- AT&T: A Quick Introduction

- AT&T: Controversies And History

- Political Involvement And Controversies

- AT&T Stock Price Prediction: Price History

- AT&T (T) Dividend History

- Role Of T Dividend

- AT&T Stock Price: Technical Analysis

- AT&T Price Prediction By Blockchain Reporter

- AT&T Price Prediction 2024

- AT&T Price Prediction 2025

- AT&T Price Prediction 2026

- AT&T Price Prediction 2027

- AT&T Price Prediction 2028

- AT&T Price Prediction 2029

- AT&T Price Prediction 2030

- Conclusion

AT&T Inc. is an iconic figure in the telecommunications and media landscape, a company whose roots are connected with the very inception of telephonic communication. Its journey begins in the wake of Alexander Graham Bell’s revolutionary invention of the telephone in 1876. AT&T started out as the Bell Telephone Company, which quickly turned into the American Telephone and Telegraph Company in 1885. The company had big goals right from the start, aiming to connect a huge network of telegraphs and telephones across the country, making a future where people could talk across continents instantly. This dream led AT&T to grow fast, taking over smaller companies and becoming the only big player in the U.S. telecommunications field. By the early 1900s, AT&T was everywhere in American communication. But being on top meant AT&T was watched closely. Its control over the telecommunications market caught the attention of government regulators, leading to one of the biggest legal battles over monopoly practices in U.S. history. In 1982, a court decision forced AT&T to split off its regional companies, called the “Baby Bells,” changing the industry and AT&T’s direction. In this article, we’ll explore AT&T stock price, its future market potential and identify whether it’s a good investment option depending on T dividend history.

AT&T: A Quick Introduction

AT&T Inc. is a leading American multinational telecommunications company, with its headquarters located in Whitacre Tower, Downtown Dallas, Texas. It ranks as the world’s fourth-largest telecom company by revenue and holds the title of the biggest wireless carrier in the U.S. As of 2023, it’s positioned 13th on the Fortune 500 list, boasting revenues of $120.7 billion.

For the better part of the 20th century, AT&T monopolized the U.S. telephone service. It started its journey in 1878 as the American District Telegraph Company in St. Louis. Through mergers, it expanded into Arkansas, Kansas, Oklahoma, and Texas, eventually becoming the Southwestern Bell Telephone Company in 1920, under the umbrella of American Telephone and Telegraph Company (AT&T), which itself was an offshoot of Alexander Graham Bell’s original Bell Telephone Company founded in 1877.

AT&T took over as the parent company in 1899, and in 1994, it updated its name to AT&T Corp. The 1982 antitrust lawsuit led to AT&T shedding its local subsidiaries, which formed the seven “Baby Bells,” including Southwestern Bell Corporation (SBC), which later rebranded as SBC Communications Inc. in 1995.

In 2005, SBC acquired AT&T Corp., adopting its name, legacy, and iconic branding. This merger was completed on December 30, 2005. Following this, AT&T Inc. bought BellSouth Corporation in 2006, bringing the last of the independent Baby Bells and their joint venture, Cingular Wireless (which had acquired AT&T Wireless in 2004), under its full ownership. Cingular was renamed AT&T Mobility. The acquisition of Time Warner in 2016, finalized in 2018, aimed to create a media empire, subsequently rebranded as WarnerMedia. However, AT&T spun off its media assets to merge with Discovery, Inc., forming Warner Bros. Discovery in 2022.

Today’s AT&T integrates much of the original Bell System, including four of the seven Baby Bells and the former AT&T Corp., maintaining its legacy in long-distance communications.

AT&T: Controversies And History

In 1982, U.S. regulators ended AT&T’s monopoly, making it divest its local companies into seven “Baby Bells.” AT&T kept its long-distance operations but faced new competition from companies like MCI and Sprint.

Southwestern Bell Corporation (SBC), one of the “Baby Bells,” aggressively expanded through acquisitions, including taking over other telecommunications companies and two other “Baby Bells.” It changed its name to SBC Communications Inc. in the late 1990s.

