- 1. Tesla Inc: Beginnings

- 2. Tesla: Mainstream Success

- 3. Tesla Stock Price Prediction: Price History

- 4. Tesla Stock Price Prediction: Technical Analysis

- 5. Tesla Stock Price Prediction By BlockchainReporter

- 5.1. Tesla Stock Price Prediction 2023

- 5.2. Tesla Stock Price Prediction 2024

- 5.3. Tesla Stock Price Prediction 2025

- 5.4. Tesla Stock Price Prediction 2026

- 5.5. Tesla Stock Price Prediction 2027

- 5.6. Tesla Stock Price Prediction 2028

- 5.7. Tesla Stock Price Prediction 2029

- 5.8. Tesla Stock Price Prediction 2030

- 6. Tesla Stock Price Prediction: Industry Experts

- 7. Tesla’s Financial Report And Market Projections: Q1 2023

- 8. Conclusion

- 9. FAQ

- 9.0.1. What is Tesla Inc?

- 9.0.2. What is the current Tesla stock price?

- 9.0.3. What was Tesla's highest and lowest stock price in the past 52 weeks?

- 9.0.4. What is Tesla's market capitalization?

- 9.0.5. What are some significant milestones for Tesla?

- 9.0.6. What is Tesla's history with Bitcoin?

- 9.0.7. How has Tesla's stock price performed historically?

- 9.0.8. What is the Tesla stock price prediction for 2025 based on technical analysis

- 9.0.9. Is Tesla stock a good investment?

