Binance, the largest centralized cryptocurrency exchange in the world, announced on Tuesday that it has reached an agreement to acquire its fastest-growing competitor, FTX. Changpeng Zhao, co-founder and CEO of Binance, revealed the decision on Twitter, sending shockwaves throughout a crypto market already beset by volatility and plummeting prices. In the following hours, Bitcoin dropped by almost 10%.

On Tuesday, no specifics about the terms of the deal were provided to the media. As of January, the market value of FTX was estimated to be $32 billion. However, the acquisition highlights the vulnerabilities of even crypto’s most stalwart dealmakers and might attract the increasing scrutiny of global regulators.

It also tarnished the reputation of Sam Bankman-Fried, the founder of FTX and one of crypto’s most recognizable characters, who was widely regarded as a dominant player striving to popularize cryptocurrency. Analysts now contend that even under his leadership, Bankman-Fried’s FTX mishandled its massive development and disguised its financial deficiencies, necessitating a rescue from one of the company’s greatest (and most astute) competitors.

Alex Svanevik, the CEO of the blockchain analytics firm Nansen, said, “it will probably go down in history as one of the greatest corporate raids of all time,” noting that the transaction significantly enhances Zhao’s status and authority. A representative from FTX declined to answer questions beyond Bankman-Fried’s Twitter announcement of the deal.

On Sunday, Zhao played a role in helping to set the stage for the subsequent twist in the story by publicly spreading suspicion on Twitter about the amount of funds FTX had on hand. In response to Zhao’s announcement that Binance wanted to sell more than $500 million worth of FTX’s native token, FTT, apprehensive crypto traders who had endured a year of economic crises hurried to withdraw their funds.

This precipitated a real liquidity crisis at FTX, which responded by momentarily suspending withdrawals. Bankman-Fried tweeted on Tuesday that Binance was assisting FTX in repaying all of its users who had attempted to withdraw their assets. He stated that ultimately, all users would have the ability to withdraw their funds at a “1:1” ratio. Interestingly, Binance’s acquisition does not encompass FTX.US’s retail business, which runs as a distinct entity.

History Of The Conflict: FTX And Binance Rivalry

Binance is the leading cryptocurrency exchange. According to Bloomberg, it was responsible for generating revenue of at least $20 billion in 2021 and facilitates transactions worth billions of dollars every single day. Users utilize Binance to exchange dollars into Bitcoin, Ethereum, Solana, or Dogecoin, as well as to trade Binance’s riskier investment instruments, such as crypto derivatives, which let them speculate on prospective price swings in cryptocurrencies.

Sam Bankman-Fried, an up-and-coming entrepreneur in the cryptocurrency space, established the FTX exchange in 2019, with the goal of introducing a new generation of interested investors to the world of cryptocurrencies. During the most recent bull run in cryptocurrency, which occurred from 2020 to 2021, FTX was among the companies with the fastest-growing revenue in the industry. During this time, its revenue increased by more than 1000%.

Bankman-Fried himself emerged as one of the most well-known figures in the cryptocurrency industry. He participated in seminars with Bill Clinton and Tony Blair, put a lot of money into political campaigns, and made regular appearances in Washington for congressional hearings and behind-the-scenes discussions with legislators and regulators. He contended that cryptocurrency will make finance more accessible to the general public, appeared on the cover of FORTUNE magazine, and invested heavily in branding, including purchasing the naming rights to the venue where the Miami Heat play, which is now known as FTX Arena, for $135 million.

Bankman-Fried was chosen to be enlisted in the TIME100 for 2022 in May. And when the cryptocurrency market endured one catastrophic crash after another, Bankman-Fried stepped in to play the role of a white knight, rescuing failing companies with enormous loans and, in the meantime, constructing an impressive cryptocurrency empire. (Among his major transactions, he acquired a 30 percent share in Anthony Scaramucci’s hedge company SkyBridge Capital.)

The Unanticipated Fall Of FTX

On November 2, it was reported that FTX’s sibling firm, Alameda Research, appeared to have a weak financial sheet. Due to recent findings, Zhao declared on Twitter on November 6 that Binance would sell the $2 billion worth of FTT, FTX’s token, that it owned. Liquidating Binance’s FTT is simply post-exit risk assessment, learning from LUNA, Zhao stated, referencing the collapsed stablecoin ecosystem whose failure had a significant impact on the May crypto market crisis.

The connection that Zhao made between the catastrophic project LUNA and one of the most respected strong players in the market, FTX, caused many people’s suspicions, even for Bankman-Fried. Bankman-Fried tweeted, “A competitor is trying to go after us with false rumors. FTX is fine. Assets are fine.”