In 2005, SBC acquired AT&T Corporation for $16 billion, taking on the AT&T name and brand. The merger included acquiring BellSouth in 2006, making their joint venture, Cingular Wireless, fully owned by AT&T, and rebranding it as AT&T Mobility. AT&T also bought Time Warner in 2016, aiming to expand its media holdings, but spun off these assets in 2021 to merge with Discovery, Inc., forming Warner Bros. Discovery.

Recent years saw AT&T purchasing Mexican carriers Iusacell and DirecTV, attempting to buy T-Mobile (a deal that ultimately failed), and venturing into Latin America. In efforts to streamline and cut costs, AT&T announced major cost-cutting moves in 2020, including divesting from DirecTV and merging WarnerMedia with Discovery. The company also sold Crunchyroll to Sony and Xandr to Microsoft, marking significant shifts in its business strategy and portfolio.

Political Involvement And Controversies

From 1989 to 2019, AT&T was the fourteenth-largest donor in U.S. federal political campaigns, giving over $84.1 million, with 42% to Republicans and 58% to Democrats. In 2005, it donated the maximum $250,000 to President George W. Bush’s second inauguration. AT&T is also involved with the American Legislative Exchange Council (ALEC), a group that drafts conservative legislation.

The company spent $380.1 million on lobbying between 1998 and 2019, focusing on broadband internet access rights among other issues. It supported the Federal Communications Commission Process Reform Act of 2013, aiming for more transparent FCC rulemaking processes.

In 2018, it was reported AT&T paid $600,000 to Essential Consultants, a firm linked to President Trump’s lawyer Michael Cohen, for guidance on various issues, including its attempted merger with Time Warner and changes in net neutrality policies. The FCC chairman denied Cohen inquired about net neutrality on AT&T’s behalf. AT&T was contacted by Mueller’s Special Counsel investigation regarding these payments.

In early 2019, the Democratic House Judiciary requested records from the White House related to the AT&T-Time Warner merger. Despite supporting LGBTQ causes, AT&T has also donated to sponsors of anti-transgender legislation in several Republican-governed states.

Over the years, AT&T has been involved in various controversies over the years:

- Hemisphere Database: Since 1987, AT&T has maintained a detailed record of all calls passing through its network, sharing data with law enforcement upon request without court orders.

- Censorship: In 2007, AT&T faced criticism for a legal policy that could terminate services for harming its reputation but later revised its terms to support freedom of expression.

- Privacy Controversy: The Electronic Frontier Foundation sued AT&T in 2006, accusing it of allowing NSA warrantless monitoring of communications. Despite allegations and legal battles, AT&T’s involvement with government surveillance, including a massive calling database shared with the NSA, has been a significant issue.

- Copyright Enforcement: AT&T planned to filter Internet traffic for copyright violations in 2008 but shifted to a program based on content owner notifications rather than direct filtering.

- Discrimination against Public-access TV: In 2009, AT&T was accused of limiting access to local public-access TV channels, relegating them to a cumbersome menu system.

- Information Security: Security breaches have been a problem, including a 2010 incident where email addresses of iPad 3G service customers were exposed.

- Accusations of Enabling Fraud: In 2012, AT&T faced a lawsuit for allegedly facilitating fraudulent use of IP Relay services, settling for $21.75 million in 2013.

- Aaron Slator Controversy: In 2015, AT&T fired an executive over racist texts, amidst protests and a defamation lawsuit.

- Overcharging Government Agencies: In 2020, AT&T settled a lawsuit for $48 million over accusations of not providing the lowest cost services to government entities.

- One America News Network: A 2021 report revealed AT&T’s significant role in supporting the far-right TV network OAN, contributing to its revenue and influence.

- Leaking Data to Wall Street: In 2021, AT&T was sued by the SEC for unauthorized disclosures of nonpublic information to analysts, settling for $6.25 million in 2022.

- 2024 Outage: A nationwide cellular service disruption in 2024 affected millions, leading to investigations by the FBI and Department of Homeland Security. The FCC opened an investigation following AT&T’s claim that the outage was due to a server update, not a cyberattack.

AT&T Stock Price Prediction: Price History

Reflecting on AT&T’s stock price history requires a dive into decades of telecommunications evolution, market fluctuations, and strategic corporate decisions that have shaped the company into a global communications behemoth.