- Tesla Inc: Beginnings

- Tesla: Mainstream Success

- Tesla’s Global Expansion

- Tesla And Bitcoin

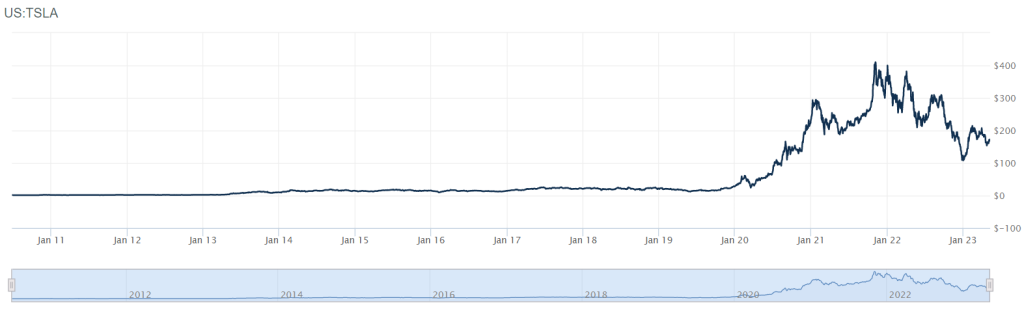

- Tesla Stock Price Prediction: Price History

- Tesla Stock Price Prediction: Technical Analysis

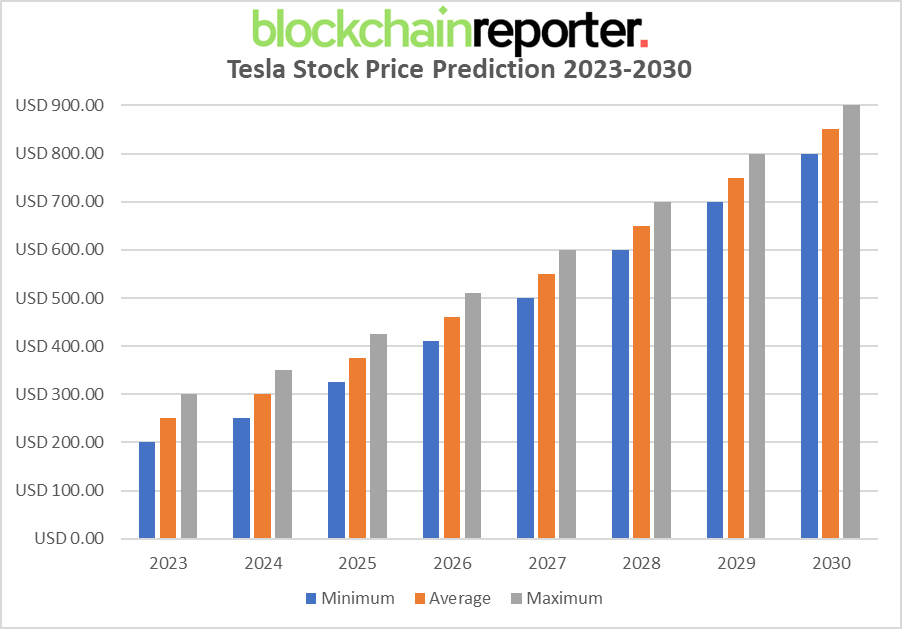

- Tesla Stock Price Prediction By BlockchainReporter

- Tesla Stock Price Prediction 2023

- Tesla Stock Price Prediction 2024

- Tesla Stock Price Prediction 2025

- Tesla Stock Price Prediction 2026

- Tesla Stock Price Prediction 2027

- Tesla Stock Price Prediction 2028

- Tesla Stock Price Prediction 2029

- Tesla Stock Price Prediction 2030

- Tesla Stock Price Prediction: Industry Experts

- Tesla’s Financial Report And Market Projections: Q1 2023

- Conclusion

- FAQ

In the vibrant panorama of technology and innovation, there’s a radiant beacon that shines brighter than the rest, illuminating the path toward a more sustainable future. That beacon is Tesla Inc., a company that has ceaselessly challenged the status quo and spearheaded the transition from fossil fuels to sustainable energy sources. In the cacophony of climate change debates and the cries for environmental protection, Tesla’s mission statement rings clear as a bell: “To accelerate the advent of sustainable transport by bringing compelling mass market electric vehicles to market as soon as possible.” Founded by the indomitable Elon Musk, Tesla’s journey began with the Roadster, a high-performance electric sports car. In the face of skepticism and criticism, Tesla demonstrated to the world that electric vehicles could not only compete with traditional combustion engine cars but surpass them in performance and efficiency. From there, Tesla has continued to push the boundaries of what’s possible in the realm of sustainable energy. Today, Tesla stands at the forefront of the clean energy revolution. With its ever-evolving suite of products, the company is breaking down barriers, dispelling misconceptions, and setting new standards in the industry. But beyond the products, Tesla’s vision of a sustainable energy future is empowering people around the world to make greener choices, thus playing a vital role in the global battle against climate change. However, despite Tesla’s innovative approach, the Tesla stock price has experienced noticeable volatility in the past few months. Hence, our Tesla stock price prediction 2025 aims to guide investors with an in-depth technical analysis of Tesla’s future market trends and stock potential.

Tesla Inc: Beginnings

Tesla Inc. is a distinguished American multinational company specializing in automotive and clean energy solutions, with its headquarters in Austin, Texas. The company is a pioneer in designing and manufacturing electric vehicles, including cars and trucks, and is renowned for its offerings in battery energy storage solutions scaling from homes to power grids. In addition, Tesla produces solar panels and solar roof tiles, along with a range of related products and services.

By 2023, Tesla has established itself as one of the world’s most valuable companies and, notably, the most valuable automaker globally. The company dominated the battery electric vehicle market in 2022, capturing an impressive 18% of global sales. Tesla Energy, a subsidiary of Tesla, is a prominent player in the development and installation of photovoltaic systems in the United States. It is also a leading global supplier of battery energy storage systems, boasting an installation of 6.5 gigawatt-hours (GWh) in 2022.

Tesla’s journey began in July 2003 when Martin Eberhard and Marc Tarpenning incorporated the company as Tesla Motors, paying homage to the renowned inventor and electrical engineer Nikola Tesla. Elon Musk, through a significant investment of $6.5 million in February 2004, became the company’s largest shareholder. Musk, serving as the CEO since 2008, articulates Tesla’s purpose as accelerating the transition to sustainable transport and energy via electric vehicles and solar power.