However, Zhao’s actions alarmed other investors, and an increasing number of crypto specialists began to support the belief that Alameda Research was covertly bankrupt. Consequently, tens of millions of dollars worth of cryptocurrency was withdrawn from FTX during the past two days. The anxieties of investors multiplied, and the market as a whole declined, with Bitcoin falling 10%.

FTX was suddenly forced to deal with a significant lack of cash. On Tuesday morning, the platform ceased processing the withdrawal requests that customers had submitted. A few hours later, Zhao made the announcement that Binance was going to buy FTX. He tweeted, “FTX asked for our help.” He made it clear that the arrangement would not be legally binding.

Given Bankman-Fried’s prominence in the cryptocurrency business, the move came as a significant shock to crypto specialists. Kristin Smith, executive director of the Blockchain Association, a crypto lobbying group in Washington, D.C., said, “If you suggested something like this 48 or even 24 hours ago—I don’t think anyone saw this coming. This is absolutely mind-blowing news for the crypto community, and a day that is going to be looked back upon for years ahead.”

“Most people did not expect FTX to end up in this situation, given they were the savior of these other distressed companies,” Svanevik asserts. “We of course know that Sam Bankman-Fried had been quite active trying to influence regulation in the U.S. It looks a bit embarrassing to end up in this situation so shortly after.”

Uncovering The Undisclosed Truth

Sam Bankman-Fried sent an internal note to FTX staff in which he apologized for the exchange’s recent lack of communication and revealed that the business had suffered almost $6 billion of net outflows during the preceding 72 hours. This was in comparison to the hundreds of millions of dollars that would typically be inflows and outflows on a regular day.

In the note received by The New York Times, Bankman-Fried admitted to having made errors. “I apologize,” he added, saying that the majority of the transaction’s details with Binance have not yet been worked out.

On Twitter, Bankman-Fried thanked Zhao for negotiating the deal, which he said would help FTX to eliminate liquidity shortages. FTX is situated in the Bahamas, where it provides unlicensed trading services in the United States. In his tweets, Bankman-Fried stated that the company’s smaller U.S. operation, FTX.US, was processing withdrawals and would not be a part of the transaction with Binance.

A spokesperson for FTX stated that the company had no statement beyond the tweets. A comment from a representative of Binance was requested, but no response was given. Ed Moya, a crypto analyst at trading platform OANDA, said, “There’s a confidence crisis here. Whenever you have the instability of a key token or coin that is tied to one of the key crypto figures, there’s always a concern that you could see contagion and a much more significant moment of crisis.”

FTX was supported by a slew of other prominent investors, including Sequoia Capital, Lightspeed Venture Partners, and SoftBank, in addition to Zhao. According to PitchBook, which monitors private finance, FTX has secured over $2 billion in fundraising. Three stakeholders in FTX described their astonishment at the Binance acquisition and its implications for cryptocurrency start-ups.

According to a copy of the email acquired by The Times, Bankman-Fried emailed investors at 11 a.m. Pacific time with news of the transaction. In it, he stated that FTX’s investors were the firm’s “second priority” and that he was more concerned with protecting consumers and “the market” as the firm’s “first priority.”

“I’m sorry I didn’t do better,” he stated. As previously mentioned, on Tuesday, Bankman-Fried sent a note to the FTX staff in which he made a commitment that further details regarding the sale would be forthcoming. He said, “Let’s live to fight another day.”

Proposed Merger Shakes The Crypto Market

The proposed buyout of troubled rival exchange FTX by Binance exemplified how pressures in the digital asset market are now pressurizing a number of its leading companies.

