The decentralized finance (DeFi) ecosystem, once a wild frontier of high yields and speculative ventures, is entering a new phase of maturity and rationality, according to the latest report by Exponential, a leading investment platform for cryptocurrency enthusiasts. The “State of DeFi 2024” report sheds light on the evolving behaviors and trends within the DeFi sector, revealing a community that is increasingly prioritizing security, stability, and sustainable growth over the erratic chase for high yields.

A Shift Towards Conservative Allocation

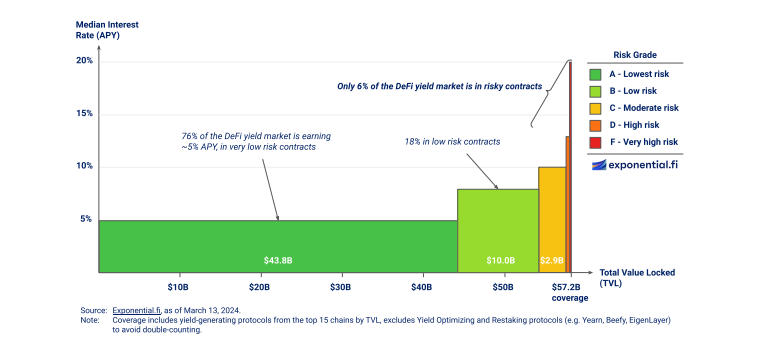

One of the report’s key findings is the significant shift in investor behavior towards more conservative yield allocations. An astounding 75% of DeFi’s total value locked (TVL) is now found in pools offering annual percentage yields (APY) of 0-5%, particularly noticeable in Ethereum staking pools. This trend signals a departure from the high-risk, high-reward mentality that once dominated the DeFi landscape and points towards a more risk-aware community valuing predictability and safety.

Rise in TVL and Staking Dominance

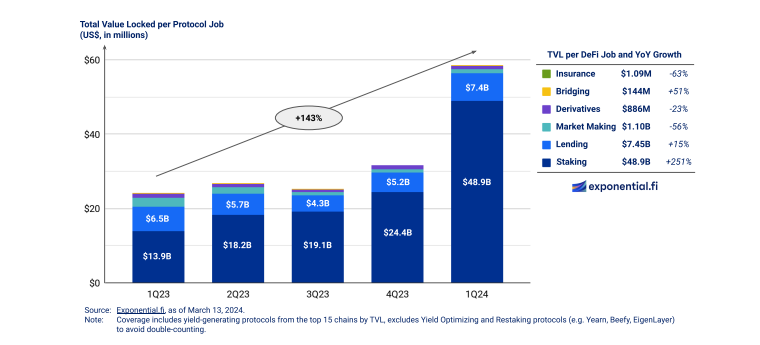

The report indicates robust growth in the DeFi sector, with the TVL in yield-generating protocols nearly doubling from $26.5 billion in Q3 2023 to $59.7 billion in Q1 2024. This resurgence is attributed to a regained confidence in the DeFi market, coupled with an increasing lean towards low-risk endeavors such as staking and secured lending. Notably, staking, especially after Ethereum’s transition to a Proof-of-Stake model, has become a dominant force, constituting about 80% of DeFi’s TVL.

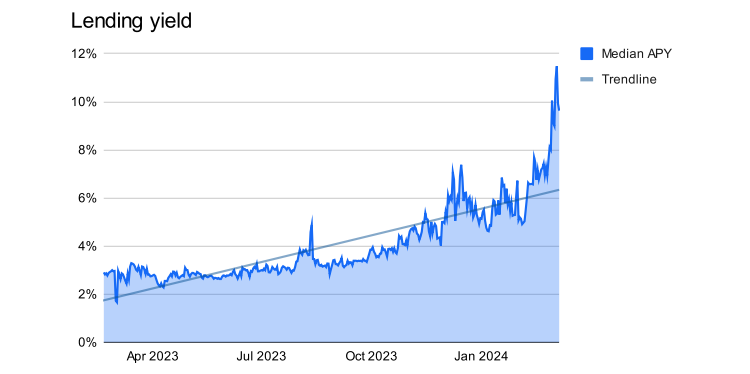

Lending Sector Revival and Market Making Challenges

The lending sector within DeFi is experiencing a renaissance, driven by a risk-on attitude among traders and a rising demand for leveraged investments. Platforms like Aave and Compound have seen their stablecoin borrowing rates reach double digits, signaling a healthy demand and a vibrant ecosystem. This rise is powered by traders using stablecoins against their holdings to enhance profits or to delve into new DeFi ventures without incurring tax liabilities.