Before diving deeper into our Tesla stock price prediction 2025, let’s take a look at Tesla stock’s current market details.

| Company | Tesla Inc |

| Stock Symbol | TSLA |

| Price | $172 |

| 52 Week High | $314.6667 |

| 52 Week Low | $101.81 |

| Share Volume | 1,676,945 |

| Average Volume | 132,853,895 |

| Forward P/E 1 Yr | 55.33 |

| Earnings Per Share(EPS) | $3.40 |

| Market Cap | 556,628,345,342 |

Tesla: Mainstream Success

The company’s first car model, the Roadster sports car, rolled out in 2008, followed by the Model S sedan in 2012, the Model X SUV in 2015, the Model 3 sedan in 2017, the Model Y crossover in 2020, and the Tesla Semi truck in 2022. Tesla is also planning to kick off the production of the Cybertruck, a light-duty pickup truck, in 2023. The Model 3 enjoys the distinction of being the all-time bestselling plug-in electric car worldwide, and in June 2021, it became the first electric car to hit the 1 million units sales mark globally. Tesla delivered approximately 1.31 million vehicles in 2022, marking a 40% increase from the previous year. By August 2022, Tesla’s cumulative sales had crossed the 3 million cars milestone. In October 2021, Tesla’s market capitalization soared to $1 trillion, making it the sixth company in U.S. history to achieve this feat.

In 2012, Tesla halted the production of its Roadster model to focus its resources on the new Model S sedan. This new model received high praise from automotive experts for its superior performance and sleek design. It was offered with three distinct battery choices, providing estimated travel distances of either 235 or 300 miles (379 or 483 km). The high-performance battery variant allowed the vehicle to accelerate from 0 to 60 miles (96 km) per hour in just over four seconds, reaching a top speed of 130 miles (209 km) per hour.

In a departure from the Roadster’s design, where the battery system was located at the rear, the Model S featured its battery system beneath the floor. This strategic placement not only offered additional storage space in the rear but also enhanced the vehicle’s handling due to its lowered center of gravity. This innovative battery placement was subsequently adopted in future Tesla models.

In 2014, Tesla introduced its Autopilot feature—a semi-autonomous driving system—initially available on the Model S and later extended to other models in its lineup.

Tesla’s Global Expansion

In 2019, Tesla established its first “Gigafactory” outside the United States, situated in Shanghai, China. Remarkably, Giga Shanghai became the first-ever wholly foreign-owned car manufacturing plant in China, its construction completed in under six months. In the subsequent year, Tesla initiated the construction of two more Gigafactories, one near Berlin, Germany, and the other in Texas, United States. In March 2020, Tesla started deliveries of its fifth vehicle model, the Model Y crossover.

On January 10, 2020, Tesla’s market capitalization soared to $86 billion, setting a new record as the highest-valued American automaker. On June 10, 2020, Tesla’s market capitalization exceeded the combined valuations of BMW, Daimler, and Volkswagen. In the following month, Tesla’s valuation rose to $206 billion, outpacing Toyota’s $202 billion and securing its position as the world’s most valuable automaker in terms of market capitalization. Given the surge in the company’s value, Tesla executed a 5-for-1 stock split on August 31, 2020.

Tesla And Bitcoin

In February 2021, Tesla disclosed that it had made a $1.5 billion investment in Bitcoin (BTC) during 2020. Subsequently, on March 24, the company began accepting Bitcoin as a mode of payment for its vehicles in the United States, with plans to extend this payment option to other countries later in the year. At the time, Elon Musk declared on Twitter that the Bitcoin received by Tesla would be retained as Bitcoin and not converted into fiat currency. It was later unveiled in financial reports that Tesla had realized a profit of $101 million from the sale of Bitcoin between January 1 and March 31, 2021.

However, after 49 days of accepting the digital currency, Tesla reversed its stance on May 12, 2021. The company announced that it would cease accepting Bitcoin due to growing concerns about the environmental impact of Bitcoin mining, which was perceived to be exacerbating fossil fuel consumption and contributing to climate change.

