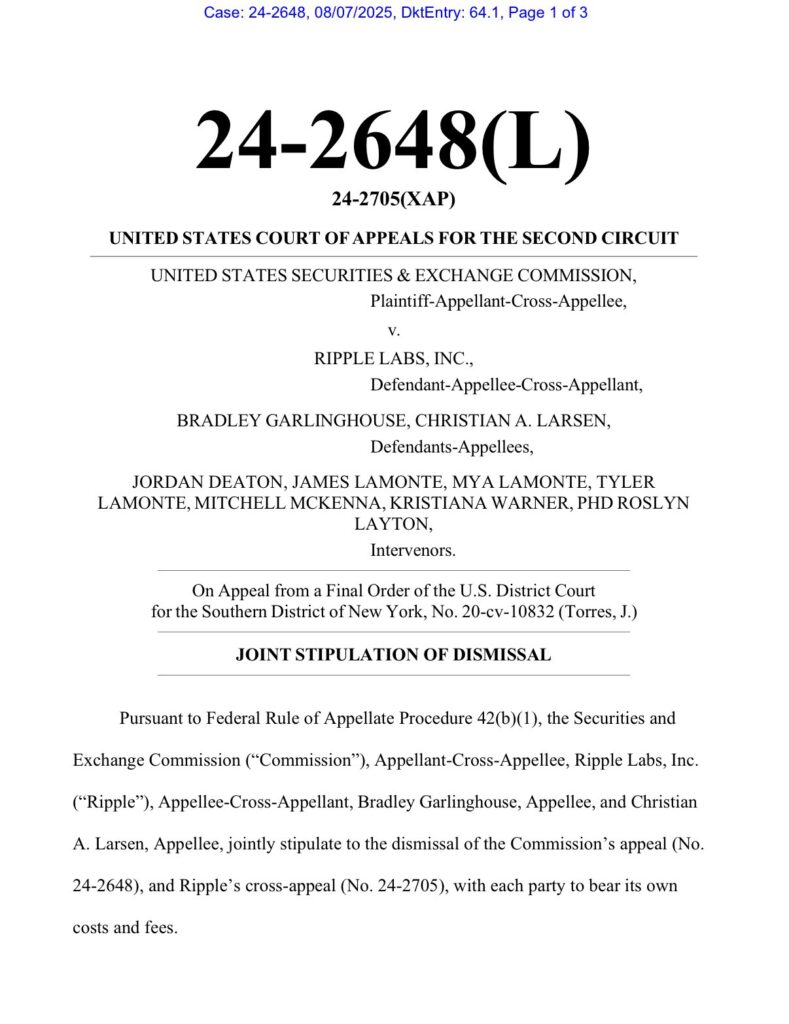

BREAKING — August 7, 2025: The long-running legal battle between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs Inc. has officially concluded. In a significant move, both parties filed a Joint Stipulation of Dismissal with the U.S. Court of Appeals for the Second Circuit, effectively ending the case once and for all.

What Happened?

According to the filing in Case No. 24-2648(L) and 24-2705(XAP), the SEC and Ripple Labs—along with individual defendants Bradley Garlinghouse and Christian A. Larsen—have agreed to dismiss all appeals. This includes both the SEC’s primary appeal and Ripple’s cross-appeal. Each party will bear its own legal costs and fees.

The case had been on appeal following a final order from the U.S. District Court for the Southern District of New York (No. 20-cv-10832), which partially ruled in Ripple’s favor in 2023 by stating that XRP was not a security in secondary market sales.

The Signatures that Sealed It

The joint dismissal was signed by attorneys representing Ripple, Garlinghouse, Larsen, and the SEC. Notably, the document confirms that Ripple and its executives authorized the SEC to file the stipulation with their signatures included.

Why It Matters

This marks the official end of a lawsuit that began in December 2020 and has had massive implications for the crypto industry. With all appeals withdrawn, Ripple is cleared of any further federal litigation tied to XRP’s regulatory status—at least for now. The decision could influence how other tokens are treated under U.S. securities law, especially as lawmakers debate crypto regulation frameworks.

For XRP holders and crypto companies watching from the sidelines, this is a major victory and a potential signal of regulatory clarity to come.