Recent days have seen a selling activity in the cryptocurrency sector, particularly impacting *SHIB* and *DOGE* holders. With Bitcoin’s price consolidating within a range-bound zone of $50K-$52K, a ripple effect of bearish sentiment spread throughout the market, leading to a noticeable slowdown for many meme-based cryptocurrencies, Shiba Inu and Dogecoin among them. Amid this selling pressure, the meme coin market is witnessing a surge in on-chain activities and most of them have now turned bearish, suggesting further correction for SHIB and DOGE prices. Nonetheless, market experts are forecasting a robust comeback for both DOGE and SHIB, citing signs that point towards a promising recovery ahead.

Whale Interest Continues To Decline For Meme Coins

Since January 22, the total value of all cryptocurrencies has shown a steady increase, recently reaching a new high for the year by crossing the $2 trillion mark. Despite this impressive milestone, there has been a minor pullback in prices lately. Additionally, the market cap has lost its momentum.

Notably, Bitcoin’s value is attempting to surge above $52K; however, it continues to face rejection from sellers near the resistance line. As a result, both buyers and sellers continue to liquidate their positions during minor rallies to secure the maximum gains amid the consolidated momentum. According to Coinglass data, the crypto market has witnessed total liquidation of over $110 million, and both side traders contributed to this liquidation equally.

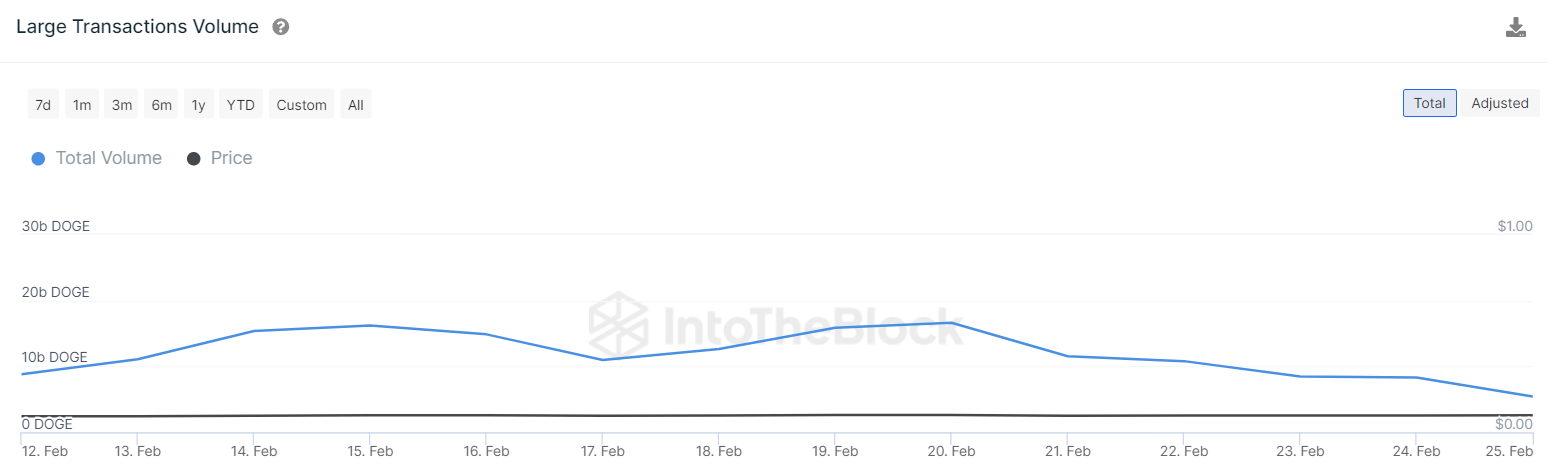

Consequently, the market for meme cryptocurrencies like Dogecoin and Shiba Inu is experiencing volatility. With critical on-chain metrics turning negative, there’s an indication of increased selling pressure on these popular meme tokens. According to IntoTheBlock data, there’s been a significant drop in large transactions for Dogecoin, falling more than 50% from a high of 16.6 billion DOGE to just 5.4 billion DOGE, signaling reduced interest from major investors. This decrease could lead to lower volatility and reduce the chances for a bullish reversal.

