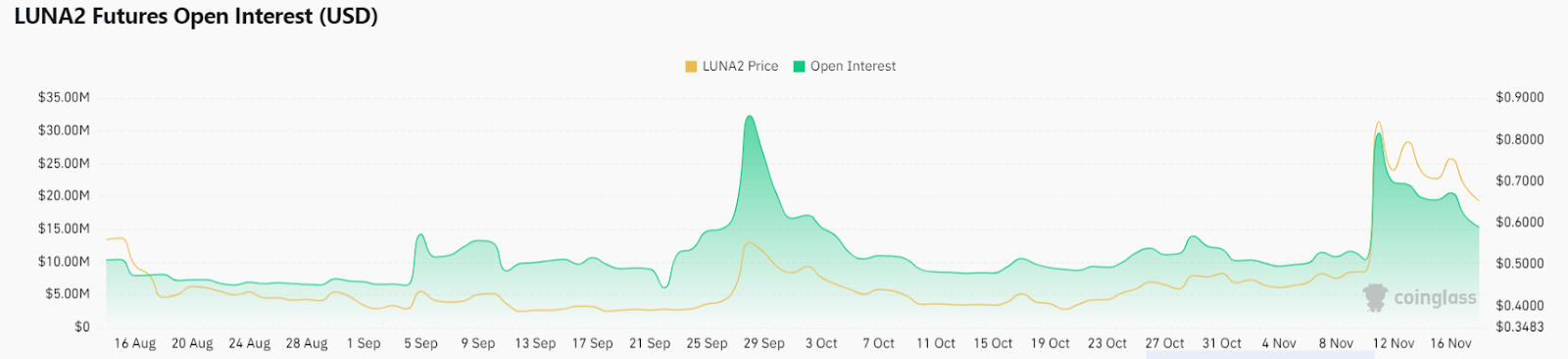

Amidst a general uptick in altcoin values following Bitcoin’s surge past the $43K mark, Terra Luna Classic (LUNC) and LUNA stood out with an extraordinary performance today. The LUNA ecosystem noted an average price increase ranging from 6% to 10% amid declining open interest. Nonetheless, at these higher price points, the LUNA ecosystem is encountering mild resistance, with investors starting to liquidate their positions. This trend has triggered an increase in price volatility for both LUNC and LUNA, indicating a significant market movement in the coming hours.

LUNC And LUNA Recover Amid Declining Open Interest

After LUNC’s price rapidly climbed from $0.000115 to a high of $0.000145, a liquidation event occurred among its investors. Data from Coinglass reveals that LUNC underwent a short squeeze, leading to over $200K million in liquidations as the price defied bearish forecasts. Previously, bullish traders faced challenges following a $600 million crypto market crash, with LUNC liquidations exceeding $1.3 million.

On the other hand, LUNA has not experienced any short liquidations yet, as the stop-loss orders of sellers remain untriggered. However, there was a significant number of long liquidations amounting to $300K that took place on January 3rd.

Remarkably, both LUNC and LUNA have bounced back from their recent dips, approaching the price levels they held before the crash. Yet, there’s been a consistent decrease in their open interest (OI), with LUNA’s OI dropping to $10.5 million and LUNC’s OI falling to $10.1 million. This trend indicates that buyers have been actively purchasing these altcoins near their lowest points, even amidst relatively low volatility.

Talking about its current development, the Terra Luna Classic community rejected three proposals to burn USTC, including the latest to eliminate all USTC in the community pool. This proposal failed to persuade the community of its merit.

Amid discussions to burn 800 million USTC from the inaccessible Risk Harbor Multisig Wallet, the community’s focus has shifted to developments post-approval of Genuine Labs as the new developer group. Proposal 11958, to burn 8 million USTC from the community pool, was notably rejected, with key validators like Interstellar Lounge and JesusisLord voting against it. The community prefers using these funds for the chain’s development and supporting project liquidity.

Terra Luna Classic (LUNC) Price Analysis

Bullish traders are currently attempting to send the LUNC price above the immediate Fib channel as they successfully pushed the price above the EMA20 trend line. However, bears are defending further surges above the moving averages as LUNC faces minor rejection. As of writing, LUNC price trades at $0.00013, surging over 10.3% from yesterday’s rate.

If bulls successfully hold the price above the moving averages on the 4-hour price chart, LUNC price might attempt to break the monthly bearish consolidation. In such a case, LUNC price might hover around $0.0002 for an extended period before surging toward $0.00028. However, this zone is expected to attract sellers to open new short-positions and trigger a correction.

However, if the price reverses from the current level bears might intensify their domination and plunge the price. If this happens, we might see LUNC price declining toward $0.0001.

Luna Price Analysis

LUNA upward momentum hit a snag at the EMA20 trend line as sellers emerged with pressure. However, buyers are defending a decline below $0.7 strongly. As of writing, LUNA price trades at $0.74, surging over 4.5% from yesterday’s rate.

The situation might worsen sellers gain confidence and intensify selling, leading to a drop below $0.7. Should Luna remain under this level, the price might consolidate around $0.6.

Conversely, if Luna price can hold above the 20-day EMA, it would signal robust buying interest. This could potentially trigger a rebound towards the $0.85 to $1 resistance zone, where it’s likely to encounter significant resistance from the bears.