Institutional interest in stablecoins has surged, giving rise to the circulating supply crossing $210 billion. This showcases the unprecedented growth of the stablecoin market. Blockchain technology has passed the bills of Cash and Treasury, enabling a fungible increase and an increased transferable speed. Therefore, the financial ecosystem has presented stablecoins as a crucial asset class.

The increasing demand for this asset has solidified its position as a critical player in decentralized and traditional finance alike. It also has given a rapid interest with robust growth in trading activity. OKX Ventures has commented on the rising demand of stablecoins with stats over its X account.

On-Chian Activity and Trading Dominated by Stablecoins

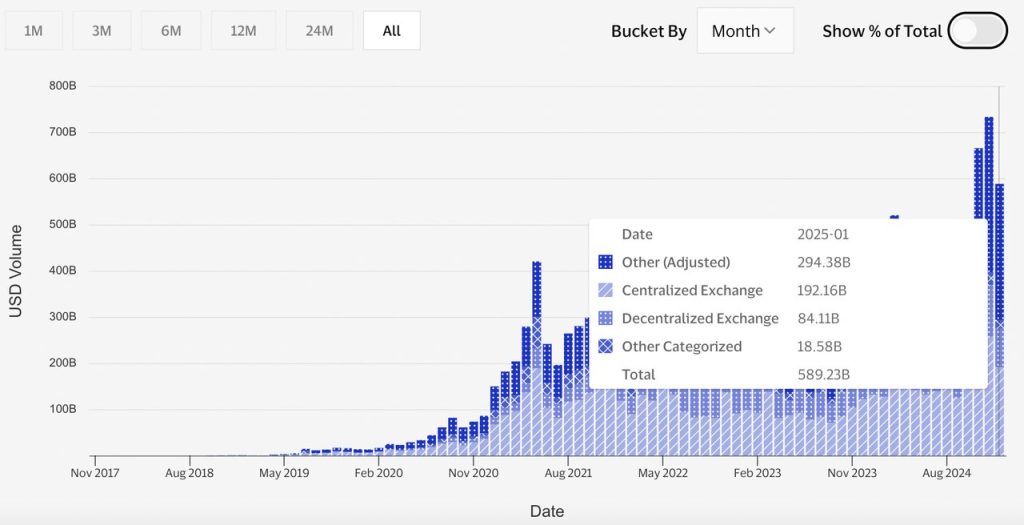

In 2024, the trading volume of stablecoins had boosted to a groundbreaking $22.5 trillion. In just the past 30 days, the growth accelerated to a staggering $6 trillion. With this surge, organic stablecoin usage has also increased, excluding bot activity and wash trading.

Over the year 2024, the trading volume was adjusted to $5.1 trillion. It showcases streamlined growth in legitimate activities, including lending, exchange transactions, and fund investments. In the past year, Ethereum, Solana, and TRON have emerged as dominant market players. With this dominance, the transactions in stablecoins surpassed 40 billion last year.

Ethereum showcased the stablecoin supply of 58.1%, valued at $123.4 billion, with a $189.4 billion increase in transaction volume within a month. TRON stood out with a market share of 28.5%, with monthly volume boosted to $252 billion. Solana follows with a market share of 4.8%, growing rapidly during the last month with a surprising 103.97% supply growth. Significantly, Solana has emerged as a leading player in micro-transactions. With this, the coin stood out as an attractive network known for faster but smaller transactions.

Stablecoin Market Enhanced by $USDC and Tokenized Assets

The growth of $USDC is rapidly increased by the resurgence of this sector. Its circulating supply reached $51 billion which is doubled from its 2023 low of $24 billion. The growing trend in the migration of networks is showcased by its rapid increase. The Ethereum’s $USDC share has dropped from 85% to 61% whilst the 16% surge was highlighted by Solan’s share. This trend underscores the rapidly evolving use cases with the increased integration of stablecoins with tokenized assets.

The versatility of stablecoins was demonstrated by the lending activities. The $8.65 billion was lended for major DeFi protocols such as Aave and Compound. Moreover, Circle acquired Hasnote and showcased its exciting partnership with DRW. This advancement has highlighted the remarkable expansion of mainstream finance. It further empowered growing transactions of cash and yield assets.

The stablecoin market is set for rapid growth as markets adopt on-chain solutions. With this development, stablecoins are poised for on-going global liquidity. But the full potential of stablecoins is unleashed by increasing compliance and infrastructure, specifically for retailers. At the forefront of innovation is CeDeFi, with stablecoins reinventing traditional and decentralized finance.