- ProShares UltraPro Short QQQ ETF: A Quick Introduction

- Drawbacks of the UltraPro Short QQQ (SQQQ) ETF

- Benefits of the UltraPro Short QQQ (SQQQ) ETF

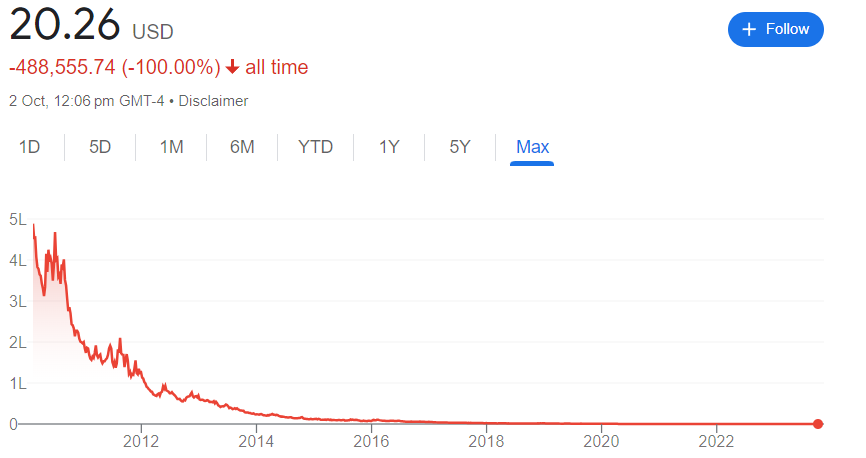

- SQQQ Stock: Price History

- SQQQ Stock Price: Technical Analysis

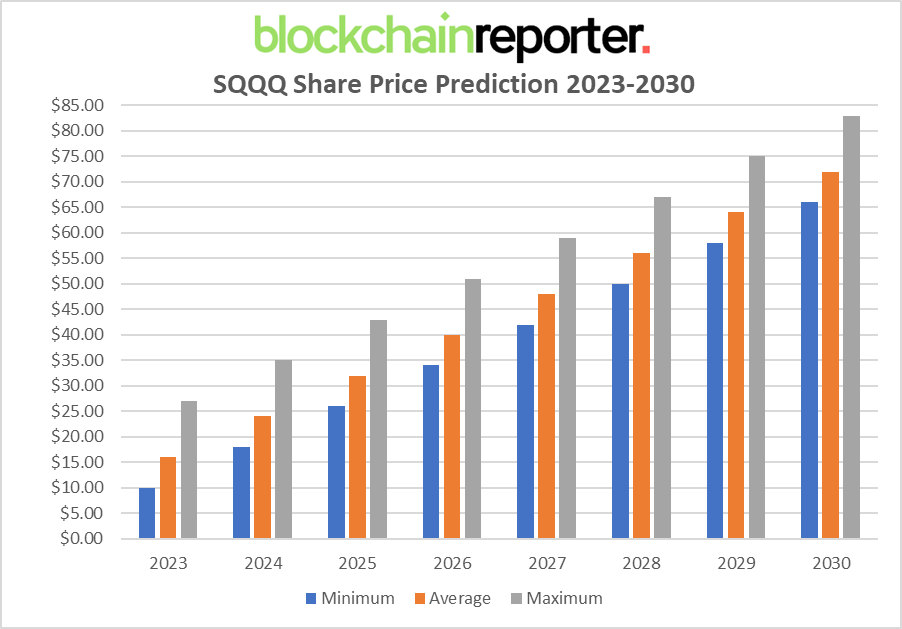

- SQQQ Stock Price Prediction By Blockchain Reporter

- SQQQ Stock Price Prediction 2023

- SQQQ Stock Price Prediction 2024

- SQQQ Stock Price Prediction 2025

- SQQQ Stock Price Prediction 2026

- SQQQ Stock Price Prediction 2027

- SQQQ Stock Price Prediction 2028

- SQQQ Stock Price Prediction 2029

- SQQQ Stock Price Prediction 2030

- SQQQ Stock Price Target: By Experts

- Use Cases Of SQQQ

- Conclusion

Exchange-traded funds (ETFs) have revolutionized the investment landscape since their inception. These funds, which are traded on stock exchanges much like individual stocks, offer investors a way to diversify their portfolios without having to buy each component of a particular index or sector. They’ve democratized access to various asset classes, allowing both institutional and retail investors to tap into markets that might have been out of reach or too costly to access individually.