Following the divestiture of AT&T in 1984, which broke up the Bell System, the company’s stock went on a new path. Its price started trading around $4, adjusting to the new market realities without its regional bell operating companies.

This period set the stage for what would be a series of reinventions for AT&T. The tech boom of the late 90s likely boosted AT&T’s stock. This era underscored AT&T’s efforts to diversify and expand its services beyond traditional telephony.

Over the next few years, AT&T stock price made a skyrocketing rally and touched a high of $40 in the early 2000s. However, the stock price declined toward $15 by 2005’s end. A landmark moment came in 2005 when SBC Communications acquired AT&T Corp., leading to the latter adopting the storied AT&T brand. This move, aimed at creating a stronger competitor in the telecommunications field, influenced the stock price.

In 2007, the stock price again climbed and surpassed the $30 mark. With a bearish pullback below $20 again in 2010, T stock price lost its momentum. Though it attempted to break the $30 level in 2016 and 2019, it failed to meet buyers’ expectations. As a result, the price is now consolidating below $20.

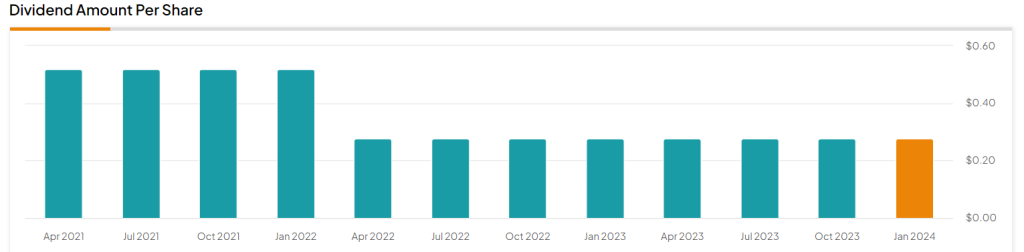

AT&T (T) Dividend History

A deep dive into the T dividend history from 1987 to the present day reveals growth, adaptation, and strategic decisions reflected through its dividend payments.

In the late 1980s and early 1990s, AT&T’s dividend payments showed a pattern of steady growth, starting from $0.58 in early 1988 and increasing to $0.73 by 1992. However, a pivotal moment in AT&T’s dividend history occurred in the early 2000s. The company began to adjust its dividend payments more frequently, reflecting both the opportunities and challenges brought on by the dot-com bubble, increased competition, and regulatory changes.

A significant moment was observed in 2022 when AT&T reduced its dividend from $0.52 to $0.2775, a move that showed the company’s strategic move towards reducing debt and investing in growth areas like 5G and fiber optic infrastructure. This adjustment was a clear indication of AT&T’s intent to prioritize long-term sustainability and competitiveness over short-term shareholder returns.

Throughout the years, the timing of dividend declarations, record dates, and payment dates have been relatively consistent, showcasing AT&T’s reliability in rewarding its shareholders.

Recently, AT&T processed its ex-dividend rate on January 9 and the amount was $0.2775.

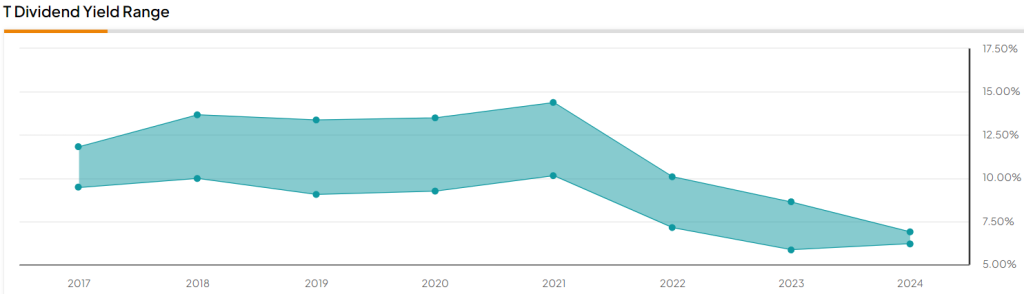

Role Of T Dividend

Allocating funds into stocks that distribute dividends is often a solid approach for those looking to generate regular income and enhance the steadiness of their investment collection. One notable example is the telecommunication giant AT&T (NYSE:T), renowned for its substantial dividend yield of 6.45%, significantly surpassing the industry average of 2.5%. Additionally, market experts forecast a promising growth trajectory for AT&T’s shares, anticipating an increase of more than 58% within the upcoming year.