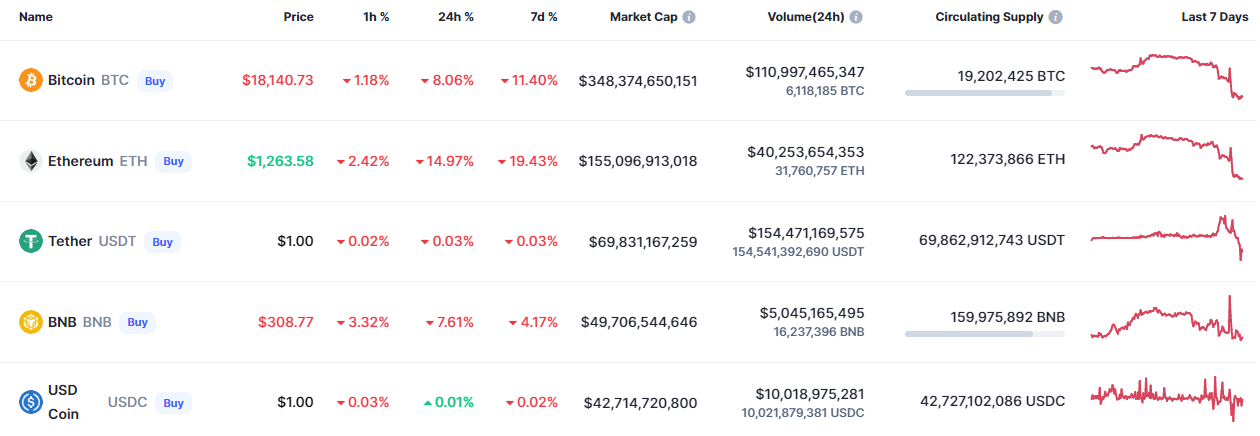

Bitcoin, the largest cryptocurrency by market value, plummeted as much as 3.8% on Wednesday, following a near-10% decline the previous day, and was trading at approximately $18,120 at 11:37 a.m. local time in the United Kingdom. Ethereum, Polkadot, Avalanche, and Solana, as well as the meme token Dogecoin, all experienced declines.

Traders pointed to a tweet by Zhao claiming a letter of intent between the two sides is nonbinding as one of the factors that contributed to the instability in the market. Traders are on edge about the possibility of a crisis spreading given the significant role that FTX and its co-founder Sam Bankman-Fried performed in the industry.

The impromptu negotiations emphasized the continued fragility of the crypto business, which was rocked this spring by a $2 trillion crisis that devastated the funds of numerous amateur investors. This decline destabilized some of the crypto industry’s largest enterprises, with FTX suffering the most. It was largely considered one of the most agile and well-managed crypto firms until its resources began to crumble almost immediately.

Comparisons have been made between the unexpected catastrophe and the fall of Lehman Brothers, the investment firm whose demise was a contributing factor in the onset of the global financial crisis in 2008.

Cory Klippsten, a Bitcoin investor who is skeptical of the rest of the cryptocurrency industry, opined that many of the largest crypto businesses are intrinsically vulnerable, liable to a Lehman-like crash at any time.” “The only hope once under pressure is that another player will bail them out,” he added.

If the deal is finalized, it would bring together two of the major cryptocurrency firms and solidify the position of Binance’s founder, Changpeng Zhao, as one of the most influential players influencing the future of the sparsely regulated cryptocurrency industry.

The agreement was announced just as the crypto markets, which have suffered catastrophic losses so far in 202022, were on the verge of panicking more. There were rumors circulating that FTX’s financial fundamentals were unstable.

A significant number of its users, who utilize FTX to purchase and keep their digital currencies, hurriedly withdrew their funds from the exchange. The cryptocurrency research firm Nansen published its findings on Monday evening, stating that more than half a billion dollars had been removed from the network during the course of the previous day.

The price of FTT, the utility token of the FTX exchange, has decreased by more than 70% in the past 24 hours and was trading around $5. The price of Sol, the native token of the Solana blockchain, which is affiliated with both FTX and the associated crypto trading firm Alameda Research, and other tokens of Solana-based enterprises, dropped dramatically.

The Crypto Community Reacts To The Situation

David Moreno Darocas, research associate at CryptoCompare, said, “the letter of intent is non-binding, which means that further issues could still arise if CZ/Binance decides to back out of the deal.”

After a severe dispute with Bankman-Fried came to light, Zhao’s Binance Holdings issued a letter of intent to acquire. Zhao intentionally eroded trust in FTX’s financial stability, which contributed to a mass outflow of users from the three-year-old FTX.com exchange.

As mentioned before, a day before striking an agreement, Bankman-Fried tweeted that FTX assets were “fine.” The terms of the emergency buyout were vague, with Binance stating that the arrangement was reached after FTX requested assistance due to a “severe liquidity shortage.”

Teng Yan, a researcher at digital-asset research firm Delphi Digital, said on Twitter, “SBF and FTX were the biggest patrons of Solana. This era is over. Binance has taken over, and they will heavily favor the BNB chain over Solana. Alameda had ~$1B in locked and unlocked $SOL, which they’ll have to sell if insolvent. This puts a huge sell pressure on $SOL.”

Traders drew parallels between the FTX-Binance debacle and the problems encountered by Celsius, the crypto lender that crashed earlier this year, and other enterprises immersed in this year’s slump in digital assets.

Teong Hng, CEO of crypto investment firm Satori Research, said the scenario remains highly unpredictable while adding “I am confident these two crypto giants will do the right thing to protect investors and the industry.”

Binance and FTX did not immediately give information regarding the agreement, and they stated that the two parties were working together to figure it out in real time. Zhao tweeted, “There is a lot to cover and will take some time. This is a highly dynamic situation, and … Binance has the discretion to pull out from the deal at any time.”

Last week, concerns about FTX and Alameda Research, Bankman-Fried’s trading firm, arose after a report stated that the majority of Alameda’s balance sheet was composed of FTT, a rather illiquid token.