Tesla Stock Price Prediction: Price History

To get a detailed Tesla share value outlook, it is essential for investors to get an idea of Tesla stock’s price history to determine its future growth potential. However, it is to be noted that past performance is not an indicator of Tesla’s future price points and financial projections.

When Tesla first went public in July 2010, the company’s shares were priced at $1.46. With this IPO, Tesla raised around $226 million, a relatively modest sum compared to its current valuation. Over the next few years, Tesla’s share price saw steady growth, buoyed by the launch of its Model S sedan in 2012. By the end of 2013, Tesla shares were trading at around $10.

However, the real game-changer came in 2020. Amidst a global pandemic, Tesla’s stock started the year by trading above $50 (post-stock-split price). Then, in February, Tesla announced its second consecutive quarterly profit, a first for the company, leading to a significant surge in the stock price.

In July 2020, Tesla reported a fourth consecutive profitable quarter, qualifying it for inclusion in the S&P 500 index. This news, coupled with strong sales numbers despite the ongoing pandemic, ignited a remarkable bull run. By August, Tesla announced a 5-for-1 stock split, further boosting investor confidence. The company’s shares reached a peak of about $150 (post-split) by the end of August.

This momentum carried into 2021, with Tesla’s stock price hitting a high of $294 in January. This spike was partly driven by the company’s impressive delivery numbers, posting record deliveries despite the pandemic’s challenges.

However, Tesla’s stock price hasn’t been immune to volatility. For example, in February 2021, Tesla disclosed a $1.5 billion investment in Bitcoin, causing a stir in the market. Initially, the move seemed to boost the stock, but as concerns about the environmental impact of Bitcoin mining grew, Tesla suspended Bitcoin payments for its cars in May. This decision, along with broader market trends, led to a drop in Tesla’s share price, which hovered around $200 in June 2021.

However, the price then again spiked by the end of 2021 and made a new high of $409 in November 2021. In 2022, the Tesla stock price maintained a steady momentum near the $300-400 mark but failed to continue this trend. The stock’s price made a steep decline and touched the $109 mark in January 2023.

As of May 2023, Tesla’s stock price stands at approximately $170. While it has experienced some fluctuations, the overall trend remains positive. The company’s commitment to innovation, its robust product line, and a global shift towards renewable energy all bode well for its future.

Tesla Stock Price Prediction: Technical Analysis

Recently, Tesla stock has exhibited a temporary bearish trend, which has now given way to a resurgence in momentum. The market has largely been impacted by the Fed’s recent interest rate hikes, and Tesla’s share price has shown incredible resilience in overcoming critical resistance levels. A comprehensive technical analysis of Tesla’s stock reveals a wealth of bullish indicators, providing investors with a prime opportunity to capitalize on a long-term growth strategy. This upward trajectory highlights the strong potential for Tesla to continue its rise, solidifying its position as a top-tier investment choice.

According to TradingView, Tesla shares are currently trading at $172, reflecting an increase of over 2% in the last 24 hours. Our technical evaluation of Tesla stocks indicates that the bearish momentum is not over yet, and bears may make a comeback if the Tesla stock struggles to gain enough buying pressure to support its current uptrend. Examining the daily price chart, Tesla shares have found support near the $150-160 level, from which the stock price may try to breach its immediate resistance line. As Tesla’s price recently surpassed its EMA20 trend line at $170, buyers may gain confidence and open long positions, pushing the stock’s price higher in the coming days before any downward movement emerges. The Balance of Power (BoP) indicator is currently trading in a bullish zone at 0.5, hinting at further upward correction soon.

To thoroughly analyze the price of Tesla shares, it is crucial to take a look at the RSI-14 indicator. As this indicator recently experienced buying pressure, it has risen above the mid-line and trades near the buying region of the 50.15-level, suggesting pressure to push the TSLA stock price to $180. It is anticipated that Tesla’s price will soon attempt to break above its 38.6% Fibonacci level to achieve its short-term bullish goals. If TSLA fails to climb above this Fibonacci region, a downtrend might occur.