The firm’s initiative to boost its free cash flow through a reduction of expenses by approximately $6 billion is promising. Moreover, its dedication to enhancing the quality of its 5G network and broadening its fiber network’s reach is a positive sign for sustained growth.

Wolfe Research analyst Peter Supino regards AT&T as a promising option for investors looking for stable, long-term growth. He points out that the company is enhancing its primary operations, becoming more efficient, and reducing its debt. Moreover, despite facing stiff competition, AT&T succeeded in growing its net postpaid phone customer base in the most recent quarter.

On March 5, in an investment analysis, Supino upgraded AT&T’s stock to a “Buy” rating from a previous “Hold,” setting a price target of $21, which suggests a potential increase of 22.1% from its current price.

Furthermore, hedge funds have shown their confidence in AT&T, purchasing 4.8 million shares in the last quarter. Currently, AT&T is viewed favorably in the market, with a Very Positive Hedge Fund Confidence Signal.

AT&T Stock Price: Technical Analysis

Lately, AT&T stock has seen a noticeable surge in value, causing a push in its upward journey. However, bears continue to defend the resistance channels, resulting in a minor correction for the T stock price. Market conditions, largely driven by the company’s financial results and settlements and T dividend history, have had a positive effect on the company’s share price. An in-depth examination of AT&T technical charts reveals some bullish signs, although they might soon fade if sellers intensify their bearish dominance. Investors are encouraged to exercise caution, given the uncertain short-term growth prospects of AT&T stock price. The durability of a surge appears uncertain, raising doubts about T stock’s capacity to maintain its top-tier investment status.

TradingView reports that AT&T shares currently stand at $17.05, showcasing a slight uptick of more than 0.2% in the past day. An in-depth examination of T stock price indicates that while the downward trend may still be present, there’s a strong possibility for a bullish turnaround as the stock previously witnessed a strong bullish surge. Despite the stock facing challenges at its immediate resistance levels, there’s an underlying potential for increased buying interest near immediate Fib channels that could drive a positive momentum shift. A glance at the daily price chart reveals that T shares have found a support line around the $15 mark, a point from which the share price could aim to overcome the next resistance barrier. With T stock price recently crossing multiple EMA trend lines following a surge above $18, it’s plausible that investors may be lured to enter long positions, potentially driving the share price upwards in the following days. The Balance of Power (BoP) indicator currently resides in a bullish area at 0.63, suggesting further upward correction could be on the horizon.

To thoroughly analyze the price of T shares, it is crucial to take a look at the RSI-14 indicator. The RSI indicator recently experienced a decline below the midline as it hovers around a selling region at 44-level. It is anticipated that AT&T stock price will soon attempt to break above its 38.6% Fibonacci level to achieve its short-term bullish goals. If it fails to climb above this Fibonacci region, a downtrend might occur.

As the SMA-14 continues its upward swing near the 48-level, it trades way above the RSI line, potentially accelerating the stock’s downward correction on the price chart. However, if T shares break above the consolidation zone and surge above the EMA20 trend line, it can pave the way to the crucial resistance of $18. A breakout above the strong resistance will drive the share price toward the upper limit of the Bollinger band at $22.

Conversely, if T stock price fails to hold above the critical support level of $16, a sudden collapse may occur, resulting in further price declines and causing the AT&T share to trade near the crucial support zone at $13.5.