The main advantage of ETFs is in their simplicity and transparency. They typically track an index, commodity, bonds, or a basket of assets. Investors can easily understand what’s inside an ETF thanks to its daily disclosure of holdings. Moreover, ETFs have brought about significant cost savings due to their low expense ratios compared to traditional mutual funds. Their tax efficiency, liquidity, and flexibility have further solidified their position as a preferred investment vehicle for many.

As the financial market expanded to meet investors’ demands, so did the complexity and variety of ETFs. From broad-market ETFs to sector-specific, thematic, and even leveraged or inverse ETFs, the choices are vast. This brings us to one such unique instrument – the ProShares UltraPro Short QQQ ETF, commonly known by its ticker symbol, SQQQ. SQQQ offers a distinctive approach to the market, particularly for those looking to hedge against or capitalize on downward movements in the NASDAQ-100 Index. In this article, we’ll explore the SQQQ stock price, its current technical analysis, future market prediction and SQQQ price target by analysts to determine whether this is the best ETF to invest in 2023.

ProShares UltraPro Short QQQ ETF: A Quick Introduction

ProShares, a prominent issuer of exchange-traded funds, also specializes in inverse ETFs and related products. The company’s origins trace back to 1997 when Louis Mayberg and Michael Sapir, both former employees of Rydex, established ProFunds Group with an initial investment of $100,000. In the same year, the company pioneered the introduction of bear market inverse mutual funds.

Fast forward to 2006, and ProFunds Group expanded its offerings by launching ProShares, marking the debut of its first inverse ETF. By October 2021, ProShares took another innovative step by introducing an ETF focused on Bitcoin futures contracts.

Launched in February 2010 by ProShares, the UltraPro Short QQQ (SQQQ) is an inverse-leveraged ETF designed to mirror the performance of the Nasdaq 100 Index. This index represents the top companies, spanning both domestic and international realms, listed on the Nasdaq stock exchange. These companies are ranked based on their overall market capitalization, with financial institutions being the exception and not included.

Inverse-leveraged funds, like SQQQ, are constructed using financial derivatives, and in some cases, derivatives of those derivatives. To emulate the inverse performance of a particular asset, fund managers engage in short selling and utilize swaps. These financial instruments are essentially wagers on the anticipated underperformance of the underlying asset or security.

SQQQ: ETF Performance And Characteristics Top of Form

While many of Proshares’ ETFs fall into the moderately small to very small category, SQQQ follows suit. As of 2023, the total assets under management (AUM) for SQQQ stood at $4.56 billion.

SQQQ employs an inverse-leveraged strategy, aiming to deliver daily investment outcomes that are approximately the inverse of the daily performance of its benchmark index, amplified by a specific factor. In essence, SQQQ’s goal is to achieve three times the inverse performance of the Nasdaq 100.

Investing in SQQQ is akin to anticipating challenges in the broader non-financial stock market. Given that the Nasdaq 100 is predominantly influenced by sectors like technology, telecommunications, and healthcare, SQQQ is poised to thrive when these sectors face downturns.

Drawbacks of the UltraPro Short QQQ (SQQQ) ETF

Inverse-leveraged ETFs, like SQQQ, present several challenges, especially for investors aiming for long-term growth or those lacking the bandwidth to actively manage such assets:

- SQQQ is crafted for short-term, high-stakes trading, aiming to capitalize on potential downturns in the Nasdaq 100.

- It’s not tailored for prolonged holding. Over time, the returns of SQQQ can be significantly eroded by expenses and decay.

- Multiple factors make SQQQ an unsuitable cornerstone for a diversified portfolio.

- Being a smaller ETF, SQQQ can experience volatile price swings and is perpetually on the brink of potential closure.

- SQQQ’s valuation hinges on diverging from traditional market trajectories. While the Nasdaq 100 Index doesn’t mirror the entire stock market’s movements, it’s cyclical. Given the Nasdaq’s inherent tendency to appreciate over time, the long-term prospects for a 3x inverse-leveraged ETF like SQQQ appear grim.

Benefits of the UltraPro Short QQQ (SQQQ) ETF

Despite the challenges, there are merits to holding a daily-targeted leveraged ETF like SQQQ:

- It offers higher liquidity compared to other similarly-sized funds.

- Crafted to capitalize on market downturns, rather than being solely dependent on market ascents.

- Acts as a protective measure against anticipated market drops.

- Offers active traders a chance to benefit from daily market dynamics.

SQQQ Stock: Price History

Launched by ProShares in 2010, SQQQ emerged as a rising star for investors seeking to capitalize on potential downturns in the NASDAQ-100 Index.