As the SMA-14 continues its upward swing near the 40-level, it trades way below the RSI line, potentially accelerating the stock’s upward correction on the price chart. If Tesla shares break above the consolidation zone, it can pave the way to the crucial resistance of EMA100 at $180. A breakout above the strong resistance will drive the share price toward the upper limit of the Bollinger band at $200.

Conversely, if Tesla fails to hold above the critical support level of $150, a sudden collapse may occur, resulting in further price declines and causing the Tesla share to trade near the Bollinger band’s lower limit of $110. If Tesla’s price fails to continue a trade above $100, it may trigger a more significant bearish downtrend.

Tesla Stock Price Prediction By BlockchainReporter

Tesla Stock Price Prediction 2023

With the company’s ongoing advancements in technology and expansion into global markets, Tesla’s growth potential remains significant. By the end of 2023, Tesla stock may reach an average trading price of $250, with a minimum value of $200 and a maximum price of $300.

Tesla Stock Price Prediction 2024

As Tesla’s energy sector begins to gain more traction in 2024, alongside its continued growth in the automotive industry, the stock is expected to see a steady climb. By the end of 2024, Tesla’s stock could average around $300, with the potential to dip to a minimum of $250 and surge to a maximum of $350.

Tesla Stock Price Prediction 2025

The year 2025 could see significant milestones for Tesla, particularly with its autonomous vehicle technology. It’s projected that by the end of the year, Tesla’s stock may achieve an average price of $375, potentially fluctuating between a minimum of $325 and a maximum of $425.

Tesla Stock Price Prediction 2026

In 2026, with their planned expansion into new markets and potential breakthroughs in battery technology, Tesla’s stock might reach an average price of $460, with a minimum value of $410 and a maximum value of $510.

Tesla Stock Price Prediction 2027

By 2027, Tesla’s progress in renewable energy solutions might start to significantly impact its stock value. Predictions suggest an average stock price of $550, with a minimum of $500 and a maximum of $600.

Tesla Stock Price Prediction 2028

Further advancements in Tesla’s energy solutions and possibly a solid market presence in autonomous vehicles could drive the stock price further up in 2028. Expectations point to an average price of $650, with a minimum of $600 and a maximum of $700.

Tesla Stock Price Prediction 2029

As we approach the end of the decade, Tesla’s ongoing innovations and market leadership could see the average stock price reach $750, potentially moving between a minimum of $700 and a maximum of $800.

Tesla Stock Price Prediction 2030

By 2030, if Tesla’s ambitious projects, such as the Tesla Network or the Tesla Bot, come to fruition, Tesla stock could see dramatic increases. It’s projected that the average stock price could hit $850, with a minimum value of $800 and a maximum of $900.

Tesla Stock Price Prediction: Industry Experts

According to CNN Money’s 36 market experts who have provided 12-month price predictions for Tesla Inc anticipate a median target of $186.20. The most optimistic among them forecasts a high of $300.00, while the most conservative predicts a low of $71.00. Compared to Tesla’s latest price of $172.06, the median projection suggests a potential increase of +8.22%.

Over the past quarter, thirty Wall Street analysts have provided 12-month price predictions for Tesla. The consensus price target among them is $203.64, with the most optimistic prediction at $280.00 and the most conservative at $115.00. This average target indicates a potential 18.34% shift from Tesla’s recent price of $172.08.

Tesla’s Financial Report And Market Projections: Q1 2023

In the first quarter of 2023, Tesla achieved global vehicle deliveries amounting to 422,875, resulting in total revenues of $23.3 billion, marking a year-over-year growth of nearly 25%. Tesla’s announcement of price reductions for its models starting in January correlated with a 36% year-on-year surge in vehicle deliveries. Sales in the United States and China surged, contributing to 40% and 33% of Tesla’s worldwide deliveries, respectively.