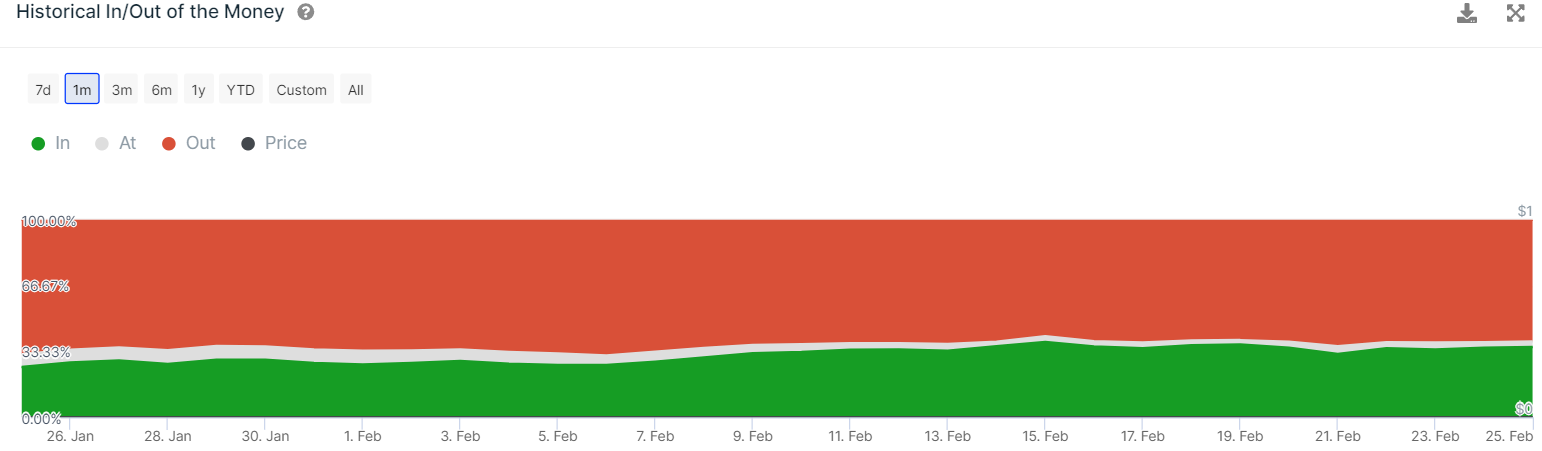

Meanwhile, Shiba Inu is seeing a rise in the number of addresses incurring losses, with the figure reaching a new high of 62%, or 822,000 addresses, now underwater. This bearish trend for Shiba Inu could compel holders to sell off their assets, potentially triggering a fresh wave of selling pressure across the market.

Dogecoin (DOGE) Price Analysis

Efforts by sellers to push Dogecoin back into the symmetrical triangle pattern were not countered by buyers, leading to a continued decline in DOGE’s price below key Fibonacci levels, plunging the likelihood of a bullish reversal. Currently, Dogecoin is trading at $0.0846, showing a decrease of more than 1.6% from the previous day’s value.

The 20-day Exponential Moving Average (EMA) is now at $0.085 and is on a downward trend, while the Relative Strength Index (RSI) has fallen below the midpoint to 43, indicating that sellers are gaining the upper hand.

If Dogecoin remains below the moving averages, it could face difficulty in showing any bullish momentum. This situation points to a growing bearish mood, with selling pressure likely even during minor price recoveries. Falling beneath the support line at $0.08 could trigger a strong selling wave.

Conversely, if buyers manage to reverse the downward trajectory and push the price above the EMA levels, Dogecoin could aim for an upward move towards the $0.09 resistance area.

Shiba Inu (SHIB) Price Analysis

Shiba Inu has seen a pullback after its failure to sustain an upward trajectory around $0.00001, suggesting that short-term investors may be cashing in their gains. Such pullbacks can often attack investor confidence, potentially leading to a period of consolidation for SHIB’s price within a downward trend. Currently, SHIB is trading at $0.00000954, marking a decline of more than 0.88% from the previous day’s price.

The downward trend of the 20-day EMA, currently at $0.0000096, combined with an RSI nearing 45-level, indicates that bearish momentum predominates. Should the price drop below $0.0000092, it could head towards a significant support level at $0.0000085, which might renew interest among buyers. Yet, if selling pressure persists, the price could fall to $0.0000079.

Conversely, a price rebound above the EMA trend lines could signify a comeback in buying activity, potentially resuming the upward trend and aiming for a target price of $0.00001.