Additionally, pioneering developments like Ethena, providing upwards of 60% APY through a blend of staking rewards and ETH futures contracts, are injecting new vitality into the lending arena. Moreover, the adoption of advanced lending models like isolated markets has bolstered the security of these platforms, thus motivating an increased number of users to invest their funds with reduced anxiety over collateral loss.

However, the market-making sector faces challenges, particularly due to the issue of impermanent loss, dampening the growth of decentralized exchanges. Impermanent loss refers to the discrepancy in value between assets maintained in a pool and those held externally, excluding the income from trading fees. The rising interest in “stable” pools, known for their reduced volatility through the use of matched assets like stablecoins, indicates a minor hiccup as the DeFi market persistently adjusts and progresses.

The Evolution of Bridging and Layer 2 Solutions

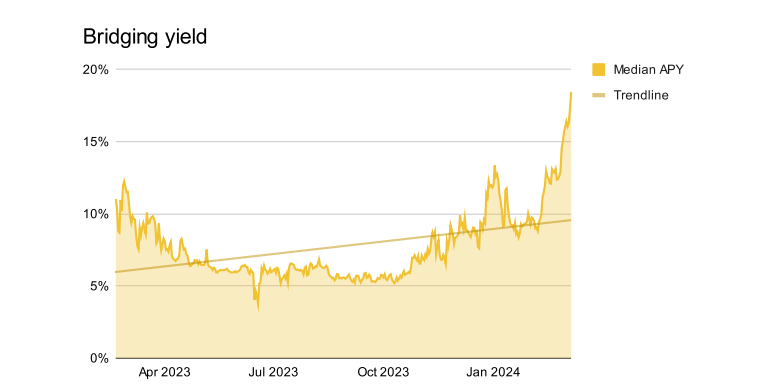

The bridging sector has experienced a significant uptick, with its total value locked (TVL) climbing 51% in the last year, from $94.8 million to $143.6 million. This growth is largely due to the advent of Layer 2 rollups, enhancing the DeFi ecosystem’s expansion across various networks. Bridging protocols such as Across and Synapse have benefited, securing higher fees through more robust and profitable bridging approaches.

The Exponential report highlights a shift towards more secure, trust-reducing models like optimistic bridges and zero-knowledge (ZK) proofs signifies the bridging sector’s advancement, paving the way for a more cohesive and effective DeFi infrastructure. This trend towards more secure and efficient bridging solutions highlights the ongoing evolution and integration within the DeFi ecosystem, promising a more seamless and interconnected future.

From Rewards-Based to Activity-Driven Yields

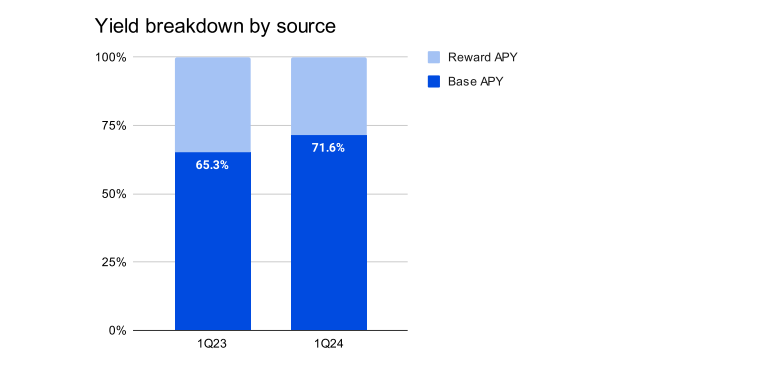

An interesting shift observed in the report is the reduction in rewards-based yields, indicating a DeFi market increasingly sustained by genuine on-chain activity. This movement away from incentive-based models towards more activity-driven yields suggests a maturation of the DeFi sector, where real-world applications and transactions are beginning to take precedence over mere token incentives.

Year-over-year comparison reveals that the rewards component dropped from around 35% in the first quarter of 2023 to 28% in the same period in 2024. This move away from incentive-driven models indicates a new era of development and refinement in DeFi. However, with incentives still constituting about a third of the total yield, they remain an effective strategy for drawing in new participants and investment into the DeFi space.

A Maturing DeFi Ecosystem

The Exponential report concludes that the DeFi community is moving towards a phase of increased judiciousness in investment choices, prioritizing risk-awareness, and stability. This shift is seen as a positive sign for the future of DeFi, indicating a move towards a more sustainable and innovative financial landscape.

As the DeFi winter thaws, the market is not just recovering but evolving into a more mature, stable, and secure ecosystem. With investors becoming increasingly cautious and the sector embracing innovation and safety, the next phase of DeFi looks set to offer a balance between steady growth and financial security.