The Model Y and Model 3 were responsible for nearly 98% of the company’s sales. The Model Y emerged as the top-selling car in Europe and the best-selling non-pickup vehicle in the US during this period. The Model 3 also saw a substantial boost in European sales, with close to 29,000 units sold in the continent in Q1. All Model 3s sold in Europe were imported from China, as the Berlin factory only manufactures the Model Y.

Tesla’s robust standing in the automobile sector has positively influenced its market projections. The company’s strategic price reductions have made its vehicles more accessible, and with the eligibility of the Model Y and Model 3 for tax credit subsidies in the US, we foresee Tesla seizing over half of the nation’s EV market. In a recent earnings call, Tesla indicated further price reductions on the horizon. Moreover, the company intends to inaugurate another facility in Shanghai, concentrating on cell and battery production, following its announcement of a 100-GW cell factory capacity last year.

Conclusion

Tesla has truly revolutionized the automobile industry with its innovative approach to electric vehicles and sustainable energy. The company’s impact on the future of transportation and energy storage cannot be overstated. Tesla’s unique blend of high-tech software, next-generation battery technology, and commitment to a sustainable future has made it an undisputed leader in the electric vehicle market.

Tesla’s stock price reflects this success, having seen substantial growth over the past decade. However, as with any investment, the future potential of Tesla’s stock price is uncertain and subject to a myriad of factors. These include the company’s ability to maintain its competitive edge, the global adoption rate of electric vehicles, the success of its energy storage and solar products, and the overall economic environment.

FAQ

What is Tesla Inc?

Tesla Inc. is an American multinational company specializing in electric vehicles, clean energy solutions, and related products and services. Founded in 2003, Tesla’s mission is to accelerate the transition to sustainable transport and energy through electric vehicles and solar power.

What is the current Tesla stock price?

As of May 2023, Tesla’s stock price stands at approximately $170.

What was Tesla’s highest and lowest stock price in the past 52 weeks?

The 52 week high for Tesla stock was $314.6667, and the 52 week low was $101.81.

What is Tesla’s market capitalization?

Tesla’s current market capitalization is $556,628,345,342.

What are some significant milestones for Tesla?

Tesla’s journey began with the Roadster, a high-performance electric sports car, in 2008. Today, Tesla stands at the forefront of the clean energy revolution. Some of its significant milestones include hitting the 1 million units sales mark globally with the Model 3, establishing Gigafactories in different parts of the world, and reaching a market capitalization of $1 trillion in October 2021.

What is Tesla’s history with Bitcoin?

In February 2021, Tesla announced a $1.5 billion investment in Bitcoin and began accepting Bitcoin as a mode of payment for its vehicles in the United States. However, due to environmental concerns about Bitcoin mining, Tesla suspended Bitcoin payments in May 2021.

How has Tesla’s stock price performed historically?

When Tesla first went public in July 2010, the company’s shares were priced at $1.46. Over the years, Tesla’s share price saw steady growth, with a significant surge in 2020. Despite some fluctuations, the overall trend remains positive.

What is the Tesla stock price prediction for 2025 based on technical analysis

The technical analysis reveals a wealth of bullish indicators, suggesting that Tesla’s stock is a prime opportunity for a long-term growth strategy. However, investors should be aware of potential volatility, and the possibility of a bearish trend should Tesla fail to maintain above the critical support level of $150.

Is Tesla stock a good investment?

While the overall trend for Tesla’s stock remains positive, potential investors should conduct their own research, consider their risk tolerance, investment goals, and consult with a financial advisor if necessary before making an investment decision.

READ MORE:

Lucid Stock Price Prediction 2025: Can LCID Stock Recover Amid Bearish Sentiment?

Wrapped LUNA Classic (WLUNC) Price Prediction

Rivian Stock Price Prediction 2025 & 2030: What Lies Ahead for RIVN Stock Price?

Bitgert Price Prediction: Is Bitgert a Good Investment?

EverGrow Coin Price Prediction: Will EGC Skyrocket to $1 Soon?

Nio Stock Price Prediction 2030: Will There Be a Bullish Reversal for Nio Stock?