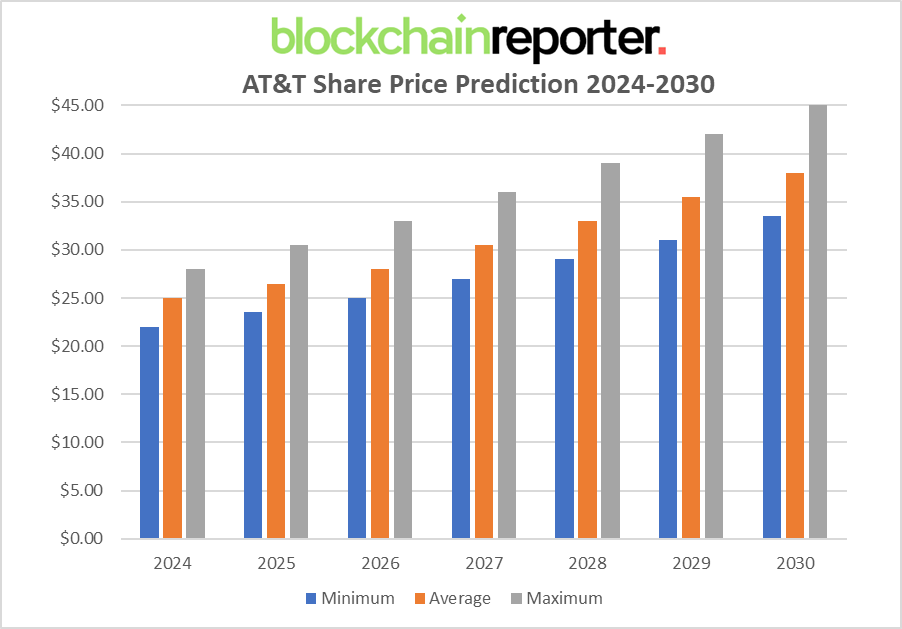

AT&T Price Prediction By Blockchain Reporter

AT&T Price Prediction 2024

The AT&T stock is expected to see fluctuations in 2024, influenced by market volatility and company-specific developments. The price is predicted to reach a minimum value of $22.00, with the potential to climb to a maximum value of $28.00. The average trading price throughout the year is anticipated to be around $25.00.

AT&T Price Prediction 2025

In 2025, AT&T could experience growth driven by strategic initiatives and the expansion of its digital services. The stock is expected to reach a minimum price value of $23.50. The price could reach a maximum value of $30.50, with the average value estimated at $26.50.

AT&T Price Prediction 2026

The price of AT&T is predicted to continue its upward trajectory in 2026, supported by advancements in 5G technology and broader market adoption. A minimum value of $25.00 is expected, with a possible maximum value of $33.00. The average trading price is anticipated to be around $28.00.

AT&T Price Prediction 2027

By 2027, AT&T’s investments in infrastructure and technology could start paying off significantly. The stock is forecasted to reach a minimum price of $27.00 and may reach a maximum of $36.00, with an average price of $30.50.

AT&T Price Prediction 2028

Anticipating further market penetration and successful execution of long-term growth strategies, AT&T’s stock could achieve a minimum value of $29.00 in 2028. The price could peak at $39.00, with the average price likely around $33.00.

AT&T Price Prediction 2029

With the potential maturation of the company’s investments and continued adaptation to technological innovations, AT&T might see its stock reach a minimum value of $31.00. The maximum price could be around $42.00, with an average trading price expected to be $35.50.

AT&T Price Prediction 2030

Looking towards 2030, assuming steady growth and favorable market conditions, AT&T’s stock is expected to reach a minimum value of $33.50. The price has the potential to reach a maximum value of $45.00, with the average price forecasted at $38.00.

Conclusion

AT&T (Ticker: T) is regarded as a solid option for retirees and income-focused investors, primarily due to its significant dividend yield. As of the latest analysis, AT&T offers an annual dividend of $1.11 per share, resulting in a dividend yield of 6.53%, which is higher than 75% of all dividend-paying stocks. This positioning makes it a leading player in the dividend space. The dividend payout ratio stands at 56.63%, indicating a healthy and sustainable level below 75%.

Analysts have mixed feelings about AT&T’s stock but lean towards a positive outlook. The average price target among 16 analysts is $20.22, suggesting a potential increase of 18.5% from the current stock price. Estimates range from a low of $14 to a high of $29. Another source forecasts the stock price could rise to $23.13 or higher next year, indicating an upside potential of +20%.