With a starting price of $488,576 in 2010, SQQQ’s journey has been nothing short of a roller coaster. Its inverse-leveraged nature means that when the NASDAQ-100 climbs, SQQQ descends, and vice versa. This counter-movement has rendered SQQQ’s price chart a thrilling spectacle, with its peaks and troughs often reflecting the tech-centric index’s performance. Though the SQQQ ETF price failed to maintain a position near this level, it declined heavily in the following weeks. SQQQ’s price dropped to a low of $312,000 in April 2010.

However, the price made a strong rebound and touched a high of $467,000, and this was the last time for SQQQ to reach as high as this much. SQQQ price made heavy price fluctuation around the $300,000 mark and declined toward the bottom heavily.

However, the tech sector, a dominant force in the NASDAQ-100, has experienced numerous fluctuations over the past decade. From the meteoric rise of FAANG stocks to the challenges posed by data privacy concerns and antitrust issues, each tech tremor has resonated in SQQQ’s price.

SQQQ’s price showed hopes of a minor comeback by surging above $200K in 2011. It failed to maintain a bullish momentum later and dropped toward $20K in 2014. External dynamics, such as trade wars, geopolitical unrest, and global health crises, have left their imprint on SQQQ. For instance, during significant market downturns instigated by such events, SQQQ often witnessed surges, serving as a sanctuary for investors in stormy times.

Despite its sporadic moments of brilliance, it’s crucial to recognize SQQQ’s overarching trend. Given the stock market’s general upward trajectory, especially the NASDAQ-100, SQQQ, being an inverse-leveraged ETF, has struggled with sustaining consistent long-term growth.

SQQQ’s price continued to decline heavily and dropped below $1000 in 2017. While it presented short-term gain prospects during market slumps, its long-term outlook is deeply bearish with broader market tendencies. For market players, SQQQ’s trajectory brings the significance of timing, thorough market analysis, and a profound grasp of leveraged tools.

The SQQQ ETF price has declined gradually over the years, and it has now dropped below $20, sparking a high decline in trading interest.

SQQQ Stock Price: Technical Analysis

Recently, the SQQQ share price experienced a bearish trend, which has triggered sellers near the immediate resistance levels. The price has been on a steady upward trajectory over the last few weeks. After surging above the $16-mark, SQQQ price sparked an intense buying momentum and surged exponentially. As the market was previously heavily influenced by rising inflation and the COVID-19 pandemic, SQQQ showed no recovery, as seen on the daily price chart, and maintained its price momentum within a bearish region. The price has been facing intense bearish pressure recently; however, it managed to hold an uptrend above the support level. A thorough technical analysis of SQQQ ETF price reveals mixed indicators, which may soon send the price either to new lows or highs.

According to TradingView, the SQQQ price is currently trading at $19.8, reflecting a decrease of 2.8% in the last 24 hours. Our technical evaluation of SQQQ’s price indicates that the current bullish momentum may soon fade as bears are attempting to reverse the trend from the upcoming resistance at EMA100; however, bulls are trying to prevent the price from dropping below the support level of $16. Examining the daily price chart, SQQQ stock price has found support near the $16.8 level, from which the price gained bullish momentum and broke above multiple Fib channels. As SQQQ’s price continues to trade above the EMA20, bulls are gaining confidence to open further long positions and send the stock price to test its upcoming resistance. The Balance of Power (BoP) indicator is currently trading in a negative region zone at 0.83 as sellers are increasing their domination on the price chart.

To thoroughly analyze the price of SQQQ ETF, it is crucial to take a look at the RSI-14 indicator. The RSI indicator recently experienced a decline as SQQQ’s price failed to hold buyers’ demand near $20. The trend line is currently hovering below the midline as it trades at level 41, hinting that further downward correction is on the horizon. It is anticipated that SQQQ price will soon attempt to break above its 23.6% Fibonacci level to achieve its short-term bullish goals of around $22. If bears fail to plunge below the current 0.038 Fibonacci region, an upward trend might be on the horizon.

As the SMA-14 continues its downward swing by trading at 54, it trades slightly above the RSI line, potentially holding promises about the ETF’s upward movement on the price chart. If SQQQ price makes a bullish reversal, it can pave the way to resistance at $22. A breakout above will drive the share price toward the upper limit of the Bollinger band at $27.

Conversely, if SQQQ fails to hold above the critical support level of EMA200, a sudden collapse may occur, resulting in further price declines and causing the SQQQ price to trade near the Bollinger Band’s lower limit of $16. If the price fails to continue a trade above, it may trigger a more significant bearish downtrend to $10.

SQQQ Stock Price Prediction By Blockchain Reporter

SQQQ Stock Price Prediction 2023

In 2023, the SQQQ stock price is projected to maintain an average of around $16. The minimum price is expected to be around $10, while the maximum could soar up to $27. These predictions are based on the stock’s historical performance, market trends, and the overall economic landscape.

SQQQ Stock Price Prediction 2024

Heading into 2024, the SQQQ stock price is anticipated to experience a positive uptrend, averaging at approximately $24. The potential low for this year might be around $18, while the upper limit could reach $35. This forecast is grounded on the stock’s recovery, its adaptability to market fluctuations, and the strategic decisions made by its management.

SQQQ Stock Price Prediction 2025

By 2025, the SQQQ stock price is predicted to further climb, with an average price of $32. The minimum value for this year could be about $26, and the maximum might touch $43. This projection takes into account the stock’s potential to capitalize on market opportunities and its ability to go through inflation.

SQQQ Stock Price Prediction 2026

In 2026, the SQQQ stock is expected to sustain its upward trajectory, with an average price hovering around $40. The potential low for this year is estimated at $34, while the high could be as much as $51.

SQQQ Stock Price Prediction 2027

Moving forward to 2027, the SQQQ stock price is projected to average at about $48. The minimum price for this year might be around $42, and the maximum could escalate to $59. This prediction is rooted in the stock’s robust performance metrics and its ability to attract long-term investors.

SQQQ Stock Price Prediction 2028

By 2028, the SQQQ stock price is forecasted to reach an average of $56. The potential low for this year could be approximately $50, while the high might soar to $67.

SQQQ Stock Price Prediction 2029

In 2029, the SQQQ stock is anticipated to maintain a steady climb, with an average price of $64. The minimum for this year is projected at $58, while the maximum could touch $75. These estimates reflect the stock’s potential to leverage market opportunities and its capability to meet buyers’ demand.

SQQQ Stock Price Prediction 2030

Concluding the decade, in 2030, the SQQQ stock price is expected to average around $72. The potential low for this year might be $66, and the high could reach an impressive $83.

SQQQ Stock Price Target: By Experts

According to Munafa Sutra, the price target for ProShares UltraPro Short QQQ (SQQQ) is set at $20.04 on the lower end and $21.07 on the higher end.

On the other hand, Wallet Investor predicts that the minimum price of SQQQ could be $11 in 2024’s January, and it can further decline toward $0 by the end of the decade.

Historically, over a 52-week period in the past 13 years, ProShares UltraPro Short QQQ has seen an average decline of 45.3%. In 12 out of those 13 years, the stock has dropped further, indicating a historical consistency of 92.31%.

Use Cases Of SQQQ

SQQQ is optimal for brief short-term wagers against the Nasdaq 100 index. Generally, SQQQ is most effective as a niche holding in a bold investor’s portfolio. It’s likely best suited for those who anticipate a downturn in large-cap stocks in the immediate future. Indeed, the QQQ functions similarly to stock shares in many respects. If you can secure QQQ shares through your broker, you have the option to short-sell them.

The decision to either short a long ETF or invest in an inverse ETF often rests with the trader. In overextended durations, an inverse ETF might exhibit unexpected behavior. There are several inverse ETFs that profit when the Nasdaq 100 index declines. The ProShares Short QQQ (PSQ) offers the inverse return of the index on a one-to-one ratio. The ProShares UltraShort QQQ (QID) provides a 2x inverse return, while the ProShares UltraPro UltraShort QQQ (SQQQ) offers a 3x inverse return. The higher the leverage (e.g., 2x or 3x), the more pronounced the price fluctuations. However, leveraged ETFs experience decay over time. Consequently, the greater the leverage of an ETF, the shorter its recommended holding duration.

Conclusion

The ProShares UltraPro Short QQQ ETF is a notable fund with assets exceeding $4.2 billion. It boasts an average daily trading volume surpassing $120 million and offers a dividend yield of approximately 3.35%. This yield stands out, especially when compared to Invesco QQQ’s yield, which is just under 2%. However, investors should note the fund’s expense ratio of around 0.95%; thus, a $100k investment would incur a fee of roughly $950.

This fund is structured to profit when U.S. tech stocks face a downturn. Specifically, it aims for a 3x daily return of the Nasdaq 100 index. Due to the compounding effect of daily returns, maintaining the investment over extended periods might result in returns that don’t directly correlate with the index.

The performance of the SQQQ ETF has lagged behind the broader market this year, primarily because of the resurgence in tech stocks. This surge has been propelled by the “magnificent 7,” which features giants like Microsoft, Apple, Nvidia, and Tesla. Lately, several emerging tech firms have also contributed to this momentum.